Are you gearing up for a career in Life Insurance Agent? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Life Insurance Agent and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

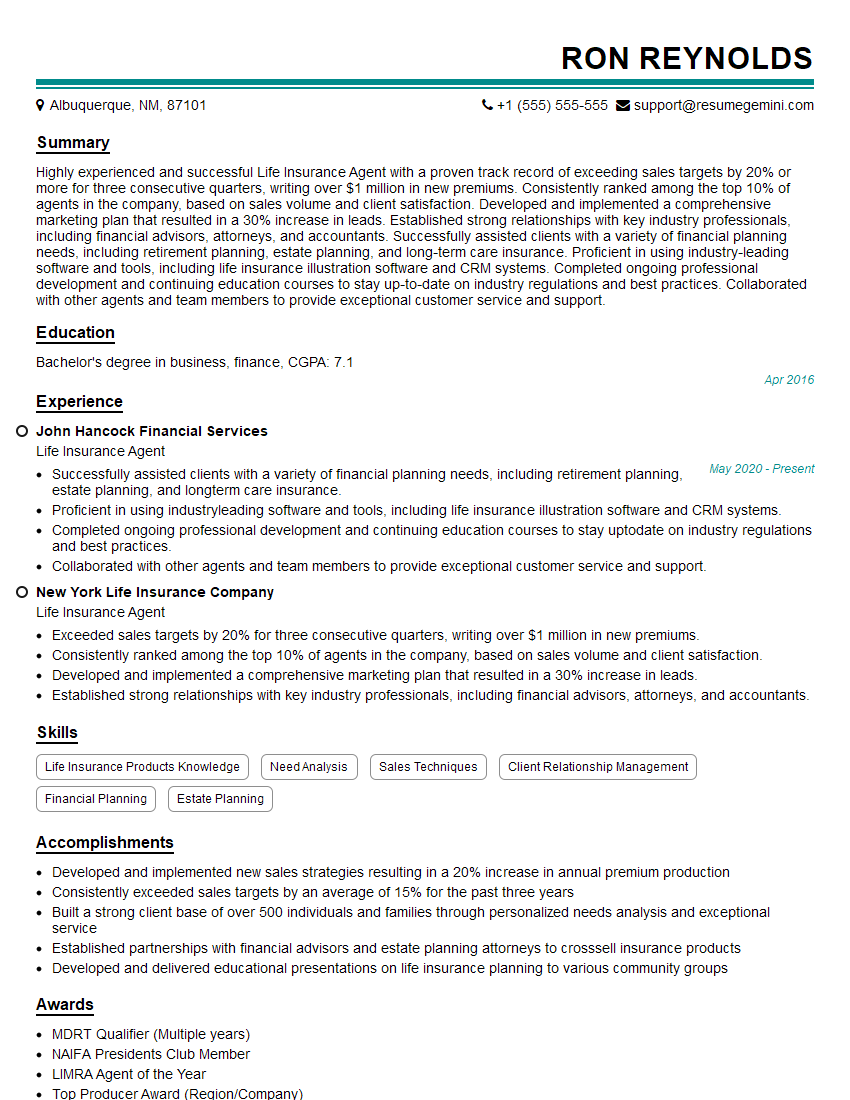

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Life Insurance Agent

1. Explain the different types of life insurance policies and their key features.

Answer:

- Term life insurance: Provides coverage for a specific period, such as 10, 20, or 30 years. If the insured dies within the term, the death benefit is paid to the beneficiary.

- Whole life insurance: Provides coverage for the entire life of the insured, as long as premiums are paid. It also has a cash value component that grows over time, which can be borrowed against or withdrawn.

- Universal life insurance: A flexible policy that allows policyholders to adjust the death benefit and premium payments. It also has a cash value component that can be used for various purposes.

- Variable life insurance: A type of whole life insurance where the cash value is invested in a sub-account that can fluctuate in value based on market performance.

2. How do you determine the appropriate coverage amount for a client?

Answer:

- Gather information about the client’s income, expenses, assets, liabilities, and dependents.

- Estimate the potential financial loss to the family if the client dies.

- Consider factors such as outstanding debts, funeral costs, education expenses for children, and the cost of living.

- Discuss different coverage options with the client and make recommendations based on their individual circumstances.

3. What are the key underwriting factors that affect life insurance premiums?

Answer:

- Age and gender of the insured

- Health and medical history

- Smoking habits

- Occupation and hobbies

- Family history of certain diseases

4. How do you build and maintain relationships with clients in the life insurance industry?

Answer:

- Provide excellent customer service and support.

- Communicate regularly with clients to keep them informed about their policies and coverage.

- Educate clients about life insurance and different products available.

- Be transparent and build trust by clearly explaining all terms and conditions.

- Stay informed about industry updates and regulations to provide valuable advice.

5. Discuss the ethical considerations involved in selling life insurance.

Answer:

- Duty to the client: Act in the best interests of the client and recommend suitable products based on their needs.

- Duty of disclosure: Fully disclose all relevant information about the policy to the client before they purchase.

- Avoid misrepresentation and coercion: Do not mislead or pressure clients into purchasing policies they do not need or understand.

- Maintain confidentiality: Respect the privacy of clients and keep their personal information confidential.

- Comply with regulations: Adhere to all applicable laws and industry standards related to life insurance sales.

6. How do you handle objections and concerns from potential clients?

Answer:

- Listen attentively to the client’s objections and concerns.

- Understand the underlying reasons for their hesitation.

- Address each objection or concern with clear and factual information.

- Provide alternative solutions or explanations that meet the client’s needs.

- Be patient and persistent in addressing the client’s doubts.

7. Explain the claims process for life insurance policies.

Answer:

- Notification: Inform the insurance company of the insured’s death as soon as possible.

- Submission of documents: Provide necessary documents such as the death certificate and proof of insurability.

- Investigation: The insurance company may investigate the claim to verify the circumstances of the death.

- Approval: If the claim is approved, the death benefit is paid to the beneficiary.

- Denial: If the claim is denied, the insurance company must provide a written explanation of the reasons for the denial.

8. How do you stay up-to-date with changes in the life insurance industry?

Answer:

- Attend industry conferences and seminars.

- Read trade publications and articles.

- Participate in online forums and discussion groups.

- Consult with insurance professionals and experts.

- Take continuing education courses.

9. Describe your experience with using CRM (Customer Relationship Management) systems in life insurance sales.

Answer:

- Experience using CRM systems such as Salesforce or HubSpot to manage client relationships.

- Track client interactions, preferences, and policy information.

- Automate tasks such as follow-ups, reminders, and marketing campaigns.

- Generate reports and analyze data to identify sales opportunities.

- Use CRM systems to provide personalized and efficient service to clients.

10. How do you measure your success as a life insurance agent?

Answer:

- Number of policies sold and amount of premiums generated.

- Client satisfaction and positive referrals.

- Contribution to the growth and profitability of the insurance agency.

- Compliance with ethical standards and industry best practices.

- Personal development and improvement in sales skills and knowledge.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Life Insurance Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Life Insurance Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Life Insurance Agents are responsible for selling life insurance policies to individuals and their families. They work with clients to assess their life insurance needs, explain policy options, collect premiums, and provide ongoing support.

1. Prospecting and Sales

Agents identify potential clients through networking, cold calling, and referrals. They develop relationships with clients, understand their financial goals and risk tolerance, and present appropriate life insurance solutions.

- Build and maintain a strong client base

- Identify and qualify potential clients

- Present and explain life insurance products and benefits

- Negotiate and close sales

2. Policy Management

Agents assist clients in completing applications, collecting premiums, and ensuring that policies are in place. They also work with underwriters to assess risk and determine policy terms.

- Process life insurance applications

- Collect and manage premiums

- Issue and renew policies

- Provide policyholder service and support

3. Customer Service

Agents provide ongoing support to clients. They answer questions, resolve issues, and assist with claims and policy changes. They also educate clients about the importance of life insurance and financial planning.

- Provide excellent customer service

- Respond to inquiries and complaints promptly

- Educate clients about life insurance and financial planning

- Resolve policyholder issues

4. Regulatory Compliance

Agents must comply with all applicable laws and regulations governing the sale of life insurance. They must maintain up-to-date licenses and complete continuing education requirements.

- Maintain required licenses and certifications

- Comply with all applicable laws and regulations

- Stay abreast of industry trends and best practices

Interview Tips

Preparing for a Life Insurance Agent interview is essential. Here are some tips to help you ace the interview:

1. Research the Company

Learn about the company’s history, products, and values. This will give you a better understanding of the company’s culture and whether it’s a good fit for you.

- Visit company website

- Read industry articles and news

- Contact current or former employees

2. Practice Your Answers

Common interview questions will likely include your experience, sales skills, and knowledge of the life insurance industry. Prepare thoughtful answers that highlight your strengths and qualifications.

- Use STAR method (Situation, Task, Action, Result)

- Tailor your answers to the specific job description

- Practice with a friend or family member

3. Dress Professionally

First impressions matter. Dress professionally and appropriately for the interview. This will show the interviewer that you are serious about the position.

- Wear a suit or business attire

- Iron your clothes and polish your shoes

- Arrive well-groomed and on time

4. Be Enthusiastic and Confident

Employers want to hire people who are passionate about the industry and have a positive attitude. Show the interviewer that you are excited about the opportunity and that you are confident in your abilities.

- Make eye contact and smile

- Speak clearly and confidently

- Ask thoughtful questions

5. Follow Up

After the interview, send a thank-you note to the interviewer. This shows that you appreciate their time and that you are still interested in the position.

- Send thank-you note within 24 hours

- Personalize the note and mention specific topics discussed

- Reiterate your interest in the position

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Life Insurance Agent interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!