Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Investment Specialist position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

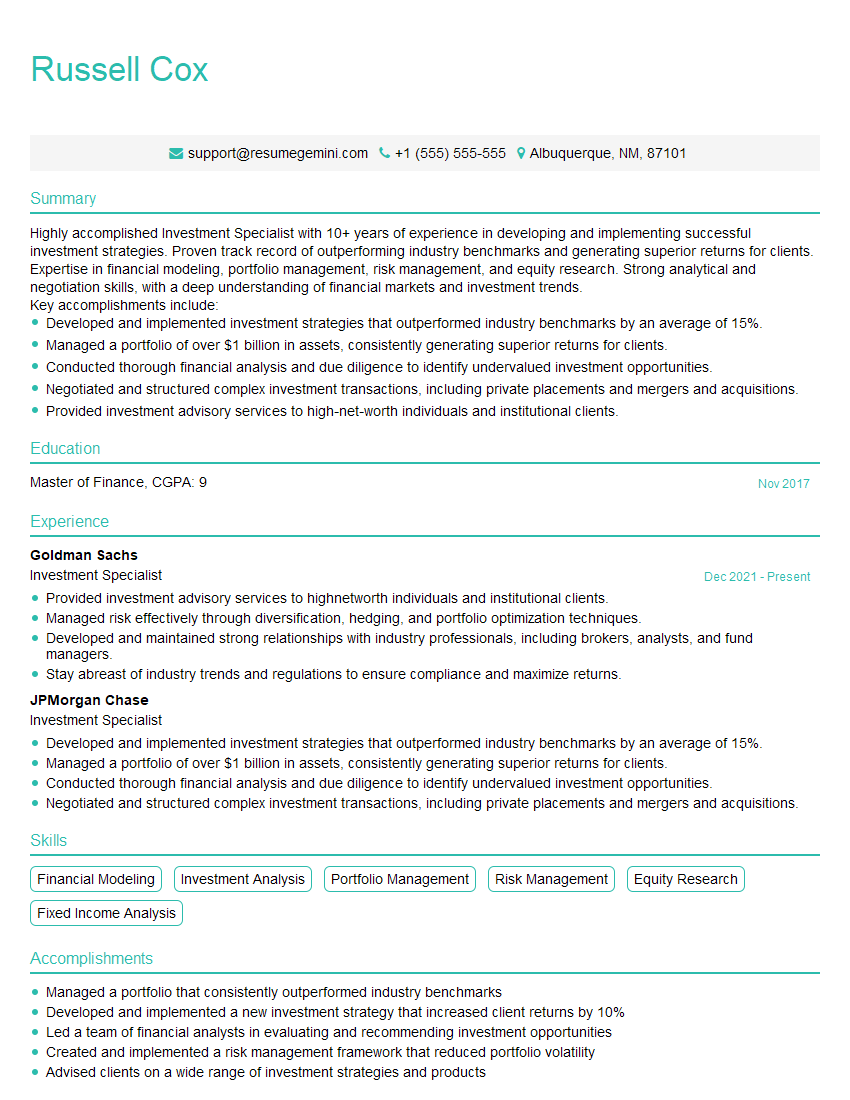

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Investment Specialist

1. What are the key factors you consider when evaluating a potential investment opportunity?

To evaluate a potential investment opportunity, I consider the following key factors:

- Investment thesis: The underlying reasons why the investment is expected to generate a return.

- Market analysis: The size, growth potential, and competitive landscape of the target market.

- Financial analysis: The company’s financial health, profitability, and cash flow.

- Management team: The experience, capabilities, and track record of the management team.

- Exit strategy: The potential ways to exit the investment and realize a return.

2. How do you stay up-to-date on industry trends and best practices?

- Attend industry conferences and webinars: This provides opportunities to learn from experts and network with peers.

- Read industry publications and research reports: This keeps me informed about the latest developments and trends.

- Connect with thought leaders and industry influencers: This allows me to stay ahead of the curve and gain insights from experts.

- Participate in professional development programs and certifications: This helps me enhance my knowledge and skills.

3. Can you describe your investment philosophy and how it has guided your investment decisions?

My investment philosophy is founded on the principles of value investing and long-term horizon. I believe in investing in undervalued companies with strong fundamentals and a competitive advantage. I seek to identify companies with solid management teams, robust financial performance, and sustainable growth potential. By focusing on long-term value creation, I aim to generate consistent returns for my clients while mitigating risks.

4. How do you manage risk in your investment portfolio?

I employ a comprehensive approach to risk management in my investment portfolio:

- Asset allocation: Diversifying investments across different asset classes (e.g., stocks, bonds, real estate) and sectors.

- Risk tolerance assessment: Understanding and aligning investments with clients’ risk appetite.

- Regular portfolio monitoring: Continuously tracking performance and adjusting allocations as needed.

- Stress testing: Simulating market downturns to assess portfolio resilience.

- Hedging strategies: Using financial instruments to reduce exposure to specific risks.

