Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Insurance Consultant interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Insurance Consultant so you can tailor your answers to impress potential employers.

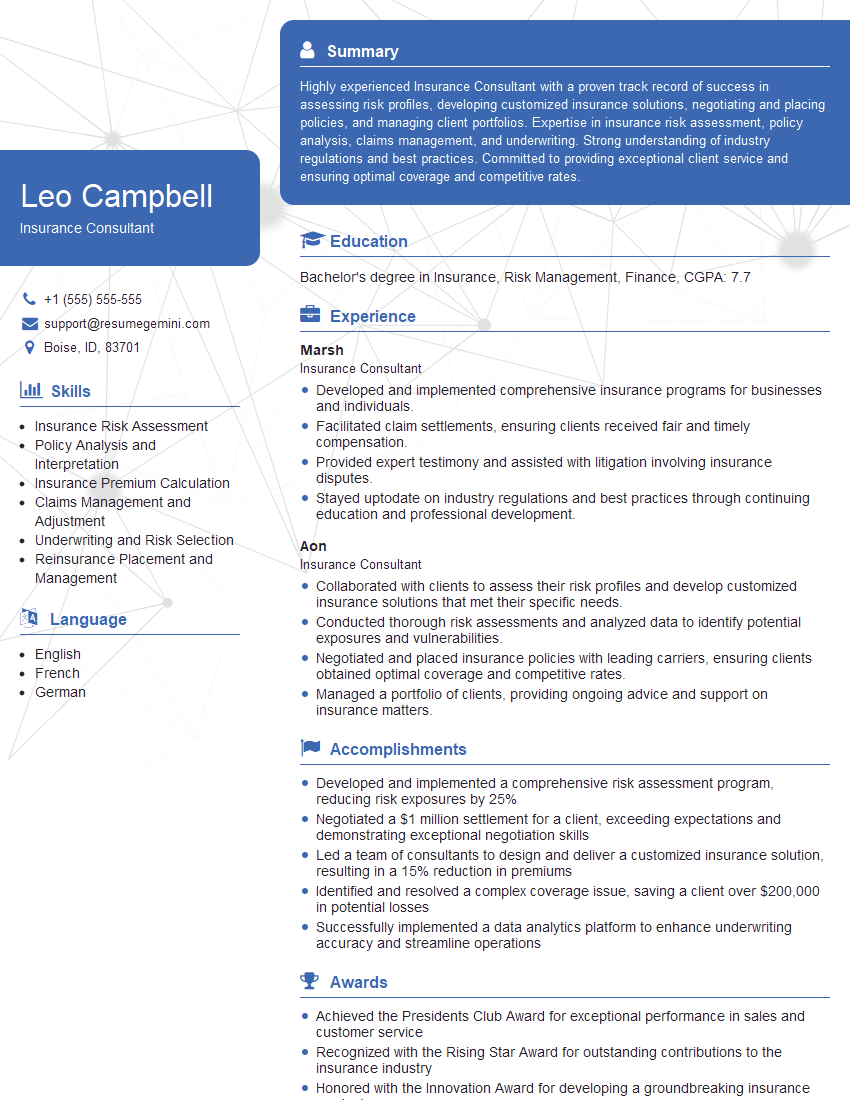

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Consultant

1. What are the key elements of an insurance policy?

The key elements of an insurance policy typically include:

- The policyholder (the person or entity purchasing the insurance)

- The insured (the person or property covered by the insurance)

- The insurer (the company providing the insurance)

- The coverage (the specific risks or events covered by the policy)

- The policy period (the length of time the policy is in effect)

- The premium (the amount of money the policyholder pays for the insurance)

- The deductible (the amount of money the policyholder must pay out of pocket before the insurance coverage begins)

- The policy limits (the maximum amount of money the insurer will pay out for a covered event)

- The exclusions (the events or situations that are not covered by the policy)

2. What are the different types of insurance policies?

Personal Insurance

- Health insurance

- Life insurance

- Disability insurance

- Homeowners insurance

- Auto insurance

Commercial Insurance

- Property insurance

- Liability insurance

- Workers’ compensation insurance

- Business interruption insurance

- Cyber insurance

- Errors and omissions insurance (professional liability insurance)

3. What are the key factors to consider when choosing an insurance policy?

The key factors to consider when choosing an insurance policy include:

- The type of coverage needed

- The amount of coverage needed

- The cost of the policy

- The reputation of the insurance company

- The financial strength of the insurance company

- The claims process

4. What are the different ways to obtain insurance?

Insurance can be obtained through a variety of channels, including:

- Insurance agents

- Insurance brokers

- Directly from insurance companies

- Online insurance marketplaces

5. What are the advantages and disadvantages of using an insurance agent or broker?

Advantages

- Insurance agents and brokers can provide personalized advice and guidance.

- They can help you find the best coverage for your needs.

- They can help you file claims and negotiate with insurance companies.

Disadvantages

- Insurance agents and brokers typically charge a fee for their services.

- They may be biased towards certain insurance companies.

- They may not be able to provide the best coverage for your needs.

6. What are the benefits of insurance?

Insurance provides a number of benefits, including:

- Financial protection against unexpected events

- Peace of mind

- Access to quality healthcare

- Protection of assets

- Business continuity

7. What are the risks of not having insurance?

The risks of not having insurance include:

- Financial ruin

- Loss of property

- Loss of income

- Legal liability

- Personal injury

8. What are the different types of insurance fraud?

The different types of insurance fraud include:

- Applicant fraud

- Policyholder fraud

- Claim fraud

- Insurance company fraud

9. What are the consequences of insurance fraud?

The consequences of insurance fraud can include:

- Criminal prosecution

- Civil penalties

- Loss of insurance coverage

- Increased insurance premiums

10. What are the best practices for preventing insurance fraud?

The best practices for preventing insurance fraud include:

- Educating consumers about insurance fraud

- Using fraud detection tools and techniques

- Cooperating with law enforcement and other agencies

- Reporting suspected fraud

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Consultant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Consultant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance Consultants provide expert advice and guidance to clients on various insurance matters. Their primary responsibilities include:

1. Risk Assessment and Analysis

Assess clients’ insurance needs by evaluating their risks and exposures, and identifying potential gaps in coverage.

- Conduct thorough interviews and review financial statements to understand client’s operations and exposures.

- Analyze industry trends, regulations, and market data to stay updated on potential risks and threats.

2. Insurance Policy Design and Placement

Develop and recommend customized insurance solutions tailored to clients’ specific requirements and risk profile.

- Identify the most appropriate insurance policies and carriers based on the client’s needs and budget.

- Negotiate terms and conditions with insurance providers to secure optimal coverage and favorable rates.

3. Claims Advocacy and Management

Assist clients in navigating the claims process, ensuring their interests are protected and claims are settled fairly.

- Provide guidance on claim preparation, documentation, and submission.

- Represent clients in negotiations with insurance adjusters and third-party administrators.

4. Insurance Education and Training

Educate clients on insurance concepts, coverages, and best practices to enhance their understanding and compliance.

- Conduct workshops, seminars, and webinars to provide comprehensive insurance knowledge.

- Develop training materials and resources to support clients’ ongoing insurance education.

Interview Tips

To ace the interview for an Insurance Consultant position, candidates should consider the following tips:

1. Research and Prepare

Thoroughly research the insurance industry, the specific company you’re applying to, and the role itself. This will demonstrate your interest and enthusiasm.

- Review the company’s website, read industry publications, and connect with professionals on LinkedIn.

- Identify key skills and experiences required for the role and highlight them in your resume and cover letter.

2. Showcase Expertise and Experience

Use specific examples to demonstrate your expertise in risk assessment, insurance policy design, and claims management. Quantify your accomplishments whenever possible.

- Highlight successful projects where you provided valuable insurance advice and solutions to clients.

- Share examples of complex claims you handled and the outcomes you achieved for your clients.

3. Emphasize Communication and Client Service Skills

Insurance Consultants must have excellent communication and interpersonal skills to effectively interact with clients and build strong relationships.

- Describe situations where you effectively communicated complex insurance concepts to non-technical audiences.

- Provide examples of how you went above and beyond to meet client needs and provide exceptional service.

4. Prepare for Industry-Specific Questions

Be prepared to answer questions related to insurance regulations, industry trends, and specific insurance products. This will demonstrate your knowledge of the field.

- Review recent insurance industry news and regulatory updates.

- Familiarize yourself with different types of insurance policies, their coverages, and exclusions.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Insurance Consultant interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!