Are you gearing up for a career in Investment Counselor? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Investment Counselor and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

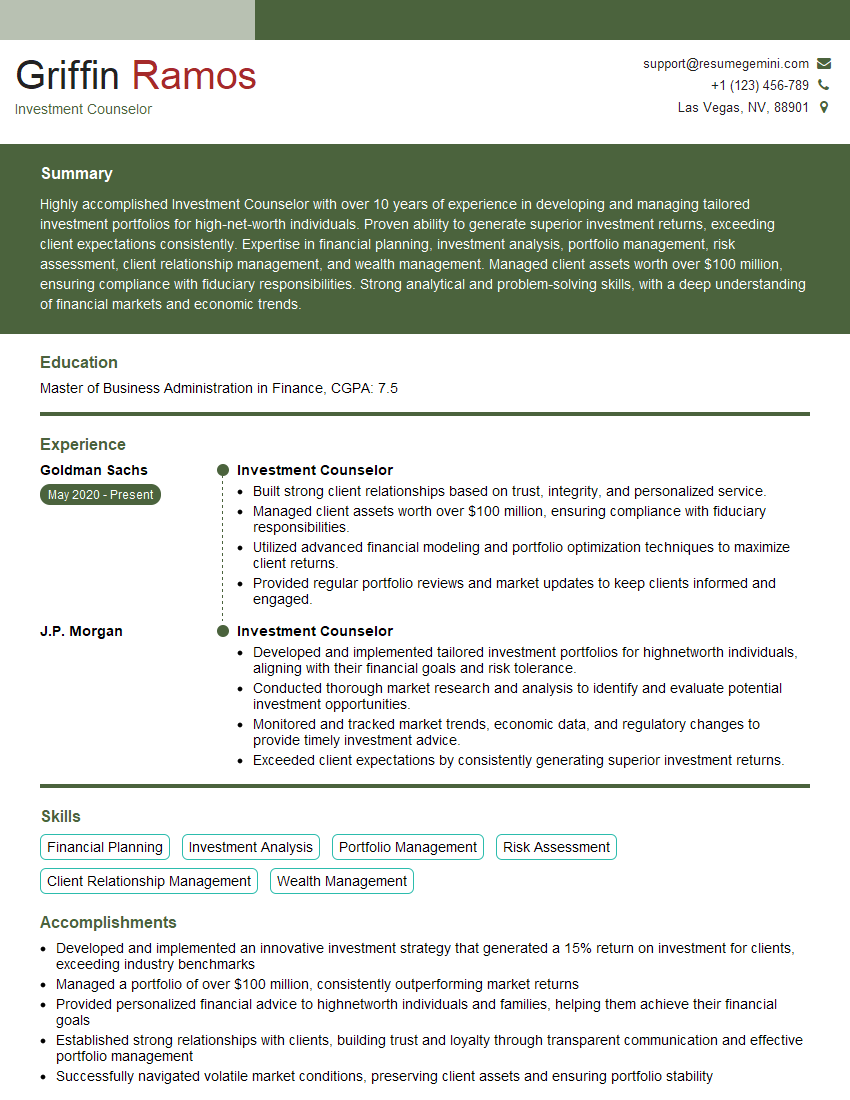

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Investment Counselor

1. How would you evaluate the overall risk and return profile of a portfolio?

- Analyze the portfolio’s asset allocation, including the proportions of stocks, bonds, and other investments

- Calculate the portfolio’s risk metrics, such as standard deviation and beta

- Assess the portfolio’s return history and compare it to benchmarks or peer groups

- Consider the investor’s risk tolerance, time horizon, and financial goals

2. What are the key factors to consider when selecting investments for a portfolio?

Diversification

- Spread investments across different asset classes, sectors, and geographies

- Reduce risk by minimizing exposure to any single asset or industry

Risk Tolerance

- Determine the investor’s ability and willingness to take risk

- Align investments with the investor’s risk profile

Time Horizon

- Consider the investor’s investment timeline

- Match investments with the expected duration of the portfolio

Financial Goals

- Identify the specific financial goals the portfolio aims to achieve

- Select investments that align with those goals

3. How do you stay up-to-date on the latest market trends and investment strategies?

- Attend industry conferences and workshops

- Read financial publications and research reports

- Monitor news and economic data

- Network with other financial professionals

4. What are the ethical considerations involved in investment counseling?

- Adhering to fiduciary duty and acting in the best interests of clients

- Avoiding conflicts of interest and disclosing any potential conflicts

- Following industry regulations and compliance guidelines

- Maintaining confidentiality and protecting client information

- Providing accurate and unbiased information to clients

5. How do you handle situations where clients have unrealistic expectations about investment returns?

- Educate clients about the risks and uncertainties of investing

- Set realistic return expectations based on historical data and market conditions

- Discuss investment strategies that align with the client’s risk tolerance and financial goals

- Encourage clients to focus on long-term returns rather than short-term fluctuations

6. What is your investment philosophy and how does it guide your recommendations?

- Outline your general approach to investing, such as value investing, growth investing, or a combination of both

- Explain how you research and select investments

- Describe how you monitor and adjust portfolios

7. How do you communicate complex investment concepts to clients in a clear and understandable way?

- Use simple and concise language

- Provide visual aids such as charts and graphs

- Tailor explanations to the client’s level of financial literacy

- Encourage questions and provide opportunities for feedback

8. How do you build and maintain strong client relationships?

- Foster open and transparent communication

- Be responsive to client inquiries and requests

- Provide personalized investment advice tailored to each client’s needs

- Regularly review and update client portfolios

- Host client events and educational workshops

9. What are the challenges and opportunities in the investment counseling industry?

Challenges

- Evolving market conditions and economic uncertainty

- Increasing competition from robo-advisors and online platforms

Opportunities

- Growing demand for personalized financial advice

- Technological advancements in financial planning and portfolio management

10. What are your career goals and how does this position align with them?

- State your career aspirations in the investment field

- Explain how the position aligns with your goals and provides opportunities for professional growth

- Discuss how your skills and experience fit the requirements of the role

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Investment Counselor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Investment Counselor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Investment Counselors help clients make informed decisions about their investments. They analyze financial markets, research potential investment opportunities, and provide tailored advice to meet each client’s financial goals and risk tolerance.

1. Consult with Clients

Understanding client needs and objectives is crucial. Counselors gather information about clients’ financial situations, risk tolerance, investment goals, and time horizons.

- Interview clients to gather comprehensive financial data.

- Analyze client financial statements and investment portfolios.

2. Research and Analyze Investments

Counselors stay abreast of financial markets and conduct thorough research to identify suitable investment opportunities for clients. They consider factors like market trends, economic indicators, and company performance.

- Review financial statements, market reports, and industry news.

- Analyze investment performance, risk-adjusted returns, and correlation to the overall portfolio.

3. Develop and Implement Investment Strategies

Counselors create personalized investment strategies based on client needs and assessments. They allocate assets, select investments, and monitor performance to meet financial objectives.

- Create diversified investment portfolios that align with client risk tolerance and goals.

- Recommend specific investment products, including stocks, bonds, mutual funds, and alternative investments.

4. Monitor and Adjust Portfolio Performance

Counselors continuously monitor investment performance and make necessary adjustments to optimize returns. They provide regular updates to clients and address any concerns.

- Track investment performance against benchmarks and client expectations.

- Analyze market changes and adjust investment strategies as needed.

Interview Tips

Preparing for an Investment Counselor interview requires thorough research about the industry, company, and specific role. Here are some tips to help you ace the interview:

1. Research and Understand the Industry

Demonstrate your knowledge of financial markets, economic principles, and investment strategies. Stay updated on current events and market trends that may impact investment decisions.

- Read industry publications, such as The Wall Street Journal or Barron’s.

- Attend industry events, webinars, or conferences.

2. Practice Common Interview Questions

Prepare for common interview questions related to your skills, experience, and knowledge. Anticipate questions about investment strategies, portfolio management, and client relationships.

- Practice answering questions about your investment philosophy, risk management strategies, and ethical principles.

- Prepare examples of successful investment decisions you have made or strategies you have implemented.

3. Highlight Your Analytical and Communication Skills

Investment Counselors need strong analytical and communication skills. Emphasize your ability to analyze financial data, interpret market trends, and clearly communicate investment recommendations to clients.

- Describe specific situations where you demonstrated your analytical prowess or problem-solving abilities.

- Share examples of how you effectively communicated complex financial concepts to non-financial professionals.

4. Show Enthusiasm and Passion for the Industry

Convey your genuine interest in the financial industry and passion for helping clients achieve their financial goals. Demonstrate your commitment to staying updated on market developments and providing exceptional service.

- Explain why you are passionate about the investment industry and what motivates you to excel in this field.

- Share your aspirations and goals for your career as an Investment Counselor.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Investment Counselor interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.