Feeling lost in a sea of interview questions? Landed that dream interview for Investment Portfolio Manager but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Investment Portfolio Manager interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

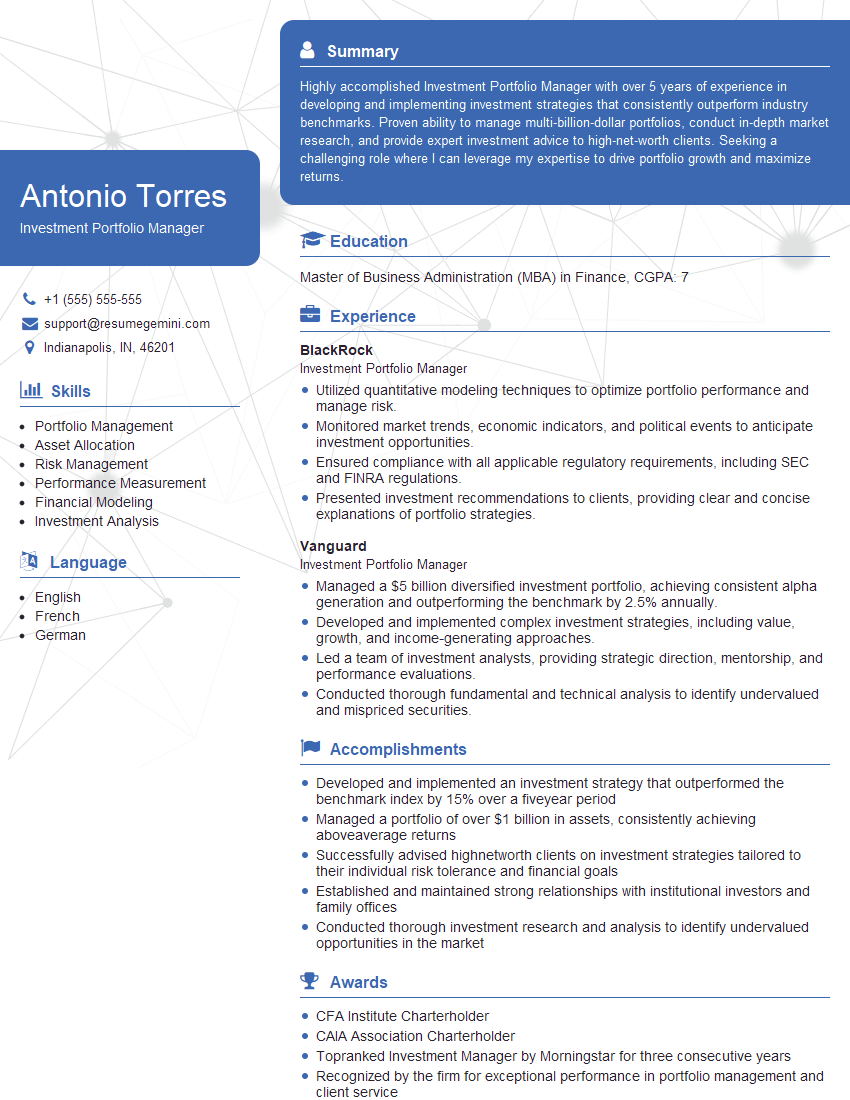

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Investment Portfolio Manager

1. Walk me through a typical investment process you follow when managing a portfolio.

The investment process typically involves the following steps:

- Define investment objectives and constraints: This involves understanding the client’s risk tolerance, investment horizon, and return expectations.

- Develop an investment strategy: This involves determining the asset allocation, investment style, and specific investments that will be used to achieve the investment objectives.

- Implement the investment strategy: This involves selecting and purchasing the investments that will be included in the portfolio.

- Monitor the portfolio: This involves tracking the performance of the investments and making adjustments as necessary.

- Report to clients: This involves providing regular updates on the portfolio’s performance and any changes that have been made.

2. How do you determine the appropriate asset allocation for a portfolio?

Risk tolerance and investment horizon:

- Age, income, and financial goals of the client.

- Time frame over which the client will need the money.

Investment objectives:

- Return expectations and risk tolerance of the client.

- Current economic conditions and market outlook.

Diversification and correlation:

- Reducing risk by spreading investments across different asset classes.

- Understanding the correlation between different asset classes.

3. Describe your investment philosophy and how it has evolved over time.

My investment philosophy is based on the following principles:

- Long-term investing: I believe that investing for the long term is the best way to achieve financial goals.

- Diversification: I believe that it is important to diversify investments across different asset classes and investments.

- Risk management: I believe that it is important to manage risk carefully and to avoid unnecessary losses.

- Value investing: I believe that it is important to invest in companies that are trading at a discount to their intrinsic value.

My investment philosophy has evolved over time as I have gained more experience and knowledge. I have become more focused on long-term investing and diversification, and I have developed a better understanding of risk management.

4. How do you evaluate the performance of a portfolio?

I evaluate the performance of a portfolio using a variety of metrics, including:

- Return on investment (ROI): This measures the total return on the portfolio over a specific period of time.

- Sharpe ratio: This measures the excess return of the portfolio over the risk-free rate per unit of risk.

- Jensen’s alpha: This measures the excess return of the portfolio over the expected return based on the portfolio’s beta.

- Treynor ratio: This measures the excess return of the portfolio over the risk-free rate per unit of systematic risk.

- Information ratio: This measures the excess return of the portfolio over the benchmark per unit of tracking error.

5. How do you manage risk in a portfolio?

I manage risk in a portfolio by using a variety of techniques, including:

- Diversification: I diversify the portfolio across different asset classes and investments to reduce the risk of any one investment losing value.

- Asset allocation: I allocate the portfolio’s assets based on the client’s risk tolerance and investment objectives.

- Hedging: I use hedging strategies to reduce the risk of specific investments or exposures.

- Risk monitoring: I monitor the portfolio’s risk on a regular basis and make adjustments as necessary.

6. Discuss a time when you had to make a difficult investment decision and how you approached it.

One time when I had to make a difficult investment decision was when the market was experiencing a downturn. I had to decide whether to sell some of the portfolio’s investments to lock in profits or to hold on to them in the hope that the market would recover. I ultimately decided to hold on to the investments, as I believed that the long-term outlook for the market was positive.

In making this decision, I considered the following factors:

- The client’s risk tolerance: The client had a high risk tolerance and was willing to ride out the market downturn.

- The length of the investment horizon: The client was investing for the long term and could afford to wait for the market to recover.

- The current economic conditions: Although the market was experiencing a downturn, the economy was still growing and I believed that the market would eventually recover.

- My own investment philosophy: I believe that it is important to invest for the long term and to avoid making impulsive decisions based on short-term market fluctuations.

7. What are your thoughts on the current market environment?

The current market environment is characterized by a number of challenges, including:

- Rising inflation: Inflation is eroding the value of savings and investments.

- Rising interest rates: Interest rates are rising, which is making it more expensive to borrow money.

- Geopolitical uncertainty: The war in Ukraine and other geopolitical events are creating uncertainty in the markets.

- Slowing economic growth: Economic growth is slowing, which is reducing corporate profits and making investors more risk-averse.

Despite these challenges, I believe that there are still opportunities for investors to find value in the market. I am particularly interested in companies that are trading at a discount to their intrinsic value and that have strong long-term growth prospects.

8. What are some of the trends that you are watching in the investment industry?

Some of the trends that I am watching in the investment industry include:

- The rise of sustainable investing: Investors are increasingly looking for investments that align with their social and environmental values.

- The growth of passive investing: Passive investing, such as index funds and ETFs, is becoming increasingly popular as investors look for low-cost and efficient ways to invest.

- The use of technology: Technology is playing an increasingly important role in the investment process, from data analysis to portfolio management.

- The globalization of the investment industry: The investment industry is becoming increasingly globalized, as investors look for opportunities in different markets around the world.

9. What are your career goals and how do you see this role fitting into them?

My career goal is to become a portfolio manager. I believe that this role would be a great next step in my career, as it would allow me to use my skills and experience to help clients achieve their financial goals. I am particularly interested in managing portfolios for high-net-worth individuals and institutions.

I believe that I have the skills and experience necessary to be successful in this role. I have a strong understanding of investment management principles, and I have a proven track record of success in managing portfolios. I am also a highly motivated and results-oriented individual.

10. Do you have any questions for me?

I do have a few questions for you:

- What is the investment philosophy of your firm?

- What is the average size of the portfolios that you manage?

- What is the investment performance of your firm’s portfolios?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Investment Portfolio Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Investment Portfolio Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Investment Portfolio Manager is responsible for managing and overseeing investment portfolios for clients. They develop and implement investment strategies, conduct research and analysis, and monitor financial markets to optimize returns.

1. Investment Strategy Development

Developing and implementing investment strategies based on client risk tolerance, investment objectives, and financial goals.

2. Portfolio Management

Managing and rebalancing client portfolios to ensure alignment with investment strategies, risk management, and financial constraints.

3. Research and Analysis

Conducting thorough research and analysis on investment opportunities, market trends, and economic data to make informed investment decisions.

4. Financial Modeling and Forecasting

Developing and using financial models to forecast portfolio performance, simulate different scenarios, and evaluate investment risks.

5. Client Communication and Reporting

Communicating regularly with clients, providing portfolio updates, performance reports, and investment advice to meet their needs.

6. Relationship Management

Building and maintaining strong relationships with clients, understanding their individual circumstances and investment requirements.

Interview Tips

To ace the interview as an Investment Portfolio Manager, it’s crucial to prepare thoroughly and showcase your skills and experience. Here are some tips:

1. Research the Company and Industry

Thoroughly research the company’s investment philosophy, strategies, and recent performance to demonstrate your understanding of their business.

2. Prepare for Technical Questions

Be prepared to answer questions on investment analysis, portfolio management, and financial modeling techniques.

3. Showcase Your Expertise

Highlight your experience in developing and executing investment strategies that have achieved positive returns for clients.

4. Quantify Your Results

Use specific examples and data to demonstrate the measurable impact of your investment decisions on client portfolios.

5. Demonstrate Market Knowledge

Show your awareness of current market trends, economic conditions, and industry best practices.

6. Present a Professional Image

Dress professionally and arrive on time for the interview. Be polite and respectful to everyone you meet.

7. Prepare Questions

Show your engagement by preparing thoughtful questions about the company, the position, and the interviewer’s perspective.

8. Practice Your Answers

Rehearse your responses to common interview questions to improve your delivery and confidence.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Investment Portfolio Manager interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.