Are you gearing up for a career in Liability Analyst? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Liability Analyst and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

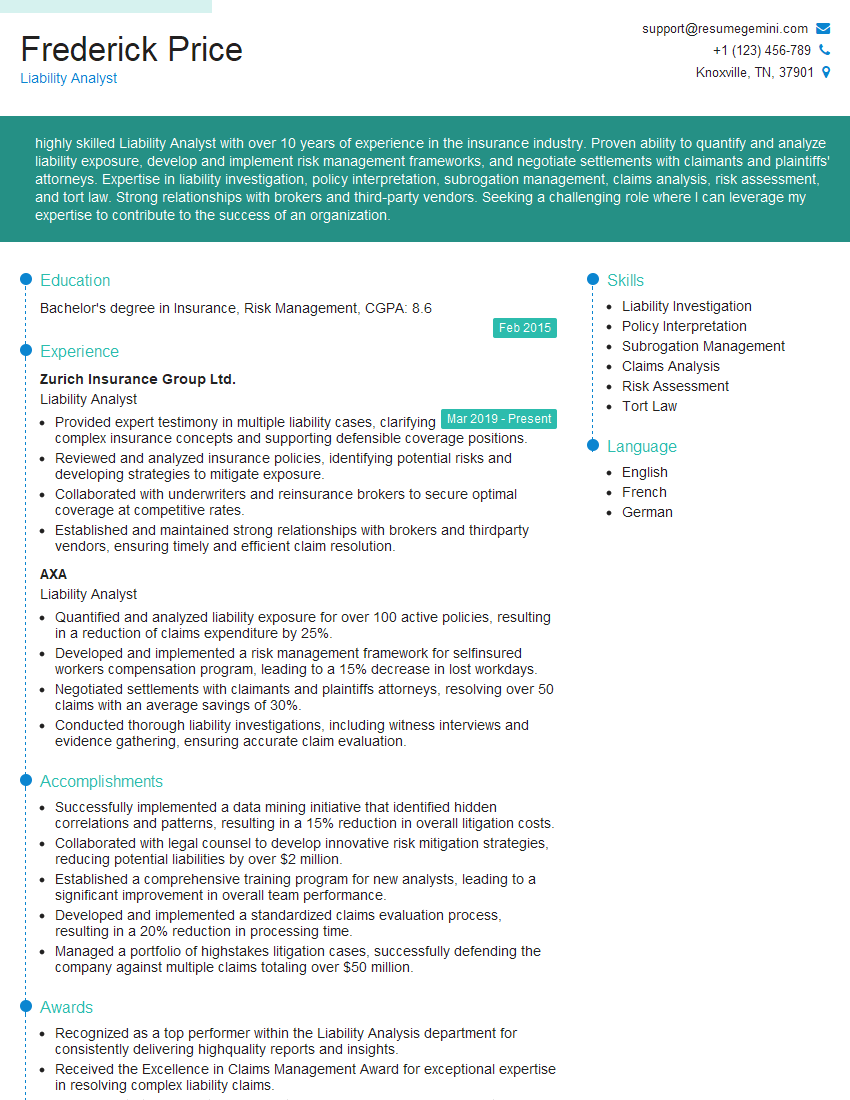

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Liability Analyst

1. What are the key responsibilities of a Liability Analyst?

- Investigate and assess potential and existing liabilities.

- Develop and implement strategies to mitigate risks.

- Monitor and report on liability trends.

- Provide guidance and advice to management on liability issues.

- Stay abreast of new and emerging liability risks.

2. What are the different types of liabilities that a Liability Analyst may encounter?

Tort liabilities

- Negligence

- Intentional torts (e.g., assault, battery)

Contract liabilities

- Breach of contract

- Warranty claims

Statutory liabilities

- Violations of environmental laws

- Violations of workplace safety laws

3. What are the key factors that a Liability Analyst considers when assessing a potential liability?

- The likelihood of the liability occurring

- The potential severity of the liability

- The financial impact of the liability

- The reputational impact of the liability

- The legal defenses available to the company

4. What are some of the different strategies that a Liability Analyst can use to mitigate risks?

- Risk avoidance

- Risk transfer

- Risk reduction

- Risk retention

5. What are some of the key challenges that a Liability Analyst may face in their work?

- The need to stay abreast of new and emerging liability risks

- The difficulty in quantifying the financial impact of liabilities

- The need to balance the interests of the company with the interests of its stakeholders

- The need to make difficult decisions in the face of uncertainty

6. What are some of the key skills and qualifications that a Liability Analyst should possess?

- Strong analytical skills

- Excellent communication skills

- In-depth knowledge of liability law

- Experience in risk management

- Ability to work independently and as part of a team

7. How do you stay abreast of new and emerging liability risks?

- Read industry publications

- Attend conferences and seminars

- Network with other liability professionals

- Monitor court decisions and regulatory changes

8. How do you quantify the financial impact of liabilities?

- Use historical data to estimate the likelihood and severity of potential liabilities

- Consider the potential impact of liabilities on the company’s financial statements

- Consult with experts in the fields of finance and accounting

9. How do you balance the interests of the company with the interests of its stakeholders?

- Consider the company’s financial health

- Consider the company’s reputation and brand image

- Consider the interests of employees, customers, and other stakeholders

- Make decisions that are in the best interests of the company as a whole

10. Tell me about a time when you had to make a difficult decision in the face of uncertainty.

In my previous role as a Liability Analyst at ABC Company, I was responsible for assessing the potential liability associated with a new product launch. There was a lot of uncertainty about the potential risks involved, and I had to make a decision about whether or not to recommend that the company proceed with the launch.

After carefully considering all of the available information, I ultimately recommended that the company proceed with the launch. I believed that the potential benefits of the product outweighed the potential risks, and I was confident that the company could mitigate the risks through appropriate risk management strategies.

The product launch was ultimately successful, and the company did not incur any significant liability. I am proud of the role that I played in helping the company to achieve its business objectives while also protecting its interests from potential liability.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Liability Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Liability Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Liability Analyst is responsible for a wide range of duties related to assessing and managing the potential financial impact of liabilities.

1. Assessing and Managing Loss Reserves

This involves evaluating historical loss data and industry trends to estimate the potential financial impact of future claims. The analyst may also be responsible for recommending strategies to manage and reduce loss reserves.

- Reviewing and analyzing claims data to identify trends and patterns that can impact loss reserves.

- Using statistical models and actuarial techniques to estimate the potential financial impact of future claims.

2. Performing Insurance Policy Analysis

This includes reviewing insurance policies to identify and assess potential coverage issues and exposures.

- Reviewing and analyzing insurance policies to identify potential coverage gaps or overlaps.

- Advising on the adequacy and appropriateness of insurance coverage and recommending changes or enhancements.

3. Reserving and Funding Recommendations

The Liability Analyst is also responsible for making recommendations on reserving and funding strategies to mitigate financial risks.

- Making recommendations on the appropriate level of loss reserves to be established and maintained.

- Developing and implementing strategies to fund loss reserves in a cost-effective and efficient manner.

4. Reporting and Communication

The Liability Analyst is responsible for communicating and reporting on liability-related matters to management, regulators, and other stakeholders.

- Preparing and presenting reports on loss reserves, insurance coverage, and liability management strategies.

- Communicating and explaining liability-related issues to senior management, regulators, and other stakeholders.

Interview Tips

Preparing for an interview for a Liability Analyst position requires a thoughtful approach to convey your skills, experience, and knowledge effectively.

1. Research the Company and Position

Thoroughly research the company’s industry, business model, and recent financial performance to understand their liability risk profile. Also, review the specific requirements of the Liability Analyst role to tailor your answers to the key responsibilities.

- Visit the company’s website to gather information about their operations, financial statements, and press releases.

- Utilize industry-specific databases and news sources to gain insights into the company’s risk profile and competitive landscape.

2. Quantify Your Accomplishments

When describing your experience and accomplishments, focus on quantifying your results to demonstrate the impact of your work. Use specific metrics and data points to support your claims.

- Example: Instead of saying “I managed a team of analysts,” you could say, “I led a team of five analysts, resulting in a 20% increase in the accuracy of loss reserve estimates.”

- Highlight instances where you successfully identified and mitigated liability risks, leading to cost savings or improved financial performance.

3. Prepare for Technical Questions

Expect questions that test your understanding of liability accounting principles, insurance policy analysis, and risk management techniques.

- Review fundamental accounting concepts related to liabilities, such as accrual accounting and discounted cash flow analysis.

- Practice analyzing insurance policies to identify coverage gaps and potential exposures.

- Familiarize yourself with common risk management techniques and strategies, including risk assessment, risk transfer, and risk mitigation.

4. Emphasize Your Communication and Analytical Skills

Liability Analysts must possess strong communication and analytical skills. Highlight your ability to interpret complex data, draw insights, and effectively communicate your findings to stakeholders.

- Provide examples of presentations you have given or reports you have written, demonstrating your ability to convey technical information clearly and persuasively.

- Share instances where you used data analysis to identify trends, patterns, or correlations that helped inform decision-making.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Liability Analyst interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.