Are you gearing up for a career in Investment Analyst? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Investment Analyst and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

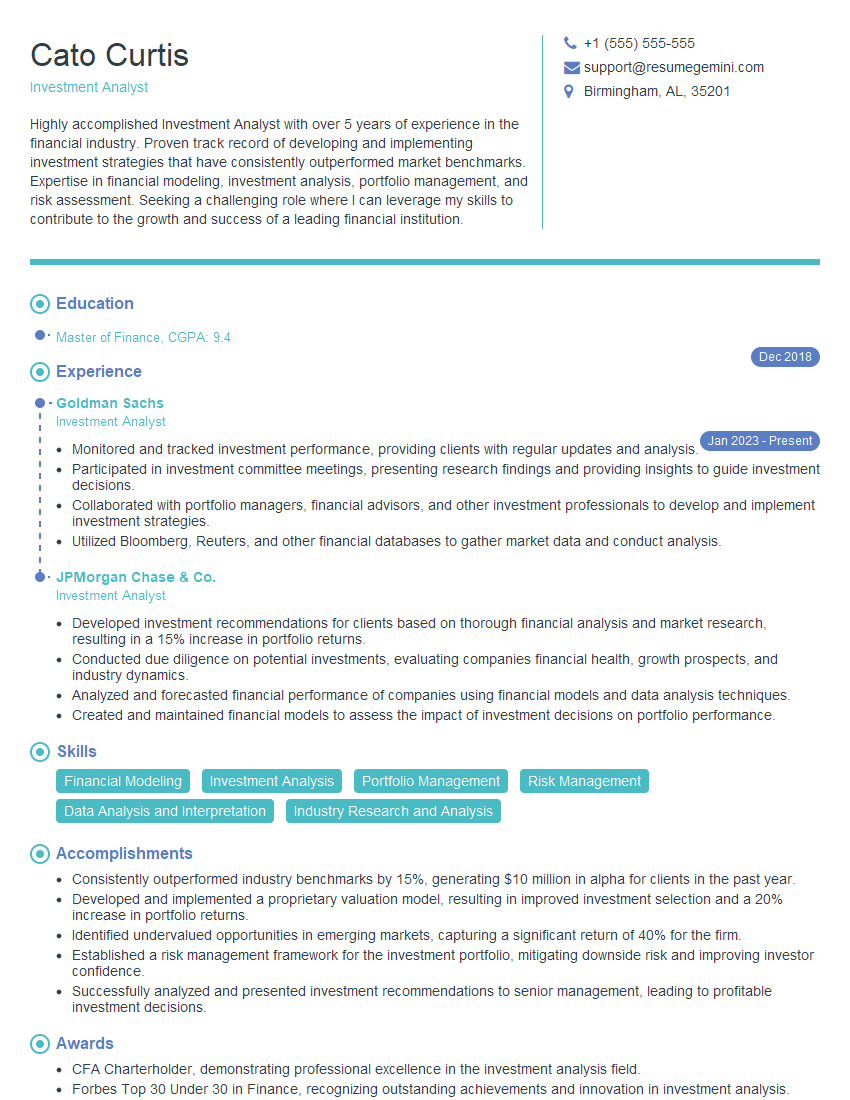

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Investment Analyst

1. What are the key financial metrics you use to evaluate the performance of a company?

- Revenue growth

- Profitability

- Return on equity

- Debt-to-equity ratio

- Cash flow from operations

2. How do you incorporate ESG factors into your investment analysis?

Environmental Factors

- Climate change risk

- Water scarcity

- Pollution

Social Factors

- Employee relations

- Diversity and inclusion

- Community engagement

Governance Factors

- Board independence

- Executive compensation

- Risk management

3. What are some of the challenges you have faced in your previous role as an Investment Analyst?

- Navigating complex financial markets

- Staying up-to-date on industry trends

- Making accurate investment recommendations

- Managing risk

- Communicating investment findings to clients

4. What are your thoughts on the current market conditions?

- The current market conditions are volatile and uncertain.

