Are you gearing up for a career in Lead Portfolio Manager? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Lead Portfolio Manager and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

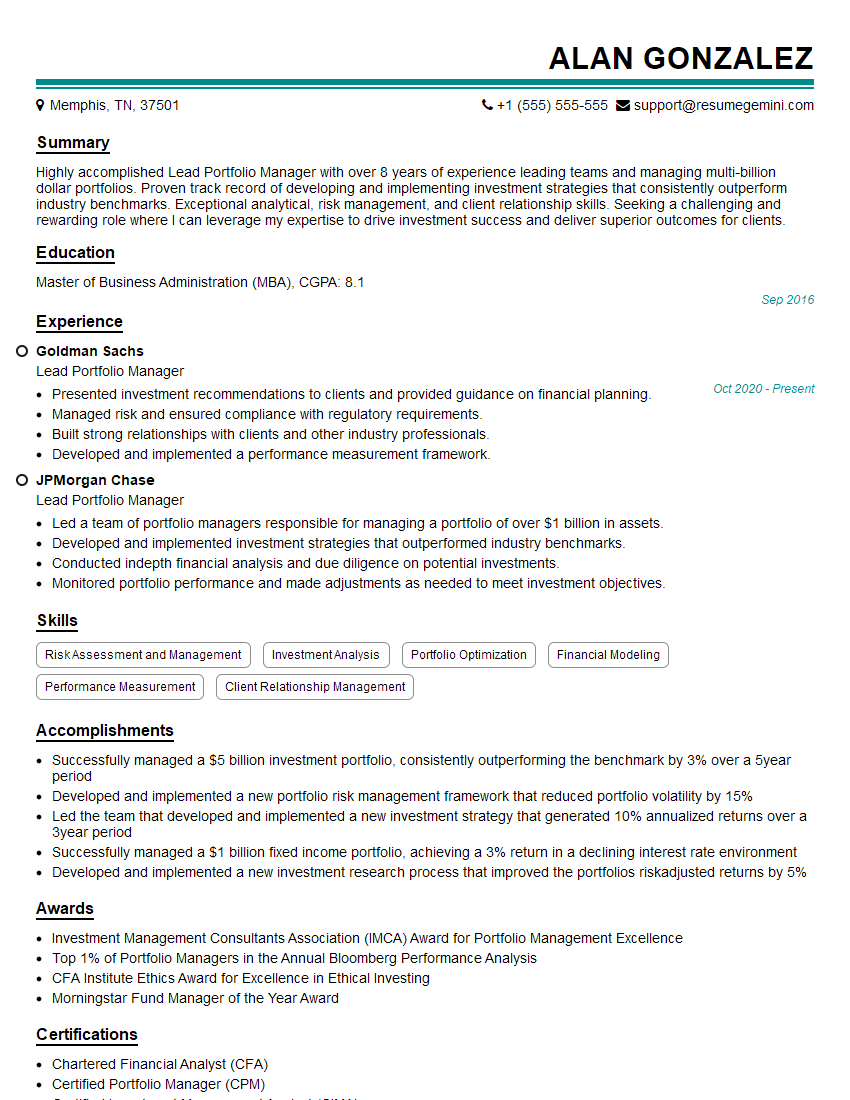

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Lead Portfolio Manager

1. Describe your process for conducting due diligence on a potential investment?

- Reviewing the company’s financial statements

- Conducting site visits and meeting with management

- Analyzing the company’s competitive landscape

- Assessing the company’s regulatory and legal environment

- Reviewing the company’s risk management policies and procedures

2. How do you assess the risk and return profile of an investment?

Risk Assessment

- Analyze market conditions

- Evaluate company financials

- Assess management quality

- Review regulatory compliance

Return Assessment

- Project future cash flows

- Estimate future growth prospects

- Consider reinvestment opportunities

- Calculate expected returns

3. How do you allocate assets across different asset classes?

- Consider client risk tolerance

- Analyze market trends

- Diversify across asset classes

- Rebalance portfolio regularly

4. How do you monitor and evaluate the performance of your investments?

- Track portfolio performance against benchmarks

- Conduct regular portfolio reviews

- Meet with clients to discuss performance

- Make adjustments to portfolio as needed

5. How do you manage risk in your investment portfolio?

- Diversify across asset classes

- Control investment horizon

- Implement stop-loss orders

- Manage portfolio volatility

- Monitor market conditions

6. How do you stay up-to-date on the latest market trends and investment strategies?

- Read industry publications

- Attend industry conferences

- Network with other investment professionals

- Conduct independent research

7. How do you communicate investment recommendations to clients?

- Meet with clients in person

- Send written reports

- Host webinars

- Use online platforms

8. How do you handle client concerns and objections?

- Listen attentively to client concerns

- Provide clear and concise explanations

- Address client objections in a professional manner

- Work with clients to find mutually acceptable solutions

9. How do you build and maintain strong relationships with clients?

- Communicate regularly with clients

- Be transparent and honest with clients

- Provide excellent customer service

- Build trust with clients

10. How do you see the investment landscape evolving in the next 5-10 years?

- Increased use of technology in investment management

- Focus on sustainable and impact investing

- Continued globalization of financial markets

- Growing demand for customized investment solutions

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Lead Portfolio Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Lead Portfolio Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Lead Portfolio Manager is a senior-level investment professional responsible for the overall management and performance of one or more investment portfolios. They play a pivotal role in making strategic investment decisions, overseeing portfolio construction, and managing risk within defined parameters.

