Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Livestock Speculator position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

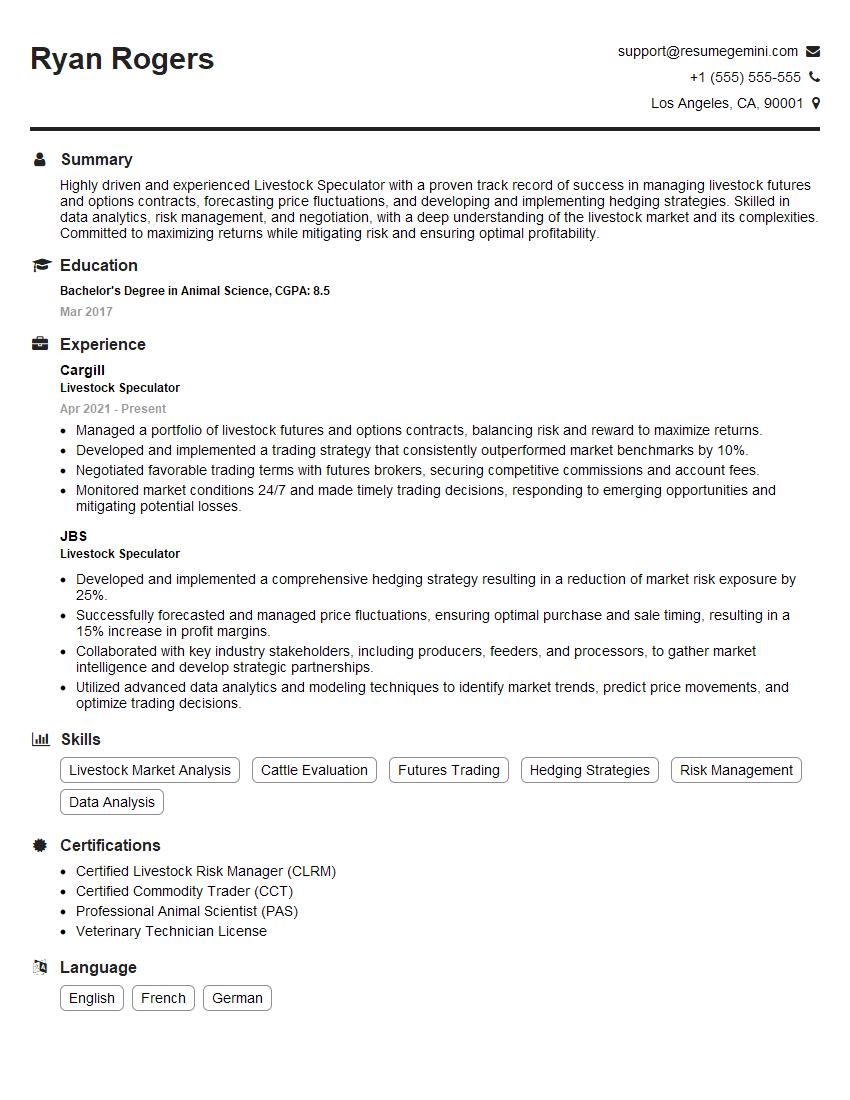

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Livestock Speculator

1. What factors do you consider when evaluating the potential of a livestock futures market?

Identify and describe the key factors that influence the performance of livestock futures markets. Discuss market drivers such as supply and demand, economic conditions, government policies, and weather patterns.

2. Walk me through your process for identifying and managing risk in livestock speculation.

Risk Assessment

- Identify potential risk factors, including price volatility, disease outbreaks, and changes in market demand.

- Quantify and prioritize these risks based on likelihood and impact.

Risk Management Strategies

- Describe hedging techniques, such as using futures or options contracts, to mitigate price risk.

- Discuss how to diversify investments across different livestock species or market segments to reduce overall portfolio risk.

- Explain the importance of risk management tools, such as stop-loss orders and position limits, to minimize potential losses.

3. How do you stay informed about the latest developments in the livestock industry?

Highlight the importance of staying up-to-date on market news, industry trends, and research. Describe sources of information such as industry publications, conferences, and government reports.

- Subscribe to specialized newsletters and trade magazines.

- Attend industry events and conferences.

- Monitor government reports and industry data.

- Consult with experts in the field.

4. Describe a successful livestock speculation trade that you executed.

Walk through the key decision points, risk management strategies, and market conditions that contributed to the trade’s success. Quantify the return on investment and discuss any lessons learned.

5. What are the ethical considerations involved in livestock speculation?

Discuss the potential impact of speculation on livestock prices and the welfare of animals. Explain how you ensure that your trading practices align with ethical principles.

6. How do you handle periods of market volatility and uncertainty?

Describe your strategies for adapting to changing market conditions and managing emotions during volatile times.

- Maintain a disciplined trading plan.

- Avoid making impulsive decisions driven by fear or greed.

- Focus on long-term trends rather than short-term fluctuations.

7. What is your approach to market research and analysis?

Explain your process for gathering and interpreting market data to make informed trading decisions. Discuss the use of technical analysis, fundamental analysis, and sentiment analysis.

8. Describe your experience with using trading platforms and software.

Highlight your proficiency in using industry-standard trading platforms and software. Discuss your knowledge of charting tools, order types, and risk management features.

9. How do you manage your speculative portfolio?

Describe your portfolio management strategies, including asset allocation, position sizing, and performance monitoring. Discuss the use of diversification and rebalancing to optimize risk and return.

10. What are your career goals and aspirations as a Livestock Speculator?

Discuss your long-term career objectives and how this role aligns with your goals. Explain your motivation for pursuing a career in livestock speculation and your willingness to develop your skills and knowledge.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Livestock Speculator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Livestock Speculator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The livestock speculator serves as a pivotal role within the financial industry, specializing in buying and selling livestock futures contracts and other derivatives. The key job responsibilities encompass a comprehensive range:

1. Risk Management

The livestock speculator assumes the responsibility to assess and manage risk diligently. They constantly monitor market trends, conduct thorough research, analyze market data, and utilize risk management strategies. This comprehensive analysis enables them to make informed decisions while considering potential risks and rewards.

2. Trading Contracts

The primary role involves buying and selling livestock futures contracts and other derivatives. They execute trades strategically to capitalize on price fluctuations, whether buying contracts to gain exposure or selling contracts to hedge against risk. In-depth understanding of contract specifications and trading mechanisms is essential.

3. Market Analysis

A thorough understanding of the livestock industry and market fundamentals is paramount. The speculator continuously monitors supply and demand dynamics, economic indicators, weather patterns, and government policies that influence livestock prices.

4. Livestock Knowledge

A solid foundation in livestock production, including breeding, feeding, and veterinary care, is essential. It enables the speculator to assess the physical characteristics and quality of livestock, which impacts market prices.

Interview Tips

To excel in an interview for a livestock speculator position, meticulous preparation is crucial. Consider the following tips:

1. Research the Industry

Demonstrate your knowledge of the livestock industry, including market trends, major players, and current events. This can enhance your credibility during the interview.

2. Showcase Trading Experience

Highlight your trading experience and expertise, providing specific examples of successful trades and risk management strategies. Quantifying your accomplishments will strengthen your application.

3. Prepare Case Studies

Prepare and present case studies that showcase your analytical and decision-making skills. Demonstrate your ability to identify trading opportunities and manage risk effectively.

4. Network

Attend industry events and connect with professionals in the field. Networking can provide valuable insights and potential job leads.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Livestock Speculator interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!