Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Junior Accountant position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

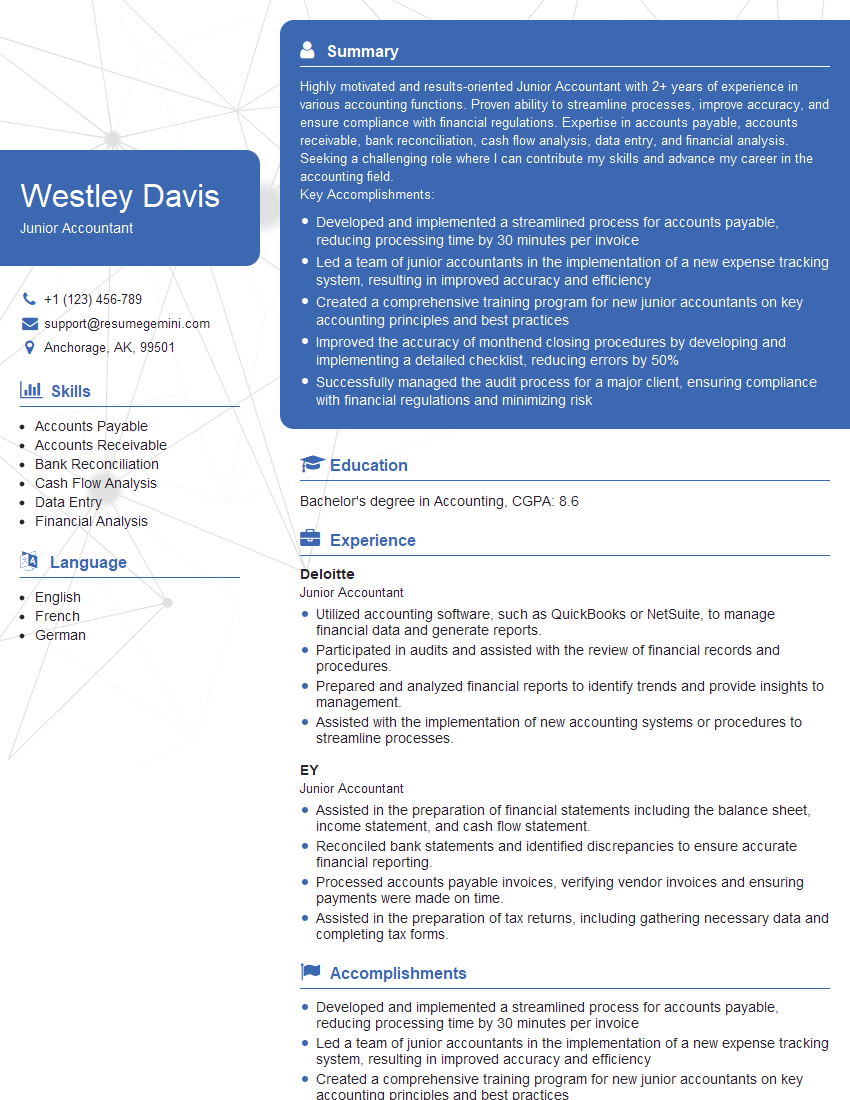

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Junior Accountant

1. Describe the accounting cycle?

The accounting cycle is a series of steps that are followed to record, summarize, and report financial information. The cycle begins with the recording of transactions in a journal and ends with the preparation of financial statements.

- Recording transactions in a journal

- Posting journal entries to a ledger

- Preparing a trial balance

- Adjusting the trial balance

- Preparing financial statements

- Closing the books

2. What are the different types of financial statements?

Balance Sheet

- Provides a snapshot of a company’s financial health at a specific point in time.

- Lists assets, liabilities, and equity.

Income Statement

- Shows a company’s revenues and expenses over a period of time.

- Calculates net income (loss).

Statement of Cash Flows

- Tracks the flow of cash in and out of a company.

- Classifies cash flows into operating, investing, and financing activities.

3. What are the different types of accounts?

- Assets: Resources owned by a company.

- Liabilities: Debts owed by a company.

- Equity: The owner’s investment in a company.

- Revenue: Income earned by a company.

- Expenses: Costs incurred by a company.

4. What is the difference between a debit and a credit?

A debit is an entry on the left side of an account, while a credit is an entry on the right side of an account. Debits increase asset and expense accounts, and decrease liability, equity, and revenue accounts. Credits decrease asset and expense accounts, and increase liability, equity, and revenue accounts.

- Debit = Left side

- Credit = Right side

- Debits increase assets, expenses; decrease liabilities, equity, revenue

- Credits decrease assets, expenses; increase liabilities, equity, revenue

5. What is the purpose of a trial balance?

A trial balance is a list of all the accounts in a company’s ledger, with their balances. The purpose of a trial balance is to check the accuracy of the accounting records. If the total debits equal the total credits, then the accounting records are in balance.

