Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Insurance Specialist position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

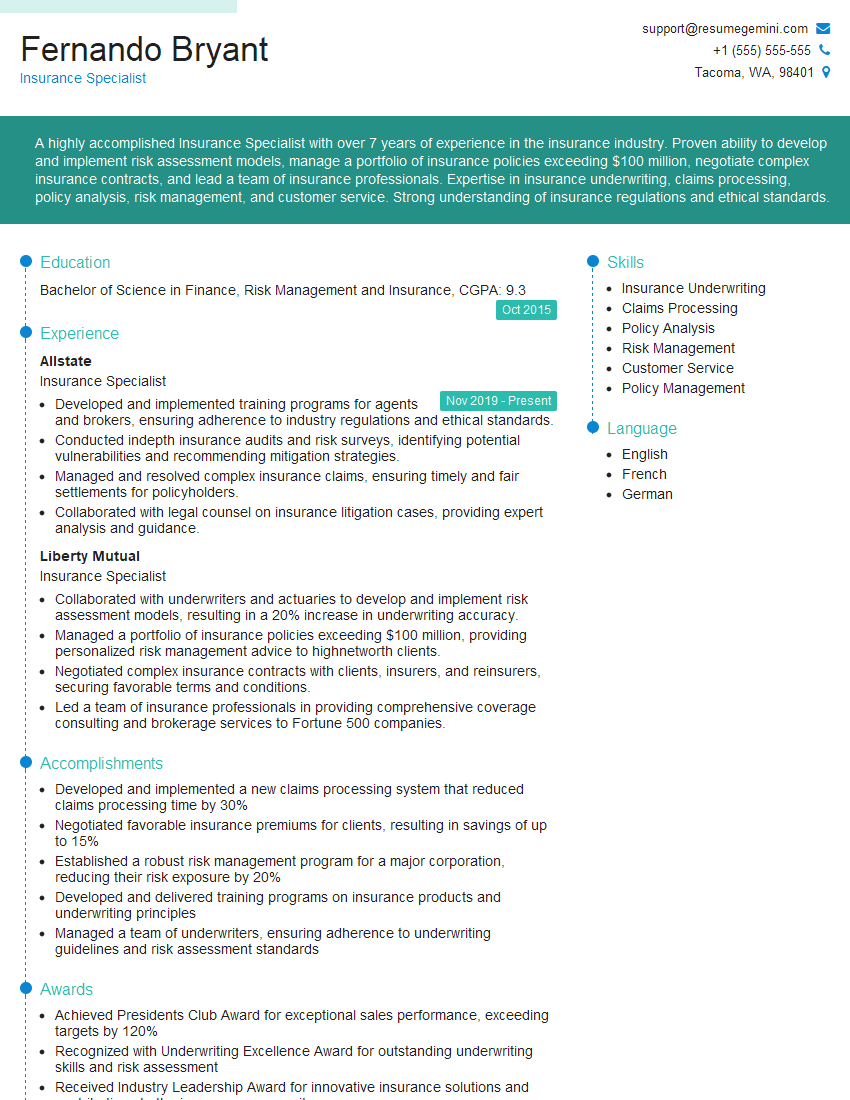

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Specialist

1. Describe the key principles of insurance underwriting?

The key principles of insurance underwriting include:

- Risk assessment: Evaluating the likelihood and potential severity of a loss.

- Ratemaking: Determining the appropriate premium to charge for coverage.

- Policy issuance: Creating and issuing policies that define the coverage provided.

- Claims handling: Assessing and settling claims in a fair and timely manner.

- Reserve adequacy: Maintaining sufficient reserves to meet future claims obligations.

2. Explain the difference between term and whole life insurance?

Term life insurance

- Provides coverage for a specific period (e.g., 10, 20, or 30 years).

- Typically has lower premiums than whole life insurance.

- Does not accumulate cash value.

Whole life insurance

- Provides coverage for the entire lifetime of the insured.

- Has higher premiums than term life insurance.

- Accumulates cash value that can be borrowed against or withdrawn.

3. What are the major types of health insurance plans?

The major types of health insurance plans include:

- Health maintenance organizations (HMOs): Provide comprehensive coverage through a network of providers.

- Preferred provider organizations (PPOs): Offer access to a wider network of providers but may have higher out-of-pocket costs.

- Point-of-service (POS) plans: A hybrid of HMOs and PPOs that provide more flexibility.

- Fee-for-service (FFS) plans: Allow patients to choose any provider but typically have higher premiums and deductibles.

- High-deductible health plans (HDHPs): Offer lower premiums but higher deductibles and out-of-pocket costs.

4. Describe the role of reinsurance in the insurance industry?

Reinsurance is a risk-sharing mechanism that allows insurance companies to transfer a portion of their risk to other insurance companies.

- Reduces risk exposure: Spreads risk across multiple insurers.

- Provides financial stability: Helps insurance companies survive large or catastrophic losses.

- Facilitates underwriting: Allows insurance companies to offer broader coverage by reducing exposure.

- Improves pricing accuracy: Reinsurance data helps insurers refine their risk assessment and pricing.

5. What are the key factors to consider when evaluating an insurance policy?

Key factors to consider when evaluating an insurance policy include:

- Coverage: Ensure the policy provides adequate protection for the risks involved.

- Exclusions: Understand what is not covered by the policy.

- Limits: Determine the maximum amount the insurer will pay for covered claims.

- Deductibles: Consider the amount the insured will be responsible for paying before coverage begins.

- Premiums: Compare the cost of the policy with other options and ensure it fits the budget.

- Financial strength of the insurer: Check the insurer’s financial stability and ability to pay claims.

