Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Insurance Office Manager position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

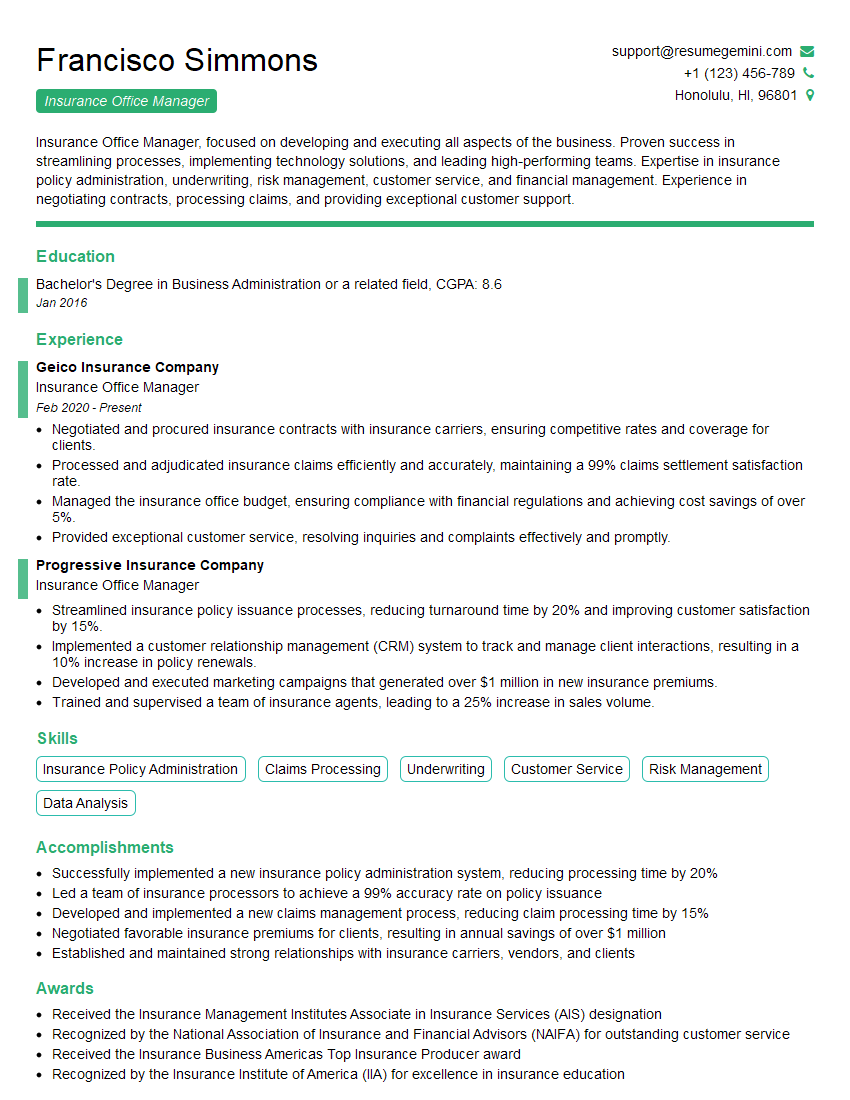

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Office Manager

1. How would you handle a complex insurance claim that requires extensive research and analysis?

- Gather all relevant information about the claim, including the policy, the incident report, and any witness statements.

- Review the policy carefully to determine the coverage and exclusions that apply to the claim.

- Conduct a thorough investigation into the incident, including interviewing witnesses and gathering evidence.

- Analyze the information gathered to determine the cause of the loss and the extent of the damages.

- Prepare a detailed report of the findings and make a recommendation on how to settle the claim.

2. What are the key elements of an effective insurance policy?

subheading of the answer

- Clear and concise language

- Complete and accurate coverage

- Fair and reasonable premiums

- Prompt and efficient claims handling

subheading of the answer

- Flexibility to meet the needs of the insured

- Competitive pricing

- Financial strength of the insurer

- Good reputation in the industry

3. How would you manage a team of insurance agents or brokers?

- Set clear goals and expectations for the team.

- Provide regular training and development opportunities.

- Monitor the team’s performance and provide feedback.

- Create a positive and supportive work environment.

- Delegate tasks and responsibilities effectively.

