Are you gearing up for an interview for a Insurance Solicitor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Insurance Solicitor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

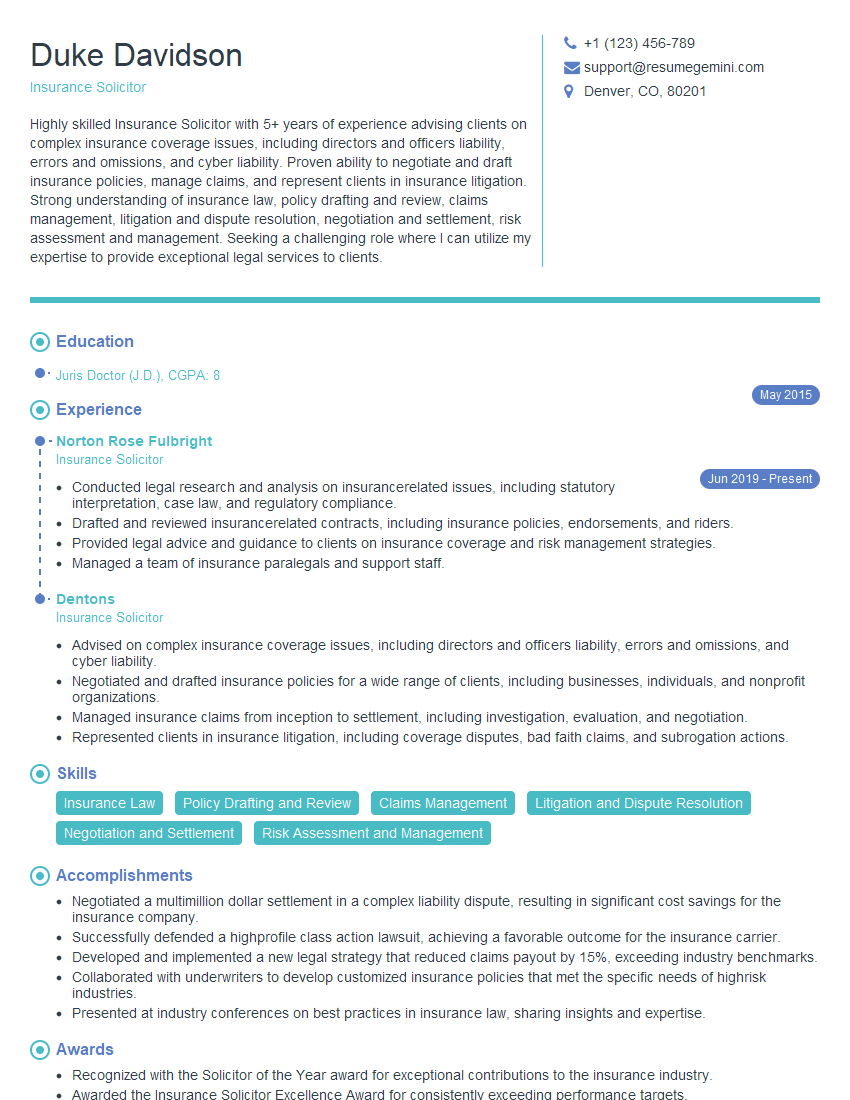

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Solicitor

1. Explain the key principles of subrogation in insurance law.

Subrogation is the legal right of an insurer to step into the shoes of the insured and pursue claims against third parties who have caused or contributed to a loss covered by the insurance policy.

- The insurer must have paid the insured for the loss.

- The insurer must have a legal right to pursue the third party.

- The insurer must be able to recover the amount it has paid to the insured from the third party.

2. Discuss the different types of insurance policies and their respective coverages.

Property Insurance

- Covers damage to or loss of property, such as buildings, vehicles, and personal belongings.

- May include coverage for additional living expenses if the property is uninhabitable due to a covered loss.

Liability Insurance

- Protects against claims of bodily injury or property damage caused by the insured or their employees.

- May include coverage for legal defense costs.

Health Insurance

- Covers medical expenses incurred by the insured for illness or injury.

- May include coverage for prescription drugs, dental care, and vision care.

Life Insurance

- Provides a death benefit to the beneficiary upon the death of the insured.

- May include coverage for riders such as accidental death and dismemberment.

3. Describe the role of an insurance solicitor in handling insurance disputes.

An insurance solicitor represents either the insured or the insurer in insurance disputes. Their responsibilities include:

- Investigating the claim and advising their client on the coverage available under the policy.

- Negotiating with the other party’s insurer.

- Litigating the claim in court if necessary.

