Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Licensed Bondsman interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Licensed Bondsman so you can tailor your answers to impress potential employers.

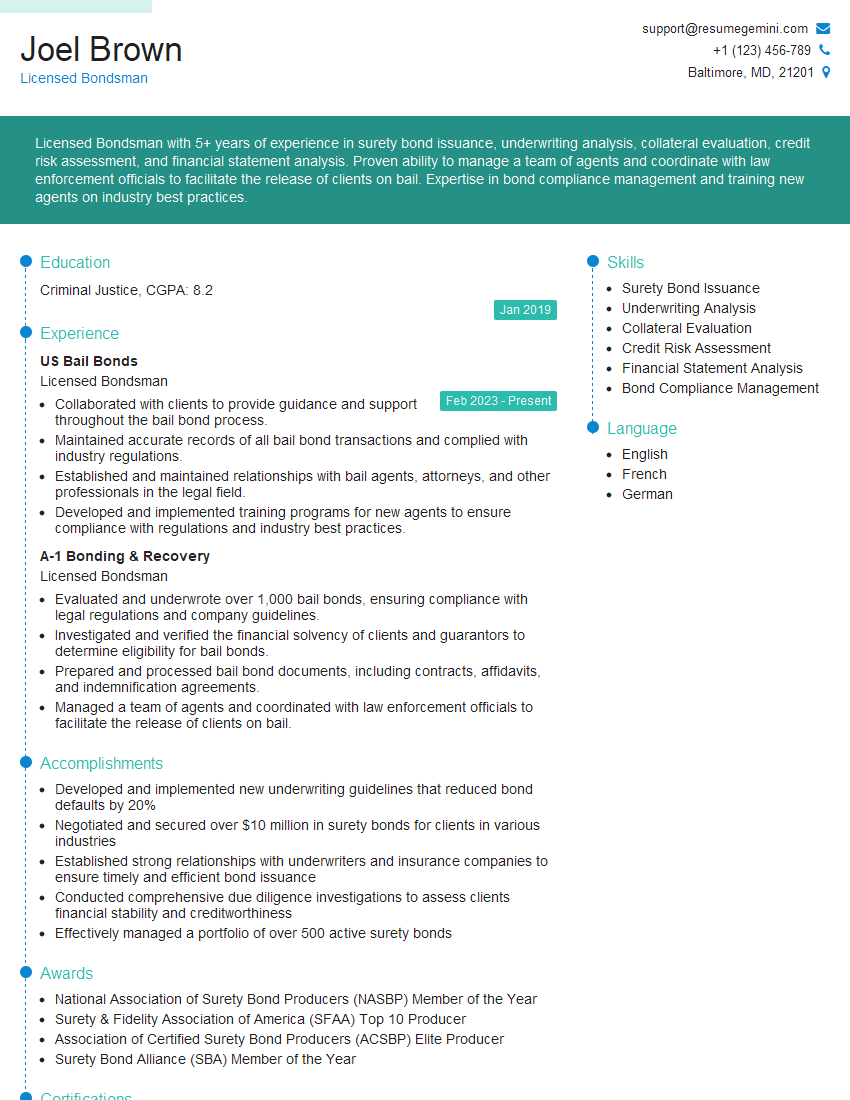

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Licensed Bondsman

1. What are the key responsibilities of a Licensed Bondsman?

- Write and issue surety bonds, including criminal, civil, and contract bonds.

- Underwrite and evaluate bond applications, determining the risk involved and setting premiums.

- Maintain detailed records of all bonds issued and their status.

- Work closely with insurance carriers and agents to arrange coverage for bonds.

- Represent clients in court proceedings related to bonds, such as forfeitures and collections.

2. What are the different types of surety bonds and their purposes?

Criminal Bonds

- Bail bonds: Release individuals from jail before trial.

- Appearance bonds: Ensure defendants attend court hearings.

- Fidelity bonds: Protect employers from financial losses due to employee dishonesty.

Civil Bonds

- Replevin bonds: Allow individuals to regain possession of seized property.

- Injunction bonds: Prevent parties from taking specific actions.

- Attachment bonds: Secure property to satisfy potential judgments.

Contract Bonds

- Bid bonds: Guarantee that contractors will honor their bids on projects.

- Performance bonds: Ensure contractors complete projects according to specifications.

- Payment bonds: Protect subcontractors and suppliers from non-payment by contractors.

3. What factors do you consider when underwriting a bond application?

When underwriting a bond application, I consider the following factors:

- The applicant’s credit history and financial stability.

- The nature and risk of the bond being requested.

- The applicant’s experience and reputation in the industry.

- The security or collateral offered by the applicant.

- Any relevant legal or regulatory requirements.

4. How do you determine the premium for a surety bond?

The premium for a surety bond is determined based on the following factors:

- The amount of the bond.

- The risk involved in the bond.

- The creditworthiness of the applicant.

- The term of the bond.

- Any additional fees or charges.

5. What are the ethical and legal obligations of a Licensed Bondsman?

As a Licensed Bondsman, I am bound by the following ethical and legal obligations:

- To act with honesty and integrity in all dealings.

- To maintain confidentiality of client information.

- To comply with all applicable laws and regulations.

- To avoid conflicts of interest.

- To provide fair and reasonable pricing for bonds.

6. What are the potential risks and challenges involved in the bail bond industry?

- The risk of non-appearance by defendants, resulting in financial losses for the bondsman.

- The potential for fraud and abuse by unscrupulous individuals.

- The challenge of navigating complex legal and regulatory frameworks.

- The need to maintain a high level of financial stability to cover potential losses.

- The emotional toll of dealing with defendants who may be facing serious charges.

7. How do you maintain accurate and up-to-date records of bond transactions?

I maintain accurate and up-to-date records of bond transactions using the following methods:

- A secure electronic database that stores all bond-related information.

- Physical copies of bond documents, kept in a secure and organized manner.

- Regular reviews and audits to ensure accuracy and completeness of records.

- Collaboration with insurance carriers and agents to obtain necessary documentation timely.

8. What is your experience with collateral for surety bonds?

I have extensive experience with collateral for surety bonds, including:

- Evaluating the value and sufficiency of collateral offered by applicants.

- Obtaining and perfecting liens on collateral to secure the bond obligation.

- Managing and liquidating collateral in the event of a bond default.

- Working with attorneys and courts to enforce collateral rights.

9. Can you describe your understanding of the surety bond claims process?

- The claimant files a written notice of claim to the surety.

- The surety investigates the claim and determines whether it is valid.

- If the claim is valid, the surety will pay the claimant up to the amount of the bond.

- The surety then pursues subrogation rights against the principal on the bond.

10. How do you stay informed about changes in the laws and regulations governing the surety bond industry?

- Attending industry conferences and training seminars.

- Reading trade publications and online resources.

- Networking with other surety professionals.

- Consulting with legal counsel to ensure compliance.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Licensed Bondsman.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Licensed Bondsman‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Licensed Bondsmen play a pivotal role in the bail bond industry, providing indispensable services to those in need. Their primary responsibilities involve:

1. Issuing Bail Bonds

The cornerstone of a Bondsman’s job is to issue bail bonds, which serve as guarantees to the court that a defendant will appear for future court appearances. Bondsmen assess defendants’ risk levels, verify their information, and determine the appropriate bond amount based on bail schedules.

2. Managing Collateral

To secure bail bonds, Bondsmen typically require collateral, such as cash, property, or a third-party guarantee. They are responsible for evaluating and safeguarding the value of collateral, ensuring it meets or exceeds the bond amount.

3. Monitoring Defendants

Licensed Bondsmen have a legal obligation to monitor defendants released on bail. They maintain regular contact, track defendants’ whereabouts, and enforce any court-ordered conditions, such as travel restrictions or curfew.

4. Ensuring Court Appearances

Bondsmen are ultimately responsible for ensuring defendants appear for all scheduled court hearings. If a defendant fails to appear, Bondsmen must surrender them to the court or risk forfeiting the bond and facing legal consequences.

5. Complying with Regulations

Licensed Bondsmen must adhere to stringent state and federal regulations governing the bail bond industry. They must maintain proper licensing, insurance, and record-keeping practices, as well as comply with ethical guidelines.

Interview Tips

To excel in a Licensed Bondsman interview, it’s crucial to be well-prepared and demonstrate a thorough understanding of the role. Here are some essential tips to help you ace the interview:

1. Research the Company and Industry

Prior to the interview, take the time to research the bail bond company and the bail bond industry in general. Familiarize yourself with their services, policies, and any industry-specific regulations.

2. Practice Your Responses

Anticipate common interview questions and prepare thoughtful, concise responses. Focus on highlighting your relevant skills, experience, and knowledge of the bail bond process.

3. Emphasize Liability Consciousness

Licensed Bondsmen assume substantial liability. Emphasize your understanding of the risks associated with the role and your commitment to responsible business practices.

4. Showcase Communication and Interpersonal Skills

Bondsmen interact with a diverse range of individuals, from defendants to attorneys and law enforcement. Demonstrate your ability to communicate effectively and build strong relationships.

5. Prepare Examples

In your responses, provide specific examples of your relevant experience. For instance, discuss how you have successfully managed collateral, monitored defendants, or ensured court appearances.

6. Ask Informed Questions

Engaging in a thoughtful conversation shows interest in the position. Prepare a list of pertinent questions about the company, the role, and the industry.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Licensed Bondsman interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.