Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Insurance Salesman interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Insurance Salesman so you can tailor your answers to impress potential employers.

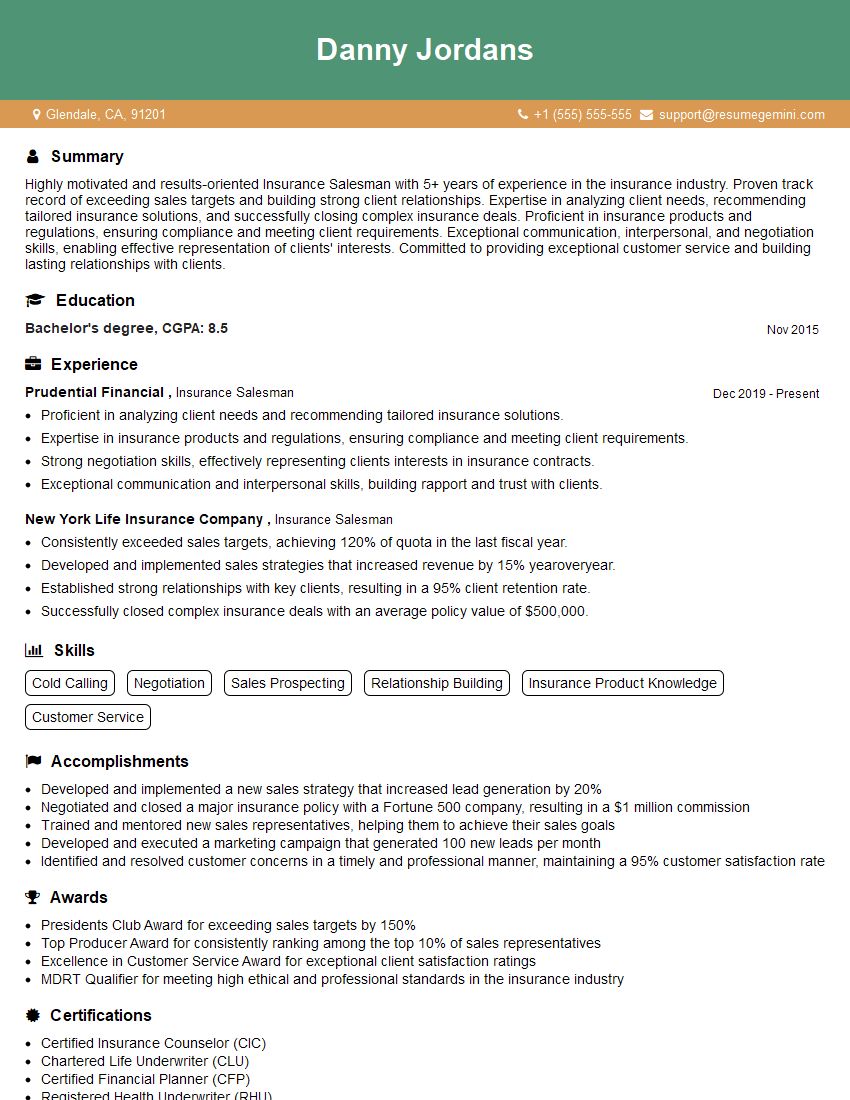

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Salesman

1. Explain the different types of insurance policies that you are familiar with, and what their key features are?

- Life insurance: Provides financial protection to the beneficiaries in case of the policyholder’s death, ensuring financial security for loved ones.

- Health insurance: Covers medical expenses incurred due to illness or injury, providing peace of mind and financial assistance during vulnerable times.

- Property insurance: Protects homes, vehicles, or other personal belongings from loss or damage, safeguarding valuable assets and reducing financial burdens.

- Business insurance: Safeguards businesses against various risks, such as property damage, liability, and employee-related issues, enabling business continuity and financial stability.

2. What is the importance of risk assessment in insurance sales, and how do you conduct it effectively?

Understanding Client Needs and Tailoring Solutions

- Identify and evaluate potential risks faced by clients.

- Assess the likelihood and severity of these risks.

- Determine appropriate insurance coverage to mitigate identified risks.

Effective Risk Assessment Process

- Interview clients to gather detailed information about their assets, liabilities, and risk exposures.

- Utilize industry data and analytics to inform risk assessment.

- Consider both internal and external factors that may influence risk.

3. Describe your sales process for insurance products, and highlight the key steps involved?

- Prospecting: Identifying potential clients through various channels.

- Qualifying leads: Assessing clients’ needs and suitability for insurance products.

- Needs analysis: Understanding clients’ unique risk exposures and financial objectives.

