Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Investment Advisor interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Investment Advisor so you can tailor your answers to impress potential employers.

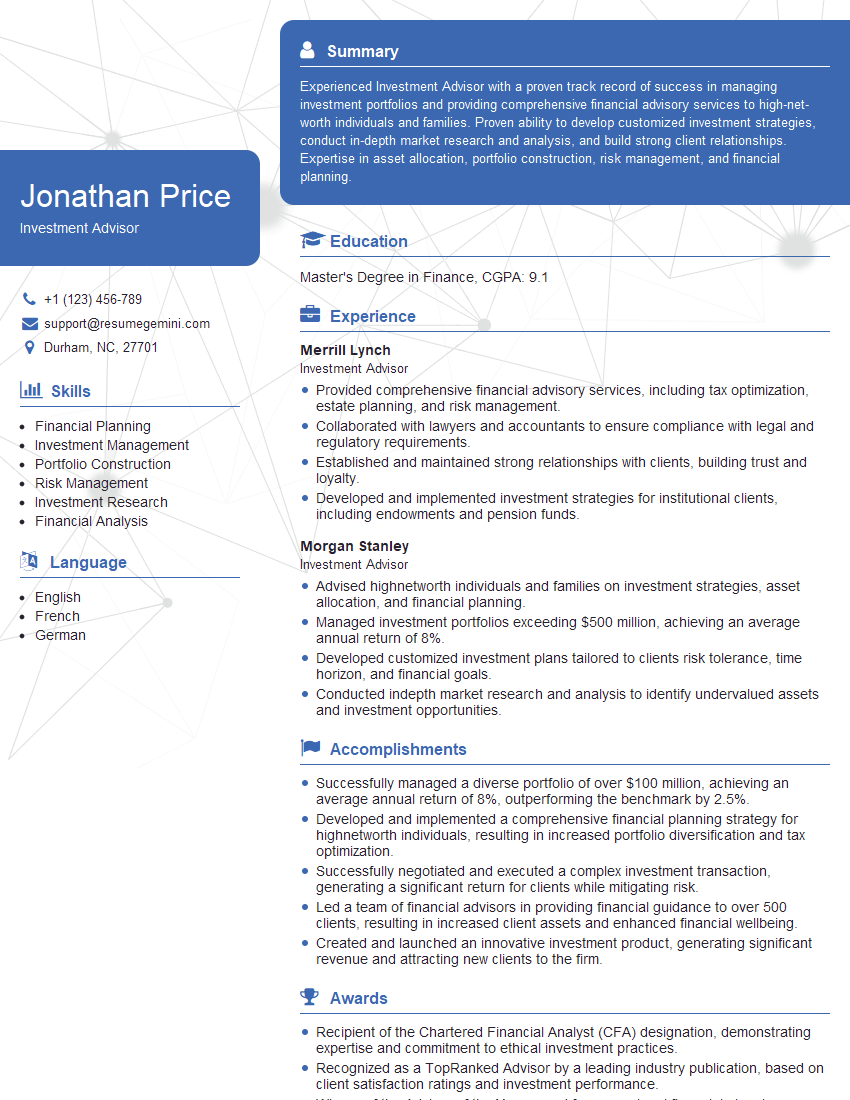

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Investment Advisor

1. What are the key factors to consider when evaluating an investment opportunity?

- Investment Objective – Understand the client’s financial goals, risk tolerance, and investment horizon.

- Risk Assessment – Evaluate the potential risks associated with the investment, including market volatility, interest rate changes, and political events.

- Return Potential – Analyze the potential return on investment, considering historical performance, economic indicators, and market sentiment.

- Investment Horizon – Determine the time frame for which the investment will be held, which will influence asset allocation and risk management strategies.

- Tax Implications – Consider the potential tax consequences of the investment, including capital gains taxes and dividend income.

2. How do you develop and implement an investment strategy for clients?

Investment Strategy Development

- Analyze client’s financial situation, investment goals, and risk tolerance.

- Research market conditions, economic indicators, and industry trends.

- Identify suitable investment options aligned with client’s objectives.

Investment Strategy Implementation

- Allocate assets according to the investment strategy.

- Select specific investments within each asset class.

- Monitor and adjust the portfolio regularly to align with changing market conditions and client’s needs.

3. How do you manage risk in investment portfolios?

- Diversification – Allocate assets across different classes, sectors, and geographical regions to reduce overall portfolio risk.

- Asset Allocation – Adjust the proportion of assets in each class based on client’s risk tolerance and market conditions.

- Hedging Strategies – Utilize financial instruments, such as options or futures, to mitigate potential losses.

- Regular Rebalancing – Periodically adjust portfolio allocations to maintain desired risk levels and asset diversification.

- Stress Testing – Simulate market downturns and adverse scenarios to assess portfolio resilience and identify areas for risk mitigation.

4. How do you stay up-to-date on market trends and economic developments?

- Industry Publications – Read financial news, research reports, and industry journals.

- Conferences and Seminars – Attend industry events to connect with experts and gain insights.

- Online Resources – Utilize financial websites, databases, and social media platforms.

- Networking – Engage with other investment professionals, economists, and market analysts.

- Continuous Education – Pursue professional development courses, certifications, and designations.

5. How do you build and maintain strong relationships with clients?

- Active Communication – Regularly communicate with clients to provide updates, answer queries, and discuss investment strategies.

- Personalized Service – Tailor investment advice and strategies to each client’s specific needs and circumstances.

- Transparency and Trust – Maintain transparent and ethical practices, fostering client confidence and loyalty.

- Responsiveness – Respond to client inquiries and requests promptly and professionally.

- Education and Empowerment – Educate clients about investment concepts and empower them to make informed decisions.

6. How do you handle and resolve client concerns or complaints?

- Active Listening – Listen attentively to client concerns and acknowledge their perspectives.

- Empathy and Understanding – Show empathy and try to understand the client’s emotional state.

- Investigation – Thoroughly investigate the issue, gather relevant information, and identify potential causes.

- Problem Solving – Develop and propose solutions that address the client’s concerns and align with investment objectives.

- Communication – Communicate the resolution clearly and transparently, ensuring client satisfaction.

7. How do you measure and evaluate your investment performance?

- Return on Investment (ROI) – Calculate the percentage return on investment compared to benchmarks or peer portfolios.

- Risk-Adjusted Returns – Evaluate returns in relation to risk taken, using metrics like Sharpe Ratio or Sortino Ratio.

- Portfolio Diversification – Assess the level of diversification within the portfolio and its impact on risk and return.

- Client Satisfaction – Measure client satisfaction through surveys, feedback, and retention rates.

- Compliance and Regulation – Ensure adherence to regulatory and industry standards, such as fiduciary duties and best execution practices.

8. How do you adapt to evolving market conditions and client needs?

- Market Monitoring – Continuously monitor market trends, economic data, and geopolitical events.

- Investment Research – Conduct ongoing research to identify new investment opportunities and strategies.

- Client Communication – Regularly communicate with clients to discuss market conditions and potential implications.

- Investment Strategy Adjustment – Make necessary adjustments to investment strategies based on changing market conditions and client goals.

- Professional Development – Stay up-to-date on industry best practices and regulatory changes.

9. How do you handle conflicts of interest and maintain ethical standards?

- Disclosure and Transparency – Disclose any potential conflicts of interest to clients and seek their consent.

- Fiduciary Duty – Act in the best interests of clients, prioritizing their financial objectives.

- Compliance with Regulations – Adhere to industry regulations and ethical guidelines to avoid conflicts of interest.

- Independent Research – Utilize independent research and analysis to make investment decisions.

- Continuing Education – Stay informed about ethical standards and best practices in the investment industry.

10. How do you utilize technology to enhance your investment advisory services?

- Investment Management Software – Use software to manage portfolios, track performance, and generate reports.

- Data Analytics – Leverage data analytics to identify investment opportunities, assess risk, and make informed decisions.

- Client Portals – Provide clients with online access to portfolio information, account statements, and market updates.

- Robo-Advisory Platforms – Utilize automated platforms to provide personalized investment advice and portfolio management.

- Social Media – Engage with clients and share market insights through social media channels.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Investment Advisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Investment Advisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Investment Advisors provide financial advice and guidance to clients to help them meet their financial goals. Their primary responsibilities revolve around investing, portfolio management, and financial planning. Here are some key job responsibilities of an Investment Advisor:

1. Client Relationship Management

Investment Advisors develop and maintain strong relationships with clients. They understand client needs, risk tolerance, investment objectives, and financial situation.

- Conducting comprehensive financial assessments

- Understanding client risk tolerance and investment goals

2. Investment Research and Analysis

Investment Advisors conduct thorough research and analysis of financial markets, economies, and industries. This helps them make informed investment decisions for clients.

- Monitoring economic trends and market conditions

- Evaluating investment opportunities and risks

3. Portfolio Management

Investment Advisors manage client portfolios by selecting and recommending suitable investments based on their financial goals and objectives.

- Creating and implementing investment plans

- Monitoring and adjusting portfolios as needed

4. Financial Planning

Investment Advisors provide financial planning advice to clients. This includes retirement planning, tax planning, estate planning, and other financial aspects.

- Developing and reviewing financial plans

- Providing guidance on financial risks and opportunities

Interview Tips

To ace an Investment Advisor interview, it is important to prepare thoroughly. Here are some tips to help you:

1. Research the Company and Position

Make sure you have a good understanding of the company’s business, its investment philosophy, and the specific role you are applying for.

- Visit the company’s website

- Read industry news and articles

2. Highlight Your Skills and Experience

In your resume and interview, emphasize your relevant skills and experience. Quantify your accomplishments whenever possible.

- Highlight your investment knowledge

- Share examples of successful client relationships

3. Demonstrate Your Passion for Finance

Investment Advisors should have a genuine passion for finance. Show the interviewer that you are excited about the industry and eager to learn more.

- Describe your investment strategy

- Discuss your favorite financial books or blogs

4. Practice Your Answers to Common Interview Questions

There are certain questions that are commonly asked in Investment Advisor interviews. Prepare your answers to these questions in advance.

- Why are you interested in becoming an Investment Advisor?

- What are your investment goals for clients?

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Investment Advisor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!