Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Insurance Processing Clerk interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Insurance Processing Clerk so you can tailor your answers to impress potential employers.

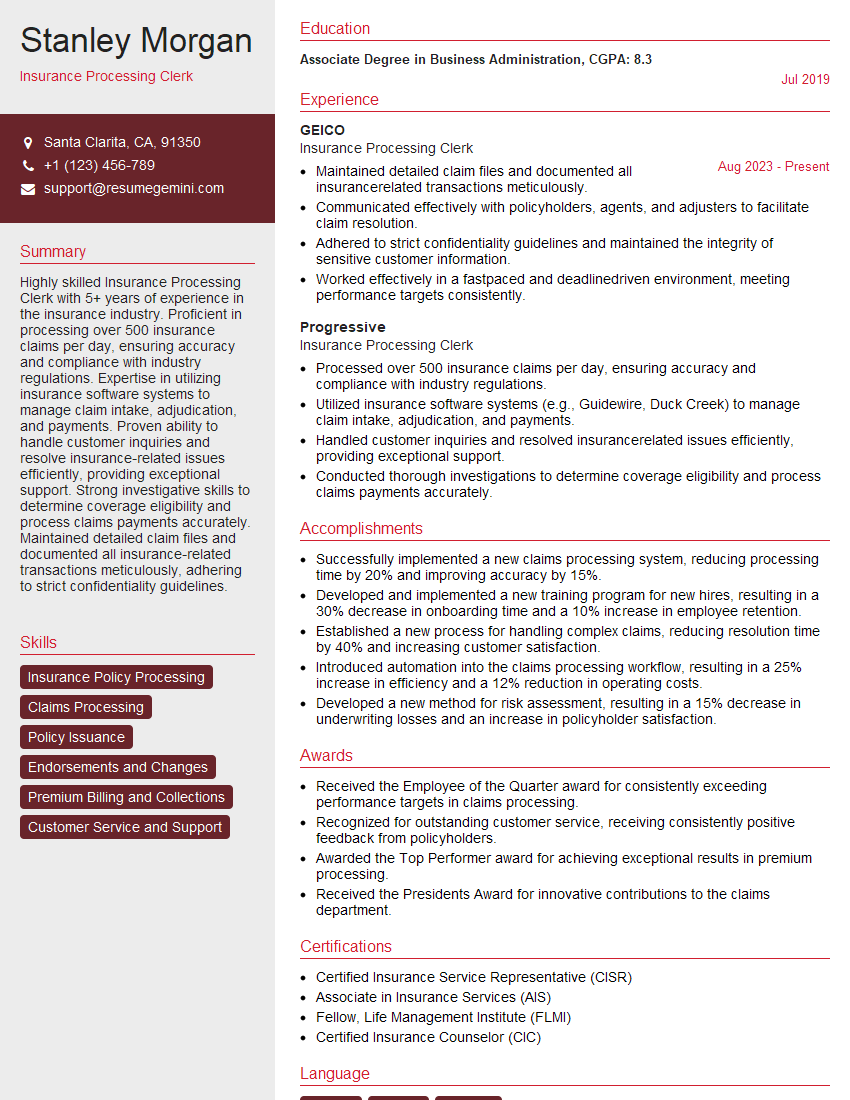

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Processing Clerk

1. What are the key responsibilities of an Insurance Processing Clerk?

As an Insurance Processing Clerk, my primary responsibilities would encompass:

- Processing insurance claims accurately and efficiently.

- Verifying and recording policyholder information.

- Calculating loss payments and preparing settlement drafts.

- Responding to inquiries from policyholders and agents.

- Maintaining records and ensuring compliance with company policies and procedures.

2. Describe the process you would follow when processing an insurance claim.

: Initial Assessment

- Review the claim form to ensure all required information is provided.

- Contact the policyholder to gather additional details if necessary.

- Verify coverage and determine if the claim is covered under the policy.

Subheading: Investigation and Adjustment

- Investigate the claim by obtaining reports, photos, or other supporting documentation.

- Assess the damages and determine the appropriate settlement amount.

- Negotiate with the policyholder if necessary to reach a mutually acceptable settlement.

Subheading: Processing and Payment

- Prepare and process the settlement draft for payment.

