Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Licensed Customs Broker interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Licensed Customs Broker so you can tailor your answers to impress potential employers.

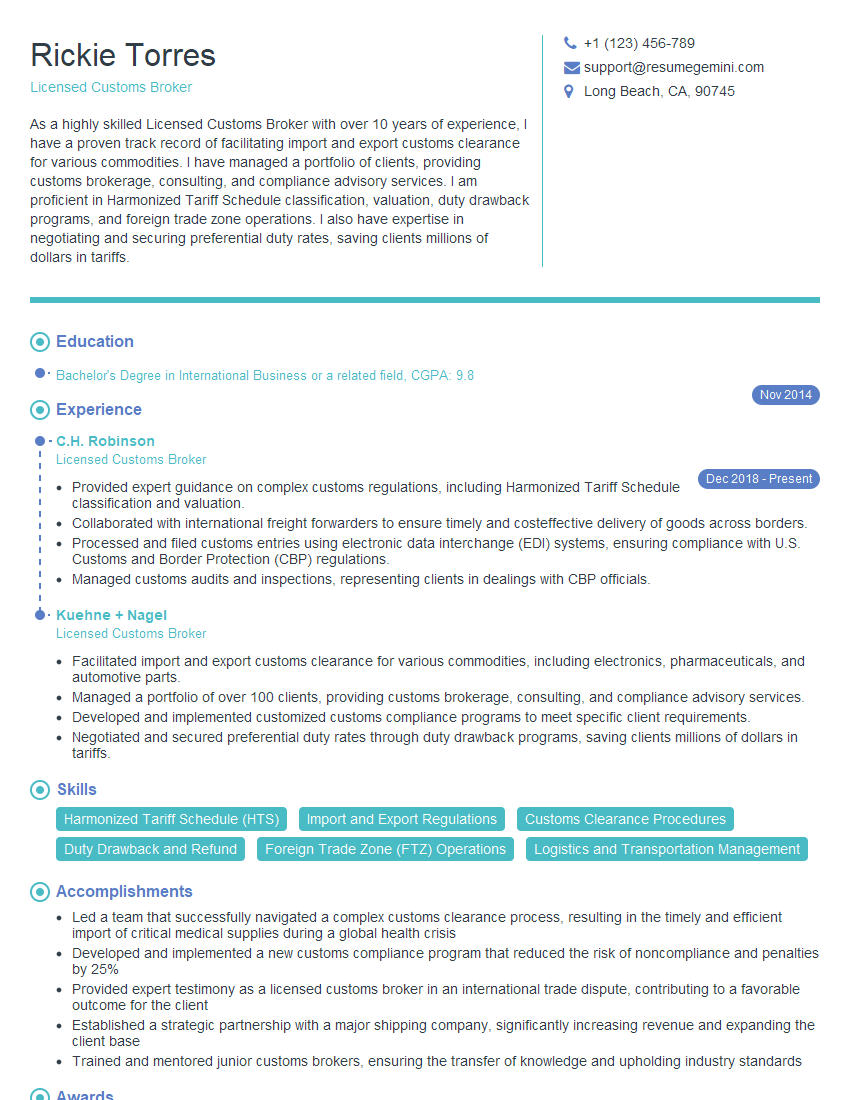

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Licensed Customs Broker

1. Explain the role and responsibilities of a Licensed Customs Broker?

As a Licensed Customs Broker, I am responsible for:

- Classifying and valuing goods for import and export purposes

- Preparing and submitting import and export declarations

- Calculating and paying duties, taxes, and fees

- Representing clients in audits and other proceedings before U.S. Customs and Border Protection (CBP)

- Providing consulting services on customs matters

2. What are the key regulations and laws that govern customs brokerage?

The key regulations and laws that govern customs brokerage include:

- The Tariff Act of 1930

- The Customs Modernization Act of 1993

- The Harmonized Tariff Schedule of the United States (HTSUS)

- The U.S. Customs and Border Protection (CBP) regulations

3. How do you determine the correct classification of a good under the HTSUS?

To determine the correct classification of a good under the HTSUS, I use a combination of:

- The HTSUS text

- The CBP’s rulings

- The importer’s documentation

- My knowledge of the industry

4. What is the difference between ad valorem and specific duties?

- Ad valorem duties are based on the value of the goods

- Specific duties are based on the quantity or weight of the goods

5. What are the different types of entry summaries?

- Formal entry summaries

- Informal entry summaries

- Warehouse entry summaries

- Temporary importation entry summaries

6. What are the benefits of using a Licensed Customs Broker?

- Licensed Customs Brokers are experts in customs regulations and procedures

- Licensed Customs Brokers can help importers avoid costly mistakes

- Licensed Customs Brokers can help importers save time and money

7. What are the different types of surety bonds that are required for customs brokerage?

- Single-entry bonds

- Continuous bonds

- Term bonds

8. What is the process for obtaining a customs power of attorney?

- The importer must complete a Power of Attorney (POA) form

- The importer must notarize the POA

- The importer must submit the POA to CBP

9. What is the difference between a drawback and a refund?

- A drawback is a refund of duties, taxes, and fees that have been paid on imported goods that are subsequently exported

- A refund is a refund of duties, taxes, and fees that have been paid on imported goods that are found to be defective or non-conforming

10. What are the different types of customs audits?

- Pre-entry audits

- Post-entry audits

- Quota audits

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Licensed Customs Broker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Licensed Customs Broker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Licensed Customs Broker is a highly skilled and experienced professional who assists individuals and businesses with the complex and time-consuming process of importing and exporting goods across international borders.

1. Classification and Valuation of Goods

Identify and classify goods according to the Harmonized System (HS) codes to determine applicable duties and taxes.

- Assess the value of goods for customs purposes, considering factors such as purchase price, insurance, and freight costs.

- Prepare and file entry documents, such as customs declarations and invoices, ensuring accuracy and compliance with regulations.

2. Preparation and Filing of Customs Documents

Prepare and file various customs documents, such as entry summaries, bonds, and power of attorney, to facilitate the clearance of goods.

- Calculate and pay duties, taxes, and other fees associated with the import or export of goods.

- Manage and track the status of shipments through customs clearance processes.

3. Liaison with Customs Authorities and Other Agencies

Establish and maintain positive relationships with customs officials, freight forwarders, and other stakeholders involved in the import/export process.

- Represent clients’ interests before customs authorities and resolve any issues or disputes that may arise.

- Stay informed about changes in customs regulations and procedures and advise clients accordingly.

4. Compliance and Risk Management

Ensure compliance with all applicable laws, regulations, and ethical standards governing customs brokerage.

- Implement and maintain a comprehensive risk management program to identify and mitigate potential risks associated with import/export activities.

- Monitor and report on customs-related activities to ensure adherence to legal requirements and client expectations.

Interview Tips

To ace an interview for a Licensed Customs Broker position, it is crucial to demonstrate a deep understanding of the job responsibilities, industry knowledge, and your own qualifications. Here are some tips to help you prepare effectively:

1. Research the Company and the Role

Thoroughly research the company you are applying to and the specific role you are interviewing for. This will help you tailor your answers to the interviewer’s questions and demonstrate your genuine interest in the position.

- Visit the company’s website to learn about their business, services, and company culture.

- Read industry publications and articles to stay up-to-date on the latest trends and developments in customs brokerage.

2. Highlight Your Experience and Skills

Emphasize your relevant experience and skills that align with the key job responsibilities of a Licensed Customs Broker. Quantify your accomplishments with specific examples to demonstrate your impact.

- Describe your experience in classifying and valuing goods, preparing and filing customs documents, and liaising with customs authorities.

- Showcase your proficiency in using customs software and your understanding of compliance and risk management practices.

3. Practice Answering Common Interview Questions

Prepare answers to common interview questions that may be asked, such as:

- “Tell me about your experience in customs brokerage.”

- “How do you stay informed about changes in customs regulations?”

- “Describe a challenging situation you faced in customs brokerage and how you resolved it.”

4. Dress Professionally and Be Punctual

First impressions matter, so dress professionally and arrive for your interview on time. This demonstrates your respect for the interviewer and the company.

- Wear a suit or business casual attire that is appropriate for the company culture.

- Arrive 10-15 minutes early to allow yourself ample time to settle in and prepare.

5. Ask Thoughtful Questions

At the end of the interview, ask thoughtful questions that show your engagement and interest in the position. This is an opportunity to gain additional insights and demonstrate your enthusiasm.

- “What are the key challenges facing the customs brokerage industry today?”

- “Can you describe the training and development opportunities available for new employees?”

- “What is the company’s growth strategy for the next few years?”

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Licensed Customs Broker interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.