Feeling lost in a sea of interview questions? Landed that dream interview for Letter-of-Credit Document Examiner but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Letter-of-Credit Document Examiner interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

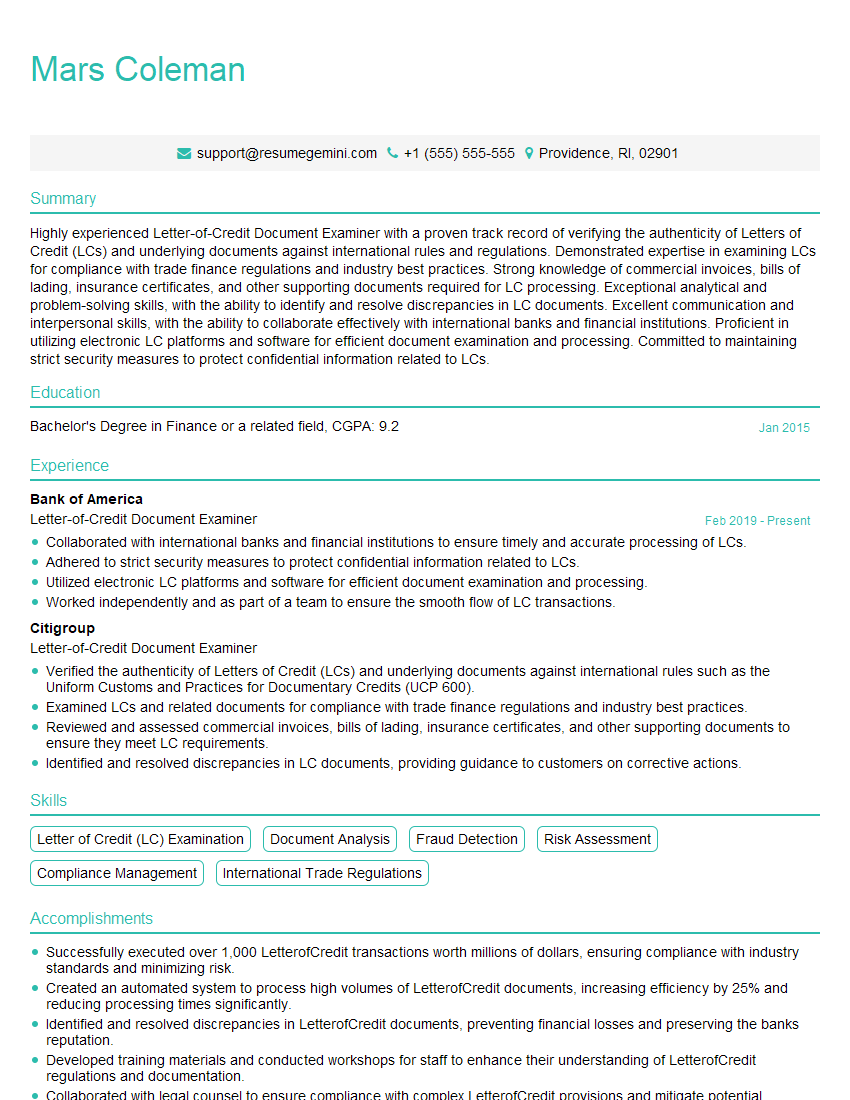

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Letter-of-Credit Document Examiner

1. How would you determine if a Letter of Credit is authentic?

To determine the authenticity of a Letter of Credit, I would carefully examine the following key features:

- Format and Language: The Letter of Credit should adhere to the standard format and terminology prescribed by the International Chamber of Commerce (ICC). Any deviations or inconsistencies could indicate a forgery.

- Issuing Bank Details: I would scrutinize the issuing bank’s name, address, and SWIFT code. These details should align with the information provided in recognized banking directories or databases.

- Security Features: Genuine Letters of Credit typically incorporate security features such as watermarks, holographic images, and unique identifiers. I would examine these features closely to confirm their validity.

- Signature Verification: The authenticity of the issuing bank’s signature is crucial. I would compare the signature on the Letter of Credit with a sample obtained from the bank or through a reputable source.

2. What are the common types of discrepancies in Letter of Credit documents?

Discrepancies in the Presentation of Documents

- Incorrect or missing documents

- Discrepancies between the invoice and the packing list

- Discrepancies between the packing list and the goods shipped

Discrepancies in Terms and Conditions

- Incorrect or missing payment terms

- Discrepancies in the shipping terms

- Inconsistency between the Letter of Credit and the underlying contract

3. How do you handle discrepancies in Letter of Credit documents?

- Identify the Discrepancy: Carefully analyze the documents to identify the specific discrepancies and their potential impact on the transaction.

- Communicate with the Applicant: Promptly inform the applicant of the discrepancies and discuss possible solutions. Explore whether they can submit corrected documents or provide clarifications.

- Consult with the Issuing Bank: Seek guidance from the issuing bank to determine their acceptable level of tolerance for the discrepancies.

- Negotiate a Resolution: Work with the parties involved to find a mutually acceptable solution that complies with the terms of the Letter of Credit and mitigates risks.

- Document the Process: Maintain a clear record of all communication and decisions related to the discrepancies.

4. What are the key factors to consider when examining a Bill of Lading?

- Consignor and Consignee Information: Verify the names and addresses of the shipper and the recipient of the goods.

- Goods Description: Ensure that the description of the goods matches the information provided in the Letter of Credit.

- Quantity and Number of Packages: Confirm that the quantity and number of packages align with the Letter of Credit.

- Shipping Terms and Destination: Check if the shipping terms and the destination port or place stated in the Bill of Lading comply with the Letter of Credit.

- Date and Place of Issue: Examine the date and place of issuance of the Bill of Lading to ensure its validity and timely presentation.

5. How do you differentiate between an original and a copy of a Bill of Lading?

- Original Bill of Lading: Usually marked as “Original” or “Original Bill of Lading.” It carries the original signature of the carrier or its authorized agent.

- Copy of Bill of Lading: May be marked as “Copy” or “Non-Negotiable Copy.” It does not bear an original signature and has limited legal standing.

6. What are the consequences of accepting forged or fraudulent Letter of Credit documents?

- Financial Loss: The bank could suffer financial losses if it honors fraudulent documents and releases payment without receiving the corresponding value.

- Reputational Damage: Accepting fraudulent documents can damage the bank’s reputation and erode trust among its customers.

- Legal Liability: The bank could face legal liability for releasing payment on the basis of forged or fraudulent documents.

7. What is the role of SWIFT in Letter of Credit transactions?

- Secure Communication Channel: SWIFT provides a secure and efficient electronic messaging system for transmitting Letter of Credit documents between banks.

- Standardized Messaging: SWIFT uses standardized messaging formats (MT messages) to facilitate the exchange of information related to Letter of Credit transactions.

- Authentication and Verification: SWIFT helps authenticate and verify the authenticity of messages and ensure the integrity of data.

8. How do you stay updated with the latest regulations and industry practices related to Letter of Credit transactions?

- Attend Industry Conferences and Webinars: Participate in industry events to learn about emerging trends and regulatory updates.

- Read Trade Publications and Journals: Stay informed by subscribing to relevant publications that cover the latest developments in Letter of Credit operations.

- Seek Certifications and Training: Obtain specialized certifications or attend training programs to enhance my knowledge and skills.

- Network with Professionals: Engage with experts and professionals in the field to exchange insights and share best practices.

9. How do you handle the ethical challenges that may arise in your role as a Letter of Credit Document Examiner?

- Maintain Confidentiality: Strictly adhere to confidentiality guidelines and protect sensitive information related to Letter of Credit transactions.

- Avoid Conflicts of Interest: Disclose any potential conflicts of interest and recuse myself from situations where my personal interests could influence my decision-making.

