Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Insurance Collector position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

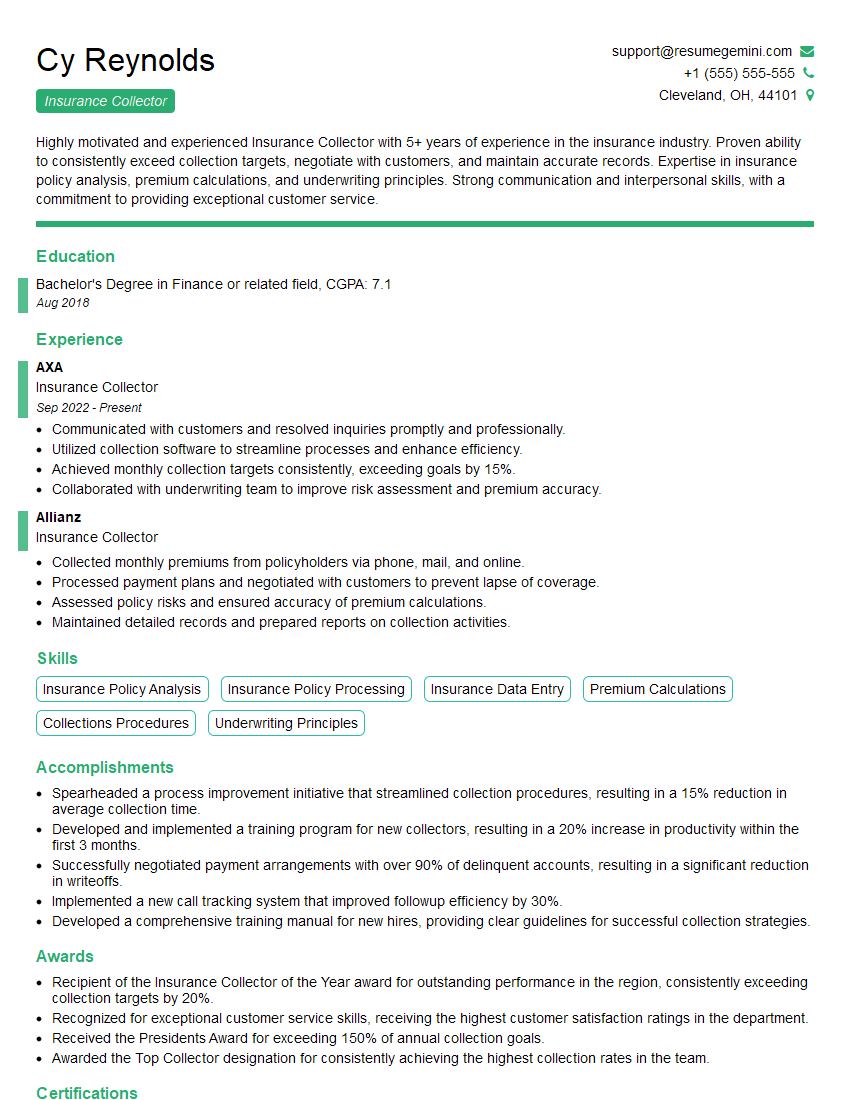

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Collector

1. How do you prioritize your workload when faced with multiple overdue accounts?

To prioritize my workload, I would consider the following factors:

- Account status: I would prioritize accounts that are in default or have a high risk of default.

- Amount overdue: I would focus on accounts with the largest overdue balances.

- Payment history: I would review the payment history of each account to identify those that have a history of late payments.

- Customer communication: I would prioritize accounts where the customer has not responded to previous attempts to contact them.

2. What is your approach to collecting on delinquent accounts?

Negotiation and Payment Plans

- I would first attempt to contact the customer by phone or email to discuss their payment options.

- I would be empathetic and understanding, while also being firm and clear about the need to resolve the delinquency.

- I would work with the customer to develop a payment plan that is feasible for their financial situation.

Legal Action

- If negotiation and payment plans are unsuccessful, I may consider legal action as a last resort.

- I would only pursue legal action after exhausting all other options and after consulting with management.

3. How do you handle difficult or irate customers?

When dealing with difficult or irate customers, I would remain:

- Calm and professional: I would stay composed and avoid getting defensive or argumentative.

- Empathetic: I would try to understand the customer’s perspective and acknowledge their concerns.

- Solution-oriented: I would focus on finding a mutually acceptable solution to the issue.

- Firm: If necessary, I would be firm in setting boundaries and explaining the consequences of non-payment.

4. How do you stay up-to-date on changes in insurance regulations?

- Industry publications: I would subscribe to industry publications and newsletters.

- Conferences and workshops: I would attend industry conferences and workshops to learn about new regulations and best practices.

- Online resources: I would use online resources, such as the websites of regulatory agencies, to stay informed.

- Company training: I would participate in any training programs offered by my employer to keep up with changing regulations.

5. What is your experience with using skip tracing techniques to locate policyholders?

- Social media: I would use social media platforms to search for policyholders.

- Public records: I would search public records, such as property records and voter registration lists.

- Online search engines: I would use online search engines to find information about policyholders, such as their current address or phone number.

- Private investigators: If other methods are unsuccessful, I may consider hiring a private investigator to locate the policyholder.

6. How do you manage your time and resources effectively?

- Prioritization: I would prioritize my tasks and focus on the most important ones first.

