Are you gearing up for a career in Investment Consultant? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Investment Consultant and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

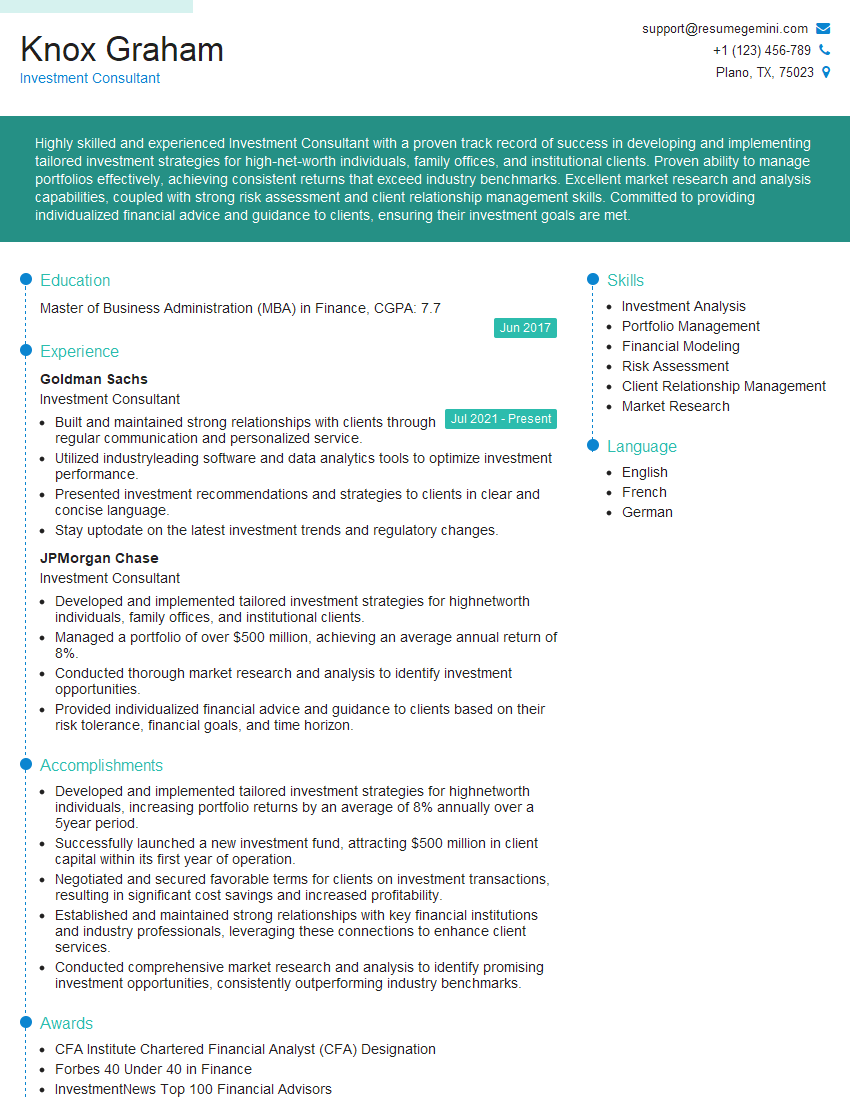

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Investment Consultant

1. How would you assess the risk tolerance of a new client?

- Conduct a risk tolerance questionnaire that assesses their financial situation, investment goals, time horizon, and comfort level with volatility.

- Interview the client to gather qualitative information about their risk preferences and life experiences that may influence their risk tolerance.

- Use financial modeling and stress testing to demonstrate the potential impact of different market scenarios on their portfolio.

2. What are the key factors you consider when making investment recommendations?

Risk and return

- Evaluate the client’s risk tolerance and determine an appropriate asset allocation.

- Analyze the historical performance and risk characteristics of potential investments.

- Consider the current market conditions and economic outlook.

Investment goals

- Identify the client’s specific financial goals, such as retirement, education funding, or wealth preservation.

- Develop an investment strategy that aligns with their goals.

- Monitor the portfolio’s performance and make adjustments as needed.

3. How do you stay up-to-date on market trends and economic data?

- Read industry publications and research reports.

- Attend conferences and webinars.

- Monitor financial news and data sources.

- Network with other investment professionals.

4. What are the ethical considerations you take into account when providing investment advice?

- Ensure that recommendations are suitable for the client’s individual circumstances and objectives.

- Avoid conflicts of interest and disclose any potential conflicts.

- Maintain confidentiality and protect client information.

