Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Investment Recovery Technician position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

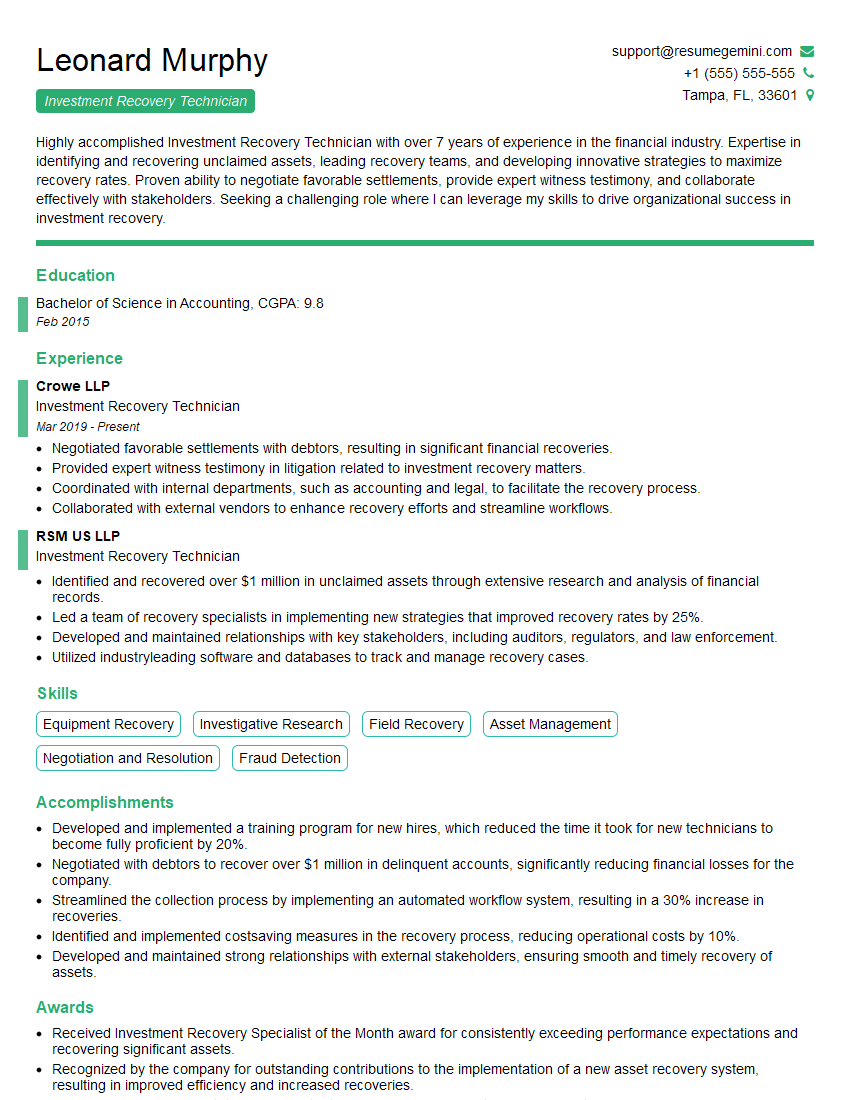

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Investment Recovery Technician

1. How do you assess the default risk of an investment portfolio?

To assess the default risk of an investment portfolio, I would use a combination of qualitative and quantitative factors. Qualitative factors include the industry in which the companies operate, the management team’s experience, and the company’s financial health. Quantitative factors include the debt-to-equity ratio, the interest coverage ratio, and the company’s historical performance.

- Analyze the portfolio’s exposure to different sectors, industries, and geographies.

- Evaluate the creditworthiness of individual investments using financial ratios, industry analysis, and company-specific factors.

- Monitor market conditions, economic indicators, and regulatory changes that may impact default risk.

- Use stress testing and scenario analysis to assess the portfolio’s resilience to potential adverse events.

2. What are the different types of investment recovery methods?

Liquidation

- Sale of assets

- Repossession and sale of collateral

- Foreclosure on real estate

Restructuring

- Debt forgiveness

- Extension of loan terms

- Equity conversion

Litigation

- Lawsuits to recover funds

- Bankruptcy proceedings

3. What are the key skills and qualities of a successful Investment Recovery Technician?

Key skills and qualities of a successful Investment Recovery Technician include:

- Strong financial and accounting knowledge

- Expertise in investment analysis and risk management

- Excellent communication and negotiation skills

- Ability to work independently and as part of a team

- Attention to detail and accuracy

- Persistence and determination

- Ethics and integrity

4. How do you prioritize and manage a high volume of recovery cases?

To prioritize and manage a high volume of recovery cases, I would use a combination of the following strategies:

- Triage cases based on potential recovery value and urgency.

- Use technology to automate tasks and streamline workflows.

- Delegate tasks to team members based on their skills and experience.

- Regularly monitor progress and adjust strategies as needed.

- Communicate regularly with clients and stakeholders to keep them informed of progress.

5. What are the ethical considerations in investment recovery?

Ethical considerations in investment recovery include:

- Treating debtors with respect and fairness

- Adhering to all applicable laws and regulations

- Avoiding conflicts of interest

- Maintaining confidentiality

- Acting in the best interests of clients

6. What are the emerging trends and challenges in investment recovery?

Emerging trends and challenges in investment recovery include:

- The increasing complexity of financial products

- The rise of global investment

- The impact of technology on investment recovery

- The growing importance of environmental, social, and governance (ESG) factors

7. What is your experience in using data analytics and technology in investment recovery?

In my previous role, I used data analytics and technology to improve the efficiency and effectiveness of investment recovery. I used data analysis to identify trends and patterns in recovery cases. I also used technology to automate tasks and streamline workflows. As a result, I was able to increase the recovery rate and reduce the time it took to resolve cases.

8. How do you stay up-to-date on the latest developments in investment recovery?

I stay up-to-date on the latest developments in investment recovery by reading industry publications, attending conferences, and networking with other professionals. I am also a member of the American Recovery Association (ARA) and the International Association of Credit and Collection Professionals (IACCP).

9. What are your career goals?

My career goals are to become a manager in investment recovery. I am confident that my skills and experience make me a strong candidate for this role. I am excited about the opportunity to lead a team of professionals and to continue to develop my career in this field.

10. Why are you interested in this position?

I am interested in this position because it is a great opportunity to use my skills and experience to make a difference. I am confident that I can be a valuable asset to your team and I am excited about the opportunity to contribute to the success of your organization.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Investment Recovery Technician.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Investment Recovery Technician‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Investment Recovery Technicians play a critical role in minimizing financial losses and recovering valuable assets for organizations. Their core responsibilities encompass:

1. Asset Recovery and Liquidation

Locate, track, and recover delinquent assets, such as equipment, vehicles, and real estate.

- Develop and implement recovery strategies to maximize asset value.

- Conduct market research and identify potential buyers for seized assets.

2. Loss Mitigation

Analyze and assess financial losses associated with delinquent accounts and assets.

- Identify and implement strategies to reduce losses and improve recovery outcomes.

- Negotiate with debtors and creditors to minimize financial impact.

3. Customer Relationship Management

Maintain positive relationships with debtors and other stakeholders throughout the recovery process.

- Communicate regularly with debtors to inform them of the recovery status and negotiate payment options.

- Build trust and establish rapport with clients to facilitate cooperation.

4. Reporting and Compliance

Document and report all recovery activities, including asset disposition, financial transactions, and legal proceedings.

- Adhere to all applicable laws and regulations governing asset recovery and liquidation.

- Prepare detailed reports for management and other stakeholders.

Interview Tips

To ace an interview for an Investment Recovery Technician position, consider the following tips:

1. Research the Company and Industry

Demonstrate your knowledge of the organization, its business model, and the current landscape of asset recovery.

- Visit the company website and review their financial reports and press releases.

- Read industry publications and articles to stay informed about trends.

2. Highlight Your Skills and Experience

Emphasize your core competencies in asset recovery, loss mitigation, and negotiation. Quantify your accomplishments and provide specific examples of your successes.

- Describe how you maximized asset recovery value in previous roles.

- Share strategies you’ve implemented to reduce financial losses.

3. Showcase Your Communication and Interpersonal Skills

Investment Recovery Technicians must possess excellent communication and interpersonal skills to effectively interact with debtors and other stakeholders.

- Discuss your ability to build rapport and maintain positive relationships.

- Provide examples of how you handled challenging conversations.

4. Prepare for Behavioral Interview Questions

Behavioral interview questions focus on how you’ve handled past situations. Use the STAR method (Situation, Task, Action, Result) to answer these questions effectively.

- Situation: Describe a time when you successfully recovered a delinquent asset.

- Task: Explain the steps you took to identify and locate the asset.

- Action: Outline the actions you performed to negotiate the recovery and sale of the asset.

- Result: Quantify the financial benefit your actions brought to the organization.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Investment Recovery Technician interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!