Feeling lost in a sea of interview questions? Landed that dream interview for Insurance Rater but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Insurance Rater interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

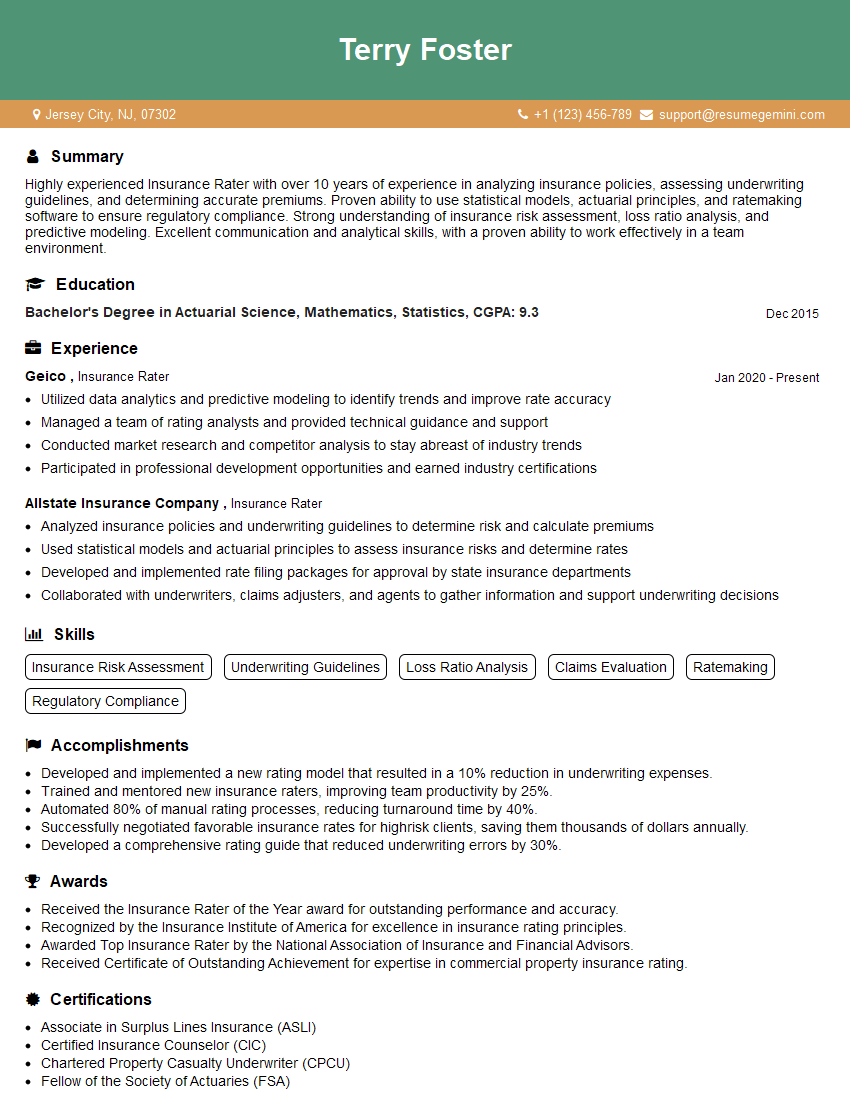

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Rater

1. How do you calculate the premium for a homeowner’s insurance policy?

The premium for a homeowner’s insurance policy is calculated based on a number of factors, including:

- The value of the home

- The location of the home

- The age of the home

- The claims history of the home

- The coverage limits that are desired

2. What are the different types of coverage that are available on a homeowner’s insurance policy?

- Dwelling coverage: This coverage protects the structure of the home, as well as any attached structures, such as a garage or porch.

- Other structures coverage: This coverage protects structures that are not attached to the home, such as a shed or fence.

- Personal property coverage: This coverage protects the personal belongings of the homeowner, such as furniture, clothing, and electronics.

- Loss of use coverage: This coverage provides reimbursement for additional living expenses if the homeowner is unable to live in their home due to a covered loss.

- Liability coverage: This coverage protects the homeowner from financial liability if someone is injured or their property is damaged on the homeowner’s property.

