Are you gearing up for a career in Inventory Accountant? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Inventory Accountant and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

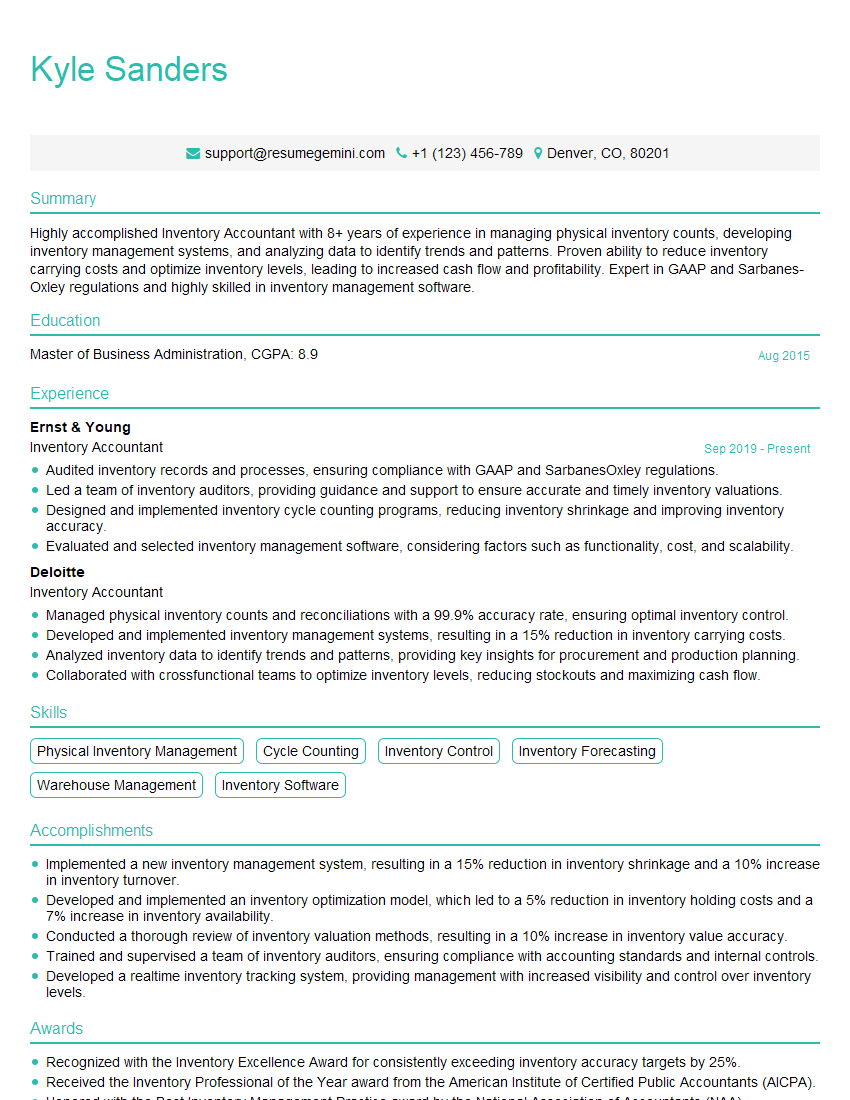

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Inventory Accountant

1. Explain the process of Physical Inventory Count?

The physical inventory count process typically involves the following steps:

- Planning and preparation: This includes determining the scope of the count, selecting a count team, and developing a counting plan.

- Counting: The count team physically counts the inventory on hand, typically using handheld scanners or other data collection devices.

- Verification: Once the count is complete, the count team verifies the accuracy of the count by comparing it to the inventory records.

- Reconciliation: Any discrepancies between the physical count and the inventory records are investigated and reconciled.

- Reporting: The results of the physical inventory count are reported to management for review and analysis.

2. What are the key accounting principles related to inventory management?

FIFO (First-In, First-Out)

- Assumes that the oldest inventory is sold first.

- Results in a higher cost of goods sold in periods of rising prices.

LIFO (Last-In, First-Out)

- Assumes that the most recent inventory is sold first.

- Results in a lower cost of goods sold in periods of rising prices.

Weighted Average Cost

- Calculates the average cost of inventory on hand based on the cost of all units purchased during the period.

- Results in a cost of goods sold that is less volatile than FIFO or LIFO.

3. Describe the different methods for valuing inventory?

The different methods for valuing inventory include:

- Lower of cost or market (LCM): This method values inventory at the lower of its cost or its market value.

- Net realizable value (NRV): This method values inventory at its estimated selling price less any costs to complete and sell the inventory.