- List of accounts and their balances

- Check accuracy of accounting records

- Total debits = Total credits if records are in balance

6. What is the difference between an adjusting entry and a closing entry?

Adjusting entries are made at the end of an accounting period to update the balances of accounts to reflect actual events or conditions that occurred during the period. Closing entries are made at the end of an accounting period to close out temporary accounts (revenue, expense, and dividend accounts) and transfer their balances to the retained earnings account.

- Adjusting entries:

- Update account balances to reflect actual events

- Made at the end of an accounting period

- Closing entries:

- Close out temporary accounts

- Transfer balances to retained earnings

- Made at the end of an accounting period

7. What are the different types of accounting software?

- Cloud-based accounting software: QuickBooks Online, Xero

- Desktop accounting software: QuickBooks Desktop, Sage 50

- Enterprise resource planning (ERP) software: SAP, Oracle NetSuite

8. What are your strengths as an accountant?

- Strong understanding of accounting principles and practices

- Proficient in using accounting software

- Excellent analytical and problem-solving skills

- Detail-oriented and accurate

- Ability to work independently and as part of a team

9. What are your weaknesses as an accountant?

- Limited experience with certain accounting software

- Still developing my knowledge of complex accounting topics

- Sometimes I can be a bit too detail-oriented

10. Why are you interested in this position?

I am interested in this position because it aligns with my career goals and my skills and experience as an accountant. I am eager to contribute my knowledge and skills to your team and help the company achieve its financial objectives.

- Align with career goals

- Contribute skills and experience

- Help company achieve financial objectives

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Junior Accountant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Junior Accountant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Junior Accountant is responsible for assisting with various accounting tasks under the supervision of a senior accountant. Their key responsibilities include:

1. Data Entry and Processing

Entering and processing financial data, such as accounts payable and receivable, bank statements, and journal entries.

- Ensuring the accuracy and completeness of data entry.

- Reviewing and verifying data for accuracy and completeness.

2. Assisting with Financial Statement Preparation

Assisting with the preparation of financial statements, such as balance sheets, income statements, and cash flow statements.

- Compiling and summarizing financial data.

- Checking for errors and inconsistencies.

3. Maintaining Accounting Records

Maintaining accounting records, such as general ledgers, subsidiary ledgers, and trial balances.

- Updating and reconciling accounting records.

- Preparing reports and summaries of accounting information.

4. Assisting with Audits and Reviews

Assisting with audits and reviews conducted by internal or external auditors.

- Gathering and presenting financial information.

- Responding to audit inquiries and requests.

Interview Tips

To ace your interview for a Junior Accountant position, it’s crucial to prepare thoroughly. Here are some tips to help you stand out:

1. Research the Company and Position

Familiarize yourself with the company’s industry, size, financial performance, and company culture. Study the job description carefully to understand the specific requirements and responsibilities of the role.

- Read the company’s website and recent news articles.

- Connect with current or former employees on LinkedIn.

2. Practice Your Answers to Common Interview Questions

Anticipate questions you might be asked and prepare thoughtful and concise answers that highlight your skills and experience. Practice answering questions related to your accounting knowledge, data entry proficiency, attention to detail, and teamwork abilities.

- Use the STAR method: Situation, Task, Action, Result.

Example Outline:

Tell me about a time you worked on a complex accounting project.

Situation: As the Junior Accountant at ABC Company, I was tasked with assisting in the preparation of the year-end financial statements. Task: My responsibilities included compiling financial data, reviewing for accuracy, calculating depreciation and amortization, and preparing adjusting entries. Action: I collaborated with the accounting team, reviewed relevant documentation, and utilized my knowledge of GAAP to ensure the accuracy and completeness of the financial statements. Result: The financial statements were completed on time and without errors, resulting in a smooth audit process and timely financial reporting to stakeholders. - Be specific and provide examples.

3. Highlight Your Technical Skills and Certifications

Emphasize your proficiency in accounting software, such as QuickBooks, Xero, or SAP. If you have obtained any certifications, such as the Certified Bookkeeper (CB) or QuickBooks ProAdvisor, mention them prominently on your resume and during the interview.

- Quantify your experience and results whenever possible.

- For example, instead of saying “I processed invoices,” say “I processed over 500 invoices per month, resulting in improved efficiency and reduced processing time.”

4. Be Enthusiastic and Show Your Passion for Accounting

Convey your genuine interest and enthusiasm for accounting. Express your eagerness to learn and grow in the field. Highlight your commitment to accuracy, detail, and ethical behavior.

- Share your experiences or projects that demonstrate your passion for accounting.

- For example, mention volunteer work or internships in the field.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Junior Accountant role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.