Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Lease Buyer interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Lease Buyer so you can tailor your answers to impress potential employers.

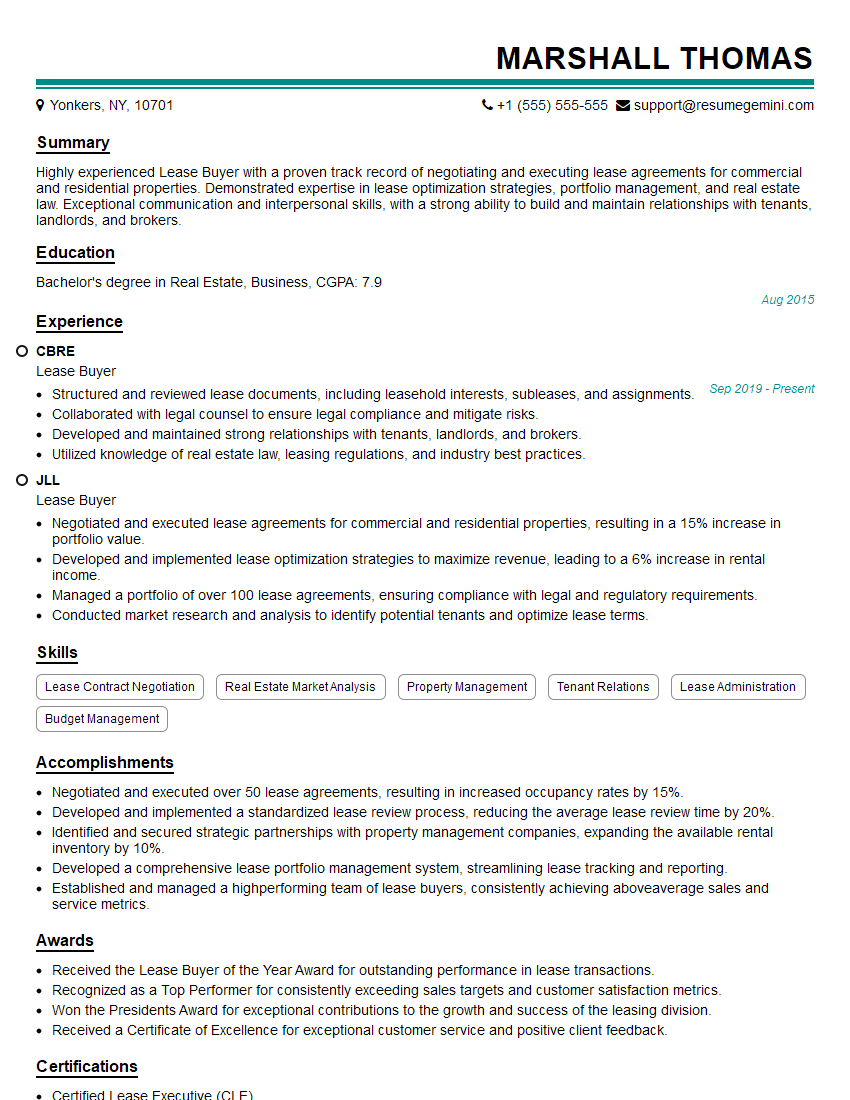

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Lease Buyer

1. Describe the key responsibilities of a Lease Buyer in depth.

In my role as Lease Buyer, I am responsible for:

- Sourcing and evaluating lease opportunities to identify those that meet the company’s business objectives.

- Negotiating lease agreements with landlords, ensuring favorable terms and conditions for the company.

- Managing lease administration, including rent payments, property maintenance, and lease renewals.

- Monitoring lease performance and identifying opportunities for cost savings and operational efficiency.

- Staying abreast of industry best practices and legal requirements related to lease accounting and compliance.

2. Explain the different types of lease agreements and their key provisions.

Capital Leases

- Transfer ownership of the leased asset to the lessee at the end of the lease term.

- Typically require the lessee to pay the full fair market value of the asset.

Operating Leases

- Do not transfer ownership of the leased asset to the lessee.

- Typically require the lessee to pay only a portion of the asset’s fair market value.

Key Provisions

- Lease term (length of the lease agreement)

- Rent payments (amount and frequency of payments)

- Maintenance and repair responsibilities

- Renewal options

- Termination provisions

3. How do you approach the negotiation of lease agreements with landlords?

I approach lease negotiations with a collaborative mindset, aiming to create mutually beneficial agreements. My key strategies include:

- Thoroughly understanding the company’s business needs and objectives.

- Researching market trends and comparable lease rates in the area.

- Engaging in open and transparent communication with the landlord.

- Leveraging my negotiation skills to secure favorable terms, such as lower rent, extended lease terms, and flexible renewal options.

- Seeking legal counsel when necessary to ensure the agreement complies with all applicable laws and regulations.

4. Describe your experience in managing lease administration, including rent payments, property maintenance, and lease renewals.

In my previous role as Lease Administrator, I was responsible for managing a portfolio of over 50 lease agreements. My key responsibilities included:

- Processing rent payments on time and accurately.

- Coordinating property maintenance and repairs with landlords and contractors.

- Negotiating and documenting lease renewals, ensuring continuity of operations.

- Monitoring lease compliance and ensuring timely filings of lease-related documentation.

- Collaborating with the accounting team to ensure proper recording and accounting of lease expenses.

