Are you gearing up for a career in Investment Representative? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Investment Representative and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

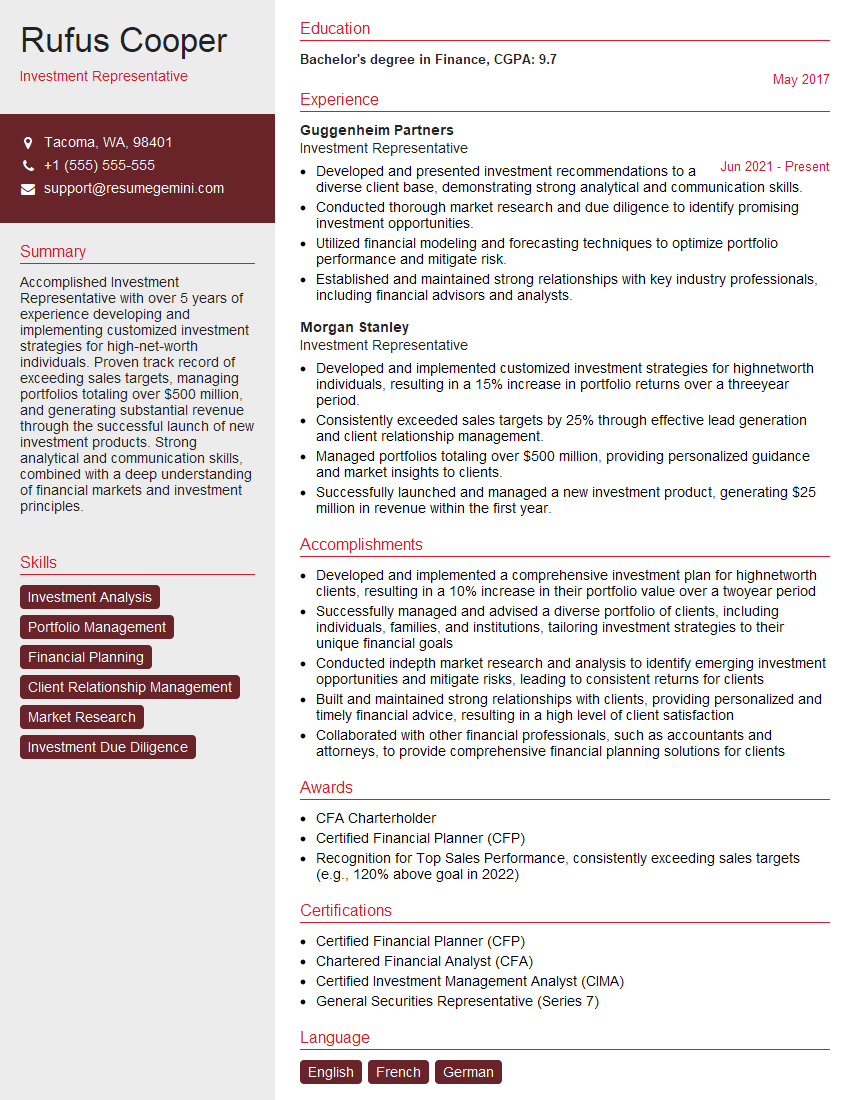

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Investment Representative

1. How do you assess a client’s risk tolerance?

I assess a client’s risk tolerance through a thorough evaluation process that considers several factors:

- Investment objectives: I determine the client’s short-term and long-term financial goals, as these influence their willingness to take risks.

- Risk capacity: I analyze the client’s financial situation, including income, assets, and liabilities, to determine their ability to withstand potential losses.

- Time horizon: I consider the time frame over which the client plans to invest, as this affects their risk tolerance.

- Behavioral factors: I observe the client’s reactions to market fluctuations and their emotional responses to potential gains or losses.

2. How do you select and manage a diversified investment portfolio?

Goals and Objectives

- Align the portfolio with the client’s risk tolerance and financial goals.

- Diversify across asset classes (e.g., stocks, bonds, real estate) and within each class to reduce risk.

Asset Allocation

- Determine the appropriate allocation of funds to each asset class based on the client’s risk profile and investment objectives.

- Rebalance the portfolio periodically to maintain the desired asset allocation.

Investment Selection

- Select individual investments within each asset class through fundamental and technical analysis.

- Consider factors such as company fundamentals, industry trends, and market conditions.

3. How do you monitor and evaluate investment performance?

- Performance Tracking: I regularly monitor the portfolio’s performance against benchmarks and track key metrics such as return, risk, and alpha.

- Performance Evaluation: I analyze the portfolio’s performance based on the client’s investment objectives and risk tolerance. I identify any discrepancies or areas for improvement.

- Client Reporting: I provide regular updates to the client on the portfolio’s performance, highlighting key trends and any changes made.

4. What types of investment products do you have experience with and how do you recommend them to clients?

- Stocks: I recommend stocks to clients with a higher risk tolerance and potential for long-term growth.

- Bonds: I suggest bonds to clients seeking stability and income generation.

- Mutual Funds: I offer mutual funds to provide clients with diversification and professional management.

