Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Loan Analyst position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

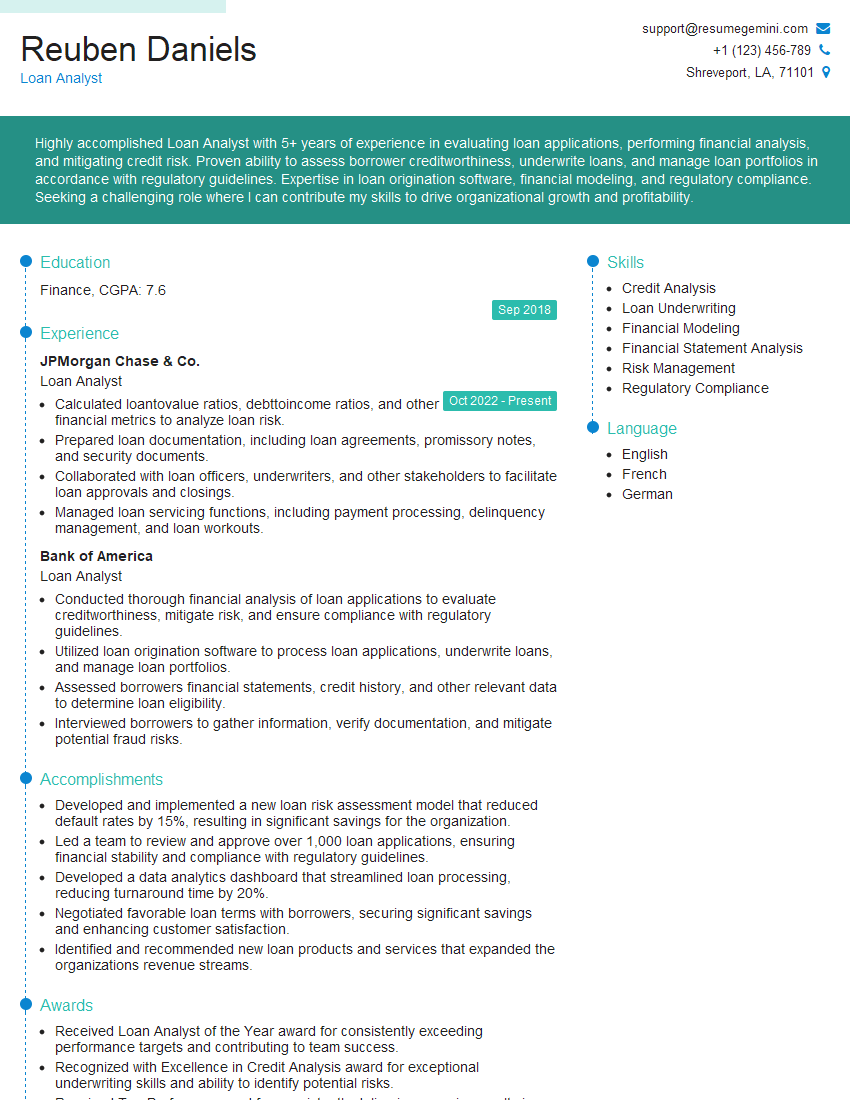

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Analyst

1. Describe the key steps involved in evaluating a loan application?

- Review the applicant’s credit history and financial statements to determine their creditworthiness.

- Calculate the loan-to-value (LTV) ratio to assess the risk of default.

- Interview the applicant to gather additional information about their income, expenses, and financial goals.

- Analyze the property to be financed to determine its value and potential for appreciation.

- Make a recommendation to approve or deny the loan based on the above factors.

2. How do you determine the appropriate interest rate for a loan?

Factors influencing interest rates

- The applicant’s credit score

- The LTV ratio

- The loan term

- The current market interest rates

- The lender’s risk tolerance

Pricing model

- Use a pricing model to calculate the appropriate interest rate based on the above factors.

- Consider the lender’s cost of funds, operating expenses, and profit margin.

- Compare the calculated interest rate to market benchmarks and competitor offerings.

3. What are the different types of loan products that you have experience with?

- Residential mortgages (e.g., conventional, FHA, VA)

- Commercial real estate loans

- Personal loans

- Auto loans

- Small business loans

4. What analytical techniques do you use to assess the financial health of a borrower?

- Ratio analysis (e.g., debt-to-income ratio, LTV ratio, current ratio)

- Cash flow analysis

- Trend analysis

- Sensitivity analysis

- Scenario analysis

5. How do you manage the risk associated with lending?

- Carefully evaluate loan applications and use sound underwriting practices.

- Monitor loan performance and identify potential problems early.

- Maintain a diversified loan portfolio.

- Use hedging instruments to mitigate risk.

- Work with third-party vendors to enhance risk management capabilities.

6. What is your experience with loan servicing?

- Processed loan payments and handled customer inquiries.

- Monitored loan performance and identified potential problems.

- Worked with borrowers to resolve delinquencies and avoid defaults.

- Assisted with loan modifications and foreclosures.

7. What are your strengths and weaknesses as a Loan Analyst?

Strengths

- Strong analytical skills

- Excellent communication and interpersonal skills

- Proficient in loan underwriting software

- Up-to-date knowledge of lending regulations

- Ability to work independently and as part of a team

Weaknesses

- Lack of experience in commercial real estate lending

- Limited experience in loan servicing

- Need to improve time management skills

8. What are your career goals and how does this role fit into them?

- Aspire to become a senior loan officer or manager.

- Interested in developing expertise in commercial real estate lending.

- This role provides an opportunity to gain valuable experience and build a strong foundation for my career goals.

9. Why should we hire you for this role?

- My strong analytical skills and attention to detail make me an ideal candidate for this role.

- My experience in loan underwriting and processing gives me a deep understanding of the lending process.

- I am a highly motivated and results-oriented individual with a strong work ethic.

- I am confident that I can contribute to the success of your team and make a positive impact on your organization.

10. Do you have any questions for me?

- What is the typical loan approval process for this organization?

- What are the key performance indicators for success in this role?

- What opportunities are there for professional development and training?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities: Loan Analyst

Loan analysts play a critical role in evaluating and analyzing loan applications to make informed decisions on lending. Their key responsibilities typically include:

1. Loan Evaluation

Assess the financial health of loan applicants, including their credit history, income, assets, and debts.

- Review financial statements, tax returns, and other relevant documents to determine the applicant’s ability to repay the loan.

- Conduct credit checks and analyze credit reports to evaluate the applicant’s creditworthiness.

2. Risk Assessment

Determine the level of risk associated with lending to an applicant by analyzing their creditworthiness, repayment capacity, and collateral.

- Assess the applicant’s industry and market conditions to identify potential risks.

- Evaluate the potential impact of economic factors and market trends on the applicant’s ability to repay the loan.

3. Loan Structuring

Recommend appropriate loan terms, including the loan amount, interest rate, repayment schedule, and collateral requirements.

- Negotiate loan terms with applicants to ensure the loan is beneficial to both parties.

- Prepare loan documentation and ensure compliance with all applicable laws and regulations.

4. Loan Monitoring

Monitor the performance of the loan, including reviewing financial statements, tracking payments, and assessing the financial health of the borrower.

- Identify potential risks or problems early on and take appropriate action to mitigate them.

- Provide regular updates on the performance of the loan to management and other stakeholders.

Interview Preparation Tips

To ace the interview for a loan analyst position, it is essential to prepare thoroughly. Here are some tips:

1. Practice Answering Common Interview Questions

Research the most common interview questions for loan analysts. Prepare answers that highlight your skills and experience.

- Practice using the STAR method to answer behavioral questions (Situation, Task, Action, Result).

- Emphasize your knowledge of financial analysis, risk assessment, and loan structuring.

2. Study the Company and Position

Research the company thoroughly, including its industry, products, and financial performance. Learn as much as possible about the specific loan analyst position.

- Read the company’s website, news articles, and financial reports.

- Find out the company’s lending criteria, target market, and risk appetite.

3. Show Your Enthusiasm and Industry Knowledge

Express your interest in the position and the industry. Highlight your passion for finance and your understanding of the market.

- Share your insights on current financial trends and how they may impact lending.

- Discuss any relevant projects or experience that demonstrate your analytical skills.

4. Be Ready to Discuss Your Technical Skills

Make sure you are well-versed in the technical skills required for a loan analyst, such as financial analysis software, credit scoring models, and loan documentation.

- Quantify your experience with specific software or techniques.

- Provide examples of how you have used these skills to solve problems or improve loan performance.

5. Ask Informed Questions

Prepare thoughtful questions to ask the interviewer. This shows your interest and engagement.

- Ask about the company’s lending strategy, growth plans, or risk management practices.

- Inquire about the specific responsibilities and expectations for the loan analyst role.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Loan Analyst, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Loan Analyst positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.