Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Loan Consultant interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Loan Consultant so you can tailor your answers to impress potential employers.

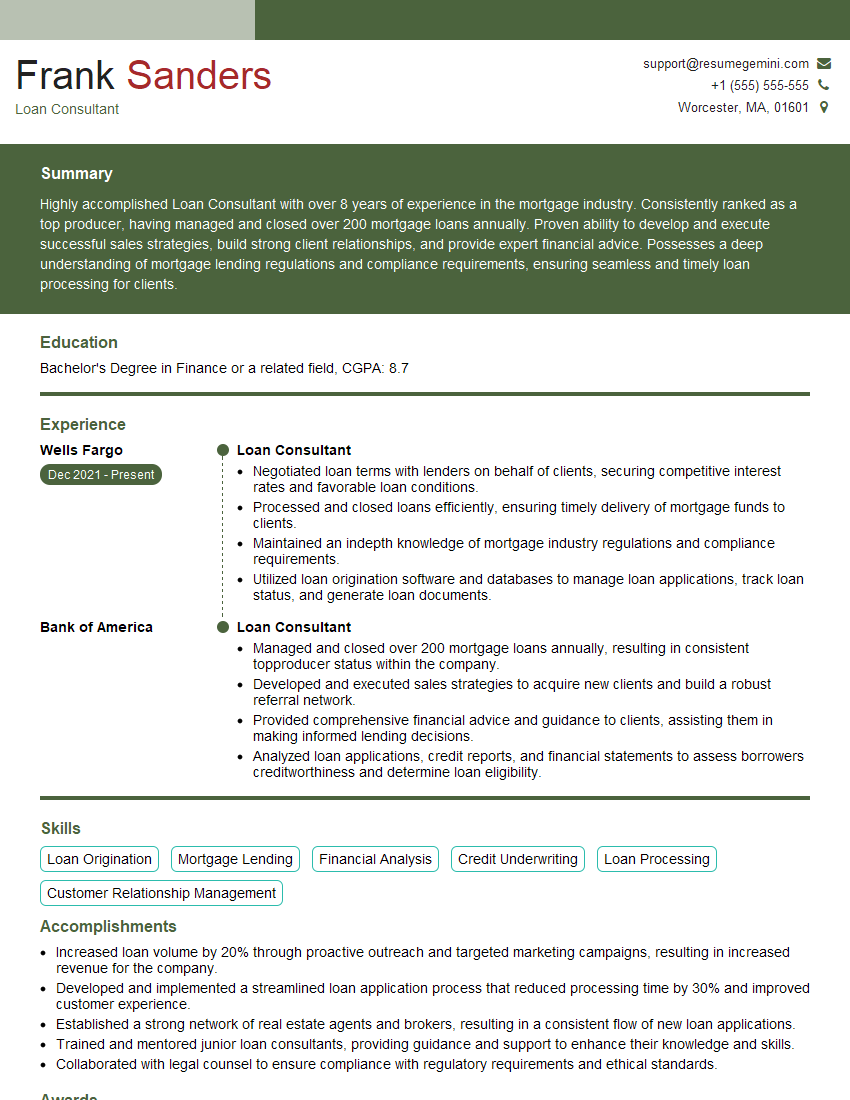

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Consultant

1. Describe the different types of loans that you are familiar with.

- Residential mortgages (conventional, government-insured, jumbo)

- Commercial real estate loans (office buildings, retail centers, industrial properties)

- Consumer loans (auto loans, personal loans, credit cards)

- Business loans (term loans, lines of credit, SBA loans)

- Agricultural loans (farm equipment, land, livestock)

2. What are the key factors that you consider when evaluating a loan application?

Credit history

- Review the applicant’s credit report for any negative items, such as late payments, collections, or bankruptcies.

- Calculate the applicant’s credit score to assess their overall creditworthiness.

Income and debt

- Verify the applicant’s income by reviewing pay stubs, tax returns, or other financial documents.

- Calculate the applicant’s debt-to-income ratio to ensure that they can afford the loan payments.

Collateral

- Determine if the loan is secured by any collateral, such as a house or a car.

- Evaluate the value of the collateral to ensure that it is sufficient to cover the loan amount.

Purpose of the loan

- Understand the applicant’s reason for borrowing money.

- Assess whether the loan purpose is sound and aligns with the lender’s guidelines.

3. How do you handle objections from potential borrowers?

- Listen attentively to the borrower’s objections and try to understand their concerns.

