Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Journal Clerk interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Journal Clerk so you can tailor your answers to impress potential employers.

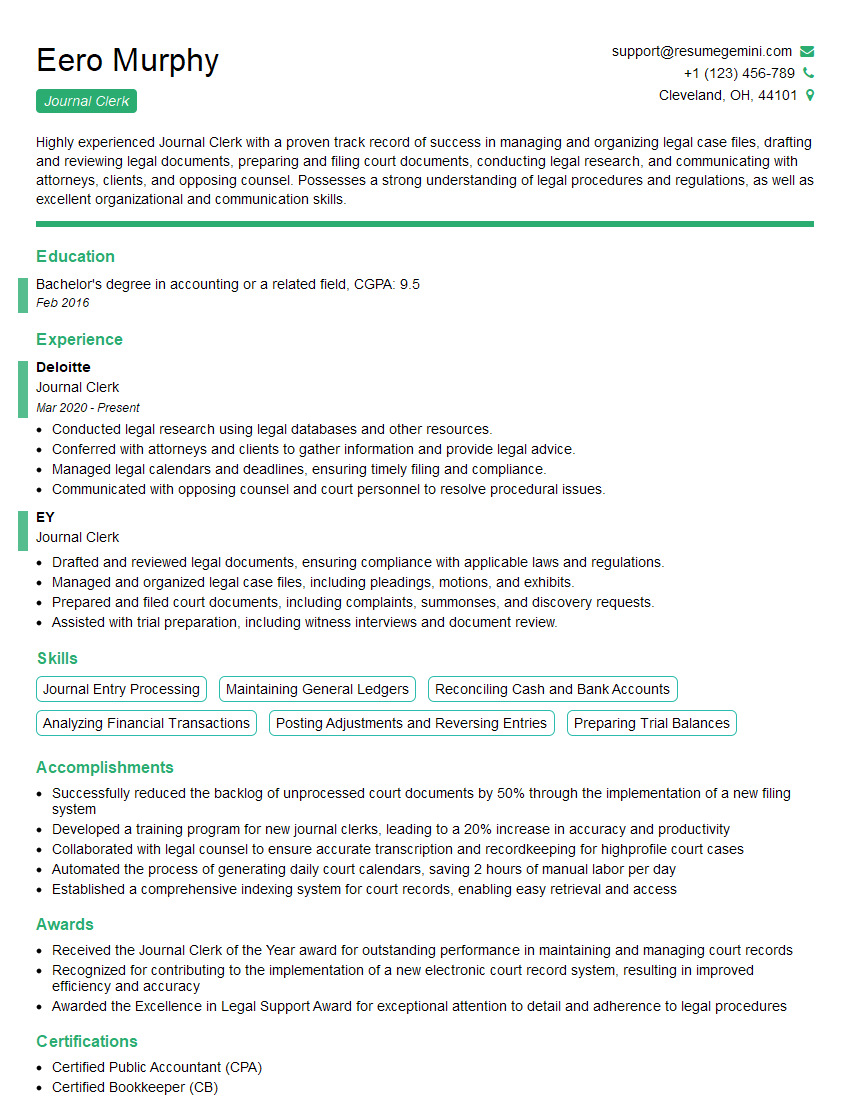

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Journal Clerk

1. Describe the process of recording journal entries?

The process of recording journal entries involves the following steps:

- Identify the transaction and its economic substance.

- Analyze the transaction to determine its impact on the accounting equation.

- Prepare the journal entry, including the date, account names, debit amounts, and credit amounts.

- Post the journal entry to the general ledger accounts.

2. What are the different types of journals used in accounting?

General Journal

- Records all transactions that do not fit into a special journal.

- Each entry includes the date, account names, debit amounts, and credit amounts.

Special Journals

- Used to record specific types of transactions, such as sales, purchases, cash receipts, and cash payments.

- Simplifies the recording process by grouping similar transactions together.

3. Explain the concept of double-entry accounting and its importance.

Double-entry accounting is a system of bookkeeping that requires every transaction to be recorded as a debit to one account and a credit to another account. This ensures that the accounting equation (Assets = Liabilities + Equity) remains in balance.

- Importance of Double-Entry Accounting:

- Accuracy: Helps ensure the accuracy of financial records by preventing errors and omissions.

- Completeness: Provides a complete picture of all transactions that have occurred.

- Auditability: Facilitates the auditing process by providing a clear trail of transactions.

4. What are the key principles of accrual accounting?

Accrual accounting is a method of accounting that recognizes transactions when they occur, regardless of when cash is received or paid. Key principles include:

- Revenue is recognized when it is earned, not when cash is received.

- Expenses are recognized when they are incurred, not when cash is paid.

- Assets and liabilities are recorded even if they do not result in an immediate cash flow.

5. How do you handle the posting of adjusting entries at the end of an accounting period?

At the end of an accounting period, adjusting entries are made to record accrued revenue, accrued expenses, depreciation, and other adjustments necessary to bring the financial records up to date. These entries are posted to the general ledger accounts, and the trial balance is then prepared.

- Steps for Posting Adjusting Entries:

- Identify the adjustments to be made.

- Prepare the adjusting journal entries.

- Post the adjusting entries to the general ledger accounts.

- Prepare an adjusted trial balance.

6. Describe the role of the trial balance in the accounting process.

The trial balance is a summary of all the debit and credit balances in the general ledger accounts at a specific point in time. It is used to check the accuracy of the accounting records and to ensure that the total debits equal the total credits.

- Importance of Trial Balance:

- Error Detection: Helps identify errors in the accounting records.

- Completeness Check: Ensures that all transactions have been recorded.

- Basis for Financial Statements: Serves as the basis for preparing financial statements.

7. Explain the concept of internal control in accounting.

Internal control is a system of policies and procedures designed to ensure the accuracy, reliability, and completeness of financial records. It includes:

- Segregation of Duties:

- Authorization of Transactions:

- Reconciliation of Accounts:

- Documentation and Verification of Transactions:

8. Describe the process of preparing a bank reconciliation statement.

A bank reconciliation statement reconciles the balance per the bank statement with the balance per the company’s books. It involves:

- Identifying outstanding checks.

- Adding deposits in transit.

- Adjusting for bank service charges.

- Investigating any errors or discrepancies.

9. How do you handle the recording of cash receipts and cash payments?

Cash receipts are recorded when cash is received from customers or other sources. Cash payments are recorded when cash is paid to suppliers, employees, or other creditors.

- Recording Cash Receipts:

- Prepare a cash receipt journal entry.

- Post the entry to the general ledger accounts.

- Recording Cash Payments:

- Prepare a cash payment journal entry.

- Post the entry to the general ledger accounts.

10. Explain the role of accounting software in the accounting process.

Accounting software is a computerized system that automates many accounting tasks and processes. It can help to:

- Record transactions.

- Prepare financial statements.

- Manage accounts receivable and payable.

- Generate reports.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Journal Clerk.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Journal Clerk‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Journal Clerks are responsible for maintaining and processing financial transactions. They ensure that all financial records are accurate and up-to-date.

1. Record financial transactions

Journal Clerks record financial transactions in a journal. This includes recording the date, amount, and type of transaction. They also record the accounts that are affected by the transaction.

- Maintain accurate and up-to-date financial records

- Prepare and process invoices, purchase orders, and other financial documents

2. Post financial transactions to the general ledger

Journal Clerks post financial transactions to the general ledger. This is a summary of all financial transactions that have occurred during a period of time. The general ledger is used to create financial statements.

- Reconcile bank statements and other financial accounts

- Prepare and file tax returns and other financial reports

3. Prepare financial reports

Journal Clerks prepare financial reports for management. These reports include the balance sheet, income statement, and cash flow statement. Financial reports are used to track the financial performance of a company.- Analyze financial data and prepare reports

- Provide technical assistance to other departments

4. Audit financial records

Journal Clerks may also be responsible for auditing financial records. This involves reviewing financial records to ensure that they are accurate and complete.

- Maintain a high level of confidentiality

- Stay up-to-date on accounting principles and regulations

Interview Tips

Preparing for a Journal Clerk interview can be daunting, but with the right approach, you can increase your chances of success. Here are some tips to help you ace your interview:

1. Research the company and the position

Before you go to your interview, take some time to research the company and the position you are applying for. This will help you understand the company’s culture and the specific requirements of the job.

- Visit the company’s website

- Read the job description carefully

- Talk to people who work at the company

2. Practice your answers to common interview questions

There are a number of common interview questions that you are likely to be asked. It is helpful to practice your answers to these questions in advance so that you can deliver them confidently and concisely.

- Why are you interested in this position?

- What are your strengths and weaknesses?

- Tell me about your experience with accounting software

3. Dress professionally and arrive on time

First impressions matter, so it is important to dress professionally and arrive on time for your interview. This shows that you are respectful of the interviewer’s time and that you are taking the interview seriously.

- Wear a suit or business casual attire

- Be on time for your interview

- Make eye contact and smile

4. Be yourself and be confident

It is important to be yourself and be confident during your interview. The interviewer wants to get to know the real you, so do not try to be someone you are not. Be confident in your abilities and your experience, and let the interviewer see your passion for the position.

- Be honest and authentic

- Highlight your skills and experience

- Be enthusiastic and positive

Next Step:

Now that you’re armed with the knowledge of Journal Clerk interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Journal Clerk positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini