Feeling lost in a sea of interview questions? Landed that dream interview for Lease Analyst but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Lease Analyst interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

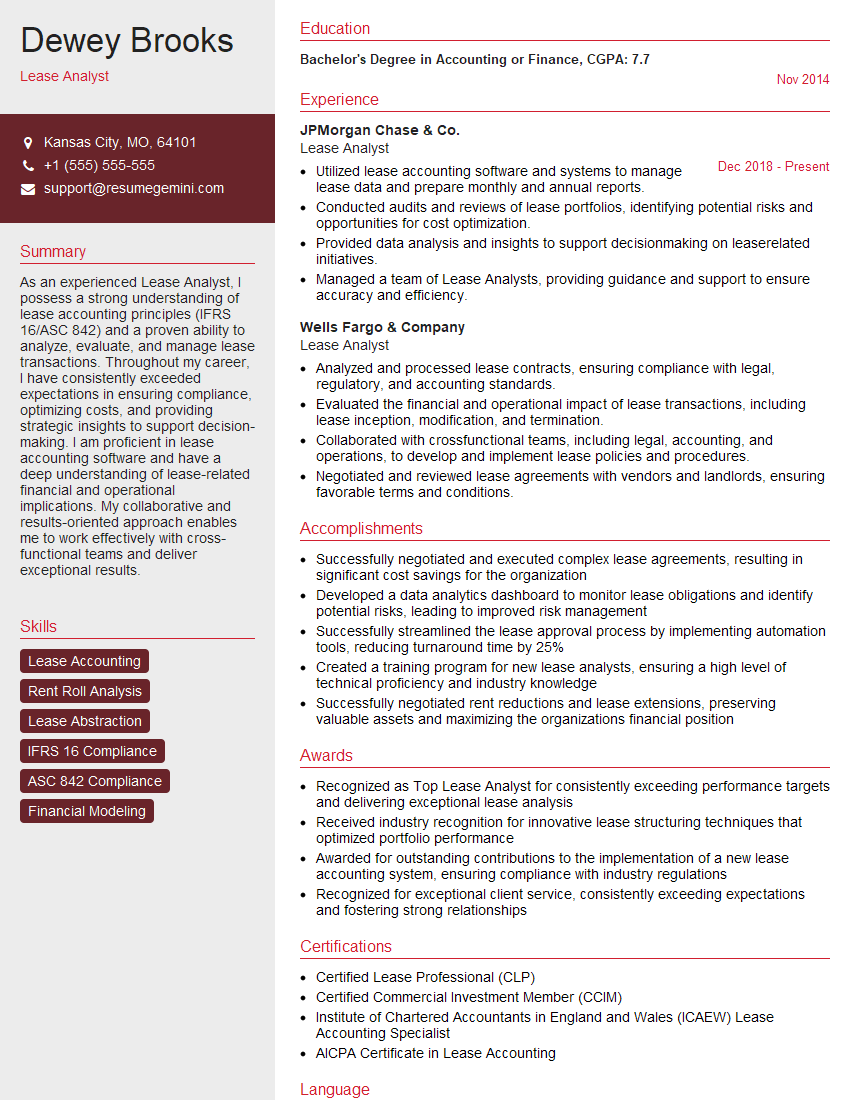

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Lease Analyst

1. What is a lease contract, and what are its key components?

- A lease contract is a legally binding agreement between a lessor (landlord) and a lessee (tenant) that outlines the terms of occupancy for a property.

- Key components include the property address, lease term, rental amount, security deposit, and any additional clauses or riders.

2. Explain the various types of lease structures and their implications for both lessors and lessees.

- Types of lease structures include gross lease, net lease, and triple net lease.

- In a gross lease, the lessor is responsible for all property expenses (e.g., taxes, insurance, maintenance).

- In a net lease, the lessee is responsible for some or all of the property expenses.

- Triple net lease requires the lessee to pay all property expenses, including taxes, insurance, and maintenance.

3. How do you analyze and interpret lease accounting standards (e.g., IFRS 16, FASB ASC 842)?

- Lease accounting standards require companies to recognize lease obligations and right-of-use assets on their balance sheets.

- IFRS 16 and FASB ASC 842 provide a common framework for lease accounting, but there are some differences between the two standards.

4. Describe the key steps involved in lease administration, including rent collection, lease renewal, and lease termination.

- Rent collection involves receiving and processing rent payments, and following up on late payments.

- Lease renewal requires negotiating and documenting new lease terms when a lease is expiring.

- Lease termination involves terminating the lease agreement and preparing the property for handover.

5. Explain how you use technology to enhance the efficiency and accuracy of lease management.

- Lease management software can automate tasks such as rent collection, lease renewal notices, and lease expiration tracking.

- Cloud-based platforms allow for remote access and collaboration.

- Data analytics tools can provide insights into lease performance and help identify areas for improvement.

6. How do you stay up-to-date with industry best practices and regulatory changes in lease accounting?

- Attend industry conferences and workshops.

- Read industry publications and websites.

- Consult with legal and accounting professionals.

7. Give an example of a complex lease negotiation that you have successfully managed. What were the challenges and how did you overcome them?

- Describe the challenges, such as conflicting interests, time constraints, or legal complexities.

- Explain how you approached the negotiation, including your preparation and communication strategies.

- Highlight your role in finding mutually acceptable solutions and achieving a successful outcome.

8. How do you ensure compliance with lease-related laws and regulations?

- Stay updated on relevant laws and regulations, such as the Real Estate Settlement Procedures Act (RESPA) and the Americans with Disabilities Act (ADA).

- Incorporate compliance measures into lease agreements and processes.

- Conduct regular audits and reviews to assess compliance.

9. Explain how you would approach the task of developing and implementing a lease accounting policy for an organization.

- Start by understanding the organization’s business model and accounting requirements.

- Research applicable accounting standards and consult with legal counsel.

- Develop a draft policy and obtain stakeholder feedback.

- Implement the policy and provide training to relevant staff.

10. Describe your experience with lease performance analysis and reporting. How do you identify and address areas of concern?

- Monitor key metrics such as occupancy rates, lease renewal rates, and tenant satisfaction.

- Analyze data to identify underperforming leases or areas for improvement.

- Develop recommendations for addressing concerns, such as lease renegotiation or tenant engagement initiatives.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Lease Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Lease Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Lease Analyst is responsible for a wide range of duties related to lease accounting and administration. Their primary focus is ensuring compliance and accuracy in all aspects of lease transactions, supporting the organization’s financial and operational objectives. Key job responsibilities of a Lease Analyst include:

1. Lease Accounting and Compliance

Prepare and maintain lease accounting records and documentation in compliance with applicable accounting standards (e.g., IFRS 16, ASC 842).

- Analyze lease agreements to determine lease classification, lease term, and lease payment schedule.

- Calculate and record lease liabilities and related expenses in accordance with accounting standards.

- Support external auditors during audits of lease accounting practices.

2. Lease Administration

Manage lease contracts, including negotiations, amendments, and terminations.

- Review and negotiate lease terms and conditions to ensure alignment with the organization’s requirements.

- Coordinate with internal and external stakeholders to obtain necessary approvals and documentation.

- Monitor lease performance, including rent payments, maintenance obligations, and insurance requirements.

3. Data Management and Reporting

Maintain accurate and up-to-date data on all leased assets and related lease transactions.

- Develop and implement processes for lease data collection, analysis, and reporting.

- Generate lease-related reports for internal and external stakeholders.

- Participate in the development and maintenance of lease management systems.

4. Lease Optimization and Risk Management

Identify opportunities to optimize lease portfolio and mitigate financial and operational risks.

- Analyze lease terms and identify potential areas for negotiation or renegotiation.

- Monitor market trends and provide recommendations for lease portfolio adjustments or divestments.

- Assess potential financial and operational risks associated with lease agreements.

Interview Tips

Preparing for a Lease Analyst interview requires a combination of technical knowledge, analytical skills, and industry understanding. Here are some helpful tips to assist you in your preparation:

1. Research the Company and Industry

Familiarize yourself with the company’s business model, industry landscape, and recent financial performance. This will provide context for your answers and demonstrate your interest in the role.

2. Review Accounting Standards and Lease Terminology

Ensure you have a solid understanding of relevant accounting standards (IFRS 16, ASC 842) and lease terminology. Be prepared to discuss lease classification, recognition criteria, and measurement principles.

3. Practice Calculations and Case Studies

Review lease accounting calculations and practice solving case studies related to lease transactions. This will demonstrate your technical proficiency and ability to apply accounting principles in practical scenarios.

4. Highlight Analytical and Problem-Solving Skills

Emphasize your analytical skills and ability to solve complex lease-related problems. Provide examples of how you have identified and resolved lease-related issues or optimized lease portfolios.

5. Demonstrate Communication and Interpersonal Skills

Lease Analysts often collaborate with various stakeholders. Showcase your ability to communicate effectively, both verbally and in writing. Highlight your interpersonal skills and ability to build relationships.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Lease Analyst interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!