- Provide clear and concise explanations of the loan terms and conditions.

- Offer alternative solutions or concessions that may address the borrower’s concerns.

- Be patient and professional, and avoid becoming defensive or argumentative.

- If necessary, escalate the issue to a supervisor or manager for assistance.

4. What are the most common challenges that you face as a loan consultant?

- Dealing with difficult borrowers who may be hesitant or skeptical.

- Meeting sales targets and quotas in a competitive environment.

- Staying up-to-date on the latest lending regulations and industry trends.

- Balancing the need to provide excellent customer service with the need to maintain profitability.

- Managing a large workload and multiple deadlines effectively.

5. How do you stay motivated and engaged in your work?

- Set personal goals and track my progress towards achieving them.

- Seek out opportunities for professional development and training.

- Build relationships with colleagues and clients and learn from their experiences.

- Celebrate successes and learn from failures.

- Take breaks and engage in activities that I find refreshing and enjoyable.

6. What are your strengths and weaknesses as a loan consultant?

Strengths

- Excellent communication and interpersonal skills

- Strong knowledge of lending products and regulations

- Ability to build rapport with clients and earn their trust

- Attention to detail and ability to manage multiple tasks effectively

- Commitment to providing outstanding customer service

Weaknesses

- I can be too detail-oriented at times, which can slow down the loan process

- I am still learning about the commercial lending side of the business

- I can be a bit of a perfectionist, which can lead to me spending too much time on certain tasks

7. What are your career goals?

- To become a top-performing loan consultant and consistently exceed sales targets.

- To develop my expertise in commercial lending and become a trusted advisor to my clients.

- To eventually move into a management role and lead a team of loan consultants.

- To make a positive impact on the lives of my clients by helping them achieve their financial goals.

8. Why are you interested in working for our company?

- I am impressed by your company’s reputation for excellence in the lending industry.

- I am eager to contribute my skills and experience to your team.

- I believe that your company’s values align with my own.

- I am confident that I can be a valuable asset to your organization.

9. What is your favorite type of loan to work on?

- I enjoy working on complex commercial real estate loans because they require a high level of expertise and attention to detail.

- I also find it rewarding to help first-time homebuyers achieve their dream of homeownership.

10. What are your thoughts on the current state of the lending industry?

- I believe that the lending industry is facing a number of challenges, including rising interest rates, increased regulation, and a competitive market.

- However, I am optimistic about the future of the industry and believe that there will always be a demand for qualified loan consultants.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Consultant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Consultant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Loan Consultants are the face of the lending institution, providing expertise and guidance to customers seeking financial solutions. Their primary responsibilities include:

1. Customer Acquisition and Lead Generation

Identifying and qualifying potential borrowers, generating leads through various channels, and building a strong referral network.

2. Loan Origination and Processing

Collecting and analyzing borrower information, processing loan applications, and ensuring compliance with underwriting guidelines.

3. Product and Loan Education

Educating customers about different loan products, terms, and rates, and helping them choose the most suitable options.

4. Negotiation and Closing

Negotiating loan terms, preparing loan documentation, and guiding customers through the closing process to ensure a smooth transaction.

5. Customer Relationship Management

Maintaining ongoing relationships with clients, providing post-loan support, and addressing any concerns or questions.

6. Market Research and Competitive Analysis

Staying up-to-date with industry trends, competitive offerings, and regulatory changes to enhance the company’s market position.

Interview Tips

To ace the interview for a Loan Consultant position, candidates should prepare by:

1. Researching the Company and Industry

Demonstrating knowledge of the lending institution, its products, and the industry landscape.

2. Practicing Product Knowledge

Thoroughly understanding the different loan products and their complexities to answer questions confidently.

3. Preparing Success Stories

Identifying examples of successful loan originations, emphasizing their ability to provide personalized solutions and exceed customer expectations.

4. Highlighting Communication and Interpersonal Skills

Emphasizing their ability to build strong relationships, communicate effectively, and adapt to different customer needs.

5. Demonstrating Attention to Detail and Accuracy

Stressing their meticulousness, attention to detail, and commitment to ensuring loan accuracy and compliance.

6. Preparing for Behavioral Questions

Reviewing common behavioral interview questions and practicing responses that demonstrate their problem-solving, customer-centric, and ethical values.

7. Asking Thoughtful Questions

Preparing insightful questions to ask the interviewer, showing their interest in the position and the company.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Loan Consultant interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.