4. Explain the defenses commonly asserted by insurers in liability cases.

- Lack of coverage

- Exclusions

- Limitations

- Breach of policy conditions

- Comparative negligence

5. Discuss the ethical obligations of an insurance solicitor.

- Duty of loyalty to their client

- Duty of confidentiality

- Duty to avoid conflicts of interest

- Duty to provide competent legal advice

6. Describe your experience in drafting and negotiating insurance contracts.

I have drafted and negotiated a variety of insurance contracts, including:

- Commercial general liability policies

- Professional liability policies

- Directors and officers liability policies

- Errors and omissions policies

I am familiar with the key provisions of these contracts and I am skilled at negotiating favorable terms for my clients.

7. Explain your understanding of the duty to defend under an insurance policy.

The duty to defend is an insurer’s obligation to provide a legal defense to an insured who is sued for a covered claim. This duty is broader than the duty to indemnify, which only requires the insurer to pay for the insured’s losses. The duty to defend arises when the allegations in the complaint against the insured potentially fall within the coverage of the policy.

8. Discuss the factors to consider when evaluating an insurance claim.

When evaluating an insurance claim, I consider the following factors:

- The terms and conditions of the policy

- The nature and extent of the loss

- The evidence supporting the claim

- The insured’s compliance with the policy conditions

- Any potential defenses that the insurer may assert

9. Explain the process for appealing an insurance claim denial.

The process for appealing an insurance claim denial typically involves the following steps:

- Requesting a written explanation of the denial from the insurer

- Submitting a written appeal to the insurer, outlining the reasons why the denial should be overturned

- Participating in an appeal hearing, if requested by the insurer

- If the insurer upholds the denial, the insured may file a lawsuit

10. Describe your experience in handling insurance litigation.

I have handled a variety of insurance litigation matters, including:

- Breach of contract claims

- Bad faith claims

- Coverage disputes

- Subrogation claims

I am familiar with the procedural rules governing insurance litigation and I am skilled at developing and presenting legal arguments in court.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Solicitor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Solicitor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance Solicitors provide legal advice and representation to insurance companies, policyholders, and other parties involved in insurance disputes. Their responsibilities include:

1. Provide legal advice and guidance to clients

Insurance Solicitors provide legal advice and guidance to clients on a wide range of insurance-related matters, including:

- Policy coverage and interpretation

- Claims handling and settlement

- Insurance disputes and litigation

2. Draft and review insurance contracts and documents

Insurance Solicitors draft and review insurance contracts and documents, such as:

- Insurance policies

- Reinsurance agreements

- Settlement agreements

3. Represent clients in insurance-related disputes and litigation

Insurance Solicitors represent clients in insurance-related disputes and litigation, including:

- Coverage disputes

- Bad faith claims

- Insurance fraud

4. Provide training and education on insurance-related matters

Insurance Solicitors provide training and education on insurance-related matters to clients, employees, and other stakeholders.

- Insurance policy coverage and exclusions

- Claims handling procedures

- Insurance regulations and legislation

Interview Tips

To prepare for an interview for an Insurance Solicitor position, consider the following tips:

1. Research the firm and the position

Take the time to research the law firm you are interviewing with and the specific position you are applying for. This will help you understand the firm’s culture, practice areas, and the specific skills and experience they are looking for in an Insurance Solicitor.

- Visit the firm’s website to learn about their history, areas of practice, and recent developments.

- Read news articles and press releases about the firm to get a sense of their reputation and industry standing.

- Network with lawyers and other professionals in the insurance industry to gather insights about the firm and the position.

2. Prepare answers to common interview questions

There are a number of common interview questions that you are likely to be asked in an interview for an Insurance Solicitor position. It is important to prepare thoughtful and well-organized answers to these questions.

- Tell me about yourself and your experience in insurance law.

- Why are you interested in working for our firm?

- What are your strengths and weaknesses as an Insurance Solicitor?

- How do you stay up-to-date on changes in insurance law?

- What are your thoughts on the current state of the insurance industry?

3. Practice your interviewing skills

It is important to practice your interviewing skills before going on an interview for an Insurance Solicitor position. This will help you feel more confident and prepared on the day of the interview.

- Ask a friend or family member to conduct a mock interview with you.

- Record yourself answering common interview questions and then review the recordings to identify areas for improvement.

- Attend a workshop or seminar on interviewing skills.

4. Dress professionally and arrive on time

First impressions matter, so it is important to dress professionally and arrive on time for your interview. This shows the interviewer that you are respectful of their time and that you take the interview process seriously.

- Wear a suit or business casual attire.

- Arrive at the interview location at least 15 minutes early.

- Be prepared to shake hands and make eye contact with the interviewer.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Insurance Solicitor, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Insurance Solicitor positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.