Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Insurance Representative interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Insurance Representative so you can tailor your answers to impress potential employers.

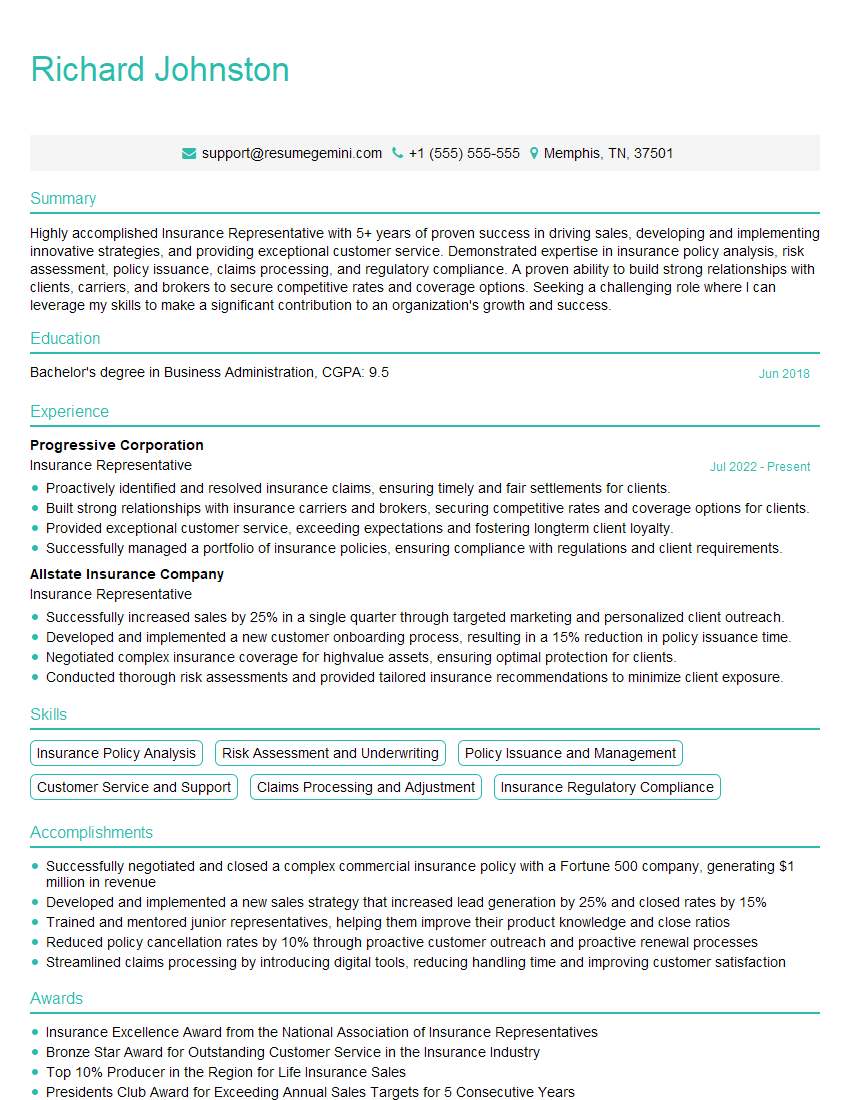

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Representative

1. What are the key factors that you consider when assessing an insurance policy?

- Type of insurance coverage

- Level of coverage

- Deductibles and co-pays

- Premiums

- Policy exclusions

- Financial stability of the insurance company

- Customer service and claims handling

2. Describe the different types of insurance policies that you are familiar with.

Life insurance

- Term life insurance

- Whole life insurance

- Universal life insurance

- Variable life insurance

Health insurance

- Major medical insurance

- Dental insurance

- Vision insurance

Property insurance

- Homeowners insurance

- Renters insurance

- Auto insurance

- Flood insurance

3. How do you help clients choose the right insurance policy for their needs?

- Ask questions to understand their needs and risk tolerance

- Research and compare different policies

- Explain the coverage and benefits of each policy

- Help them choose a policy that meets their budget

- Provide ongoing support and ensure their satisfaction

4. What are the most common mistakes that you see clients make when purchasing insurance?

- Not understanding the coverage they need

- Buying too little or too much coverage

- Choosing the wrong type of policy

- Not reading the policy carefully

- Not comparing policies from different providers

- Not considering their budget

5. What are the most important qualities of a successful insurance representative?

- Knowledge of insurance products and services

- Strong communication and interpersonal skills

- Ability to build and maintain relationships

- Professionalism and integrity

- Ability to work independently and as part of a team

6. What is your favorite thing about working as an insurance representative?

- Helping people protect their assets and their loved ones

- Educating clients about insurance

- Building relationships with clients

- Making a difference in people’s lives

7. What are your career goals?

- To become a top-producing insurance representative

- To build a successful insurance practice

- To help as many people as possible with their insurance needs

- To make a positive impact on the community

8. What are your strengths and weaknesses as an insurance representative?

Strengths

- Strong knowledge of insurance products and services

- Excellent communication and interpersonal skills

- Ability to build and maintain relationships

- Professional and ethical conduct

Weaknesses

- Limited experience in some areas of insurance

- Not yet a top-producing representative

- Working on improving my sales techniques

9. Why should we hire you as an insurance representative?

- I have the knowledge and skills to be successful

- I am passionate about helping people

- I am committed to building a long-term relationship with your company

- I am confident that I can make a positive contribution to your team

10. Do you have any questions for me?

- What are the company’s goals for the next year?

- What are the company’s training and development programs?

- What is the company’s culture like?

- What are the opportunities for advancement?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance Representatives play a crucial role in the insurance industry, serving as the primary point of contact between insurance companies and their clients. Their primary responsibilities include:

1. Sales and Client Acquisition

Identify potential clients, build relationships, and present insurance products that meet their needs.

- Prospect for new clients through various channels such as cold calling, networking, and referrals.

- Conduct needs assessments to determine appropriate coverage and premium options.

2. Policy Administration and Servicing

Process applications, issue and renew policies, and manage client accounts.

- Review and evaluate applications for underwriting.

- Prepare and issue insurance policies according to underwriting guidelines.

- Handle policy changes, cancellations, and endorsements.

3. Claims Management

Assist clients with filing and processing claims.

- Receive and review claims submissions.

- Investigate claims, gather evidence, and determine coverage.

- Negotiate settlements and advocate for clients’ interests.

4. Risk Assessment and Underwriting

Evaluate risks and determine appropriate coverage and premium rates.

- Analyze financial statements, loss history, and other relevant data.

- Assess the probability and severity of potential risks.

- Recommend coverage limits and deductibles based on the assessed risk.

Interview Tips

Preparing adequately for an Insurance Representative interview can significantly increase your chances of success. Here are some tips to help you ace the interview:

1. Research the Company and Industry

Demonstrate your interest in the company by researching their products, services, and company culture. Understand the insurance industry’s regulatory environment and trends.

- Visit the company’s website and social media pages.

- Read industry publications and articles.

- Attend webinars or seminars related to insurance.

2. Practice Your Communication Skills

Insurance Representatives must be able to communicate effectively with clients, colleagues, and underwriters. Practice your verbal and written communication skills to convey your ideas clearly and persuasively.

- Speak confidently and articulate your thoughts.

- Listen attentively and ask relevant questions.

- Prepare examples of how you have successfully communicated with clients in the past.

3. Highlight Your Sales and Customer Service Experience

Sales and customer service skills are essential for Insurance Representatives. Emphasize your ability to build relationships, identify client needs, and provide excellent customer service.

- Describe a situation where you successfully sold an insurance product by understanding the client’s needs.

- Provide examples of how you have gone the extra mile to provide exceptional customer service.

4. Prepare for Insurance-Specific Questions

Expect questions related to insurance products, underwriting, and claims handling. Review common insurance terms and concepts to demonstrate your understanding of the industry.

- Explain the different types of insurance policies available.

- Describe the underwriting process and how you would assess risk.

- Walk through the steps involved in filing and processing a claim.

5. Dress Professionally and Arrive on Time

First impressions matter. Dress appropriately for the interview and arrive on time to show your respect for the interviewer’s time.

- Wear a suit or business attire.

- Be punctual and arrive at the interview location early.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Insurance Representative interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!