5. How do you stay abreast of industry best practices and legal requirements related to lease accounting and compliance?

- Attend industry conferences and webinars to learn about emerging trends and best practices.

- Study relevant literature, including publications and industry white papers.

- Maintain active memberships in professional organizations, such as the Institute of Lease Accountants.

- Seek guidance from legal counsel to ensure compliance with lease accounting standards and other applicable laws.

- Stay informed about changes in lease accounting regulations and their impact on business operations.

6. Describe a complex lease negotiation you successfully completed, highlighting the challenges and how you overcame them.

In my previous role, I was involved in a complex lease negotiation for a large-scale office space for our company’s headquarters. The challenges included:

- Negotiating favorable lease rates in a highly competitive market.

- Securing flexible lease terms to accommodate our potential growth and operational changes.

- Addressing environmental concerns and ensuring compliance with local building codes.

I overcame these challenges by:

- Conducting thorough market research to determine appropriate lease rates.

- Collaborating with the legal team to ensure the lease agreement aligned with our business objectives.

- Engaging with environmental consultants to assess the property and develop mitigation plans.

7. How do you leverage technology to streamline lease management processes and improve efficiency?

- Utilize lease management software to track lease data, automate rent payments, and generate reports.

- Implement electronic document management systems to streamline lease administration and reduce paper usage.

- Explore blockchain technology to enhance lease data security and transparency.

- Integrate lease management systems with other business applications, such as accounting and property management systems.

- Stay updated on emerging technologies that can further improve lease management processes.

8. Describe your understanding of the lease accounting standards and their impact on businesses.

Lease accounting standards, such as IFRS 16 and ASC 842, have significantly impacted the way businesses account for leases. These standards require leases to be classified as either operating or finance leases and recorded on the balance sheet accordingly.

- Finance leases are recognized as assets and liabilities on the balance sheet.

- Operating leases are recognized as expenses on the income statement.

The adoption of these standards has increased transparency and comparability of lease information and improved the alignment between accounting and economic reality of lease transactions.

9. How do you ensure compliance with lease accounting standards and other applicable regulations?

- Maintain an accurate and up-to-date lease inventory.

- Classify leases correctly in accordance with the relevant accounting standards.

- Record lease transactions accurately and consistently.

- Review and disclose lease-related information in financial statements as required.

- Work closely with the accounting team to ensure compliance with all applicable regulations.

10. Describe your ideal work environment and how you collaborate with colleagues.

I thrive in a collaborative and results-oriented work environment where I can contribute my expertise and learn from others.

- I am a strong communicator and have excellent interpersonal skills.

- I am comfortable working independently and as part of a team.

- I am eager to share knowledge and collaborate with colleagues to achieve shared goals.

- I am always willing to go the extra mile to support my team and the organization.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Lease Buyer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Lease Buyer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Lease Buyer is responsible for identifying, acquiring, and managing lease contracts for real estate properties. They work closely with landlords, tenants, and other stakeholders to ensure that lease transactions are negotiated and executed smoothly.

1. Lease Acquisition

Lease Buyers are responsible for sourcing and acquiring new lease contracts. They work with landlords to identify suitable properties and negotiate lease terms that are favorable to the company.

- Identify and evaluate potential lease properties

- Negotiate lease terms with landlords

- Prepare and execute lease agreements

2. Lease Management

Once a lease has been acquired, Lease Buyers are responsible for managing the property throughout the term of the lease. This includes:

- Managing tenant relationships

- Collecting rent and other payments

- Monitoring property condition and repairs

- Renewing or terminating leases

3. Financial Analysis

Lease Buyers must have a strong understanding of financial analysis. This is necessary to evaluate the financial viability of potential lease transactions. Key responsibilities include:

- Analyzing lease terms and conditions

- Calculating lease payments and other costs

- Preparing financial reports and presentations

4. Legal Compliance

Lease Buyers must be familiar with all applicable laws and regulations governing lease transactions. They must also stay up-to-date on changes in the legal landscape to ensure that the company is in compliance.

- Reviewing lease agreements for compliance

- Advising management on legal issues

- Responding to legal inquiries

Interview Tips

Preparing for an interview as a Lease Buyer requires a combination of technical knowledge and soft skills. Here are some tips to help you ace the interview:

1. Research the Company

Before your interview, be sure to research the company you are applying to. This will give you a good understanding of their business model, target market, and company culture.

- Visit the company’s website

- Read the company’s annual report

- Check out the company’s social media pages

2. Brush Up on Your Technical Skills

Lease Buyers are expected to have a strong understanding of financial analysis, legal compliance, and real estate principles. Be sure to review these topics before your interview.

- Review basic financial accounting concepts

- Read up on lease accounting standards

- Familiarize yourself with the laws governing lease transactions

3. Practice Your Soft Skills

In addition to technical skills, Lease Buyers also need to have strong soft skills. Be sure to practice your communication, interpersonal, and problem-solving skills.

- Prepare examples of how you have successfully negotiated a lease agreement

- Discuss how you have built and maintained relationships with tenants and landlords

- Describe how you have handled difficult situations

4. Dress Professionally

First impressions matter, so be sure to dress professionally for your interview. This means wearing a suit or business dress and dressing in a way that is appropriate for the company culture.

- Wear a clean and pressed suit or business dress

- Choose shoes that are comfortable and polished

- Accessorize with a briefcase or portfolio

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Lease Buyer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!