Are you gearing up for an interview for a Investment Fund Manager position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Investment Fund Manager and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

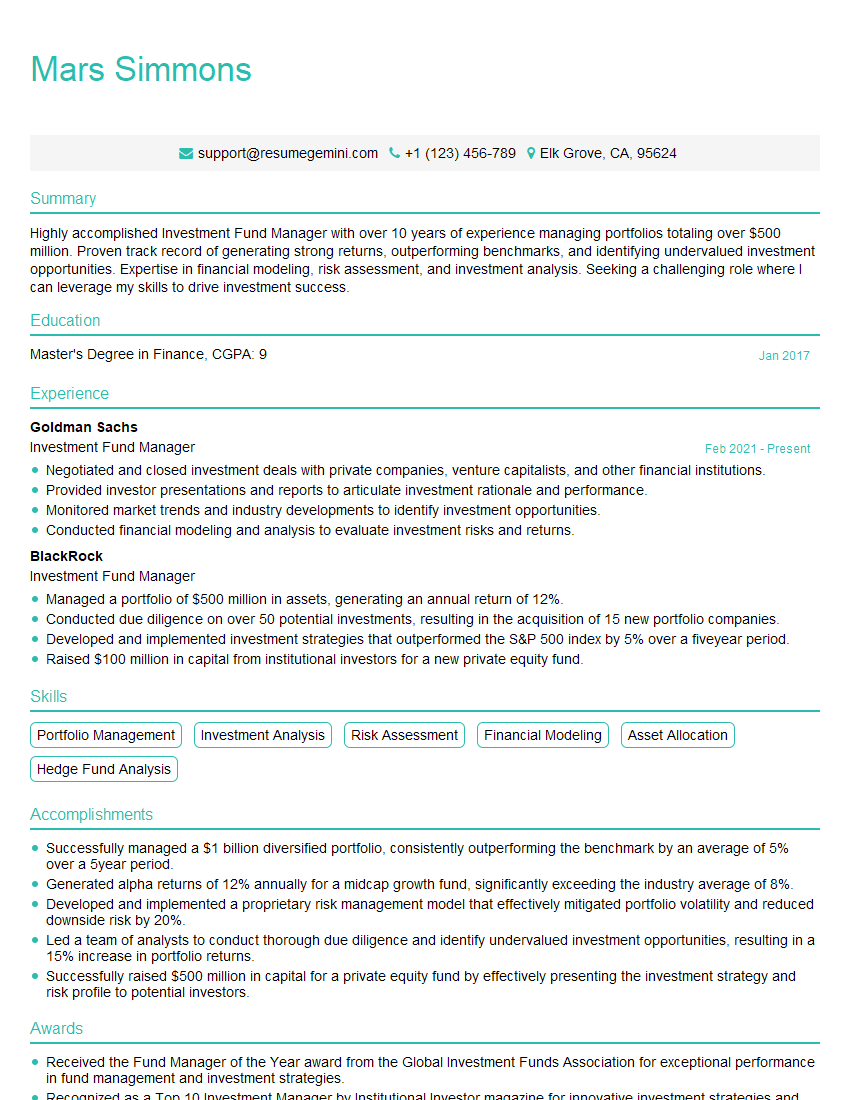

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Investment Fund Manager

1. What are the key factors you consider when evaluating a potential investment oportunidad?

When evaluating a potential investment opportunity, I consider the following key factors:

- Market analysis: I assess the overall market conditions, industry trends, and competitive landscape to identify potential growth opportunities and risks.

- Company analysis: I conduct a thorough analysis of the company’s financial statements, management team, and competitive position to evaluate its financial health, growth potential, and risk profile.

- Investment strategy: I align the potential investment with the fund’s overall investment strategy and risk tolerance, ensuring that it fits within the fund’s mandate and objectives.

- Due diligence: I conduct extensive due diligence, including site visits, financial audits, and legal reviews, to gather comprehensive information and mitigate potential risks.

- Exit strategy: I consider the potential exit options for the investment, including IPO, trade sale, or secondary offering, to ensure alignment with the fund’s investment horizon and return expectations.

2. How do you manage risk in your investment portfolio?

Diversification

- Spreading investments across different asset classes, sectors, and geographies to reduce concentration risk.

- Investing in a mix of low-risk and high-risk assets to achieve an optimal risk-return balance.

Asset Allocation

- Determining the appropriate allocation of funds to different asset classes based on investment objectives, risk tolerance, and market conditions.

- Rebalancing the portfolio periodically to maintain the desired risk-return profile.

Risk Monitoring

- Regularly monitoring portfolio performance and risk metrics, such as volatility, Sharpe ratio, and maximum drawdown.

- Identifying and evaluating potential risks and taking appropriate measures to mitigate them.

3. Describe the investment process you follow, from idea generation to portfolio construction.

- Idea generation: Identify potential investment opportunities through market research, industry analysis, and networking with industry experts.

- Due diligence: Conduct thorough due diligence, including financial analysis, site visits, and legal reviews, to assess the investment’s risk and return potential.

- Investment decision: Make an informed investment decision based on the due diligence findings and alignment with the fund’s investment strategy.

- Portfolio construction: Determine the optimal allocation of funds to the investment, considering its risk profile and contribution to the overall portfolio.

- Portfolio monitoring: Regularly monitor the investment’s performance and make adjustments as needed to maintain alignment with the fund’s objectives.

4. Can you discuss your experience in managing investments through different market cycles?

Throughout my career, I have successfully managed investments through various market cycles, including bull and bear markets:

- Bull markets: I have leveraged market momentum to identify high-growth opportunities and maximize returns, while maintaining a balanced portfolio to mitigate risk.

- Bear markets: I have implemented defensive strategies such as increasing cash reserves, reducing risk exposure, and investing in value-oriented assets to preserve capital and position the portfolio for recovery.

- Market transitions: I have adapted my investment approach to changing market conditions, adjusting asset allocation, and identifying new investment opportunities that align with emerging trends.

5. How do you stay up-to-date on the latest investment trends and developments?

- Industry journals and publications: Subscribe to and regularly read industry-leading journals, magazines, and online publications.

- Conferences and seminars: Attend industry conferences and seminars to stay informed about new trends, regulations, and investment strategies.

- Networking with peers: Communicate with other investment professionals, analysts, and experts to share insights and gain different perspectives.

- Research and analysis: Conduct independent research and analysis on market trends, economic indicators, and company fundamentals.

6. What are your thoughts on the current investment landscape and where do you see opportunities?

The current investment landscape presents both challenges and opportunities:

- Challenges: Global economic uncertainty, geopolitical risks, and rising inflation pose challenges for investors seeking growth and income.

- Opportunities: Despite the headwinds, there are opportunities in emerging markets, technology sectors, and companies with strong fundamentals and innovative business models.

- Areas of focus: I am particularly interested in exploring investments in sustainable energy, healthcare, and technology infrastructure, which offer long-term growth potential while addressing global challenges.

7. How do you measure and evaluate the performance of your investment portfolio?

- Quantitative metrics: Calculate key performance indicators such as rate of return, Sharpe ratio, and maximum drawdown to assess historical and risk-adjusted performance.

- Qualitative metrics: Evaluate the alignment of portfolio performance with the fund’s objectives, investment strategy, and risk tolerance.

- Peer comparison: Benchmark the portfolio’s performance against industry peers and relevant indices to assess relative success.

- Risk analysis: Regularly monitor risk metrics, including standard deviation, beta, and VaR, to ensure that the portfolio’s risk profile remains within acceptable limits.

8. Describe a successful investment you made and what factors contributed to its success.

One of my most successful investments was in a technology start-up that developed innovative software solutions. The following factors contributed to its success:

- Thorough due diligence: I conducted extensive research and analysis on the company’s technology, market opportunity, and management team.

- Alignment with investment strategy: The investment fit well within the fund’s mandate and was expected to generate high growth potential.

