Feeling lost in a sea of interview questions? Landed that dream interview for Insurance Counselor but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Insurance Counselor interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

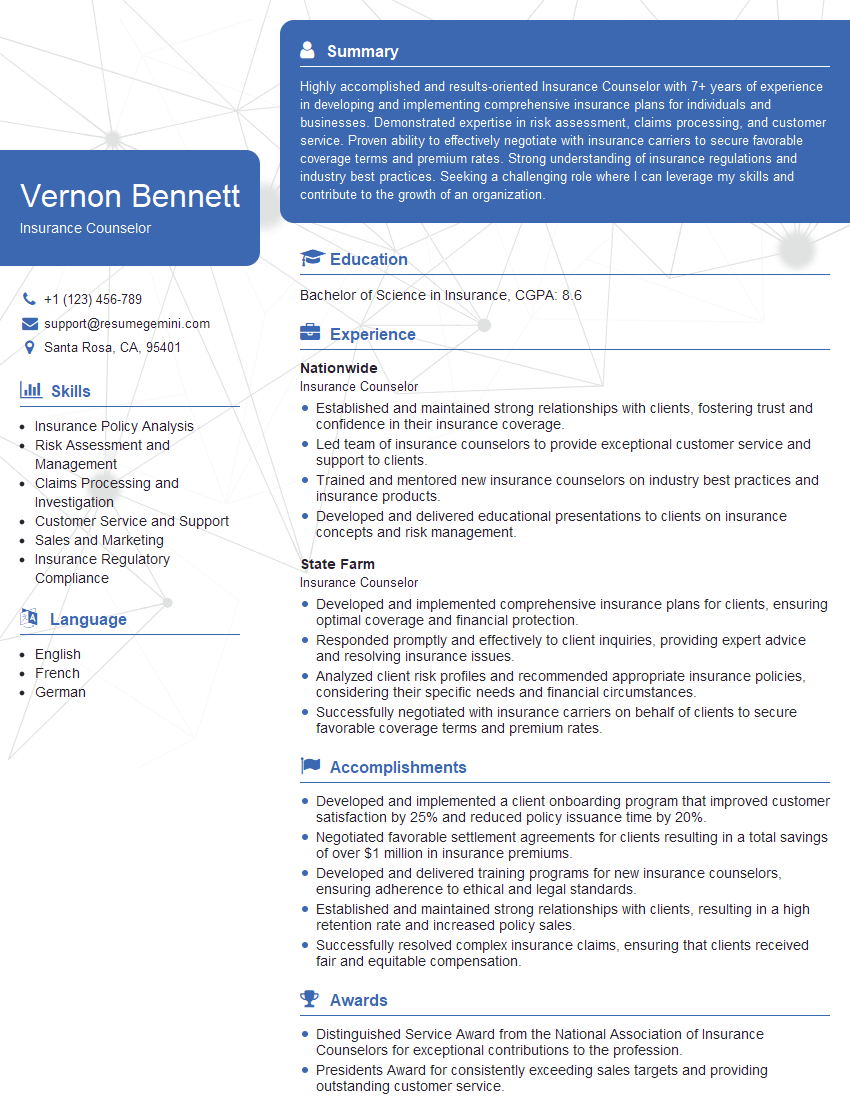

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Counselor

1. Describe the key responsibilities of an Insurance Counselor

As an Insurance Counselor, my key responsibilities include:

- Providing comprehensive insurance guidance and support to clients

- Analyzing clients’ insurance needs and recommending appropriate coverage options

- Explaining insurance policies, benefits, and exclusions to clients in clear and accessible language

- Processing insurance applications and claims

- Staying up-to-date on industry regulations and best practices

2. Explain the different types of insurance policies available and their purpose

The main types of insurance policies include:

a) Health Insurance

- Provides coverage for medical expenses, including hospitalization, doctor visits, and prescription drugs

- Examples: Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), High-Deductible Health Plan (HDHP)

b) Life Insurance

- Provides financial support to beneficiaries upon the insured’s death

- Examples: Term Life Insurance, Whole Life Insurance, Universal Life Insurance

c) Auto Insurance

- Provides coverage for damages and liabilities resulting from car accidents

- Examples: Liability Coverage, Collision Coverage, Comprehensive Coverage

d) Homeowners Insurance

- Provides coverage for damages to the home, belongings, and liabilities related to homeownership

- Examples: Dwelling Coverage, Personal Property Coverage, Liability Coverage

e) Disability Insurance

- Provides income replacement if the insured becomes unable to work due to illness or injury

- Examples: Short-Term Disability Insurance, Long-Term Disability Insurance

3. Describe the factors that affect insurance premiums

Insurance premiums are influenced by several factors, including:

- Age: Younger individuals typically pay lower premiums than older individuals

- Health: Individuals with pre-existing medical conditions or high-risk behaviors may pay higher premiums

- Occupation: Individuals in certain occupations, such as construction workers or pilots, may pay higher premiums

- Location: Premiums may vary based on the geographic location and crime rates

- Coverage Amount: Higher coverage amounts generally result in higher premiums

- Deductible: Choosing a higher deductible can lower premiums

4. Explain the difference between deductibles and copays

A deductible is a fixed amount that the insured pays out-of-pocket before the insurance coverage begins. A copay is a fixed amount that the insured pays for covered services, regardless of the total cost of the service.

