Are you gearing up for a career in Invoice Checker? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Invoice Checker and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

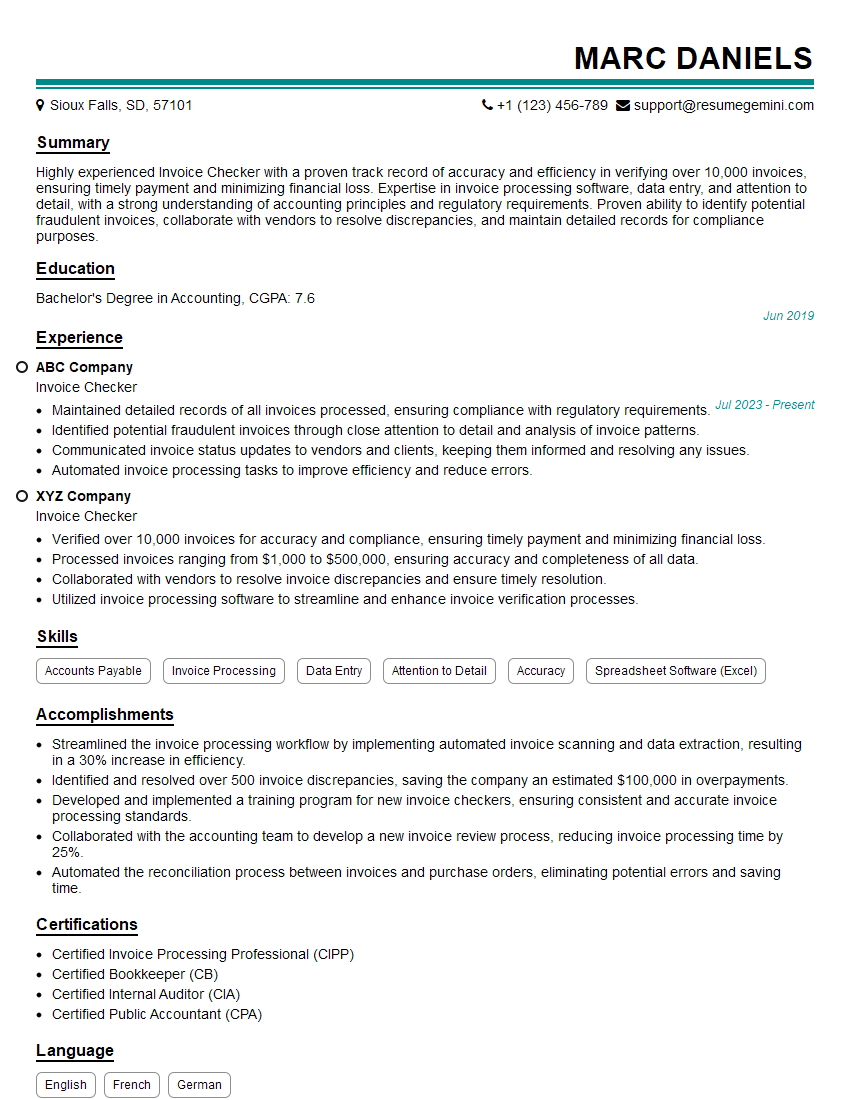

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Invoice Checker

1. How do you ensure the accuracy and completeness of the invoice information you process?

To ensure the accuracy and completeness of invoice information:

- Verify the invoice against the purchase order, packing slip, and other relevant documents.

- Check for missing or incomplete information, such as invoice number, date, vendor name, item descriptions, quantities, unit prices, and total amounts.

- Compare the invoice information to the company’s policies and procedures to ensure compliance.

- Reach out to the vendor or supplier for clarification or additional information if necessary.

- Use automated tools or software to assist with invoice data entry and validation.

2. Describe your experience using invoice processing software.

Key Features of Invoice Processing Software

- Automated data entry and validation

- Invoice matching and approval

- Exception handling and reporting

- Integration with accounting and ERP systems

Experience with Invoice Processing Software

- Name of the software used

- Key features and functionalities utilized

- How the software streamlined invoice processing

- Any challenges or successes encountered while using the software

3. How do you handle discrepancies between invoices and purchase orders?

To handle discrepancies between invoices and purchase orders:

- Identify the specific discrepancies, such as quantity, price, or description.

- Communicate the discrepancies to the vendor or supplier and request clarification.

- Negotiate and resolve the discrepancies with the vendor, if necessary.

- Document the resolution and update the invoice accordingly.

- Escalate unresolved discrepancies to management or other stakeholders for further action.

4. How do you prioritize invoices for payment?

To prioritize invoices for payment, consider the following factors:

- Due date and payment terms

- Vendor criticality or performance

- Impact on cash flow and financial stability

- Availability of funds and budget constraints

- Early payment discounts or penalties

5. What types of payment methods do you typically process?

Common payment methods processed by Invoice Checkers include:

- Checks

- Electronic Funds Transfer (EFT)

- Wire Transfers

- Credit Cards

- Virtual Cards

6. How do you handle invoices with foreign currencies?

To handle invoices with foreign currencies:

- Convert the invoice amount to the company’s home currency using the current exchange rate.

- Record the invoice and payment in both the foreign currency and the home currency.

- Monitor exchange rate fluctuations and adjust the recorded amounts as necessary.

7. What are some common types of invoice fraud to be aware of?

Common types of invoice fraud to be aware of include:

- Duplicate invoices

- Inflated prices or quantities

- Fictitious vendors or suppliers

- Counterfeit or altered invoices

- Phishing scams targeting invoice payments

8. How do you stay updated on changes in invoice processing regulations and best practices?

To stay updated on changes in invoice processing regulations and best practices:

- Attend industry conferences and webinars

- Read trade publications and online resources

- Participate in professional organizations or forums

- Consult with legal, accounting, or compliance professionals

9. How do you manage your workload and meet deadlines in a fast-paced environment?

To manage workload and meet deadlines in a fast-paced environment:

- Prioritize tasks based on importance and urgency

- Break down large projects into smaller, manageable tasks

- Delegate tasks to others when possible

- Use technology and automation tools to streamline processes

- Communicate with stakeholders and keep them informed of progress

10. Why are you interested in working as an Invoice Checker?

Reasons for interest in working as an Invoice Checker:

- Interest in finance and accounting

- Strong attention to detail and accuracy

- Desire to contribute to the smooth operation of the business

- Previous experience or education in invoice processing

- Excellent communication and interpersonal skills

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Invoice Checker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Invoice Checker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Invoice Checker is responsible for reviewing, validating, and approving invoices for payment. They ensure that invoices comply with established policies and procedures, that all necessary documentation is present, and that the charges are accurate and reasonable. The primary responsibilities of an Invoice Checker include:

1. Invoice Verification

Checking the accuracy of invoices against purchase orders, contracts, and other relevant documentation

- Verifying that the quantities, unit prices, and total amounts are correct.

- Ensuring that the goods or services received match the invoice description.

- Checking for any errors or discrepancies in the invoice, such as incorrect calculations or missing information.

2. Payment Approvals

Approving invoices for payment after verifying their accuracy and completeness

- Determining whether the invoice is payable and falls within the company’s payment terms.

- Checking for any hold or stop payment requests.

- Authorizing the release of payment to the supplier or vendor.

3. Document Management

Maintaining and organizing invoice-related documents and records

- Filing invoices and supporting documentation in a secure and organized manner.

- Tracking the status of invoices and payments.

- Providing copies of invoices and documents to authorized personnel.

4. Other Responsibilities

Performing other tasks related to invoice processing, such as:

- Investigating and resolving any invoice discrepancies or issues.

- Collaborating with suppliers or vendors to clarify invoice details.

- Participating in the development and implementation of invoice processing policies and procedures.

Interview Tips

To ace an interview for an Invoice Checker position, it is important to prepare thoroughly and demonstrate your understanding of the role’s responsibilities and the skills required to perform the job effectively. Here are some tips to help you prepare:

1. Research the Company and the Role

Visit the company’s website to learn about their business, industry, and corporate culture. Read the job description carefully and identify the key responsibilities and qualifications required for the position.

2. Highlight Your Relevant Skills and Experience

Emphasize your experience in invoice processing, including your ability to verify invoices for accuracy, complete documentation, and compliance with company policies. Quantify your accomplishments and provide specific examples of your successes in this area.

3. Demonstrate Strong Attention to Detail

Invoice Checkers must have a keen eye for detail and the ability to identify discrepancies or errors in invoices. Highlight your strong attention to detail and your ability to work accurately and efficiently in a fast-paced environment.

4. Show Your Understanding of Accounting Principles

Invoice Checkers should have a basic understanding of accounting principles, such as accounts payable, accruals, and the matching principle. Demonstrate your understanding of these concepts and how they apply to invoice processing.

5. Prepare for Common Interview Questions

Research common interview questions for Invoice Checker positions and prepare your answers in advance. Consider questions such as: “Describe your experience in invoice processing”, “How do you handle discrepancies or errors in invoices?”, and “What is your understanding of accounts payable accounting?”.

6. Practice Your Communication Skills

Invoice Checkers must be able to communicate effectively with suppliers, vendors, and internal staff. Practice your communication skills and be prepared to articulate your findings and recommendations clearly and professionally.

7. Dress Professionally and Be Punctual

First impressions matter. Dress professionally and arrive for your interview on time. This demonstrates your respect for the interviewer and the company.

Next Step:

Now that you’re armed with the knowledge of Invoice Checker interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Invoice Checker positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini