Feeling lost in a sea of interview questions? Landed that dream interview for Loan Broker but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Loan Broker interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

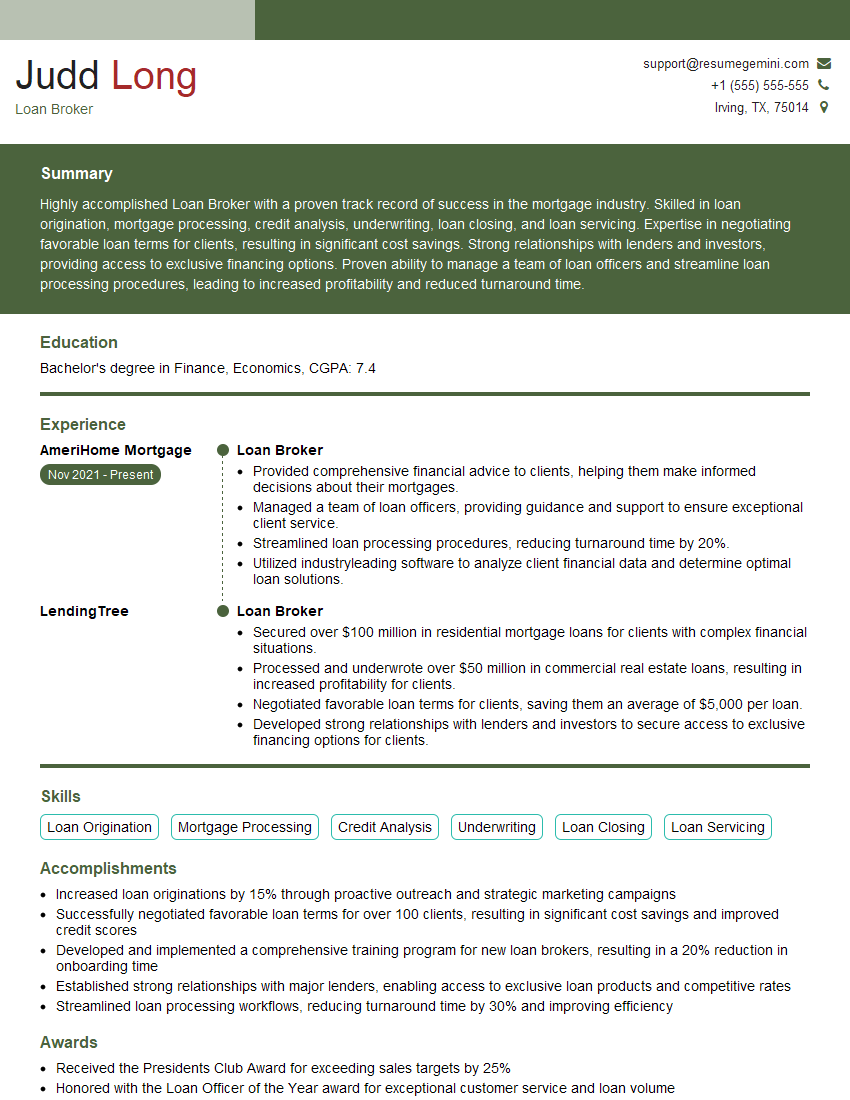

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Broker

1. What are the different types of loan products that you are familiar with?

- Mortgages (conventional, FHA, VA, USDA)

- Home equity loans and lines of credit (HELOCs)

- Auto loans

- Personal loans

- Student loans

- Business loans

2. What are the key factors that you consider when evaluating a loan application?

Credit history and score

- Payment history

- Amount of debt

- Length of credit history

Income and employment

- Stable employment

- Sufficient income to repay the loan

- Low debt-to-income ratio

Collateral

- For secured loans, the value and condition of the collateral

Loan purpose

- Whether the loan is for a responsible purpose

3. How do you stay up-to-date on changes in the mortgage industry?

- Attend industry conferences and webinars

- Read trade publications and articles

- Network with other loan professionals

- Take continuing education courses

- Stay informed about changes in government regulations

4. What is your process for finding the best loan options for your clients?

- Gather information about the client’s financial situation and loan needs

- Shop around with multiple lenders to find the best rates and terms

- Explain the different loan options to the client and help them choose the best one for their needs

- Prepare and submit the loan application

- Track the loan progress and keep the client informed

- Close the loan and ensure that the client understands the terms

5. What are some of the challenges that you have faced in your role as a loan broker?

- Finding the right loan for clients with complex financial situations

- Dealing with difficult clients

- Keeping up with changes in the mortgage industry

- Staying competitive in a crowded marketplace

- Handling loan denials

6. What are your strengths as a loan broker?

- Excellent communication and interpersonal skills

- Strong knowledge of the mortgage industry

- Ability to find the best loan options for clients

- Commitment to providing excellent customer service

- Detail-oriented and organized

7. What are your weaknesses as a loan broker?

- I can be a bit too detail-oriented at times

- I am still learning about the mortgage industry

- I am not always the best at dealing with difficult clients

- I can be a bit of a perfectionist

- I am not always the best at time management

8. What are your career goals?

- To become a top-producing loan broker

- To help as many people as possible achieve their homeownership dreams

- To build a successful and profitable business

- To make a difference in the lives of others

- To be a leader in the mortgage industry

9. Why are you interested in working for our company?

- I am impressed by your company’s reputation for excellence in the mortgage industry

- I believe that your company’s values align with my own

- I am confident that I can make a valuable contribution to your team

- I am excited about the opportunity to learn from experienced professionals

- I am eager to help your company grow and succeed

10. What questions do you have for me?

- What is the company’s culture like?

- What is the company’s training program for new loan brokers?

- What are the company’s expectations for loan brokers?

- What is the company’s compensation structure for loan brokers?

- What is the company’s track record of success?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Broker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Broker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Loan Broker serves as an intermediary between borrowers and lenders, connecting them to secure financial loans. They play a pivotal role in the mortgage industry by evaluating borrowers’ creditworthiness, identifying suitable loan programs, and facilitating the loan process.

1. Client Consultations

Loan Brokers engage in consultations with potential borrowers to understand their financial needs and goals. They analyze borrowers’ credit histories, income, assets, and liabilities to assess their eligibility for various loan products.

- Conduct thorough financial needs assessments.

- Provide guidance on loan options and interest rates.

2. Loan Product Evaluation

Loan Brokers have a comprehensive understanding of a wide range of loan products, including mortgages, personal loans, and business loans. They compare interest rates, loan terms, and eligibility criteria to find the most suitable options for borrowers.

- Research and evaluate loan programs from different lenders.

- Identify loan products that align with borrowers’ needs.

3. Loan Application Preparation

Loan Brokers assist borrowers in completing loan applications accurately and thoroughly. They gather necessary documentation, such as income statements, tax returns, and asset verification, to support the application.

- Prepare loan applications on behalf of borrowers.

- Ensure that applications meet lender requirements.

4. Lender Negotiations

Loan Brokers represent borrowers in negotiations with lenders. They advocate for favorable loan terms, interest rates, and closing costs. They also coordinate with lenders to resolve any issues in the loan process.

- Negotiate loan terms on behalf of borrowers.

- Resolve loan approval issues with lenders.

Interview Tips

Preparing for an interview as a Loan Broker requires a comprehensive understanding of the role and its responsibilities. Here are some tips to help you ace your interview:

1. Research the Company and Industry

Before the interview, gründlich investigate the company you are applying to and the mortgage industry in general. This will demonstrate your interest and knowledge of the field.

- Visit the company’s website and social media pages.

- Read industry news and articles to stay abreast of trends.

2. Practice Common Interview Questions

Anticipate common interview questions and prepare thoughtful Antworten. Focus on your skills, experience, and why you are the best candidate for the role.

- Why are you interested in becoming a Loan Broker?

- Describe your experience in the mortgage industry.

- How do you stay up-to-date on the latest loan products?

3. Highlight Your Communication and Negotiation Skills

Loan Brokers must be able to effectively communicate with borrowers and lenders. Emphasize your ability to build rapport, actively listen, and negotiate favorable loan terms.

- Provide examples of how you have successfully negotiated with lenders.

- Describe your approach to resolving loan approval issues.

4. Showcase Your Knowledge of Loan Products

Demonstrate your in-depth understanding of various loan products, including mortgages, personal loans, and business loans. Highlight your ability to evaluate loan options and identify the most suitable choices for borrowers.

- Discuss the key features of different loan types.

- Provide examples of how you have helped borrowers find the right loan programs.

5. Emphasize Your Commitment to Customer Service

Loan Brokers play a crucial role in guiding borrowers through the loan process. Emphasize your dedication to providing exceptional customer service and building lasting relationships with clients.

- Share examples of how you have exceeded client expectations.

- Explain your approach to personalized loan guidance.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Loan Broker role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.