- Deductibles are typically used for major medical expenses, such as hospitalizations or surgeries

- Copays are typically used for routine medical expenses, such as doctor visits or prescriptions

5. Describe the underwriting process and its importance

Underwriting is the process by which insurance companies assess the risk associated with insuring an individual or business.

- It involves reviewing the applicant’s medical history, occupation, driving record, and other relevant information

- Based on this assessment, the insurance company determines whether to offer coverage and at what premium rate

- Underwriting helps ensure that insurance premiums are fair and that risks are properly managed

6. Explain the role of state insurance regulations in the insurance industry

State insurance regulations play a crucial role in protecting consumers and ensuring the stability of the insurance industry.

- They set minimum standards for insurance policies, including coverage requirements and premium rates

- They require insurance companies to maintain adequate financial reserves

- They establish procedures for resolving insurance disputes

7. Describe the different channels through which insurance policies can be sold

Insurance policies can be sold through various channels, including:

- Independent insurance agents: Represent multiple insurance companies and provide personalized advice

- Captive agents: Work exclusively for one insurance company and offer only its products

- Direct writers: Sell insurance policies directly to consumers without using agents

- Online marketplaces: Allow consumers to compare and purchase insurance policies from multiple providers

8. Explain the importance of customer service in the insurance industry

Excellent customer service is crucial in the insurance industry for several reasons:

- It builds trust and loyalty among clients

- It helps resolve issues and complaints promptly and efficiently

- It generates positive word-of-mouth referrals

- It contributes to client retention and increased sales

9. Describe the ethical and legal responsibilities of Insurance Counselors

Insurance Counselors have several ethical and legal responsibilities, including:

- Acting in the best interests of their clients

- Providing accurate and transparent information about insurance policies

- Maintaining confidentiality of client information

- Complying with all applicable laws and regulations

- Avoiding conflicts of interest

10. Discuss the emerging trends in the insurance industry

The insurance industry is constantly evolving, with several emerging trends shaping its future, including:

- Increased use of artificial intelligence (AI) for underwriting, claims processing, and customer service

- Growth of personalized insurance products tailored to individual needs

- Shift towards digital insurance distribution channels

- Focus on data analytics for risk assessment and product development

- Increased emphasis on sustainability and environmental, social, and governance (ESG) issues

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Counselor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Counselor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance Counselors play a pivotal role in the insurance industry, guiding clients through the complexities of insurance policies and assisting them in making informed decisions. Their key responsibilities include:

1. Policy Analysis and Explanation

Insurance Counselors thoroughly study and analyze insurance policies, deciphering complex legal language and explaining the terms, coverage, and exclusions to clients in a clear and concise manner.

2. Risk Assessment and Coverage Recommendations

They assess clients’ risks and needs, evaluating their assets, liabilities, and potential vulnerabilities. Based on this assessment, they recommend appropriate insurance coverage and strategies to mitigate risks.

3. Sales and Marketing

Insurance Counselors are responsible for selling and marketing insurance products. They present policy options, explain benefits, and persuade clients to purchase coverage that aligns with their needs.

4. Customer Service and Support

They provide ongoing support to clients, answering questions, addressing concerns, and processing claims. They build strong relationships with clients, ensuring their satisfaction and loyalty.

Interview Tips

Thoroughly preparing for an Insurance Counselor interview is crucial. Here are some tips to help you ace it:

1. Research the Company and Industry

Familiarize yourself with the insurance company you’re applying to, their products, and the industry trends. This demonstrates your interest and understanding of the field.

2. Practice Your Sales Skills

Since Insurance Counselors are also responsible for sales, prepare to showcase your sales abilities. Role-play different scenarios, practice presenting policy options, and anticipate common objections.

3. Highlight Your Customer Service Experience

Emphasize your exceptional customer service skills and ability to build relationships. Share examples of how you handled challenging situations and exceeded client expectations.

4. Prepare for Industry-Specific Questions

Anticipate questions about insurance policies, risk assessment, and industry regulations. Brush up on your knowledge of these topics to demonstrate your expertise.

Remember, preparation is key. By following these tips, you’ll increase your chances of making a positive impression and landing the job you desire.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Insurance Counselor interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.