Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Investment Trader interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Investment Trader so you can tailor your answers to impress potential employers.

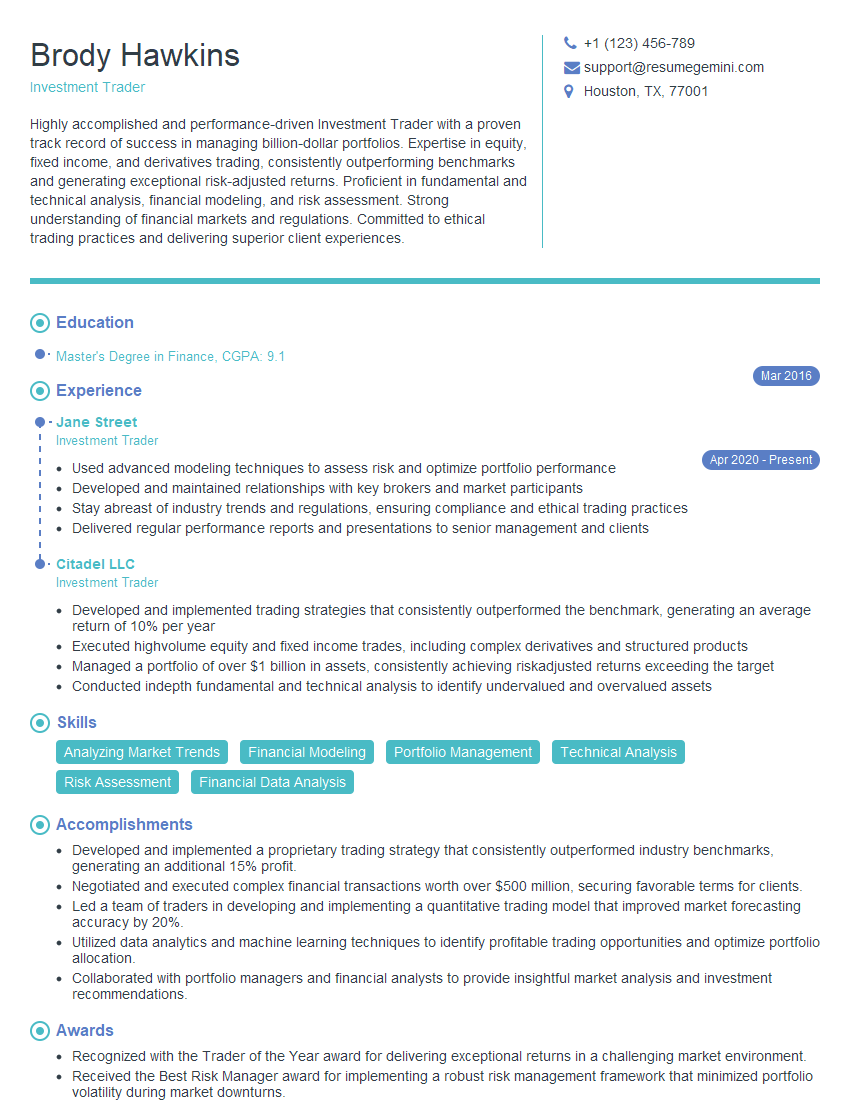

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Investment Trader

1. What quantitative models do you use for equity portfolio management?

- Factor models like Fama-French three-factor model or Carhart four-factor model

- Statistical arbitrage models that exploit price inefficiencies between related assets

- Machine learning algorithms for pattern recognition and predictive analytics

- Risk management models like Value at Risk (VaR) or Expected Shortfall (ES)

2. How do you determine the optimal portfolio allocation given a set of constraints?

Optimization techniques

- Linear programming

- Quadratic programming

- Nonlinear programming

Constraints

- Budgetary constraints

- Risk tolerance

- Liquidity requirements

- Regulatory constraints

3. How do you evaluate and select investment opportunities in fixed income markets?

- Interest rate analysis and forecasting

- Credit analysis and assessment of credit risk

- Yield curve analysis and duration management

- Valuation and pricing of fixed income instruments

- Monitoring and management of bond portfolios

4. How do you trade commodities and derivatives in a global macroeconomic framework?

Consider the following factors:

- Global economic conditions and geopolitical events

- Supply and demand dynamics for specific commodities

- Currency risk and currency hedging strategies

- Pricing and volatility of commodity futures and options

- Hedging strategies using derivatives like futures, forwards, and swaps

5. How do you assess and manage risk in investment portfolios?

- Identify and quantify potential risk factors

- Develop risk management strategies and policies

- Implement risk controls and monitoring systems

- Conduct regular risk assessments and stress tests

- Communicate risk information to stakeholders

6. What trading strategies do you employ in different market conditions?

Bull market

- Trend following and momentum strategies

- Growth and value investing

Bear market

- Defensive and income-oriented strategies

- Short selling and put options

7. How do you monitor market trends and identify investment opportunities?

- Financial news and data analysis

- Technical analysis and charting

- Industry research and analysis

- Networking and consulting with experts

- Monitoring economic indicators and geopolitical events

8. How do you handle market volatility and uncertainty?

- Adjust trading strategies accordingly

- Implement risk management measures

- Monitor market news and developments closely

- Stay informed and make well-informed decisions

- Consider hedging strategies to mitigate risk

9. How do you stay up-to-date with the latest advancements in financial markets and trading technologies?

- Continuing education and professional development

- Reading industry publications and research

- Attending conferences and workshops

- Networking with other professionals

- Exploring and utilizing new trading platforms and technologies

10. How do you maintain a high level of professional ethics and integrity in your work?

- Adherence to regulatory and industry standards

- Transparency and disclosure of potential conflicts of interest

- Commitment to fair and ethical trading practices

- Respect for confidentiality and client privacy

- Continuous review and improvement of ethical policies and procedures

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Investment Trader.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Investment Trader‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Investment Trader is responsible for the day-to-day management of an investment portfolio, making informed decisions to buy and sell stocks, and other financial instruments to maximize returns while minimizing risks.

1. Market Analysis

Investment Traders analyze market trends, economic data, and political events to make informed decisions about buying and selling stocks.

- Stay abreast of financial news and market conditions.

- Conduct thorough research on potential investments.

2. Portfolio Management

Investment Traders develop and implement investment strategies, allocate assets, and monitor portfolio performance.

- Create and execute trading plans.

- Manage risk and maintain diversification.

3. Execution of Trades

Investment Traders place buy and sell orders in the market and monitor trade execution.

- Negotiate trades with brokers and market makers.

- Ensure accurate and timely execution of trades.

4. Performance Evaluation

Investment Traders evaluate portfolio performance and make adjustments as needed.

- Track and analyze portfolio returns and risks.

- Identify areas for improvement and make necessary adjustments.

Interview Tips

Preparing for an Investment Trader interview requires a combination of technical knowledge, market understanding, and strong communication skills. Here are some tips to help candidates ace the interview:

1. Technical Proficiency

Investment Traders must have a strong foundation in financial markets, including knowledge of investment strategies, risk management, and portfolio analysis. It is essential to review core concepts and practice solving problems related to these areas.

- Study financial textbooks and articles.

- Practice using financial modeling software and analytical tools.

2. Market Knowledge

Investment Traders must have a deep understanding of the financial markets, including different asset classes, market trends, and economic factors. Stay updated with current events and analyze how they impact markets.

- Follow financial news and economic data.

- Attend industry conferences and workshops.

3. Communication Skills

Investment Traders need to be able to communicate effectively with clients, colleagues, and senior management. This includes presenting investment strategies, justifying decisions, and building strong relationships. Practice presenting your ideas clearly and persuasively.

- Prepare a portfolio presentation that showcases your analytical skills.

- Role-play answering technical questions and giving investment recommendations.

4. Behavioral Questions

Interviewers often ask behavioral questions to assess your work ethic, teamwork skills, and problem-solving abilities. Prepare for these questions by using the STAR method:

- Situation: Describe the situation or task you were faced with.

- Task: Explain the specific task or challenge you were responsible for.

- Action: Describe the actions you took to address the situation.

- Result: State the positive outcome or impact of your actions.

5. Confidence and Enthusiasm

Investment Traders typically work in fast-paced and demanding environments. Demonstrate your confidence in your abilities and passion for the financial markets. Show that you are eager to learn and contribute to the team.

- Speak clearly and confidently during the interview.

- Express your excitement and enthusiasm for the role and industry.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Investment Trader interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!