- Report Suspicious Activity: Promptly report any suspected fraud or irregularities to the appropriate authorities.

- Act with Integrity: Uphold the highest ethical standards and always prioritize the integrity of the Letter of Credit process.

10. What is your approach to continuing professional development in the field of Letter of Credit document examination?

- Regularly Attend Workshops and Training: Maintain my knowledge and skills by attending workshops and training programs offered by industry organizations.

- Study Regulatory Updates: Stay updated with changes in regulations and best practices through ongoing study of relevant materials.

- Read Industry Literature: Subscribe to trade magazines and journals to gain insights and stay abreast of industry developments.

- Participate in Online Forums and Discussions: Engage with other professionals in online forums and discussions to share knowledge and exchange ideas.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Letter-of-Credit Document Examiner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Letter-of-Credit Document Examiner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Letter-of-Credit (L/C) Document Examiners play a critical role in ensuring the validity and compliance of financial documents, particularly Letters of Credit. They meticulously analyze and assess these documents to prevent fraud and protect financial institutions and businesses from potential losses.

1. Document Examination and Compliance Verification

Thoroughly examine Letters of Credit and related documents, such as invoices, bills of lading, and insurance certificates, to ensure compliance with established regulations, policies, and industry standards.

- Verify the authenticity and accuracy of signatures, stamps, and other identifying marks.

- Ensure that the beneficiary, amount, and payment terms are clearly stated and correspond with the underlying transaction.

2. Fraud Detection and Prevention

Detect and mitigate potential fraud by carefully scrutinizing documents for inconsistencies, alterations, or suspicious patterns.

- Identify forged or counterfeit signatures, documents, or seals.

- Determine if the goods or services described in the letter of credit have been provided.

3. Risk Assessment and Mitigation

Assess the risk associated with each transaction and recommend appropriate mitigation strategies.

- Analyze the financial standing of the parties involved and evaluate the credibility of the transaction.

- Develop protocols and procedures to minimize the risk of fraud and non-compliance.

4. Communication and Reporting

Clearly communicate findings and recommendations to relevant stakeholders, including banks, businesses, and auditors.

- Prepare reports detailing the results of document examinations and fraud investigations.

- Testify in court or provide expert opinions on L/C-related matters.

Interview Tips

Preparing adequately for an interview for a Letter-of-Credit Document Examiner position can significantly enhance your chances of success. Here are some tips to help you ace the interview:

1. Research the Company and Role

Thoroughly research the financial institution or company offering the position. Learn about their products, services, and specific requirements for the role of Letter-of-Credit Document Examiner.

- Visit the company’s website, read industry publications, and connect with employees on LinkedIn to gain insights.

- Identify the key skills and experience required for the role and tailor your resume and cover letter accordingly.

2. Practice Document Examination

Familiarize yourself with the types of documents you will be required to examine. Practice analyzing sample Letters of Credit and identifying common errors, discrepancies, and potential red flags.

- Obtain sample documents from online resources or previous interviews.

- Seek guidance from industry experts or online forums to enhance your technical knowledge.

3. Prepare for Behavioral Questions

Behavioral interview questions are commonly used to assess your problem-solving abilities, teamwork skills, and attention to detail. Prepare examples from your previous work experience that demonstrate your skills in:

- Identifying and resolving discrepancies in financial documents.

- Effectively communicating complex information to stakeholders.

- Working independently and as part of a team.

4. Demonstrate Enthusiasm and Curiosity

During the interview, express your genuine interest in the role and the industry. Demonstrate your eagerness to learn and grow within the field of Letter-of-Credit Document Examination.

- Share your understanding of current trends and best practices in the industry.

- Ask thoughtful questions about the company’s approach to risk management and fraud prevention.

Next Step:

Now that you’re armed with the knowledge of Letter-of-Credit Document Examiner interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Letter-of-Credit Document Examiner positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini