Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Life Underwriter interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Life Underwriter so you can tailor your answers to impress potential employers.

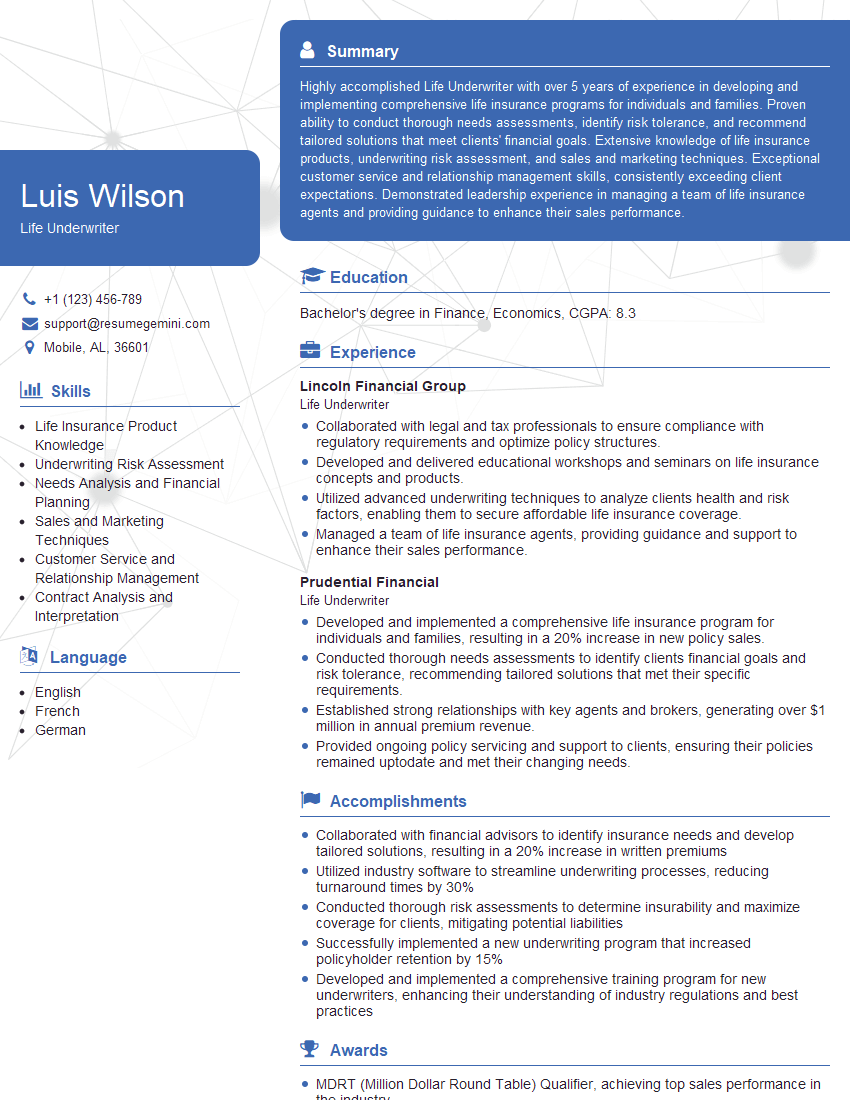

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Life Underwriter

1. What are the key principles of life insurance and how do they impact underwriting decisions?

The key principles of life insurance are:

- Insurable interest – The person taking out the policy must have a financial interest in the life of the insured person.

- Utmost good faith – Both the insurer and the insured must disclose all material information relevant to the policy.

- Indemnity – The insurance company will only pay out the death benefit if the insured person dies during the policy term.

These principles impact underwriting decisions by helping insurers to assess the risk of insuring a particular individual. For example, if an individual has a high-risk lifestyle or a family history of serious illness, the insurer may decide to charge a higher premium or even decline coverage.

2. Explain the different types of life insurance policies and their key features.

Term life insurance

- Provides coverage for a specific period of time, such as 10, 20, or 30 years.

- Premiums are typically lower than for other types of life insurance.

- No cash value accumulation.

Whole life insurance

- Provides coverage for the entire life of the insured person.

- Premiums are typically higher than for term life insurance.

- Cash value accumulation, which can be borrowed against or withdrawn.

Universal life insurance

- Provides coverage for the entire life of the insured person.

- Flexible premiums and death benefit amounts.

- Cash value accumulation, which can be borrowed against or withdrawn.

3. What are the main factors that affect the cost of life insurance?

- Age

- Health

- Lifestyle

- Occupation

- Amount of coverage

- Policy type

4. How do you assess the risk of insuring an individual?

I assess the risk of insuring an individual by considering the following factors:

- Age

- Health

- Lifestyle

- Occupation

- Family history

- Financial situation

I also use a variety of underwriting tools, such as medical exams, blood tests, and financial statements, to help me make a decision.

5. What are the most common reasons for life insurance claims being denied?

- Misrepresentation or omission of material information on the application

- Suicide within the first two years of the policy

- Death from a high-risk activity, such as skydiving or rock climbing

- Death from a pre-existing condition that was not disclosed on the application

6. How do you handle a situation where you have to decline coverage for an individual?

If I have to decline coverage for an individual, I always do so in a professional and compassionate manner. I explain the reasons for the decision in detail and offer to provide additional information or resources.

I also make sure to follow up with the individual to see if there are any other options that may be available to them.

7. What are the ethical considerations that you must be aware of when working as a life insurance underwriter?

- Confidentiality – I must keep all personal information about my clients confidential.

- Conflicts of interest – I must avoid any situations where I could have a conflict of interest, such as being related to an applicant or having a financial interest in a particular policy.

- Fairness – I must treat all applicants fairly and impartially.

8. What are the most challenging aspects of working as a life insurance underwriter?

- Making decisions that can have a significant impact on people’s lives

- Dealing with difficult situations, such as when I have to decline coverage for an individual

- Keeping up with the latest changes in the life insurance industry

9. What are the most rewarding aspects of working as a life insurance underwriter?

- Helping people protect their families and loved ones

- Making a difference in people’s lives

- Working in a challenging and rewarding field

10. What are your career goals?

My career goal is to become a senior life insurance underwriter. I am confident that I have the skills and experience to be successful in this role. I am also committed to continuing my education and development in the life insurance industry.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Life Underwriter.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Life Underwriter‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Life Underwriter plays a pivotal role in providing financial security to individuals and families. Their primary responsibilities include:

1. Prospecting and Client Acquisition

Identifying and reaching out to potential clients, building relationships, and generating leads to grow their client base.

2. Needs Analysis and Policy Selection

Assessing clients’ financial needs, risk tolerance, and goals to determine the appropriate life insurance coverage and products.

3. Sales and Policy Issuance

Presenting life insurance policies, explaining benefits, handling objections, and completing the application and underwriting process.

4. Post-Sale Service and Claims Handling

Providing ongoing support to clients, answering their queries, and assisting in the claims process when necessary.

Interview Tips

To ace the interview for a Life Underwriter position, candidates should follow these preparation tips:

1. Research the Company and Industry

Demonstrating knowledge of the company’s history, products, and industry trends shows your genuine interest and preparedness.

2. Highlight Your Sales and Customer Service Skills

Emphasize your ability to build relationships, engage with clients, and provide exceptional customer service.

3. Show Your Understanding of Life Insurance Products

Understanding different life insurance products, coverage options, and underwriting processes is crucial for success in this role.

4. Prepare for Industry-Specific Questions

Research common interview questions related to the insurance industry, such as ethical considerations, regulatory compliance, and market trends.

5. Practice Your Storytelling Skills

Life Underwriters often share their personal experiences and client testimonials to build rapport and showcase their value. Practice telling compelling stories that highlight your successes.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Life Underwriter interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!