Feeling lost in a sea of interview questions? Landed that dream interview for Insurance Policy Issue Clerk but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Insurance Policy Issue Clerk interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

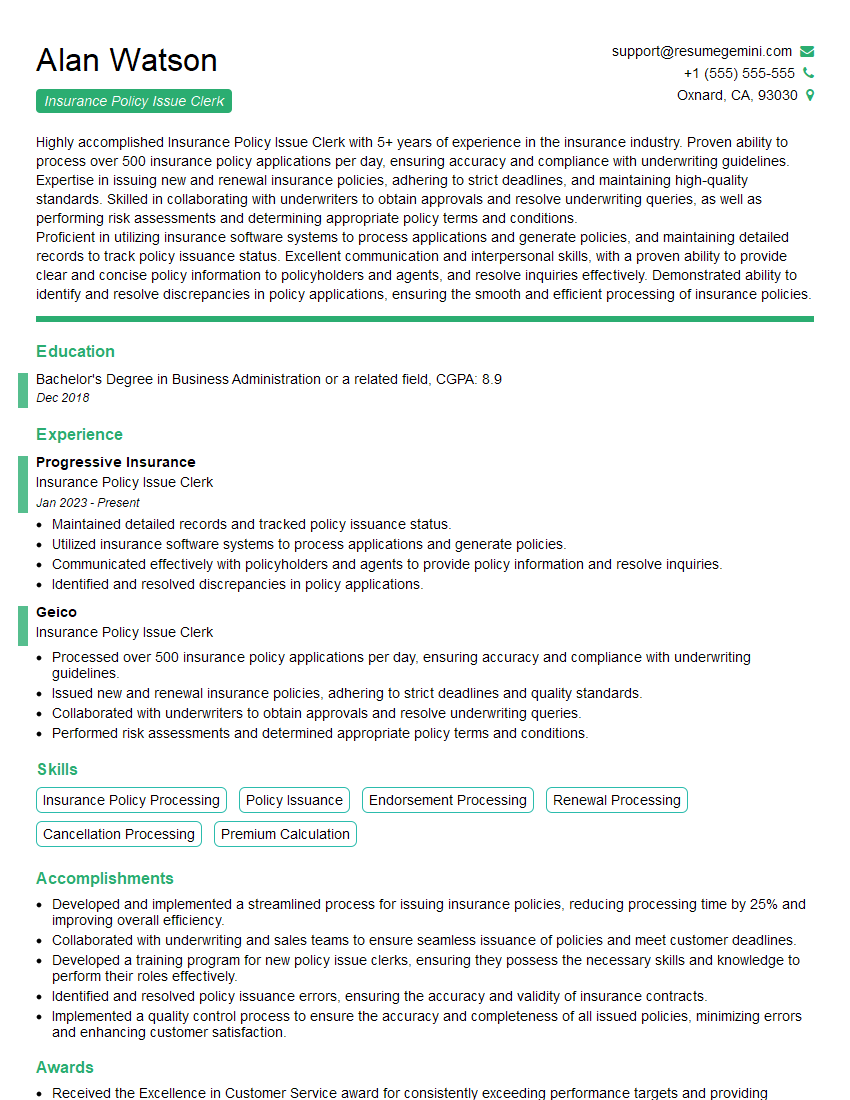

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Policy Issue Clerk

1. Describe the steps involved in processing an insurance policy application?

- Receive and review the application for completeness and accuracy.

- Verify the applicant’s identity and eligibility for coverage.

- Calculate the appropriate premium based on underwriting guidelines.

- Draft and issue the policy.

- Maintain accurate records of the policy and any subsequent changes.

2. What are the common reasons for denying an insurance policy application?

Underwriting Reasons

- High-risk occupation or lifestyle.

- Pre-existing medical conditions.

- Poor credit history.

Administrative Reasons

- Incomplete or inaccurate application.

- Applicant does not meet eligibility criteria.

- Fraudulent information on the application.

3. How do you handle a customer who is unhappy with their policy?

- Listen to their concerns and try to understand their perspective.

- Review the policy to ensure that it was issued correctly.

- Explain the policy terms and conditions in clear and concise language.

- Work with the customer to find a solution that meets their needs.

- Document the conversation and any agreements made.

4. What types of insurance policies are you most familiar with?

- Auto insurance

- Homeowners insurance

- Life insurance

- Health insurance

- Commercial insurance

5. Describe the importance of accuracy when issuing an insurance policy.

- Ensures that the policyholder receives the correct coverage.

- Protects the insurance company from financial losses.

- Maintains customer satisfaction and trust.

- Prevents disputes and legal issues.

6. How do you stay up-to-date on changes in insurance regulations?

- Attend industry conferences and webinars.

- Read trade publications and online resources.

- Network with other insurance professionals.

- Review company bulletins and updates.

7. What is your experience with using insurance software?

- Proficient in using [Software Name] for policy issuance, underwriting, and claims processing.

- Familiar with [Software Name] for managing customer accounts and generating reports.

- Able to learn and adapt to new insurance software systems quickly.

8. How do you prioritize your workload when faced with multiple deadlines?

- Use a to-do list or task management system to keep track of tasks.

- Set realistic deadlines for each task.

- Delegate tasks to others when possible.

- Break down large tasks into smaller, more manageable steps.

- Take breaks throughout the day to maintain focus and productivity.

9. Describe a situation where you had to use your problem-solving skills to resolve a customer issue.

- A customer called to report that their policy had not been renewed.

- I reviewed their account and discovered that their payment had been declined.

- I contacted the customer and helped them update their payment information.

- I processed the renewal and sent them a confirmation email.

- The customer was grateful for my quick response and resolution of the issue.

10. What are your career goals?

- To continue developing my skills and knowledge in the insurance industry.

- To take on a leadership role in a growing insurance organization.

- To make a positive impact on the lives of others through my work.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Policy Issue Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Policy Issue Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance Policy Issue Clerks play a vital role in the insurance industry, ensuring that policies are processed and issued accurately and efficiently. Key responsibilities of this position include:

1. Policy Issuance

Preparing and issuing insurance policies according to underwriting guidelines and customer requirements.

- Reviewing and verifying policy applications for completeness and accuracy.

- Calculating premiums, determining coverage limits, and ensuring compliance with regulations.

2. Policy Maintenance

Updating and maintaining policy records throughout the policy period.

- Processing changes to policies, such as endorsements, cancellations, and renewals.

- Maintaining accurate customer records and ensuring timely policy delivery.

3. Customer Service

Providing excellent customer service and resolving policy-related inquiries.

- Answering customer questions about policy details, coverage, and premiums.

- Explaining policy terms and conditions clearly and effectively.

4. Compliance and Regulatory Adherence

Ensuring compliance with all applicable laws, regulations, and company policies.

- Reviewing policies for compliance with underwriting guidelines and insurance regulations.

- Maintaining accurate documentation and records to demonstrate compliance.

Interview Tips

To ace an interview for an Insurance Policy Issue Clerk position, it’s crucial to prepare thoroughly and demonstrate your understanding of the role and the industry. Here are some interview tips and hacks to help you succeed:

1. Research the Company and Industry

Take the time to research the insurance company you’re interviewing with and the insurance industry as a whole. Familiarize yourself with their products, services, and reputation. This knowledge will help you answer questions intelligently and show that you’re genuinely interested in the position.

2. Practice Your Policy Issuance Knowledge

Be prepared to discuss your experience and knowledge of policy issuance. Practice explaining how you would calculate premiums, determine coverage limits, and review policy applications. Use examples from your previous work experience to demonstrate your skills.

3. Highlight Your Customer Service Skills

Customer service is a key aspect of this role. Emphasize your ability to communicate clearly, resolve inquiries efficiently, and maintain a positive attitude. Share examples of how you’ve handled challenging customer situations and exceeded expectations.

4. Demonstrate Your Compliance Understanding

Insurance regulations are crucial in this industry. Show that you understand the importance of compliance and have experience adhering to laws and regulations. Discuss how you have ensured compliance in previous roles and how you would do so in this position.

5. Prepare Questions for the Interviewer

Asking thoughtful questions shows that you’re engaged and interested in the company. Prepare questions about the specific role, the team you’ll be working with, and the company’s culture. This will give you valuable insights and demonstrate your enthusiasm for the opportunity.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Insurance Policy Issue Clerk interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.