Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Insurance Verifier interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Insurance Verifier so you can tailor your answers to impress potential employers.

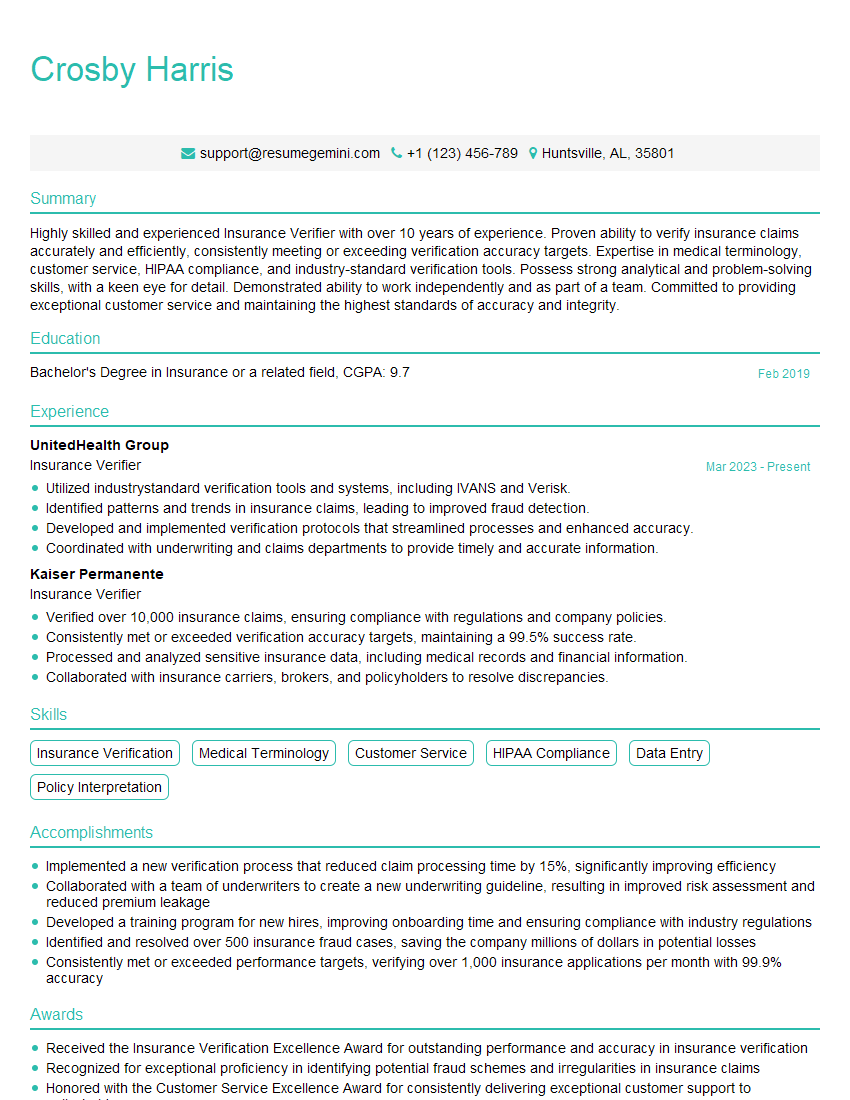

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Verifier

1. Describe the process of verifying insurance eligibility for a patient.

- Gather patient information, including name, date of birth, and insurance policy number.

- Contact the insurance company to verify coverage and benefits.

- Review the patient’s insurance policy to determine eligibility for the requested services.

- Communicate the verification results to the patient and the healthcare provider.

2. What are the different types of insurance verification?

Pre-certification

- Required for certain procedures or services before they are performed.

- Ensures that the service is medically necessary and covered by the patient’s insurance.

Concurrent Review

- Monitors the patient’s care while they are receiving services.

- Ensures that the services are being provided according to the patient’s insurance policy.

Post-Payment Review

- Conducts a review of claims after they have been paid.

- Ensures that the services were medically necessary and covered by the patient’s insurance.

3. What are the common challenges faced in insurance verification?

- Incomplete or inaccurate patient information.

- Delays in receiving responses from insurance companies.

- Denials of coverage for services that are deemed medically necessary.

- Appealing denied claims and navigating the appeals process.

4. How do you stay up-to-date on changes in insurance regulations and policies?

- Attend industry conferences and webinars.

- Read insurance publications and newsletters.

- Consult with insurance professionals and experts.

- Stay informed about legislative and regulatory updates.

