Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Lender position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

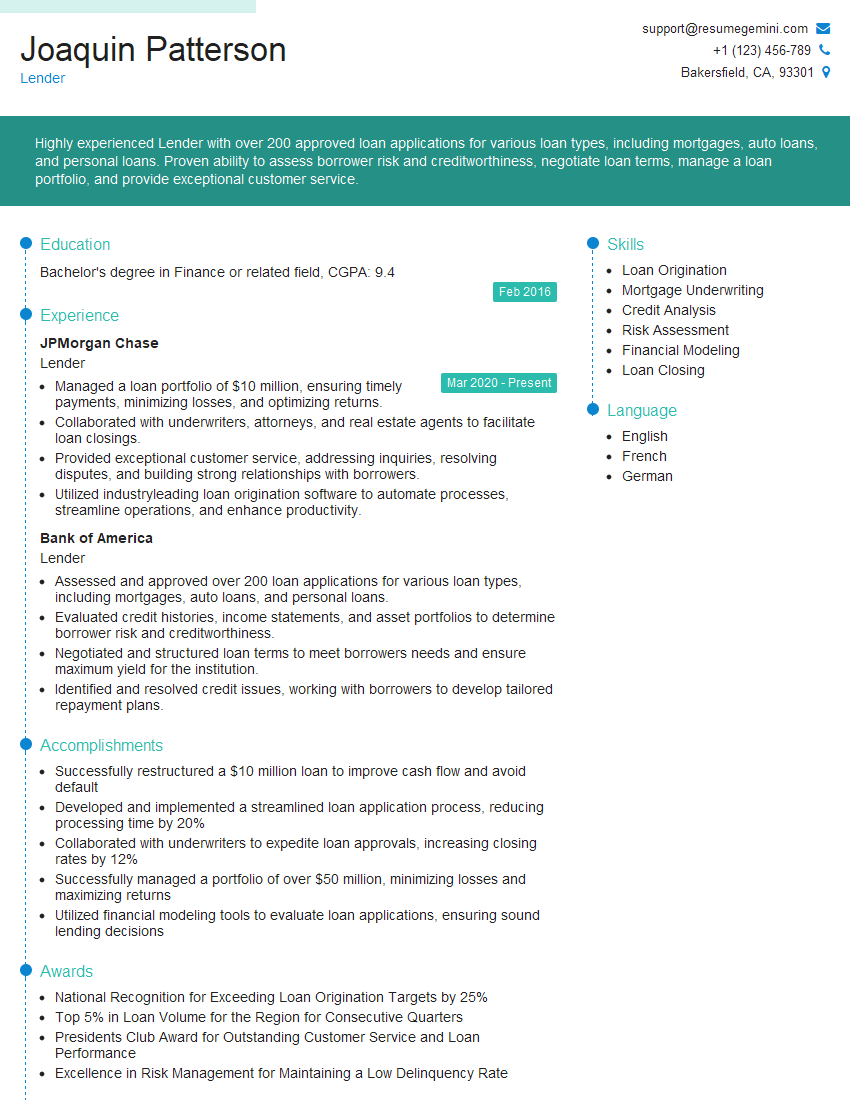

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Lender

1. What are the key factors you consider when assessing a loan application?

When assessing a loan application, I consider the following key factors:

- The borrower’s credit history and score

- The borrower’s income and debt-to-income ratio

- The property securing the loan

- The purpose of the loan

- The loan terms, including the interest rate and loan-to-value ratio

2. How do you determine the appropriate interest rate for a loan?

Credit History

- The borrower’s credit history is a major factor in determining the interest rate.

- Borrowers with higher credit scores typically qualify for lower interest rates.

Loan-to-Value Ratio

- The loan-to-value ratio (LTV) is the ratio of the loan amount to the value of the property securing the loan.

- Loans with higher LTVs typically have higher interest rates.

Loan Term

- The loan term is the length of time over which the loan is repaid.

- Loans with longer terms typically have higher interest rates.

3. What are the different types of loans that you offer?

The different types of loans that I offer include:

- Mortgages

- Personal loans

- Auto loans

- Business loans

- Student loans

4. What is the loan process?

The loan process typically involves the following steps:

- Loan application

- Credit check

- Loan approval

- Loan closing

5. What are the fees associated with getting a loan?

The fees associated with getting a loan can vary depending on the lender and the type of loan.

- Origination fees

- Appraisal fees

- Credit report fees

- Title insurance

- Recording fees

6. What are the benefits of working with a lender?

The benefits of working with a lender include:

- Access to a wide range of loan products

- Competitive interest rates

- Personalized service

- Expertise in the loan process

7. What are the challenges that you face in your role as a lender?

The challenges that I face in my role as a lender include:

- Keeping up with the changing regulatory landscape

- Maintaining a strong credit portfolio

- Meeting the needs of a diverse customer base

- Competing with other lenders

8. What are your goals for the future?

My goals for the future include:

- Growing my loan portfolio

- Expanding my product offerings

- Improving the customer experience

- Becoming a leader in the lending industry

9. How do you stay up-to-date on the latest developments in the lending industry?

I stay up-to-date on the latest developments in the lending industry by:

- Reading industry publications

- Attending conferences and webinars

- Networking with other lenders

- Taking continuing education courses

10. What are your strengths and weaknesses?

Strengths

- Strong understanding of the lending process

- Excellent communication and interpersonal skills

- Ability to build rapport with customers

- Proven track record of success in the lending industry

Weaknesses

- Limited experience in some areas of lending

- Can be too detail-oriented at times

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Lender.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Lender‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Lender is responsible for evaluating, approving, and managing loans for individuals or businesses. This role involves assessing the creditworthiness of borrowers, determining loan terms, and ensuring compliance with regulatory requirements. Key job responsibilities include:

1. Loan Origination

Originating loans by analyzing financial documents, assessing creditworthiness, and determining loan eligibility.

- Analyzing loan applications, income statements, tax returns, and credit reports

- Evaluating the applicant’s debt-to-income ratio, cash flow, and payment history

- Performing risk assessments and determining loan terms, including interest rates and repayment schedules

2. Loan Processing

Facilitating the loan approval process by gathering and verifying documentation, preparing loan documents, and coordinating with underwriters.

- Requesting and collecting necessary documents from the applicant

- Preparing loan applications, notes, and other required documentation

- Conducting background and reference checks

3. Loan Approvals and Denials

Making final loan approval or denial decisions based on the loan application and supporting documentation.

- Analyzing loan applications and determining if they meet credit and underwriting guidelines

- Communicating loan approval or denial decisions to applicants

- Explaining loan terms and conditions to borrowers

4. Loan Servicing

Managing approved loans by monitoring payments, resolving disputes, and ensuring compliance with loan agreements.

- Tracking loan payments and ensuring timely collection

- Responding to borrower inquiries and resolving any issues or disputes

- Monitoring loan performance and taking necessary actions to mitigate risks

5. Regulatory Compliance

Adhering to all applicable laws and regulations related to lending activities.

- Ensuring compliance with Truth-in-Lending Act, Fair Credit Reporting Act, and other consumer protection laws

- Maintaining up-to-date knowledge of industry regulations and best practices

- Completing required training and certifications

Interview Tips

Preparing for an interview for a Lender role involves understanding the job responsibilities and developing effective strategies to showcase your relevant skills and experience. Here are some interview tips:

1. Research the Company and Position

Thoroughly research the company and the specific Lender role you’re applying for. This will help you understand their business model, loan products, and the specific responsibilities of the position. Consider visiting the company website, reading industry news and articles, and using social media to gather information.

2. Highlight Relevant Skills and Experience

Carefully review the job description and identify the skills and qualifications that are most important to the role. Quantify your experience whenever possible, using specific examples to demonstrate your proficiency in areas such as loan origination, loan processing, and regulatory compliance.

For instance, instead of saying “I have experience in loan origination,” you could say “I have originated over $100 million in loans, including residential mortgages, commercial loans, and personal loans.”

3. Prepare for Common Interview Questions

Practice answering common interview questions related to lending, such as:

- Tell me about your experience in evaluating loan applications and determining loan terms.

- How do you stay up to date on industry regulations and best practices?

- Describe a time when you had to resolve a complex loan issue or dispute.

- What are your strengths and weaknesses as a Lender?

4. Ask Informed Questions

Prepare thoughtful questions to ask the interviewer about the company, the role, and the team. This will show that you are engaged and interested in the position. Good questions to ask might include:

- Can you describe the average loan size and type of borrowers that you typically work with?

- What are the current challenges and opportunities facing the lending industry?

- What is the company’s growth strategy and how does this role contribute to that strategy?

5. Follow Up Professionally

After the interview, send a thank-you note to the interviewer(s) restating your interest in the position and expressing your appreciation for their time. This will leave a positive and lasting impression and demonstrate your professionalism and enthusiasm.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Lender role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.