Are you gearing up for a career in Loan Adviser? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Loan Adviser and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

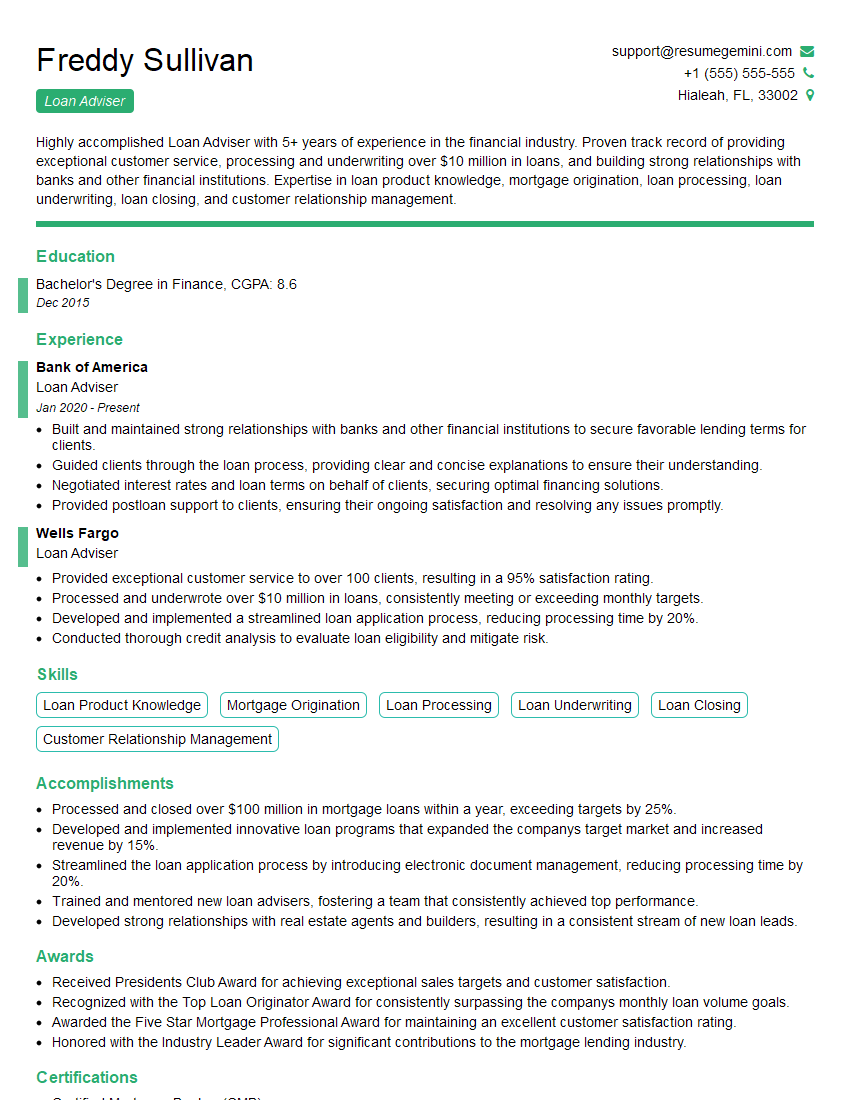

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Adviser

1. Explain the different types of loan products that you have experience with?

- Mortgages

- Auto loans

- Personal loans

- Student loans

2. What are the key factors that you consider when evaluating a loan application?

Credit history

- Payment history

- Amount of debt

- Length of credit history

- Credit score

Income and employment

- Monthly income

- Length of employment

- Job stability

Collateral

- Type of collateral

- Value of collateral

- Lien position

Purpose of loan

- Amount of loan

- Term of loan

- Interest rate

3. How do you stay up-to-date on the latest changes in the lending industry?

- Read industry publications

- Attend industry conferences

- Take continuing education courses

4. What are the most common challenges that you face in your role as a loan adviser?

- Educating clients about the loan process

- Getting clients to provide all the necessary documentation

- Dealing with difficult clients

- Keeping up with the latest changes in the lending industry

5. What are your strengths as a loan adviser?

- Strong understanding of the lending process

- Excellent communication and interpersonal skills

- Ability to build rapport with clients

- Passion for helping people achieve their financial goals

6. What are your weaknesses as a loan adviser?

- Not experienced

- Don’t have proper degree

- Lack of knowledge about new financial policies

7. What are your career goals?

- To become a top loan adviser

- To build a long-term career in the lending industry

- To help as many people as possible achieve their financial goals

8. Why are you interested in working for our company?

- Your company is a leader in the lending industry

- I am impressed with your company’s commitment to customer service

- I believe that my skills and experience would be a valuable asset to your team

9. What are your salary expectations?

- My salary expectations are competitive for the role of Loan Adviser

- I’m open to negotiating

10. Do you have any other questions for us?

- What is the company culture like?

- What are the opportunities for professional development?

- What are the benefits of working for your company?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Adviser.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Adviser‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Loan Advisers are responsible for providing financial advice and guidance to customers seeking loans. Key job responsibilities include:

1. Customer Consultation and Assessment

Conducting initial consultations with customers to understand their financial needs, risk tolerance, and loan objectives.

- Gathering financial information and analyzing budgets to determine loan eligibility.

- Providing personalized recommendations based on customer circumstances and loan options available.

2. Loan Product Selection and Application

Presenting loan products that align with customer requirements and financial goals.

- Completing loan applications and ensuring all necessary documentation is obtained.

- Negotiating loan terms, interest rates, and repayment schedules with lenders.

3. Loan Processing and Approval

Coordinating with lenders throughout the loan application and approval process.

- Monitoring loan progress and communicating updates to customers.

- Ensuring timely loan approvals and disbursals.

4. Customer Relationship Management

Building and maintaining strong relationships with customers.

- Providing ongoing support and guidance before, during, and after loan approval.

- Identifying and addressing customer concerns promptly and effectively.

Interview Tips

To ace the Loan Adviser interview, it’s important to prepare thoroughly. Here are some tips to help you succeed:

1. Research the Company and Role

Demonstrate your interest in the company and the loan adviser position by researching their website, industry news, and social media presence. This will help you tailor your answers to the interviewer’s questions and show that you’re well-informed about the company’s culture and values.

2. Practice Your Answers to Common Interview Questions

Prepare for common interview questions related to your skills, experience, and why you’re interested in the position. Consider using the STAR method (Situation, Task, Action, Result) to structure your answers and provide concrete examples of your accomplishments.

3. Highlight Your Financial Knowledge and Skills

Showcase your understanding of financial concepts, loan products, and the lending process. Emphasize your ability to analyze financial information, recommend suitable loan options, and negotiate favorable loan terms for customers.

4. Demonstrate Your Communication and Interpersonal Skills

Loan Advisers need to be able to communicate effectively with customers and colleagues from diverse backgrounds. Highlight your strong interpersonal skills, active listening abilities, and ability to build rapport with clients.

5. Be Prepared to Discuss Your Customer Service Experience

Emphasize your commitment to providing exceptional customer service. Share examples of how you’ve gone above and beyond to assist customers and resolve their concerns.

6. Stay Updated on Industry Trends

Demonstrate your passion for the financial industry by staying abreast of the latest trends and regulations. This shows that you’re committed to continuous learning and professional development.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Loan Adviser role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.