- Customer service: Evaluate the insurer’s reputation for responsiveness and claims handling.

6. How do you stay up-to-date on industry trends and regulations?

I stay up-to-date on industry trends and regulations through various means:

- Attending conferences and seminars: Industry events provide valuable insights and networking opportunities.

- Reading industry publications: Trade journals and magazines keep me informed about the latest news and developments.

- Participating in professional organizations: Memberships allow me to connect with peers and stay abreast of industry best practices.

- Monitoring regulatory updates: I regularly check government and regulatory websites for changes in laws and regulations.

- Continuing education courses: I take courses to enhance my knowledge and skills.

7. Can you explain the concept of insurance risk and how it is assessed?

Insurance risk refers to the likelihood and potential severity of a loss. It is assessed through:

- Underwriting: Evaluating factors such as medical history, driving record, and property condition.

- Actuarial science: Using mathematical models to predict future losses and set premiums.

- Loss experience data: Analyzing historical claims data to identify patterns and trends.

- Catastrophe modeling: Estimating potential losses from natural disasters and other catastrophic events.

- Industry research: Monitoring industry trends and emerging risks.

8. What is the role of an insurance broker in the insurance industry?

An insurance broker acts as an intermediary between insurance companies and clients:

- Advising clients: Providing guidance on insurance needs and policy options.

- Shopping for coverage: Comparing coverage and rates from multiple insurers.

- Negotiating premiums: Working with insurers to secure favorable terms for clients.

- Servicing policies: Handling policy changes, renewals, and claims support.

- Advocating for clients: Ensuring clients’ interests are protected.

9. How do you handle conflicts of interest that may arise in your role as an insurance specialist?

To handle conflicts of interest, I adhere to the following principles:

- Disclosure: I clearly disclose any potential conflicts to clients and seek their informed consent.

- Impartiality: I remain objective and do not favor one insurer over others.

- Transparency: I provide clients with full information about the policies and insurers I recommend.

- Continuing education: I stay updated on industry best practices and ethical guidelines.

- Professional integrity: I prioritize clients’ interests above all else.

10. Describe a challenging insurance case you handled and how you resolved it?

In a challenging case, I encountered a claim for a complex business interruption. The insured’s revenue was significantly impacted due to an unforeseen event. I thoroughly reviewed the policy and worked closely with the client to gather evidence supporting their claim. I also consulted with experts to assess the financial losses and potential coverage. Through careful analysis and negotiation, I was able to secure a fair settlement that met the client’s needs and preserved the insurer’s financial stability.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Insurance Specialist is a crucial member of the insurance industry, providing expertise and assistance in various aspects of insurance policies and claims. Their responsibilities encompass a wide range of tasks:

1. Policy Analysis and Underwriting

The specialist analyzes insurance applications, assesses risks, and determines coverage eligibility and premium rates. They evaluate factors such as medical history, property value, and risk exposure to make informed underwriting decisions.

- Reviewing and evaluating insurance applications

- Assessing risk profiles and determining coverage limits

- Calculating and adjusting insurance premiums

2. Claims Processing and Management

Insurance specialists handle the processing and management of insurance claims. They investigate claims, assess damages, and determine the appropriate coverage and settlement amounts. They also maintain communication with policyholders and adjusters throughout the process.

- Investigating and evaluating insurance claims

- Determining coverage eligibility and settlement amounts

- Negotiating with policyholders and adjusters

3. Customer Service and Support

The specialist provides customer service and support to policyholders and other stakeholders. They answer questions, explain insurance policies, and assist with policy changes or renewals. They also maintain a positive and professional demeanor while interacting with customers.

- Providing information and guidance to policyholders

- Explaining insurance policies and coverage

- Assisting with policy changes and renewals

4. Regulatory Compliance and Reporting

Insurance specialists stay abreast of industry regulations and ensure compliance with all applicable laws and standards. They file necessary reports and maintain accurate records to meet regulatory requirements.

- Monitoring regulatory changes and ensuring compliance

- Preparing and submitting insurance reports

- Maintaining accurate and organized records

Interview Tips

To ace the interview for an Insurance Specialist position, it’s imperative to prepare thoroughly and showcase your qualifications. Here are some effective tips and hacks to help you succeed:

1. Research the Company and Role

Familiarize yourself with the insurance company and the specific role you’re applying for. Research their history, mission, and current insurance offerings. Understand the job responsibilities and key skills required for the position.

- Visit the company’s website and social media pages

- Read articles and news about the company

- Study the job description and identify relevant keywords

2. Highlight Your Skills and Experience

Emphasize your relevant skills and experience that align with the job requirements. Quantify your accomplishments and provide specific examples of your work. Use action verbs and numbers to demonstrate your contributions.

- Prepare a resume and cover letter that showcase your skills and experience

- Be prepared to discuss specific projects or situations where you applied your skills

- Use the STAR method (Situation, Task, Action, Result) to structure your answers

3. Practice Common Interview Questions

Practice answering common interview questions to build confidence and prepare for likely questions. Research popular insurance interview questions and prepare well-thought-out responses. Use mock interviews or practice with a friend or family member.

- Research common insurance interview questions

- Prepare and practice your answers

- Consider using the STAR method to structure your answers

4. Dress Professionally and Arrive on Time

First impressions matter. Dress professionally and arrive for the interview on time. Punctuality and a polished appearance demonstrate respect and professionalism.

- Choose appropriate business attire

- Be punctual and arrive for the interview on time

- Bring a professional portfolio or resume to the interview

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Insurance Specialist, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Insurance Specialist positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.