Are you gearing up for a career in Insurance Underwriter? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Insurance Underwriter and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

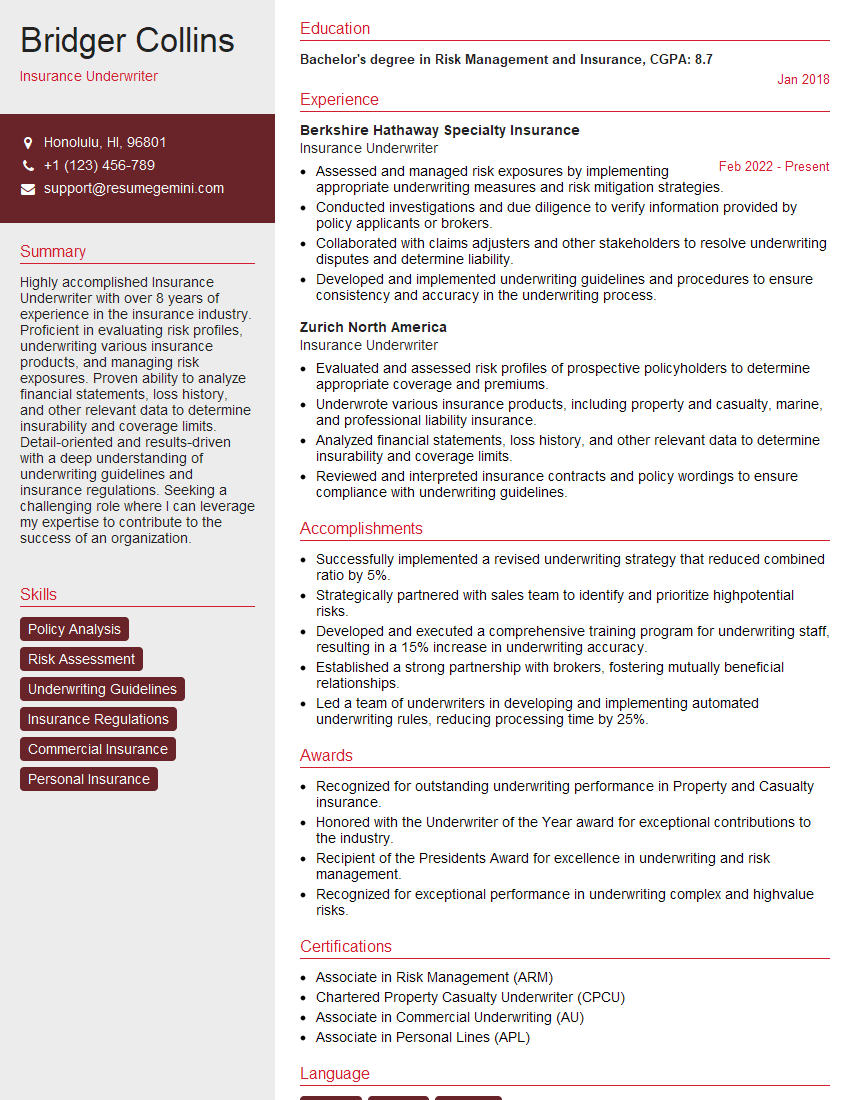

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Underwriter

1. Describe the key steps involved in the underwriting process for a commercial property risk?

Sample Answer

- Identify and assess the risk factors associated with the property, including its construction, occupancy, and location.

- Determine the appropriate coverage limits and deductibles based on the risk assessment.

- Calculate the premium based on the risk factors and coverage limits.

- Issue the policy and provide the insured with a detailed description of the coverage.

- Monitor the risk and make adjustments to the coverage or premium as needed.

2. Explain how you would assess the financial stability of a business seeking commercial property insurance?

Sample Answer

- Review the business’s financial statements, including its balance sheet, income statement, and cash flow statement.

- Check the business’s credit rating and payment history.

- Interview the business’s management team to assess their financial acumen and risk management strategies.

- Consider the business’s industry, economic conditions, and competitive landscape.

3. How do you handle a situation where you are presented with limited information from a potential insured?

Sample Answer

- Request additional information from the potential insured.

- Use my knowledge and experience to make reasonable assumptions about the missing information.

- Contact other sources, such as brokers or agents, to gather additional information.

- Explain to the potential insured that the limited information may result in a higher premium or more restrictive coverage.