4. What are the most important factors to consider when setting insurance rates?

- The type of insurance

- The risk factors involved

- The claims history of the insured

- The financial strength of the insurer

- The competitive market landscape

5. How would you handle a customer complaint about the claims process?

- Listen to the customer’s complaint and empathize with their frustration.

- Investigate the complaint thoroughly and gather all relevant information.

- Explain the claims process to the customer and answer any questions they may have.

- Work with the customer to resolve the complaint in a fair and reasonable manner.

- Follow up with the customer to ensure that they are satisfied with the resolution.

6. What are the latest trends in the insurance industry?

- The use of technology to automate and streamline insurance processes.

- The development of new insurance products and services to meet the changing needs of customers.

- The increasing importance of data and analytics in insurance underwriting and claims handling.

- The globalization of the insurance industry.

- The regulatory changes affecting the insurance industry.

7. What are the key challenges facing the insurance industry today?

- The rising cost of claims.

- The increasing frequency of natural disasters.

- The evolving regulatory landscape.

- The need to innovate and adapt to new technologies.

- The increasing competition from new entrants to the market.

8. What are your strengths and weaknesses as an Insurance Office Manager?

- Strengths

- Strong understanding of insurance principles and practices.

- Excellent communication and interpersonal skills.

- Proven ability to manage a team and achieve results.

- Experience in developing and implementing insurance policies and procedures.

- Weaknesses

- Limited experience in underwriting.

- Could improve my knowledge of financial reporting.

subheading of the answer

subheading of the answer

9. Why are you interested in this position?

- I am interested in this position because it offers the opportunity to use my skills and experience to make a positive impact on the company.

- I am confident that I have the knowledge and abilities necessary to be successful in this role.

- I am eager to learn more about the insurance industry and to contribute to the company’s success.

10. Do you have any questions for me?

- I am interested in learning more about the company’s culture and values.

- Can you tell me more about the company’s plans for growth in the future?

- What are the company’s expectations for this position?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Office Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Office Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance Office Managers are in charge of ensuring the smooth and efficient operation of an insurance company’s daily activities. They oversee the work of other employees, manage customer relations, and ensure that the company complies with all applicable laws and regulations

1. Manage day-to-day operations of the insurance office

Insurance Office Managers are responsible for directing, planning, and coordinating all office activities. This can include tasks such as:

- Supervising and training office staff

- Managing budgets and financial records

- Purchasing and maintaining office supplies and equipment

- Developing and implementing office procedures and policies

2. Manage and develop employees

Insurance Office Managers are responsible for managing and developing the staff in their office. This can include tasks such as:

- Hiring, training, and evaluating employees

- Setting performance goals and expectations

- Providing feedback and support to employees

- Promoting a positive and productive work environment

3. Provide excellent customer service

Insurance Office Managers are responsible for providing excellent customer service to both external and internal customers. This can include tasks such as:

- Answering questions and resolving customer concerns

- Processing insurance claims

- Maintaining customer records

- Ensuring that customer needs are met in a timely and efficient manner

4. Stay up-to-date on insurance laws and regulations

Insurance Office Managers are responsible for staying up-to-date on all applicable insurance laws and regulations. This can include tasks such as:

- Reading industry publications and attending conferences

- Maintaining a working knowledge of insurance policies and procedures

- Ensuring that the company complies with all applicable laws and regulations

Interview Tips

Preparing for an interview can be daunting, but there are some things you can do to increase your chances of success:

1. Research the company and the position

Before your interview, take some time to research the company and the position you’re applying for. This will help you understand the company’s culture, goals, and expectations for the role.

2. Practice answering common interview questions

There are some common interview questions that you’re likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It’s helpful to practice answering these questions in advance so that you can deliver your answers confidently and succinctly.

3. Dress professionally and arrive on time

First impressions matter, so it’s important to dress professionally and arrive on time for your interview. This shows the interviewer that you respect their time and that you’re serious about the position.

4. Be yourself and be enthusiastic

The most important thing is to be yourself and be enthusiastic about the position. The interviewer wants to get to know the real you, so don’t try to be someone you’re not. And if you’re genuinely excited about the position, it will come through in your interview.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Insurance Office Manager, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Insurance Office Manager positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.