- Act in the client’s best interests at all times.

5. How do you build and maintain strong relationships with clients?

- Provide personalized and tailored advice.

- Communicate regularly and clearly.

- Be accessible and responsive to client inquiries.

- Build trust by being honest and transparent.

6. Describe a complex investment issue you faced and how you resolved it.

- Provide a specific example of a challenging investment situation you encountered.

- Explain how you analyzed the situation and identified the root cause.

- Describe the steps you took to resolve the issue and the outcome.

7. What is your approach to portfolio management?

- Describe your investment philosophy and the strategies you use.

- Explain how you allocate assets and diversify portfolios.

- Discuss how you monitor portfolios and make adjustments as needed.

8. How do you evaluate the performance of investment portfolios?

- Discuss the metrics you use to measure performance, such as return, risk, and Sharpe ratio.

- Explain how you compare portfolio performance to benchmarks and peer groups.

- Describe how you use performance evaluation to make informed investment decisions.

9. What are the challenges and opportunities in the current investment landscape?

- Identify the key macroeconomic and market trends that are shaping the investment landscape.

- Discuss the potential risks and opportunities these trends present.

- Explain how you adapt your investment strategies to address these challenges and opportunities.

10. What is your understanding of sustainable investing and how do you incorporate it into your practice?

- Define sustainable investing and explain its principles.

- Describe the different types of sustainable investment strategies.

- Discuss how you assess the sustainability factors of potential investments.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Investment Consultant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Investment Consultant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Investment Consultants are responsible for providing a wide range of financial advisory services to individuals and institutions. They typically have a strong understanding of investment principles, financial markets, and economic trends, and they use this knowledge to help clients achieve their financial goals.Some of the key job responsibilities of an Investment Consultant include:

1. Client Relationship Management

Building and maintaining strong relationships with clients is essential for success in this role. Consultants must be able to communicate effectively, understand client needs, and provide personalized advice.

- Developing and implementing investment strategies

- Monitoring client portfolios and providing regular updates

- Conducting financial planning and risk assessments

2. Investment Research and Analysis

Investment Consultants must stay up-to-date on the latest investment trends and developments. They use this knowledge to conduct thorough research and analysis to identify suitable investment opportunities for their clients.

- Conducting due diligence on potential investments

- Evaluating market trends and economic indicators

- Developing investment recommendations

3. Portfolio Management

Investment Consultants are responsible for managing client portfolios, which may include stocks, bonds, mutual funds, and other investment vehicles. They must ensure that portfolios are aligned with client goals, risk tolerance, and investment horizon.

- Allocating assets and diversifying portfolios

- Monitoring portfolio performance and making adjustments as needed

- Providing ongoing investment advice and support

4. Risk Management

Investment Consultants must be able to assess and mitigate investment risks. They must work with clients to develop appropriate risk management strategies and ensure that portfolios are adequately diversified.

- Identifying and evaluating potential investment risks

- Developing and implementing risk management strategies

- Monitoring portfolio risk and making adjustments as needed

Interview Tips

To ace an interview for an Investment Consultant position, it is important to prepare thoroughly and showcase your skills and experience. Here are some tips to help you prepare:Prepare for behavioral questions by using the STAR method. STAR stands for Situation, Task, Action, and Result. When answering behavioral questions, be sure to provide specific examples of your work experience.

1. Research the company and the role

Take the time to learn about the company you are applying to and the specific role you are interviewing for. This will help you understand the company’s culture, values, and goals, and it will also help you tailor your answers to the interviewer’s questions.

2. Practice your answers to common interview questions

There are a number of common interview questions that you can expect to be asked, such as “Tell me about yourself” and “Why are you interested in this role?” Practice answering these questions in a clear and concise way, and be sure to highlight your skills and experience that are relevant to the job.

- Tell me about a time when you successfully managed a client relationship.

- Describe a time when you conducted thorough investment research and analysis.

- Give an example of a time when you successfully managed a client portfolio.

- Describe a time when you identified and mitigated investment risks.

3. Be prepared to talk about your investment philosophy

Investment Consultants typically have a specific investment philosophy that guides their investment decisions. Be prepared to discuss your investment philosophy in detail, and be able to explain why you believe it is the best approach for your clients.

4. Be confident and enthusiastic

Interviewers are looking for candidates who are confident and enthusiastic about the investment industry. Be sure to convey your passion for finance and your desire to help clients achieve their financial goals.

Next Step:

Now that you’re armed with the knowledge of Investment Consultant interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Investment Consultant positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini