Are you gearing up for a career in Loan Administrator? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Loan Administrator and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

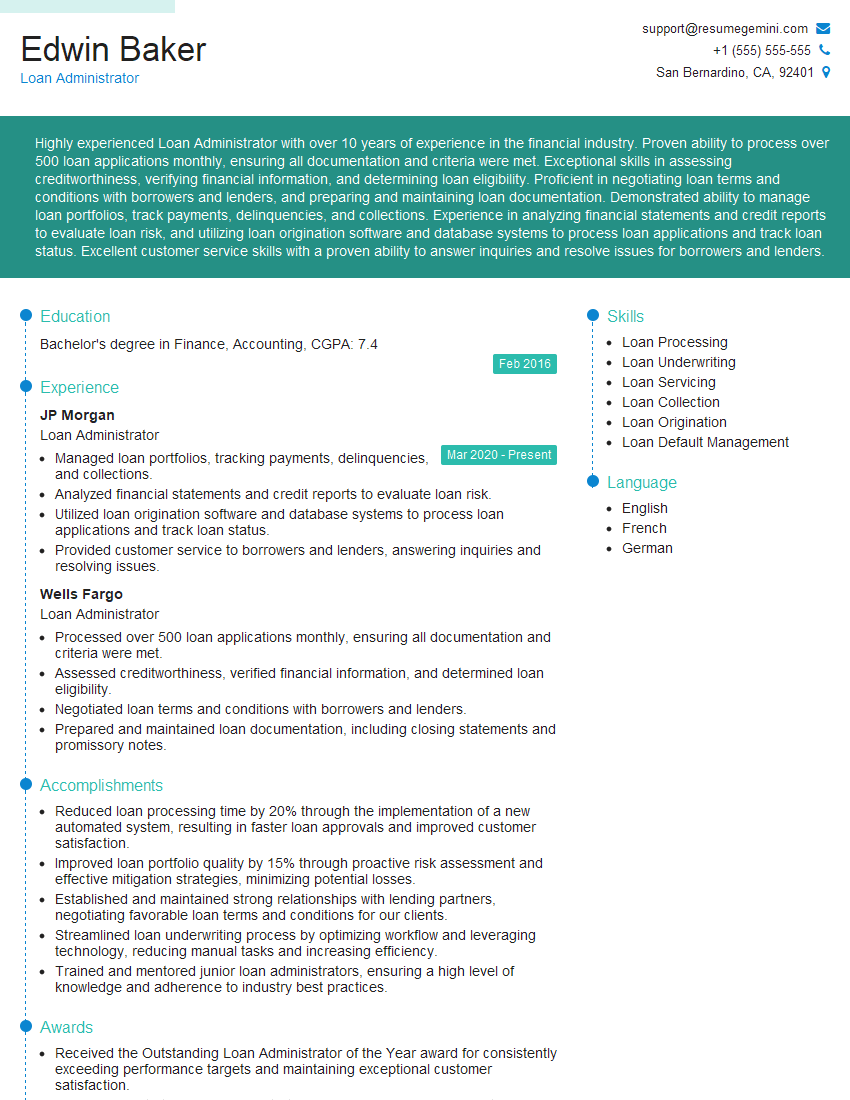

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Administrator

1. Explain the process of loan origination.

- The loan origination process typically begins when a borrower submits a loan application to a lender.

- The lender will then review the application and determine whether or not the borrower is eligible for a loan.

- If the borrower is eligible, the lender will then make a loan offer to the borrower.

- The borrower will then have the opportunity to review the loan offer and decide whether or not to accept it.

- If the borrower accepts the loan offer, the lender will then close the loan and disburse the funds to the borrower.

2. What are the different types of loans that are available?

Secured loans

- Secured loans are backed by collateral, such as a home or a car.

- If the borrower defaults on the loan, the lender can seize the collateral and sell it to recoup the losses.

Unsecured loans

- Unsecured loans are not backed by collateral.

- If the borrower defaults on the loan, the lender has no recourse other than to sue the borrower for the money.

3. How do you determine whether or not a borrower is eligible for a loan?

- Lenders use a variety of factors to determine whether or not a borrower is eligible for a loan, including:

- The borrower’s credit score

- The borrower’s debt-to-income ratio

- The borrower’s employment history

- The borrower’s income

4. What are the different types of loan documents that are required?

- The types of loan documents that are required will vary depending on the type of loan.