- Replacement cost: This method values inventory at the cost to replace the inventory with similar items.

4. What are the key metrics used to evaluate inventory performance?

Key metrics used to evaluate inventory performance include:

- Inventory turnover: This ratio measures how quickly inventory is being sold and replaced.

- Days sales in inventory (DSI): This ratio measures the average number of days it takes to sell the inventory on hand.

- Inventory carrying costs: These costs include the cost of storing, handling, and financing inventory.

5. Explain the role of inventory management in supply chain management?

Effective inventory management supports supply chain management by:

- Ensuring that the right products are available to meet customer demand.

- Minimizing inventory costs and maximizing inventory turnover.

- Improving customer service levels.

6. What are the key challenges in inventory management?

Key challenges in inventory management include:

- Forecasting demand accurately.

- Managing inventory levels to meet demand without overstocking or understocking.

- Optimizing inventory costs.

- Dealing with inventory obsolescence.

- Managing inventory in a global supply chain.

7. What are the benefits of using an inventory management system?

Benefits of using an inventory management system include:

- Improved inventory accuracy.

- Reduced inventory costs.

- Improved customer service levels.

- Increased efficiency in inventory management processes.

8. Explain the different types of inventory?

Different types of inventory include:

- Raw materials: These are the materials used to produce finished goods.

- Work-in-progress (WIP): These are the goods that are in the process of being produced.

- Finished goods: These are the goods that are ready for sale to customers.

9. What are the accounting treatments for inventory?

The accounting treatments for inventory include:

- Inventory is recorded as an asset on the balance sheet.

- The cost of goods sold is recorded as an expense on the income statement.

- Inventory is valued using one of the following methods: FIFO, LIFO, or weighted average cost.

10. What is the importance of inventory control?

Inventory control is important for the following reasons:

- To ensure that the company has the right inventory levels to meet customer demand.

- To minimize inventory costs.

- To improve customer service levels.

- To reduce the risk of inventory obsolescence.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Inventory Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Inventory Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Inventory Accountants are responsible for managing and overseeing the inventory of a company. They ensure that the inventory is accurate, up-to-date, and in compliance with company policies and procedures. Some of the key responsibilities of an Inventory Accountant include:

1. Managing Inventory Records

Inventory Accountants are responsible for maintaining accurate and up-to-date inventory records. This includes keeping track of all inventory items, including their quantity, location, and value. They must also ensure that all inventory transactions are properly recorded and accounted for.

2. Conducting Inventory Audits

Inventory Accountants periodically conduct inventory audits to verify the accuracy of the inventory records. This involves physically counting all inventory items and comparing the results to the records. Any discrepancies must be investigated and corrected.

3. Forecasting Inventory Needs

Inventory Accountants work with other departments to forecast inventory needs. This involves analyzing historical data and trends to determine how much inventory will be needed in the future. They must also take into account factors such as seasonality and changes in demand.

4. Managing Inventory Costs

Inventory Accountants are responsible for managing inventory costs. This includes tracking the cost of inventory items, as well as the cost of storing and handling inventory. They must also work with other departments to find ways to reduce inventory costs.

Interview Tips

Preparing for an interview for an Inventory Accountant position can be challenging, but there are some tips that can help you ace the interview. Here are some of the most important tips:

1. Research the Company

Before you go on an interview, it is important to research the company you are interviewing with. This will help you understand the company’s culture, values, and goals. You can learn about the company by visiting its website, reading its press releases, and talking to people who work there.

2. Practice Answering Common Interview Questions

There are some common interview questions that you are likely to be asked in an interview for an Inventory Accountant position. These questions include:

- Tell me about your experience with inventory management.

- How do you manage inventory costs?

- What are some of the challenges you have faced in your previous inventory accounting roles?

It is important to practice answering these questions so that you can articulate your skills and experience in a clear and concise manner.

3. Be Prepared to Discuss Your Skills and Experience

In addition to answering common interview questions, you should also be prepared to discuss your skills and experience in detail. This includes your experience with inventory management, cost accounting, and auditing. You should also be able to demonstrate your ability to work independently and as part of a team.

4. Be Confident and Enthusiastic

Confidence and enthusiasm can go a long way in an interview. When you are confident and enthusiastic, you are more likely to make a good impression on the interviewer. Be sure to maintain eye contact, speak clearly and concisely, and smile. You should also be prepared to ask questions about the position and the company.

Next Step:

Now that you’re armed with the knowledge of Inventory Accountant interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Inventory Accountant positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini