Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted International Banker position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

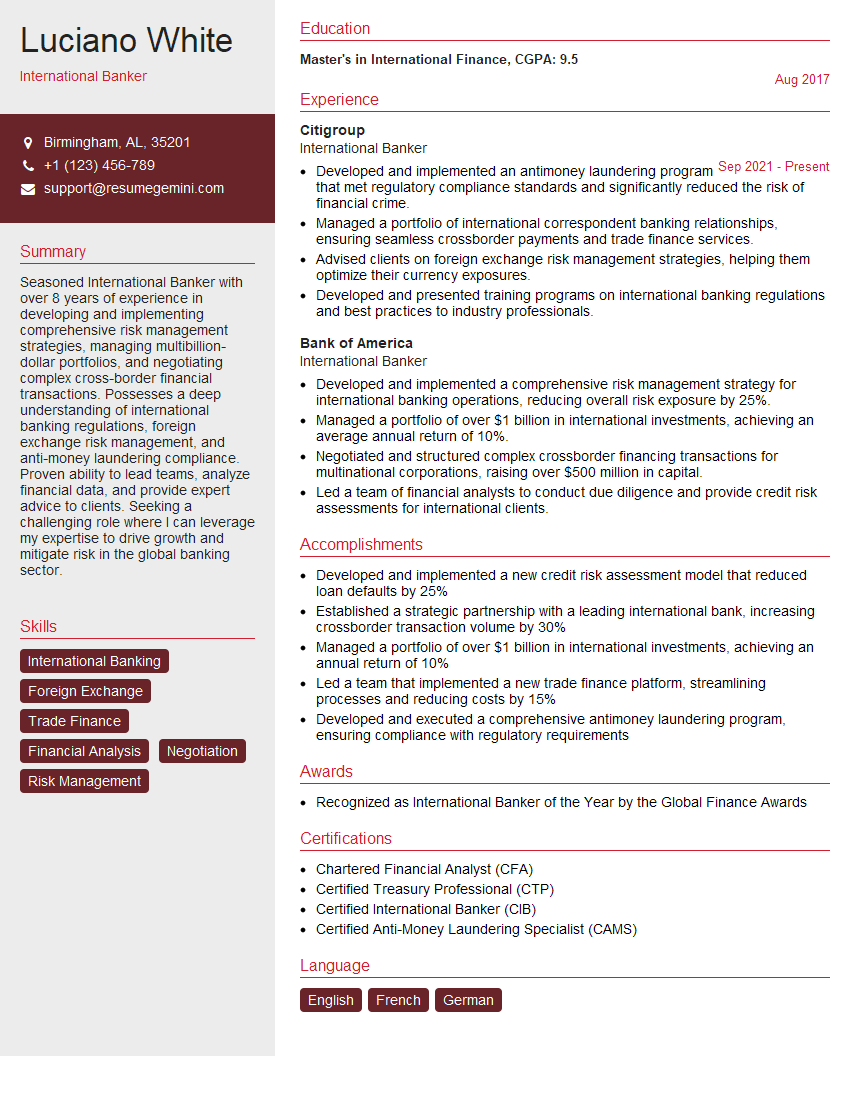

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For International Banker

1. What are the key differences between domestic and international banking operations?

International banking involves cross-border transactions and is subject to regulations of multiple jurisdictions. Key differences include:

- Currency Risk: International transactions involve converting currencies, exposing banks to exchange rate fluctuations.

- Political and Economic Risk: Banks must consider political instability, economic fluctuations, and sovereign risk in international markets.

- Regulatory Compliance: Banks must adhere to financial regulations and reporting requirements in different jurisdictions, increasing complexity.

- Language and Cultural Barriers: International banks need to understand diverse languages, cultures, and business practices.

2. Explain the role of correspondent banks in international transactions.

Correspondent Banking Relationships

- Correspondent banks act as intermediaries between banks in different countries.

- They facilitate smooth cross-border payments, clear funds, and provide trade finance services.

Benefits of Correspondent Banking

- Access to global markets and banking networks.

- Reduced transaction costs and increased efficiency.

- Risk mitigation through due diligence and regulatory compliance monitoring.

3. How do you assess credit risk in an international context?

Assessing credit risk internationally requires considering additional factors beyond traditional domestic analysis:

- Country Risk: Evaluate political and economic stability, sovereign risk, and credit ratings of the country.

- Currency Risk: Assess the stability and volatility of the borrower’s currency.

- Transfer Risk: Consider potential restrictions on transferring funds or repatriating profits.

- Legal and Regulatory Risk: Understand the legal and regulatory framework governing lending in the borrower’s jurisdiction.