- However, some common loan documents include:

- The loan application

- The loan agreement

- The promissory note

- The security agreement

5. What are the different types of loan servicing that are available?

- The different types of loan servicing that are available include:

- In-house servicing

- Outsourcing servicing

- Co-servicing

6. What are the different types of loan delinquency that can occur?

- The different types of loan delinquency that can occur include:

- Default

- Charge-off

- Repossession

7. What are the different types of loan modifications that can be made?

- The different types of loan modifications that can be made include:

- Loan forbearance

- Loan modification

- Loan assumption

8. What are the different types of loan collections that can be made?

- The different types of loan collections that can be made include:

- Pre-collections

- Collections

- Charge-off collections

9. How do you handle a delinquent loan?

- When a loan becomes delinquent, the lender will typically send the borrower a notice of default.

- The notice of default will give the borrower a certain amount of time to bring the loan current.

- If the borrower does not bring the loan current, the lender may then proceed with foreclosure or repossession.

10. How do you collect on a charged-off loan?

- Charged-off loans are typically sold to collection agencies.

- The collection agency will then attempt to collect on the loan by contacting the borrower and trying to negotiate a payment plan.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Administrator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Administrator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Loan Administrators are responsible for a range of tasks related to the management and administration of loans. These responsibilities may vary depending on the size and type of financial institution, but some of the most common duties include:

1. Loan Processing

Loan Administrators typically play a key role in the loan processing process. This involves reviewing loan applications, verifying borrower information, and obtaining necessary documentation.

- Checking the completeness of loan applications.

- Verifying borrower information, such as income, expenses, and credit history.

- Ordering and reviewing credit reports.

- Collecting and reviewing other necessary documentation, such as tax returns and bank statements.

2. Loan Closing

Once a loan has been approved, Loan Administrators are responsible for coordinating the closing process. This involves preparing loan documents, scheduling closing appointments, and disbursing loan funds.

- Preparing loan documents, such as the promissory note, mortgage, and deed of trust.

- Scheduling closing appointments with borrowers, lenders, and other parties involved in the transaction.

- Disbursing loan funds to borrowers.

3. Loan Servicing

Loan Administrators are also responsible for servicing loans after they have been closed. This involves collecting payments, monitoring loan performance, and taking appropriate action in the event of a default.

- Collecting loan payments and processing them in a timely manner.

- Monitoring loan performance and identifying any potential problems.

- Taking appropriate action in the event of a default, such as contacting the borrower, initiating foreclosure proceedings, or modifying the loan terms.

4. Customer Service

Loan Administrators often have to interact with customers, both on the phone and in person. They must be able to answer questions, provide information, and resolve problems in a professional and courteous manner.

- Answering questions from borrowers about their loans.

- Providing information about loan products and services.

- Resolving problems that borrowers may have with their loans.

Interview Tips

Interviewing for a Loan Administrator position can be a daunting task, but by following these tips, you can increase your chances of success:

1. Research the company and position

Before you go to the interview, take some time to research the company and the position. This will help you understand the company’s culture, goals, and expectations for the role.

- Visit the company’s website.

- Read the job description carefully.

- Network with people who work at the company.

2. Prepare your answers to common interview questions

There are a few common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?”. It is important to prepare your answers to these questions in advance.

- Practice answering these questions out loud.

- Be prepared to give specific examples of your skills and experience.

3. Dress professionally and arrive on time

When you go to the interview, it is important to dress professionally and arrive on time. This will show the interviewer that you are serious about the position.

- Wear a suit or dress pants and a button-down shirt.

- Arrive on time for your interview.

4. Be confident and enthusiastic

When you interview, be confident and enthusiastic. This will show the interviewer that you are passionate about the position and the company.

- Make eye contact with the interviewer.

- Speak clearly and confidently.

- Be enthusiastic about the position.

5. Follow up after the interview

After the interview, be sure to follow up with the interviewer. Thank them for their time and express your continued interest in the position.

- Send a thank-you note within 24 hours of the interview.

- Call the interviewer to follow up within a week.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Loan Administrator interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!