- Active portfolio management: I maintained regular communication with the company’s management to monitor progress and provide strategic guidance.

- Favorable market conditions: The technology sector was experiencing strong growth, providing a tailwind for the investment.

- Exit strategy: The company was successfully acquired by a larger technology firm, generating significant returns for the fund.

9. Describe a challenging investment you faced and how you overcame those challenges.

I faced a challenging investment in a real estate development project that encountered unexpected delays and cost overruns:

- Reassessment and risk mitigation: I thoroughly re-evaluated the project’s risks and took steps to mitigate them, including securing additional funding and negotiating revised construction contracts.

- Communication and stakeholder management: I kept investors and stakeholders informed of the challenges and worked closely with the project team to find solutions.

- Diversification strategy: I reduced the portfolio’s exposure to the project by diversifying into other real estate investments with different risk profiles.

- Exit strategy revision: I adjusted the exit strategy to account for the project’s extended timeline and revised market conditions.

- Positive outcome: Despite the challenges, the project was eventually completed and generated a modest return for the fund.

10. How do you approach ethical and responsible investing?

I believe that ethical and responsible investing is crucial for long-term investment success and societal impact:

- ESG integration: I incorporate environmental, social, and governance (ESG) factors into my investment analysis and decision-making process.

- Impact investing: I seek investment opportunities that align with positive social or environmental outcomes, while also generating financial returns.

- Active ownership: I engage with company management to promote responsible practices and encourage sustainability initiatives.

- Industry collaboration: I participate in industry initiatives and collaborate with other investors to promote ethical and responsible investing practices.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Investment Fund Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Investment Fund Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Investment Fund Managers play a crucial role in the financial industry, managing portfolios of various investment funds. Their key responsibilities encompass:

1. Investment Analysis and Strategy Development

Thoroughly analyzing market trends, economic data, and industry research to identify potential investment opportunities.

Developing and executing investment strategies aligned with fund objectives, risk tolerance, and investor profiles.

2. Portfolio Management

Managing and monitoring investment portfolios, including buying and selling securities, rebalancing allocations, and mitigating risks.

Conducting regular performance reviews, evaluating returns, and adjusting strategies as needed.

3. Risk Management

Identifying and assessing investment risks, implementing risk management strategies, and controlling portfolio volatility.

Monitoring regulatory compliance and adhering to industry best practices.

4. Investor Relations and Marketing

Maintaining strong relationships with investors, providing regular updates on portfolio performance, and addressing investor concerns.

Marketing and promoting investment funds to potential investors, showcasing performance and investment philosophy.

5. Team Leadership and Management

Leading and managing investment teams, providing guidance, and assigning responsibilities.

Participating in firm-wide decision-making and contributing to strategic initiatives.

Interview Tips

Preparing for an Investment Fund Manager interview requires a comprehensive approach. Here are some tips to help you ace the process:

1. Research the Firm and the Fund

Familiarize yourself with the investment firm’s history, investment philosophy, and recent performance.

Research the specific fund you’re applying to, understanding its investment objectives, risk profile, and track record.

2. Showcase Your Analytical Skills

Provide concrete examples of your ability to analyze financial data, conduct market research, and develop investment theses.

Quantify your accomplishments and demonstrate how your analytical insights led to successful investment decisions.

3. Highlight Your Portfolio Management Experience

Discuss your experience in managing investment portfolios, describing your approach to asset allocation, risk management, and performance evaluation.

Share examples of how you navigated challenging market conditions and achieved your investment goals.

4. Emphasize Your Risk Management Expertise

Emphasize your understanding of investment risks and your ability to develop and implement risk management strategies.

Provide examples of how you identified, mitigated, and managed risks in previous roles.

5. Demonstrate Strong Communication and Interpersonal Skills

Investment Fund Managers need to communicate effectively with investors, analysts, and colleagues.

Highlight your presentation skills, ability to articulate complex financial concepts, and build strong relationships with clients.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Investment Fund Manager interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!