- Update the policyholder’s account and maintain accurate records.

3. What are some of the challenges you have faced in previous insurance claim processing roles and how did you overcome them?

In my previous role, one challenge I encountered was dealing with complex and high-value claims. To overcome this, I thoroughly researched relevant policies and sought guidance from senior colleagues. I also utilized available resources, such as legal databases and insurance industry publications, to stay informed and ensure accurate decision-making.

4. How do you stay updated on changes in insurance regulations and policies?

I regularly review industry publications, attend seminars, and participate in online training programs to keep abreast of changing insurance regulations and policies. Additionally, I maintain memberships in professional organizations, such as the National Association of Insurance Commissioners (NAIC), which provide access to valuable resources and networking opportunities.

5. What is your experience with insurance software and technology?

I am proficient in various insurance software and technology tools, including claims processing systems, policy management systems, and customer relationship management (CRM) software. I am also familiar with industry-specific technologies, such as electronic data interchange (EDI) and optical character recognition (OCR), which streamline the claims processing process.

6. How do you prioritize your workload and manage multiple tasks effectively?

I prioritize my workload by assessing the urgency and importance of each task. I utilize tools such as to-do lists and scheduling apps to manage my time effectively. I also prioritize tasks based on deadlines and the impact they have on policyholders. When managing multiple tasks, I break them down into smaller, manageable steps and allocate time slots to complete each task.

7. What are your strengths and weaknesses as an Insurance Processing Clerk?

My strengths include my attention to detail, strong analytical skills, and ability to work efficiently in a fast-paced environment. I am also a highly motivated individual with a strong knowledge of insurance policies and procedures. As for weaknesses, I recognize that I can sometimes be too detail-oriented, which may lead to spending more time than necessary on certain tasks. However, I am constantly striving to improve my time management skills and maintain a high level of efficiency.

8. Why are you interested in working as an Insurance Processing Clerk for our company?

I am eager to join your esteemed organization as an Insurance Processing Clerk because I am impressed by the company’s reputation for excellence in the industry. Your commitment to providing exceptional customer service aligns with my own values, and I believe that my skills and experience would make a valuable contribution to your team. I am confident that I can leverage my knowledge and enthusiasm to support your operations and contribute to the success of the company.

9. What are your salary expectations for this role?

My salary expectations are in line with the industry average and commensurate with my skills and experience. I am confident that I can bring value to your organization, and I am open to discussing a compensation package that is mutually beneficial.

10. Do you have any questions for me about the role or the company?

I am very interested in this opportunity and would like to know more about the company’s growth plans in the insurance industry. I am also curious about the opportunities for professional development and career advancement within the organization.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Processing Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Processing Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance Processing Clerks perform various tasks to support insurance agencies and carriers. Their key responsibilities include:

1. Data Entry and Processing

Enter and update policyholder and insurance policy information into computer systems, ensuring accuracy and completeness.

2. Policy Issuance and Maintenance

Process new insurance policy applications, issue policies, and make necessary adjustments or cancellations.

3. Claims and Payment Handling

Receive, review, and process insurance claims, determining eligibility and coverage according to policy terms.

4. Customer Service

Respond to inquiries from policyholders, agents, and other stakeholders, providing information and assisting with inquiries.

5. Underwriting Support

Assist underwriters in evaluating and assessing insurance risks by providing them with relevant information.

Interview Tips

To ace an interview for an Insurance Processing Clerk position, preparation is crucial. Here are some tips:

1. Research the Company and Industry

Gather information about the insurance agency or carrier to understand their size, services, and industry presence.

2. Highlight Relevant Skills and Experience

Emphasize your proficiency in data entry, customer service, and basic insurance concepts. Highlight any previous experience in the insurance industry or related roles.

3. Practice Common Interview Questions

Prepare for questions related to your work experience, skills, and understanding of the insurance processing workflow. Provide specific examples to demonstrate your abilities.

4. Demonstrate Attention to Detail

Insurance processing requires precision and attention to detail. During the interview, pay attention to the interviewer’s questions and respond thoughtfully, ensuring accuracy in your answers.

5. Ask Questions

Ask thoughtful questions about the position, team dynamics, and opportunities for professional growth. This shows your interest and engagement in the role.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Insurance Processing Clerk interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!