- Product presentation: Presenting tailored insurance solutions that address clients’ specific needs.

- Proposal submission: Outlining the recommended insurance plan, coverage details, and premiums.

- Negotiation and closing: Discussing terms, addressing concerns, and finalizing the sale.

- Post-sale support: Providing ongoing assistance and ensuring client satisfaction.

4. How do you build rapport with clients, and what strategies do you use to earn their trust?

- Active listening: Paying genuine attention to clients’ concerns and needs.

- Empathy: Understanding and relating to clients’ perspectives and emotions.

- Transparency: Providing clear and honest information about insurance products.

- Personalization: Tailoring recommendations to clients’ specific situations.

- Building a relationship: Going beyond transactional interactions to establish trust.

5. What are some of the ethical considerations that you keep in mind while selling insurance products?

- Putting clients’ interests first: Prioritizing their financial well-being over sales commissions.

- Avoiding misrepresentation: Providing accurate and truthful information about insurance products.

- Maintaining confidentiality: Respecting clients’ privacy and protecting their personal information.

- Upholding regulatory compliance: Adhering to industry regulations and ethical guidelines.

- Continuing professional development: Staying updated on industry best practices and ethical standards.

6. How do you stay informed about the latest trends and developments in the insurance industry?

- Attending industry conferences and workshops.

- Subscribing to insurance publications and online resources.

- Networking with other insurance professionals.

- Conducting market research and analyzing industry data.

- Seeking professional development opportunities through certifications and training.

7. Describe a challenging sales situation you encountered, and how you overcame it?

In this section, I would elaborate on a specific sales situation where I faced a challenge and explain how I employed my skills, knowledge, and problem-solving abilities to successfully navigate the situation and achieve a positive outcome.

8. What are your strengths and weaknesses as an insurance salesperson?

In this section, I would provide a balanced and honest assessment of my strengths and weaknesses as an insurance salesperson. I would highlight my technical skills, interpersonal qualities, and areas where I am seeking improvement.

9. Why are you interested in working for our company specifically, and how do you think your skills can contribute to our team?

In this section, I would demonstrate my knowledge of the company, its values, and its market position. I would articulate how my skills and experience align with the company’s goals and how I can add value to the team.

10. Do you have any questions for us about the role or the company?

In this section, I would ask thoughtful questions to demonstrate my interest in the role, the company, and the industry. These questions would also allow me to clarify any details about the position or the organization.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Salesman.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Salesman‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance Salesmen are responsible for selling different types of insurance policies to individuals and businesses.

1. Prospecting and Lead Generation

Identify and qualify potential customers through networking, referrals, and market research.

- Develop and implement targeted marketing strategies to attract prospective clients.

- Attend industry events, seminars, and conferences to build relationships and generate leads.

2. Needs Assessment and Policy Selection

Meet with clients to assess their risk profile and insurance needs.

- Analyze clients’ financial situation, lifestyle, and risk tolerance to recommend suitable policies.

- Provide clear and concise explanations of policy terms, benefits, and exclusions.

3. Sales and Policy Administration

Present and sell insurance policies to clients, handling objections and negotiating terms.

- Complete and submit policy applications accurately and efficiently.

- Maintain up-to-date knowledge of insurance products and regulations.

4. Customer Relationship Management

Build and maintain strong relationships with clients to ensure satisfaction and loyalty.

- Provide ongoing support and guidance to clients regarding their insurance policies.

- Handle client inquiries, resolve complaints, and process claims promptly and professionally.

Interview Tips

Preparing for an interview as an Insurance Salesman requires thorough research and practice.

1. Research the Company and Industry

Demonstrate your understanding of the insurance industry and the specific company you’re applying to.

- Visit the company’s website, read industry news, and attend webinars to stay informed.

- Research the company’s products, target market, and competitive landscape.

2. Practice Your Sales Pitch

Be prepared to confidently present your sales pitch to the interviewer.

- Develop a clear and concise explanation of your approach to selling insurance.

- Practice handling objections and presenting benefits to potential clients.

3. Highlight Your Communication Skills

Salesmen need exceptional communication skills to build rapport with clients.

- Showcase your ability to actively listen, ask probing questions, and present information effectively.

- Provide examples of how you’ve built strong relationships with clients in the past.

4. Demonstrate Your Commitment to Excellence

Employers seek individuals who are dedicated to providing exceptional service.

- Share examples of your commitment to customer satisfaction in previous roles.

- Emphasize your attention to detail and willingness to go the extra mile for your clients.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Insurance Salesman interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.