4. What are the different types of trade finance instruments used in international banking?

Trade finance instruments provide various financing options for international trade:

- Letters of Credit: Guarantee payment to exporters for goods or services.

- Documentary Collections: Involve the collection of payment documents, such as bills of lading and invoices.

- Export Credit Agencies: Provide insurance and financing for exporters.

- Forfaiting: Purchase of accounts receivable from exporters at a discount.

5. How do you manage foreign exchange risk in international banking?

Managing foreign exchange risk involves:

- Hedging: Using financial instruments, such as forward contracts and currency options, to offset potential exchange rate fluctuations.

- Natural Hedging: Balancing assets and liabilities in different currencies.

- Diversification: Investing in assets denominated in multiple currencies to reduce overall exposure.

- Monitoring: Continuously monitoring currency markets and adjusting risk management strategies as needed.

6. What are the key regulatory and compliance considerations for international bankers?

International bankers must comply with:

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: Preventing and detecting money laundering and terrorist financing.

- FATCA and CRS: Intergovernmental agreements for reporting cross-border financial account information.

- Basel Accords: International standards for capital adequacy, liquidity, and risk management.

- Local Regulations: Understanding and adhering to financial regulations in each jurisdiction where the bank operates.

7. How do you build and maintain strong client relationships in a cross-border environment?

Building strong client relationships internationally requires:

- Cultural Sensitivity: Understanding and respecting diverse cultures, customs, and business practices.

- Communication: Establishing clear and regular communication channels with clients in their native language.

- Trust-Building: Demonstrating expertise, reliability, and commitment to client satisfaction.

- Local Knowledge: Acquiring knowledge about local markets, regulations, and industry trends.

8. What are the challenges and opportunities in the future of international banking?

Challenges

- Increased competition and globalization.

- Technological disruption and cybersecurity risks.

- Regulatory complexity and compliance costs.

- Political and economic uncertainties.

Opportunities

- Growth in emerging markets.

- Expansion of digital banking and fintech.

- Demand for specialized international financial services.

- Collaboration and innovation in cross-border payments.

9. How do you stay updated on the latest developments and trends in international banking?

I stay updated by:

- Attending industry conferences and seminars.

- Reading financial publications and research.

- Engaging in professional development activities.

- Networking with other international bankers and experts.

10. How would you contribute to the success of our international banking team?

I would contribute by:

- Applying my technical expertise in international banking operations.

- Leveraging my strong client relationship management skills.

- Providing insights into emerging trends and opportunities.

- Collaborating with colleagues to develop innovative solutions.

- Maintaining a commitment to professional development and continuous learning.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for International Banker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the International Banker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

International Bankers play a crucial role in facilitating global financial transactions. Their responsibilities encompass:

1. Client Relationship Management

Building and maintaining strong relationships with corporate and institutional clients worldwide.

- Understanding their financial needs and objectives.

- Providing tailored financial solutions, such as cross-border payments, trade finance, and investment opportunities.

2. Transaction Execution

Processing and executing complex financial transactions across different currencies and time zones.

- Managing foreign exchange (FX) transactions, including currency conversions and risk hedging.

- Facilitating international trade through trade finance products and services.

3. Market Analysis and Risk Management

Monitoring global financial markets and analyzing economic trends to make informed recommendations to clients.

- Conducting due diligence and assessing risks associated with international transactions.

- Developing and implementing risk management strategies to protect clients’ financial interests.

4. Compliance and Regulatory Adherence

Ensuring that all financial activities comply with local and international regulations.

- Staying abreast of regulatory changes and adapting operations accordingly.

- Implementing anti-money laundering (AML) and know-your-customer (KYC) procedures.

Interview Tips

To ace an interview for an International Banker position, consider the following tips:

1. Research the Industry and the Bank

Demonstrate a deep understanding of the global banking industry, foreign exchange markets, and the bank’s specific offerings.

- Familiarize yourself with recent financial news and industry trends.

- Visit the bank’s website and study its history, products, and services.

2. Highlight Your Technical Skills and Experience

Emphasize your proficiency in foreign exchange trading, trade finance, and international regulations.

- Quantify your transactions, highlighting the value you brought to previous clients.

- Discuss your experience in managing risk and safeguarding client assets.

3. Demonstrate Your Communication and Relationship-Building Abilities

International Bankers need to be effective communicators and relationship managers.

- Provide examples of how you have built rapport with international clients from diverse cultures.

- Emphasize your ability to translate complex financial concepts into clear and actionable terms.

4. Ask Insightful Questions

Asking thoughtful questions shows your engagement and interest in the role and the bank.

- Inquire about the bank’s international expansion plans or emerging markets it targets.

- Ask about the team you would be working with and the company culture.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the International Banker interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!