3. How do you determine the value of a home for insurance purposes?

The value of a home for insurance purposes is typically determined by a licensed appraiser. The appraiser will consider a number of factors when determining the value of the home, including:

- The size of the home

- The condition of the home

- The location of the home

- The recent sales prices of comparable homes in the area

4. What are the different factors that can affect the cost of homeowners insurance?

- The deductible

- The coverage limits

- The claims history of the homeowner

- The location of the home

- The age of the home

- The type of construction of the home

- The presence of a swimming pool or other attractive nuisance

- The credit score of the homeowner

5. What are some tips for reducing the cost of homeowners insurance?

- Increase the deductible

- Choose a higher coverage limit

- Install security features, such as a burglar alarm or fire alarm

- Maintain a good claims history

- Shop around for the best rates

6. What are the most common mistakes that homeowners make when purchasing homeowners insurance?

- Underinsuring the home

- Choosing the wrong deductible

- Not shopping around for the best rates

- Not understanding the policy coverage

- Failing to maintain a good claims history

7. What are the different types of commercial insurance policies that are available?

- General liability insurance

- Commercial property insurance

- Business interruption insurance

- Workers’ compensation insurance

- Commercial auto insurance

8. How do you determine the value of a commercial property for insurance purposes?

The value of a commercial property for insurance purposes is typically determined by a licensed appraiser. The appraiser will consider a number of factors when determining the value of the property, including:

- The size of the property

- The condition of the property

- The location of the property

- The recent sales prices of comparable properties in the area

- The intended use of the property

9. What are the different factors that can affect the cost of commercial insurance?

- The type of business

- The size of the business

- The location of the business

- The claims history of the business

- The coverage limits

- The deductible

- The credit score of the business owner

10. What are some tips for reducing the cost of commercial insurance?

- Increase the deductible

- Choose a higher coverage limit

- Install security features, such as a burglar alarm or fire alarm

- Maintain a good claims history

- Shop around for the best rates

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Rater.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Rater‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance Raters are responsible for analyzing and evaluating risk factors associated with insurance policies and determining the appropriate premiums for those policies. They use their knowledge of insurance policies and underwriting guidelines to assess the risk of loss and determine the likelihood of a claim being filed. Key job responsibilities include:

1. Analyze and Evaluate Risk Factors

Insurance Raters review a variety of data, including financial statements, loss history, and industry trends, to assess the risk factors associated with insurance policies. They use their knowledge of insurance policies and underwriting guidelines to determine the appropriate premiums for those policies.

2. Calculate Premiums

Insurance Raters calculate premiums based on the risk factors associated with insurance policies. They use a variety of rating factors, including the type of insurance, the amount of coverage, and the policyholder’s risk profile, to determine the appropriate premium.

3. Review and Approve Policies

Insurance Raters review and approve insurance policies before they are issued. They ensure that the policies are properly underwritten and that the premiums are correct. They also work with underwriters to resolve any issues that may arise during the underwriting process.

4. Provide Customer Service

Insurance Raters often provide customer service to policyholders. They answer questions about insurance policies and assist policyholders with claims. They also work with agents and brokers to explain insurance policies and answer their questions.

Interview Tips

Preparing thoroughly for an interview can significantly increase your chances of success. Here are a few tips to help you ace your interview for an Insurance Rater position:

1. Research the Company and the Position

Before your interview, take some time to research the insurance company and the Insurance Rater position. This will help you understand the company’s culture and values, as well as the specific requirements of the position. You can find information about the company on their website, in their annual reports, and in news articles.

2. Practice Your Answers to Common Interview Questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It is helpful to practice your answers to these questions in advance so that you can deliver them confidently and concisely. You can also prepare for specific questions that may be related to the insurance industry or the Insurance Rater position.

3. Be Prepared to Talk About Your Experience and Skills

The interviewer will likely want to know about your experience and skills as an Insurance Rater. Be prepared to discuss your experience in analyzing risk factors, calculating premiums, and reviewing and approving policies. You should also highlight any skills that are relevant to the position, such as your knowledge of insurance policies and underwriting guidelines, your ability to work independently and as part of a team, and your strong communication and interpersonal skills.

4. Ask Questions

Asking questions at the end of the interview shows that you are interested in the position and that you have taken the time to prepare for the interview. You can ask questions about the company, the position, or the interviewer’s experience. Asking thoughtful questions will also help you to get a better understanding of the position and the company.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Insurance Rater, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Insurance Rater positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.