5. Describe your experience in using insurance verification software and databases.

- Proficient in using insurance verification software.

- Access and utilize insurance databases to retrieve information.

- Maintain accurate and up-to-date information within the software and databases.

6. What are the ethical considerations in insurance verification?

- Confidentiality of patient information.

- Accuracy and completeness of information provided to patients and healthcare providers.

- Avoiding conflicts of interest.

- Adhering to all applicable laws and regulations.

7. What is your approach to resolving discrepancies or denials in insurance claims?

- Investigate the reason for the discrepancy or denial.

- Review the patient’s medical records and insurance policy.

- Negotiate with the insurance company to resolve the issue.

- File an appeal if necessary.

8. How do you handle difficult or confrontational patients or family members?

- Remain calm and professional.

- Listen to their concerns and try to understand their perspective.

- Provide clear and accurate information.

- Involve other team members or supervisors if necessary.

9. How do you prioritize your workload and manage multiple tasks?

- Prioritize tasks based on urgency and importance.

- Use time management techniques to stay organized.

- Delegate tasks to others when appropriate.

- Take breaks to avoid burnout.

10. Why are you interested in this position?

- Insurance verification is a challenging and rewarding field.

- I am eager to learn more about the industry and contribute my skills.

- I am confident that I have the necessary knowledge and experience to be successful in this role.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Verifier.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Verifier‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance Verifiers are responsible for ensuring the accuracy and completeness of insurance claims by verifying the information provided by policyholders and healthcare providers. They play a crucial role in the insurance industry by preventing fraud, overpayments, and incorrect settlements.

1. Policy Verification

Review insurance policies to determine coverage, deductibles, and exclusions.

- Verify policyholder information, such as name, address, and policy number.

- Confirm the coverage period and limits for the specific type of claim.

2. Medical Record Review

Analyze medical records to assess the necessity and appropriateness of medical services.

- Review patient history, diagnosis, treatment plans, and progress notes.

- Verify that the services provided were medically necessary and fall within the policy coverage.

3. Claims Adjudication

Determine the appropriate payment amount for insurance claims based on policy coverage and medical necessity.

- Calculate benefits based on the policy’s terms and conditions.

- Identify potential red flags or inconsistencies that may indicate fraud or errors.

4. Fraud Investigation

Investigate suspected insurance fraud by analyzing claims and identifying patterns of suspicious activity.

- Review insurance applications, medical records, and other relevant documents for discrepancies.

- Cooperate with law enforcement and insurance investigators to prosecute fraudulent claims.

Interview Tips

Preparing for an Insurance Verifier interview requires thorough research and practice. Here are some tips to help you ace the interview:

1. Research the Company and Industry

Demonstrate your interest in the company and the insurance industry by researching their history, products, and recent news. This knowledge will help you answer questions intelligently and show that you are genuinely interested in the position.

- Visit the company’s website to learn about their mission, values, and key offerings.

- Review industry publications and news articles to stay updated on current trends and regulations.

2. Practice Answering Common Interview Questions

Prepare for common interview questions by practicing your answers in advance. This will boost your confidence and help you articulate your skills and experience clearly.

- Research typical interview questions for Insurance Verifiers, such as “Why are you interested in this role?” and “What is your experience with medical record review?”

- Prepare specific examples from your previous work experience that demonstrate your relevant skills.

3. Highlight Your Attention to Detail

Insurance Verifiers must have exceptional attention to detail. Emphasize your ability to meticulously review documents, identify errors, and ensure accuracy in your interview responses.

- Provide examples of projects or tasks where you successfully detected discrepancies or solved complex problems.

- Explain your strategies for maintaining focus and concentration during repetitive or lengthy tasks.

4. Emphasize Your Communication Skills

Insurance Verifiers often interact with policyholders, healthcare providers, and other stakeholders. Highlight your ability to communicate effectively, both verbally and in writing.

- Share experiences where you successfully resolved inquiries or handled challenging conversations.

- Demonstrate your proficiency in writing clear, concise, and professional reports.

5. Dress Professionally and Arrive on Time

First impressions matter. Dress appropriately for the interview and arrive punctually to show respect for the interviewer’s time. This demonstrates your professionalism and attention to detail.

- Choose business attire that is clean, pressed, and fits well.

- Plan your route in advance to avoid delays and arrive at the interview location a few minutes early.

Next Step:

Now that you’re armed with the knowledge of Insurance Verifier interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Insurance Verifier positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini