Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Loan and Credit Manager interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Loan and Credit Manager so you can tailor your answers to impress potential employers.

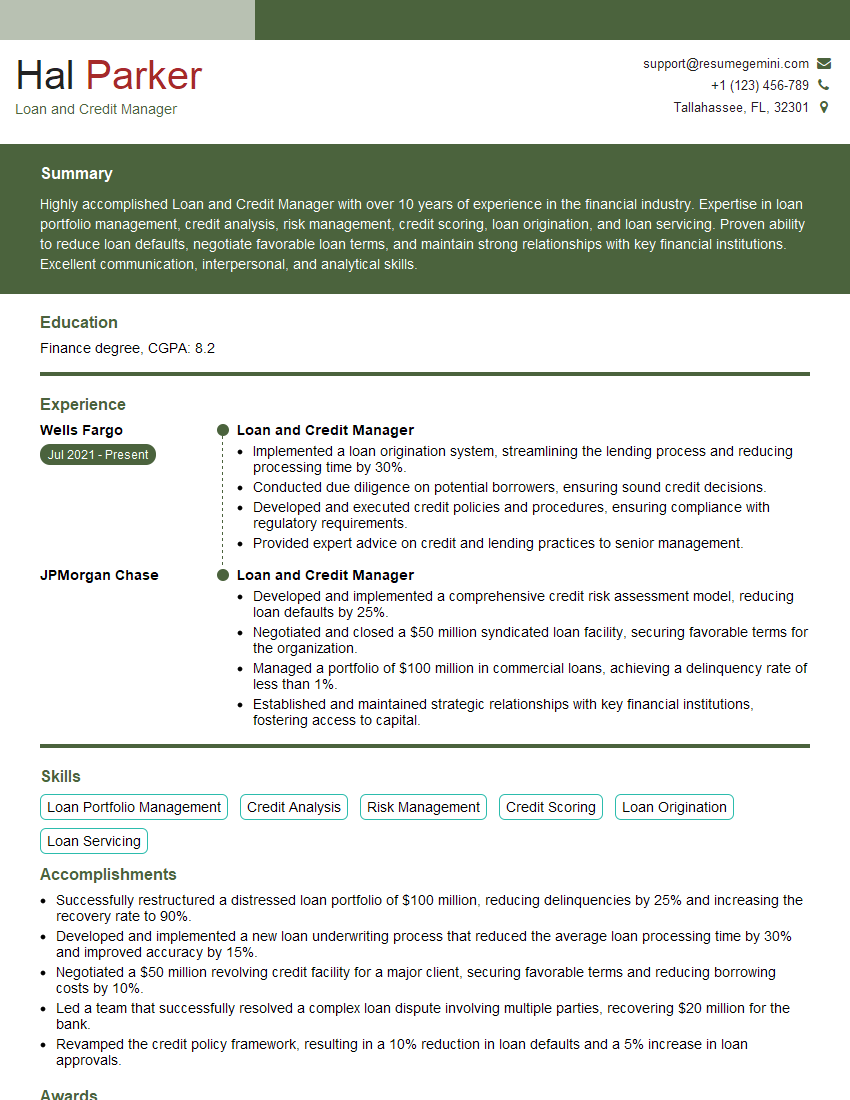

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan and Credit Manager

1. What are the key responsibilities of a Loan and Credit Manager?

- Develop and implement loan and credit policies and procedures

- Assess and approve loan and credit applications

- Manage loan and credit portfolios

- Monitor loan and credit performance

- Resolve loan and credit problems

2. What are the different types of loans that you have experience with?

- Commercial loans

- Consumer loans

- Real estate loans

- Government-backed loans

3. What are the different factors that you consider when evaluating a loan application?

- Credit score

- Debt-to-income ratio

- Collateral

- Income stability

- Employment history

4. What are the different types of credit reports that you are familiar with?

- Experian

- Equifax

- TransUnion

5. What are the different types of credit scoring models that you are familiar with?

- FICO score

- VantageScore

6. What are the different ways to improve a credit score?

- Pay bills on time

- Keep credit utilization low

- Don’t open too many new credit accounts in a short period of time

- Dispute any errors on your credit report

7. What are the different types of loan and credit fraud that you are familiar with?

- Identity theft

- Synthetic identity fraud

- Loan application fraud

- Credit card fraud

8. What are the different ways to prevent loan and credit fraud?

- Verify the identity of the loan applicant

- Check the loan applicant’s credit history

- Review the loan application for any inconsistencies

- Monitor loan and credit accounts for suspicious activity

9. What are the different types of loan and credit insurance that you are familiar with?

- Mortgage insurance

- Title insurance

- Credit life insurance

- Credit disability insurance

10. What are the different ways to maximize loan and credit portfolio performance?

- Originate high-quality loans

- Monitor loan performance closely

- Resolve loan problems quickly

- Use loan and credit analytics to identify trends and opportunities

11. What are your strengths as a Loan and Credit Manager?

- Strong understanding of loan and credit principles

- Experience in developing and implementing loan and credit policies and procedures

- Proven ability to assess and approve loan and credit applications

- Excellent communication and interpersonal skills

- Strong analytical and problem-solving skills

12. What are your weaknesses as a Loan and Credit Manager?

- I am sometimes too detail-oriented

- I can be too conservative in my lending practices

- I am still learning about the latest loan and credit technologies

13. Why are you interested in this position?

- I am passionate about helping people achieve their financial goals

- I believe that I have the skills and experience that you are looking for

- I am eager to learn more about your company and how I can contribute to its success

14. What are your salary expectations?

- My salary expectations are in line with the market rate for similar positions

- I am willing to negotiate

15. Are you available for a background check?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan and Credit Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan and Credit Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Loan and Credit Managers play a pivotal role in the financial industry, overseeing various aspects of loan and credit operations. Their primary responsibilities encompass:

1. Loan Management

Evaluate loan applications, assessing borrowers’ creditworthiness through analysis of financial statements, credit reports, and other relevant documents.

- Approve or deny loan applications based on established credit policies and risk parameters.

- Establish loan terms, including loan amounts, interest rates, and repayment schedules.

- Monitor loan performance, tracking payments, identifying potential risks, and managing delinquent accounts.

2. Credit Analysis

Develop and implement credit scoring and risk assessment models to evaluate the creditworthiness of potential borrowers.

- Stay up-to-date on industry best practices and regulatory changes in credit analysis.

- Identify and mitigate potential loan losses through proactive risk management strategies.

3. Relationship Management

Build and maintain strong relationships with borrowers and other stakeholders.

- Provide guidance and support to borrowers throughout the loan process.

- Negotiate loan modifications and workout agreements to resolve loan defaults.

4. Team Leadership and Collaboration

Lead and motivate a team of loan officers, credit analysts, and other support staff.

- Set clear goals and performance expectations for the team.

- Collaborate with other departments within the organization to ensure smooth loan processing and credit management.

Interview Tips

Preparing for an interview for a Loan and Credit Manager position requires thorough preparation and a strategic approach. Here are some tips to help you ace the interview:

1. Research the Organization and Industry

Familiarize yourself with the organization’s history, mission, values, and financial performance. Understand the industry landscape, including current trends and regulations.

- Visit the company’s website and social media pages to gather information about their culture and recent developments.

- Read industry publications and news articles to stay informed about the latest news and best practices.

2. Highlight Your Skills and Experience

Tailor your resume and cover letter to emphasize your relevant skills and experience in loan management, credit analysis, and risk management. Use specific examples to demonstrate your abilities.

- Quantify your accomplishments with specific metrics, such as the number of loans approved or the percentage of loan portfolio growth you achieved.

- Prepare examples of successful loan modifications or workout agreements you negotiated.

3. Practice Answering Common Interview Questions

Anticipate common interview questions and prepare thoughtful answers that showcase your knowledge and expertise. Research common questions and draft responses that highlight your strengths.

- Prepare answers to questions about your experience in loan underwriting, credit risk assessment, and regulatory compliance.

- Practice answering behavioral questions that assess your problem-solving abilities, decision-making skills, and teamwork experience.

4. Dress Professionally and Be Punctual

Make a positive first impression by dressing professionally and arriving on time for your interview. Your appearance and punctuality reflect your professionalism and respect for the interviewer’s time.

- Choose a conservative suit or business casual attire in neutral colors.

- Plan your route in advance and allow extra time for unexpected delays.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Loan and Credit Manager interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!