- There are a number of factors contributing to this, including the COVID-19 pandemic, the war in Ukraine, and rising inflation.

- I believe that it is important to be cautious in these conditions and to focus on investing in companies with strong fundamentals.

5. What is your investment philosophy?

- I believe in investing in companies with strong fundamentals and a long-term track record of success.

- I prefer to invest in companies that are undervalued and have the potential for growth.

- I am a patient investor and I am willing to hold stocks for the long term.

6. What are some of the recent investment decisions you have made?

- I recently invested in a company that is developing a new cancer treatment.

- I also invested in a company that is a leader in the renewable energy sector.

- I believe that these companies have the potential to generate strong returns over the long term.

7. What are your career goals?

- My career goal is to be a successful Investment Analyst.

- I want to help my clients achieve their financial goals and I want to make a positive impact on the world.

- I am confident that I have the skills and experience to be successful in this field.

8. What are your strengths as an Investment Analyst?

- I have a strong understanding of financial markets.

- I am able to analyze complex financial data and make accurate investment recommendations.

- I am a clear and concise communicator.

- I am able to work independently and as part of a team.

9. What are your weaknesses as an Investment Analyst?

- I am still relatively new to the field of investment analysis.

- I sometimes struggle to stay up-to-date on all of the latest industry trends.

- I am working on improving my communication skills.

10. Why do you want to work for our company?

- I am impressed by your company’s reputation for excellence.

- I believe that my skills and experience would be a valuable asset to your team.

- I am excited about the opportunity to contribute to your company’s success.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Investment Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Investment Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Investment Analysts play a crucial role in financial institutions and investment firms, providing valuable insights and recommendations to inform investment decisions. Their key responsibilities include:

1. Market Research and Analysis

Conduct thorough market research to identify and assess investment opportunities across various asset classes, including stocks, bonds, and commodities.

- Analyze economic indicators, industry trends, and company financials.

- Develop investment theses and provide buy/sell/hold recommendations.

2. Financial Modeling and Valuation

Build financial models to forecast company performance and determine fair value for investment opportunities.

- Use analytical tools, such as discounted cash flow and comparable company analysis.

- Calculate return on investment (ROI) and risk-adjusted returns.

3. Portfolio Management and Monitoring

Provide investment recommendations and assist in the management of investment portfolios.

- Track portfolio performance and make recommendations for adjustments.

- Monitor market trends and economic developments to identify potential risks and opportunities.

4. Reporting and Client Communication

Prepare investment reports, presentations, and analyses to communicate findings and recommendations to clients.

- Participate in client meetings to discuss investment strategies and performance.

- Stay updated on regulatory requirements and industry best practices.

Interview Tips

To ace an Investment Analyst interview, candidates should focus on the following preparation tips:

1. Technical Proficiency

Demonstrate strong analytical and modeling skills, including proficiency in financial modeling software (e.g., Excel, Bloomberg).

- Quantify your experience and showcase examples of successful investment recommendations.

- Highlight your knowledge of different valuation methodologies and risk assessment techniques.

2. Market Knowledge

Stay abreast of current economic and financial events, especially in the sectors and asset classes relevant to the role.

- Follow industry news and publications to demonstrate your understanding of market trends.

- Show that you can apply your financial analysis skills to real-world investment scenarios.

3. Behavioral Skills

Communicate your ability to work independently and as part of a team, with strong attention to detail and accuracy.

- Emphasize your problem-solving abilities and critical thinking skills.

- Highlight your ability to present complex financial concepts clearly and effectively.

4. Prepare Questions

Show your interest and engagement by asking thoughtful questions about the role, the company, and the industry.

- Inquire about the company’s investment philosophy and risk tolerance.

- Ask about potential opportunities for professional development and career growth within the firm.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Investment Analyst interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!