4. Describe your experience in underwriting casualty risks.

Sample Answer

- I have underwritten a wide range of casualty risks, including general liability, workers’ compensation, and professional liability.

- I have a deep understanding of the factors that affect casualty risk, such as the nature of the business, the industry, and the claims history.

- I have a strong track record of accurately assessing casualty risk and pricing policies accordingly.

5. How do you stay up-to-date on the latest changes in the insurance industry?

Sample Answer

- I regularly read industry publications and attend conferences.

- I network with other insurance professionals.

- I take continuing education courses.

- I am a member of professional organizations, such as the Insurance Institute of America (IIA).

6. What are some of the challenges you have faced in your underwriting career?

Sample Answer

- One of the biggest challenges I have faced is underwriting risks in new and emerging industries.

- I have also faced challenges in underwriting risks that are complex or have a high degree of uncertainty.

- In addition, I have had to deal with difficult clients and brokers who have unrealistic expectations.

7. How do you handle underwriting requests for coverage that is outside of your company’s appetite?

Sample Answer

- If I am unable to provide coverage, I will refer the request to another insurer that may be able to provide the coverage.

- I will also provide the potential insured with information about other options for obtaining coverage, such as through a surplus lines broker.

- In some cases, I may be able to negotiate with the potential insured to reduce the scope of the coverage or to increase the premium.

8. What are your thoughts on the use of artificial intelligence (AI) in underwriting?

Sample Answer

- I believe that AI has the potential to revolutionize the underwriting process by making it more efficient and accurate.

- AI can be used to automate many of the tasks that are currently performed by underwriters, such as data collection and analysis.

- AI can also be used to develop predictive models that can help underwriters identify and assess risks more accurately.

9. How do you see the future of the insurance industry?

Sample Answer

- I believe that the insurance industry is facing a number of challenges, including the increasing frequency and severity of natural disasters, the rise of new technologies, and the changing needs of customers.

- However, I also believe that the insurance industry has the potential to adapt and thrive in the face of these challenges.

- I believe that the future of the insurance industry will be characterized by increased use of technology, a focus on customer service, and a commitment to sustainability.

10. Why are you interested in working for our company?

Sample Answer

- I am interested in working for your company because of its reputation as a leader in the insurance industry.

- I am also impressed by your company’s commitment to innovation and customer service.

- I believe that my skills and experience would be a valuable asset to your team.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Underwriter.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Underwriter‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance Underwriters are responsible for assessing and pricing insurance risks, ensuring that the company can meet its financial obligations. Key job responsibilities include:

1. Risk Assessment

Underwriters evaluate the riskiness of insurance applicants, considering factors such as age, health, driving record, and property location. They use this information to determine whether or not to issue a policy and, if so, what premium to charge.

2. Policy Pricing

Underwriters determine the appropriate premium for each policy based on the risk assessment. They consider various factors, including the type of insurance, the coverage amount, and the deductible. The goal is to set a premium that is fair to both the policyholder and the insurance company.

3. Claims Processing

Underwriters review insurance claims and make decisions on whether to approve or deny them. They investigate the circumstances of the claim, determine the extent of coverage, and negotiate settlements with policyholders.

4. Regulatory Compliance

Underwriters must ensure that the insurance company complies with all applicable regulations. This includes following state and federal laws, as well as industry standards. They also work with regulators to ensure that the company’s underwriting practices are fair and equitable.

Interview Tips

To ace an interview for an Insurance Underwriter position, candidates should:

1. Prepare for Technical Questions

Be prepared to answer questions on underwriting principles, such as risk assessment, policy pricing, and claims processing. Review industry publications and practice case studies to demonstrate your knowledge and analytical skills.

2. Highlight Relevant Experience

Emphasize any previous experience in insurance underwriting or related fields. Discuss specific projects or responsibilities that demonstrate your understanding of underwriting concepts and your ability to make sound decisions.

3. Demonstrate Soft Skills

Underwriters must have excellent communication and interpersonal skills. Be able to articulate complex technical concepts to a variety of stakeholders, including policyholders, insurance agents, and senior management.

4. Research the Company

Learn about the insurance company’s products, underwriting guidelines, and recent financial performance. This demonstrates your interest in the company and your understanding of the industry.

5. Ask Thoughtful Questions

At the end of the interview, ask thoughtful questions that show your engagement and interest in the role. This could include questions about the company’s underwriting strategy, growth plans, or current challenges.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Insurance Underwriter role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.