Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Liability Claims Manager interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Liability Claims Manager so you can tailor your answers to impress potential employers.

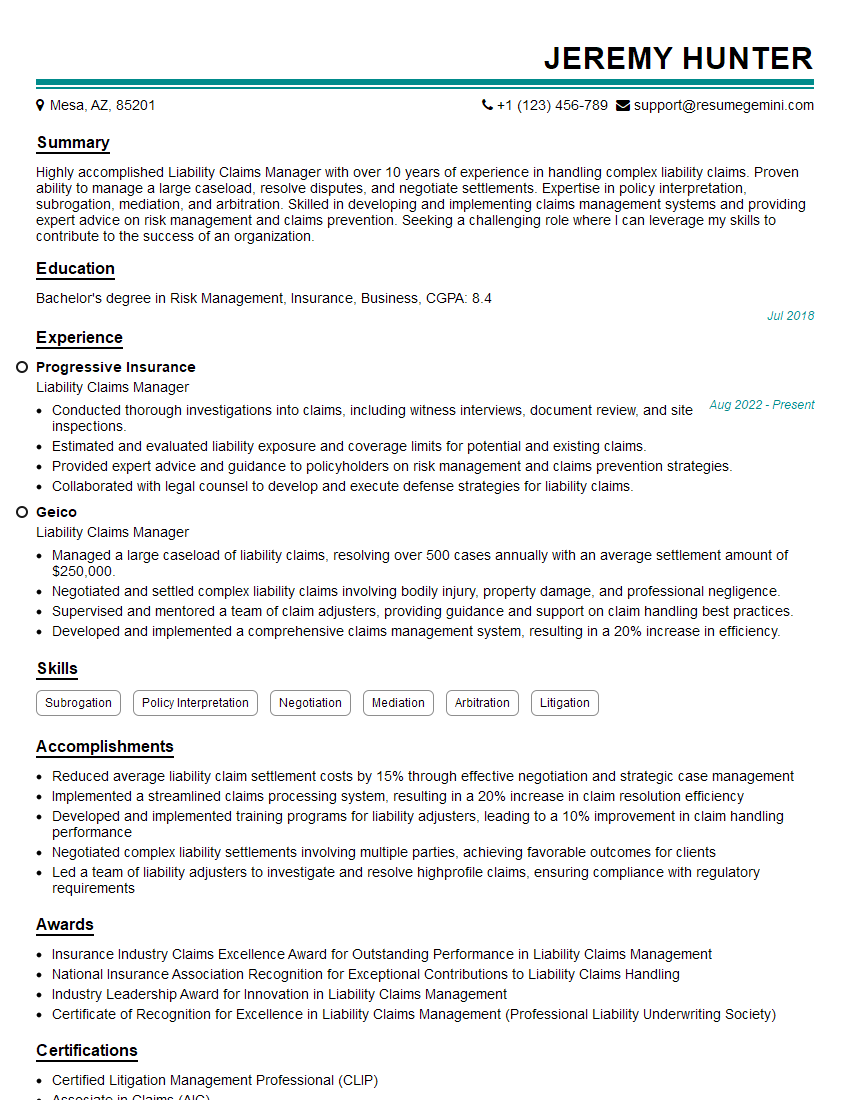

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Liability Claims Manager

1. Can you provide a brief overview of your experience in liability claims management?

In my previous role as Liability Claims Manager at [Company Name], I was responsible for handling a wide range of liability claims, including bodily injury, property damage, and professional negligence. I have successfully negotiated settlements in complex cases, resulting in significant savings for the company.

2. How do you prioritize and manage multiple claims simultaneously?

- I utilize a claims management software to track and organize all claims.

- I prioritize claims based on their severity, potential liability, and deadlines.

- I delegate tasks to team members to ensure timely resolution of all claims.

3. How do you assess the validity and potential liability of a claim?

- I thoroughly review all relevant documentation, including police reports, medical records, and witness statements.

- I conduct interviews with the policyholder, witnesses, and claimants.

- I consult with legal counsel to provide guidance on the potential liability.

4. What techniques do you use to negotiate settlements with claimants and their attorneys?

- I build strong relationships with claimants and their attorneys based on trust and respect.

- I present a comprehensive analysis of the facts and potential liability.

- I actively listen to the claimant’s perspective and show empathy.

5. How do you handle claims that involve disputes over coverage?

- I review the policy language and applicable laws to determine coverage.

- I work closely with the underwriting team to clarify coverage issues.

- I communicate the coverage decision to the policyholder and claimant in a clear and timely manner.

6. What strategies do you employ to mitigate the costs of liability claims?

- I proactively investigate claims and identify potential areas for cost containment.

- I negotiate favorable settlements with claimants and their attorneys.

- I manage vendor relationships and ensure that services are provided at the lowest possible cost.

7. How do you stay up-to-date on legal developments and industry best practices in liability claims management?

- I regularly attend industry conferences and webinars.

- I subscribe to legal journals and newsletters.

- I participate in professional development courses.

8. How do you manage the emotional aspects of dealing with claimants who have suffered significant losses?

- I approach each claimant with empathy and compassion.

- I listen attentively to their concerns and provide support.

- I maintain a professional and respectful demeanor, while also being transparent and honest about the claims process.

9. Can you provide an example of a particularly challenging liability claim that you successfully resolved?

In one instance, I handled a complex medical malpractice claim involving a patient who sustained permanent injuries. I conducted a thorough investigation, worked closely with legal counsel, and negotiated a favorable settlement that satisfied both the patient and the insured physician.

10. What qualities and skills are essential for success as a Liability Claims Manager?

- Excellent communication and interpersonal skills

- Strong analytical and problem-solving abilities

- Thorough understanding of insurance law and liability principles

- Proven negotiation and settlement skills

- Ability to manage multiple claims simultaneously and prioritize effectively

- Empathy and compassion for claimants

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Liability Claims Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Liability Claims Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Liability Claims Manager is the professional responsible for managing all aspects of liability claims, including investigation, evaluation, negotiation, and settlement. Their primary objective is to protect the company’s financial interests and minimize its liability exposure.

1. Claims Investigation and Evaluation

Thoroughly investigate liability claims and gather relevant evidence.

- Conduct interviews with policyholders, witnesses, and other parties involved

- Review police reports, medical records, and other documentation

2. Claims Analysis and Assessment

Analyze claims to determine liability and damages.

- Calculate the extent of financial damages and recommend appropriate settlement amounts

- Identify potential legal defenses and develop strategies for handling complex claims

3. Negotiation and Settlement

Negotiate settlements with claimants and their attorneys.

- Negotiate the payment of benefits while minimizing the company’s liability

- Draft settlement agreements and obtain claimant signatures

4. Legal Defense

Assist in the preparation and defense of lawsuits.

- Work with outside counsel to prepare legal documents

- Provide expert testimony on claims-related issues

5. Claims Management

Oversee the overall claims management process.

- Establish and maintain claim files

- Provide regular updates on claim status to stakeholders

Interview Tips

To ace the interview for a Liability Claims Manager position, consider the following tips:

1. Research the Company and Position

Thoroughly research the company’s history, industry, and recent developments.

- Understand the specific role and responsibilities of the Liability Claims Manager position

- Identify the company’s claims philosophy and approach to risk management

2. Highlight Relevant Experience and Skills

Emphasize your previous experience in claims management, particularly in handling liability claims.

- Quantify your accomplishments and highlight the impact of your work

- Discuss your expertise in claims investigation, evaluation, and negotiation

- Demonstrate your legal knowledge and understanding of insurance principles

3. Showcase Problem-Solving and Analytical Skills

Provide examples of how you have successfully resolved complex claims and minimized liability exposure.

- Describe your analytical approach to claims handling

- Explain how you prioritize and manage multiple claims simultaneously

4. Practice Active Listening and Communication

Emphasize your active listening skills and ability to communicate effectively with various stakeholders, including policyholders, claimants, attorneys, and company executives.

- Provide examples of how you have successfully built rapport and established trust

- Explain your approach to negotiating and resolving disputes amicably

5. Prepare Thoughtful Questions

Prepare thoughtful questions to ask the interviewer about the company’s claims management practices, the specific challenges of the position, and opportunities for professional growth.

- This shows your engagement and interest in the role

- It also provides you with insights into the company’s culture and values

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Liability Claims Manager, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Liability Claims Manager positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.