- ETFs: I recommend ETFs to clients who want cost-effective and tax-efficient exposure to specific markets or sectors.

- Alternative Investments: I explore alternative investments, such as private equity or hedge funds, for clients with a sophisticated understanding and high risk tolerance.

5. How do you stay up-to-date on market trends and economic conditions?

- Financial News and Publications: I read industry-leading publications, attend webinars, and follow financial news outlets.

- Market Analysis: I conduct market research, analyze economic data, and identify potential opportunities or risks.

- Continuing Education: I pursue professional development opportunities to enhance my knowledge and skills.

- Networking: I connect with other professionals in the industry and attend conferences to exchange insights.

6. How do you handle client objections and concerns?

- Active Listening: I listen attentively to the client’s concerns, acknowledge their perspective, and try to understand their motivations.

- Empathy: I show empathy and understand the client’s emotional state, helping them feel heard and valued.

- Logical Reasoning: I provide clear and logical explanations, backed by data or market trends, to address their concerns.

- Alternative Solutions: If necessary, I offer alternative solutions or strategies that align with the client’s goals and risk tolerance.

- Follow-Up: I follow up with the client to ensure that their concerns have been adequately addressed.

7. How do you build and maintain strong client relationships?

- Communication: I maintain open and regular communication with clients, keeping them informed and addressing their inquiries promptly.

- Trust: I earn trust by being honest, transparent, and acting in the client’s best interests.

- Responsiveness: I am available and responsive to client requests, providing support and guidance when needed.

- Personalization: I tailor my approach to each client’s unique needs and goals.

- Follow-Up: I regularly follow up with clients to review progress and make any necessary adjustments.

8. How do you handle conflicts of interest?

- Disclosure: I disclose any potential conflicts of interest to clients upfront.

- Recusal: If a conflict of interest arises, I may recuse myself from certain transactions or discussions.

- Compliance: I adhere to all relevant regulations and ethical guidelines to prevent any conflicts of interest.

- Transparency: I maintain transparent communication with clients to ensure they are aware of any potential conflicts.

9. How do you manage multiple client accounts effectively?

- Organization: I maintain organized records and systems to keep track of each client’s account information, investment objectives, and performance.

- Prioritization: I prioritize tasks based on the needs and urgency of each client.

- Delegation: If necessary, I delegate responsibilities to support staff to ensure efficient management of multiple accounts.

- Time Management: I effectively manage my time to allocate appropriate attention to each client.

10. What are the ethical responsibilities of an Investment Representative?

- Fiduciary Duty: Act in the client’s best interests and put their financial well-being above personal gain.

- Transparency: Disclose all relevant information to clients, including potential risks and conflicts of interest.

- Competence: Maintain up-to-date knowledge and skills to provide clients with sound financial advice.

- Confidentiality: Respect client privacy and maintain the confidentiality of their financial information.

- Compliance: Adhere to all applicable laws, regulations, and ethical standards.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Investment Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Investment Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Investment Representatives play a crucial role in the financial services industry, assisting clients with their investment decisions and managing their financial portfolios. Key job responsibilities of an Investment Representative include:

1. Client Relationship Management

Building and maintaining strong relationships with clients is paramount. Responsibilities include understanding client needs, goals, and risk tolerance; providing personalized investment advice; and regularly communicating with clients.

2. Investment Analysis and Portfolio Management

Analyzing market trends, researching investment opportunities, and developing investment strategies are essential. Responsibilities include recommending and executing trades, managing client portfolios, and monitoring performance.

3. Financial Planning and Advice

Providing clients with comprehensive financial planning advice is important. Responsibilities include advising on retirement planning, estate planning, and tax optimization.

4. Regulatory Compliance and Ethical Conduct

Adhering to industry regulations and ethical guidelines is crucial. Responsibilities include complying with all applicable laws and regulations, maintaining client confidentiality, and avoiding conflicts of interest.

Interview Tips

Preparing thoroughly for an interview is vital for success. Here are some tips and hacks to help candidates ace the interview for an Investment Representative position:

1. Research the Company and Role

Researching the company’s history, culture, and financial performance demonstrates your interest and enthusiasm. Also, clearly understanding the job description and responsibilities will help you tailor your answers accordingly.

2. Practice Answering Common Questions

Anticipate questions related to your investment knowledge, client relationship skills, and ethical practices. Prepare thoughtful answers that highlight your expertise and align with the company’s values.

3. Quantify Your Accomplishments

When describing your past experiences, use specific numbers and metrics to quantify your accomplishments. This provides tangible evidence of your success and makes your answers more impactful.

4. Emphasize Your Passion for Finance

Investment Representatives should be genuinely passionate about finance and helping clients achieve their financial goals. Convey this passion during the interview by discussing your interest in the industry and how you enjoy assisting others.

5. Seek Feedback and Practice

Consider practicing your answers with a mentor, friend, or family member. Their feedback can help you refine your responses and improve your delivery. Additionally, be open to feedback from the interviewer during the interview and use it to adjust your answers accordingly.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Investment Representative interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.