1. Investment Strategy and Performance Management

- Develop and implement investment strategies aligned with client objectives and risk tolerance.

- Monitor portfolio performance, analyze market trends, and make adjustments as necessary to meet investment goals.

2. Portfolio Management and Construction

- Manage a diversified portfolio of investments, including stocks, bonds, and alternative investments.

- Identify, evaluate, and select investment opportunities based on fundamental and technical analysis.

3. Risk Management and Compliance

- Establish and maintain risk management frameworks to mitigate portfolio risks.

- Ensure compliance with regulatory requirements and internal policies.

4. Team Leadership and Collaboration

- Lead and mentor a team of investment professionals.

- Collaborate with other teams, including research, risk management, and compliance, to ensure a comprehensive investment process.

5. Communication and Client Reporting

- Communicate investment decisions and portfolio performance to clients in a clear and concise manner.

- Prepare regular reports and presentations to demonstrate investment progress and justify investment recommendations.

Interview Tips

Preparing thoroughly for an interview for a Lead Portfolio Manager role is crucial. Here are some tips to enhance your chances of success:

1. Research the Company and Role

- Thoroughly research the company’s investment philosophy, portfolio management style, and performance history.

- Understand the specific responsibilities and expectations of the Lead Portfolio Manager role within the organization.

2. Highlight Your Investment Expertise

- Quantify your investment experience and track record, including successful investment strategies and portfolio management accomplishments.

- Demonstrate your knowledge of financial markets, asset allocation, and risk management techniques.

3. Showcase Your Leadership and Communication Skills

- Emphasize your ability to lead and motivate a team of investment professionals.

- Highlight your communication skills, both written and verbal, and your ability to effectively present investment strategies to clients.

4. Be Prepared for Behavioral Questions

- Prepare for common behavioral interview questions that focus on your problem-solving, decision-making, and conflict-resolution skills.

- Provide specific examples from your experience that demonstrate your ability to work effectively in a demanding and fast-paced environment.

5. Ask Thoughtful Questions

- Come prepared with thoughtful questions to ask the interviewer about the company, the investment team, and the specific responsibilities of the Lead Portfolio Manager role.

- Asking informed questions shows that you are engaged and genuinely interested in the position.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Lead Portfolio Manager interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.