5. What is your approach to ESG investing?

I believe ESG (Environmental, Social, and Governance) factors are increasingly important in investment decision-making. I incorporate ESG considerations into my investment analysis by:

- Evaluating companies’ ESG performance: Assessing their environmental practices, social impact, and corporate governance.

- Identifying companies with strong ESG ratings: Utilizing third-party ESG ratings providers to identify companies that meet sustainability standards.

- Engaging with companies on ESG issues: Actively engaging with company management to promote responsible business practices.

6. How do you communicate investment recommendations to clients?

I place great emphasis on clear and effective communication with my clients. My approach involves:

- Tailored investment reports: Providing customized reports that outline investment recommendations, rationale, and risk assessments.

- Regular portfolio updates: Sending regular updates on portfolio performance, market trends, and any changes to investment strategy.

- Client meetings and webinars: Holding regular meetings or webinars to discuss investment strategies and answer client questions.

- Online client portal: Providing secure online access to account information and investment updates.

7. What are some of the challenges you have faced as an Investment Specialist?

- Market volatility: Navigating unpredictable market conditions and making informed investment decisions.

- Identifying undervalued opportunities: Conducting thorough research to identify companies with potential for growth and value creation.

- Managing client expectations: Balancing risk and return to meet client objectives while managing expectations.

- Staying ahead of the curve: Continuously monitoring market trends and evolving investment strategies.

- Regulatory compliance: Ensuring adherence to industry regulations and ethical guidelines.

8. How do you measure your performance as an Investment Specialist?

- Investment returns: Tracking the performance of my investment recommendations against benchmarks and peer groups.

- Client satisfaction: Receiving positive feedback from clients and maintaining strong relationships.

- Contribution to firm: Generating revenue and contributing to the overall success of the investment management firm.

- Professional development: Continuously expanding my knowledge and skills through certifications and industry engagement.

9. What are some of the ethical considerations you take into account when making investment decisions?

- Fiduciary duty: Always acting in the best interests of my clients and putting their financial well-being first.

- Conflicts of interest: Avoiding any potential conflicts of interest that could compromise my objectivity.

- Responsible investing: Considering the social and environmental impact of my investment decisions.

- Compliance with regulations: Adhering to all applicable laws and industry regulations.

- Confidentiality: Maintaining confidentiality of client information and investment strategies.

10. What are your career aspirations and how does this role fit into your long-term goals?

I am passionate about the investment industry and aspire to continue growing my career as an Investment Specialist. I believe my skills, experience, and commitment to delivering exceptional client service make me an ideal candidate for this role. I am eager to contribute to the firm’s success and further develop my professional capabilities within this dynamic and challenging field.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Investment Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Investment Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Investment Specialists are financial professionals who provide investment advice and guidance to individuals and institutions. They analyze market trends, evaluate investment opportunities, and develop and manage investment portfolios. Key job responsibilities include:

1. Market Analysis and Research

Conduct in-depth research and analysis of financial markets, economic conditions, and industry trends.

2. Investment Strategy Development

Develop investment strategies and asset allocation models based on client risk tolerance, financial goals, and investment objectives.

3. Portfolio Management

Manage investment portfolios, including buying, selling, and rebalancing securities to meet client investment objectives.

4. Investment Performance Monitoring

Monitor and track investment performance, analyze returns, and make adjustments as necessary.

5. Client Relationship Management

Build and maintain relationships with clients, understand their financial needs, and provide ongoing investment advice.

6. Financial Planning

Provide comprehensive financial planning guidance, including retirement planning, tax planning, and estate planning.

7. Risk Management

Identify and assess investment risks, develop risk management strategies, and implement risk mitigation measures.

Interview Tips

Preparing thoroughly for an Investment Specialist interview can significantly increase your chances of success. Here are some tips to help you ace the interview:

1. Research the Company and Role

Research the company’s investment philosophy, investment strategies, and the specific role you are applying for. This will help you align your skills and experience with the company’s needs.

2. Practice Your Technical Skills

Investment Specialists require strong technical skills in financial analysis, portfolio management, and risk assessment. Practice answering questions related to these topics to demonstrate your proficiency.

3. Prepare for Behavioral Questions

Behavioral questions assess your work style, problem-solving abilities, and teamwork skills. Prepare examples of how you have handled challenging situations, solved problems, and worked effectively in a team.

4. Highlight Your Client-Centric Approach

Investment Specialists are client-facing professionals. Emphasize your ability to build strong relationships, understand client needs, and provide tailored investment advice.

5. Stay Updated on Industry Trends

The investment industry is constantly evolving. Demonstrate your knowledge of current industry trends, regulatory changes, and investment strategies to show that you are up-to-date on the latest developments.

6. Prepare Questions for the Interviewers

Asking thoughtful questions at the end of the interview shows that you are engaged and interested in the role. Prepare questions about the company’s investment process, growth plans, and opportunities for professional development.

7. Dress Professionally and Be Punctual

First impressions matter. Dress professionally and arrive on time for the interview to demonstrate your respect for the company and the interviewers.

8. Follow Up

After the interview, send a thank-you note to the interviewers reiterating your interest in the role and highlighting your key qualifications. This shows your enthusiasm and professionalism.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Investment Specialist interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!