- Time management tools: I would use time management tools, such as calendars and to-do lists, to stay organized and on track.

- Delegation: If necessary, I would delegate tasks to other team members to free up my time.

- Automation: I would use technology and automation to streamline my workflow and save time.

7. What is your experience with using insurance software?

- Policy management systems: I have experience using policy management systems to manage insurance policies, track premiums, and process claims.

- Billing systems: I have experience using billing systems to generate invoices, process payments, and manage accounts receivable.

- Customer relationship management (CRM) systems: I have experience using CRM systems to track customer interactions and manage relationships.

- Other software: I am proficient in using Microsoft Office Suite and other productivity software.

8. What are your strengths and weaknesses in relation to this role?

Strengths

- Communication skills: I am a highly effective communicator, both verbally and in writing.

- Negotiation skills: I am skilled at negotiating with customers to resolve disputes and find mutually acceptable solutions.

- Problem-solving skills: I am a quick learner and can effectively solve problems and find solutions to complex issues.

- Attention to detail: I am highly detail-oriented and organized, with a strong focus on accuracy.

Weaknesses

- Lack of experience in a high-volume collection environment: While I have experience in insurance collections, I have not worked in a high-volume environment.

- Limited knowledge of insurance regulations: While I am familiar with some basic insurance regulations, I would need to further my knowledge to excel in this role.

9. What are your salary expectations?

My salary expectations are based on my skills, experience, and the market value for similar positions in the industry.

- Research: I have researched industry benchmarks and consulted with recruiters to determine a fair and competitive salary range.

- Experience: I have [x] years of experience in insurance collections, which is relevant to the requirements of this role.

- Skills: I possess a strong skill set that aligns with the job description, including communication skills, negotiation skills, and problem-solving skills.

- Location: I am aware that salaries can vary depending on location, and I have taken into account the cost of living in this area.

10. Why are you interested in this role?

- Alignment with skills and experience: This role aligns with my skills and experience in insurance collections.

- Growth opportunities: I am eager to grow my career and take on new challenges, and this role provides opportunities for professional development.

- Company reputation: I am impressed with the company’s reputation in the industry and its commitment to customer service.

- Company culture: I am drawn to the company’s positive and supportive work culture.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Collector.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Collector‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance Collectors are responsible for collecting premiums from policyholders, processing payments, and maintaining accurate records. They may also perform other duties, such as issuing receipts, answering customer questions, and providing general customer service.

1. Collecting premiums

This is the primary responsibility of an Insurance Collector. They must collect premiums from policyholders on time and in full. This may involve contacting policyholders by phone, mail, or email, or visiting them in person.

- Understanding policies and procedures related to collecting premiums from policyholders

- Calculating and collecting premiums from policyholders in a timely and accurate manner

2. Processing payments

Once premiums have been collected, Insurance Collectors must process the payments. This may involve entering the payments into a computer system, sending out receipts, and updating policyholder records.

- Accurately processing premium payments and updating policyholder accounts

- Maintaining records of premium payments and transactions

3. Maintaining accurate records

Insurance Collectors must maintain accurate records of all premium payments and transactions. This information is used to track policyholder payments, identify unpaid premiums, and generate reports.

- Recording premium payments in a timely and accurate manner

- Identifying and correcting errors in premium records

4. Providing customer service

In addition to their other duties, Insurance Collectors may also provide customer service to policyholders. This may involve answering questions, resolving complaints, and providing general assistance.

- Answering policyholder questions and providing information about insurance products and services

- Resolving policyholder complaints and issues

Interview Tips

Preparing for an Insurance Collector interview can help you make a positive impression on the hiring manager and increase your chances of getting the job. Here are a few tips to help you prepare:

1. Research the company and the position

Before you go to your interview, take some time to research the company and the position you’re applying for. This will help you understand the company’s culture, their products or services, and the specific responsibilities of the Insurance Collector position.

- Visit the company’s website to learn about their history, mission, and values.

- Read online reviews of the company to get a sense of the work environment and culture.

- Look up the specific job description for the Insurance Collector position to learn about the specific responsibilities and qualifications required.

2. Practice your answers to common interview questions

There are a number of common interview questions that you may be asked, such as “Tell me about yourself” or “Why are you interested in this position?” It’s helpful to practice your answers to these questions ahead of time so that you can deliver them confidently and clearly.

- Use the STAR method to answer interview questions. This means providing a Situation, Task, Action, and Result for each question.

- Highlight your skills and experience that are most relevant to the Insurance Collector position.

- Be enthusiastic and positive in your answers, and make sure to make eye contact with the interviewer.

3. Dress professionally and arrive on time

First impressions matter, so it’s important to dress professionally for your interview. This means wearing a suit or business casual attire. You should also arrive on time for your interview, as this shows that you respect the interviewer’s time.

4. Be prepared to ask questions

At the end of the interview, the interviewer will likely ask if you have any questions. This is your opportunity to learn more about the position and the company. It’s also a good way to show that you’re interested in the job and that you’re taking the interview seriously.

- Prepare a few questions to ask the interviewer, such as “What are the biggest challenges facing the Insurance Collector team?” or “What are the opportunities for advancement within the company?”

- Be specific in your questions, and avoid asking questions that are too general or that have already been answered in the interview.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Insurance Collector interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!