Feeling lost in a sea of interview questions? Landed that dream interview for Loan Counselor but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Loan Counselor interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

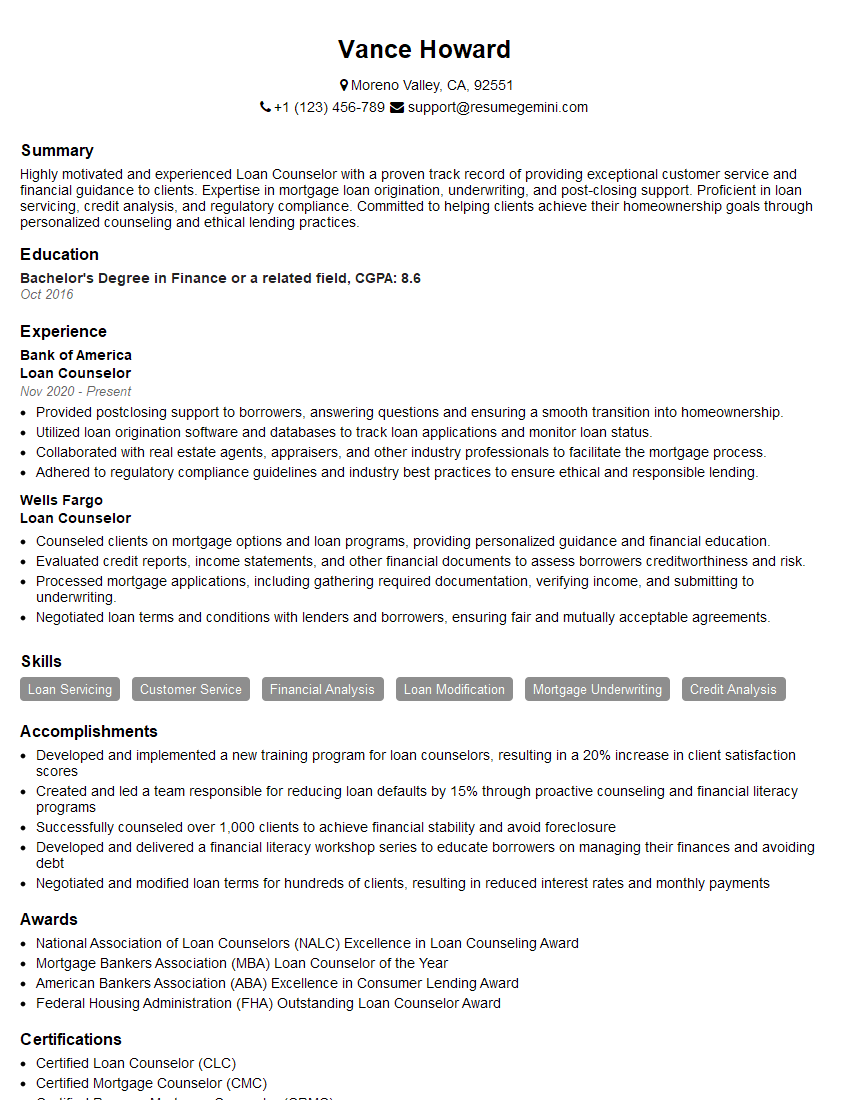

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Counselor

1. Describe the process of evaluating a loan application?

During loan application evaluation, I conduct a thorough assessment of the applicant’s:

- Credit history and score

- Income and debt-to-income ratio

- Employment history and stability

- Assets and liabilities

- Property or collateral being financed

2. How do you determine an applicant’s creditworthiness?

Credit History

- Review credit reports for any delinquencies, missed payments, or bankruptcies

- Calculate credit scores to assess overall creditworthiness

Income and Debt

- Verify income through pay stubs, tax returns, or other sources

- Calculate debt-to-income ratio to ensure that loan payments are manageable

3. What factors do you consider when approving or denying a loan?

When making a decision, I consider the following key factors:

- Applicant’s creditworthiness and financial stability

- Purpose and terms of the loan

- Collateral or security being offered

- Lender’s underwriting guidelines and policies

- Market conditions and interest rates

4. How do you handle high-risk or complex loan applications?

For high-risk or complex applications, I take the following steps:

- Gather additional documentation and information to assess the applicant’s financial situation

- Consult with underwriters or supervisors to seek guidance and support

- Review industry best practices and consider alternative loan options

5. What strategies do you use to resolve delinquent loan accounts?

To resolve delinquent accounts, I employ the following strategies:

- Contact borrowers promptly to understand their situation and offer assistance

- Review loan terms and explore options for payment plans or modifications

- Negotiate settlements when necessary to minimize losses

- Refer borrowers to credit counseling agencies for support

6. How do you maintain confidentiality and protect borrower information?

I strictly adhere to all applicable regulations and guidelines to safeguard borrower information. My practices include:

- Storing data securely and limiting access only to authorized personnel

- Shredding or destroying sensitive documents when no longer needed

- Adhering to privacy policies and obtaining consent for data collection

7. How do you stay up-to-date with industry trends and regulations?

To stay informed, I:

- Attend industry conferences and webinars

- Subscribe to trade publications and newsletters

- Participate in continuing education and training programs

8. What software and tools do you use in your role as a Loan Counselor?

I am proficient in using the following software and tools:

- Loan origination systems (LOS)

- Credit reporting platforms

- Customer relationship management (CRM) systems

- Loan analysis and underwriting software

9. How do you manage a high volume of loan applications while maintaining accuracy and efficiency?

To manage a high volume while ensuring accuracy, I:

- Establish clear processes and workflows

- Utilize technology and automation tools

- Prioritize tasks based on urgency and deadlines

- Collaborate with colleagues and delegate responsibilities

10. How do you build rapport with borrowers and provide exceptional customer service?

Building rapport and providing excellent customer service is crucial. I:

- Listen attentively to borrowers’ needs and concerns

- Communicate clearly and patiently

- Empathize with borrowers while maintaining professionalism

- Go the extra mile to assist and resolve issues

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Counselor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Counselor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Loan Counselors provide guidance and assistance to borrowers who are experiencing financial difficulties. They work with borrowers to develop and implement repayment plans, and may also provide information on other financial assistance programs. Key job responsibilities include:Communicating with borrowers to assess their financial situation and discuss repayment options.

Developing and implementing individualized repayment plans, and monitoring borrowers’ progress.

Providing information on other financial assistance programs, such as credit counseling and debt consolidation.

Educating borrowers on personal finance topics, such as budgeting and credit management.

Collaborating with other team members, such as case managers and social workers, to provide comprehensive support to borrowers.

Interview Tips

Preparing thoroughly for an interview can increase your chances of making a positive impression on the interviewer and landing the job. Here are some tips for acing a loan counselor interview:1. Research the company and the position:

Visit the company’s website to learn about their mission, values, and the specific role you’re applying for. This will help you tailor your answers to the interviewer’s questions, and demonstrate your interest in the position.

2. Practice your answers to common interview questions:

There are certain questions that are commonly asked in loan counselor interviews. Prepare your answers to these questions in advance, and practice delivering them in a clear and concise manner. Some common interview questions for loan counselors include:

- Tell me about your experience in working with borrowers who are experiencing financial difficulties.

- What are your strengths as a loan counselor?

- What are your weaknesses as a loan counselor?

- Why are you interested in this position?

- What are your salary expectations?

3. Dress professionally and arrive on time for your interview:

First impressions matter, so make sure you dress professionally for your interview. Arrive on time, and be prepared to answer questions about your experience and qualifications.

4. Be prepared to ask questions about the company and the position:

Asking questions at the end of an interview shows that you’re interested in the position and that you’ve taken the time to prepare for the interview. Some good questions to ask include:

- What are the biggest challenges facing the company right now?

- What are the company’s goals for the next year?

- What is the company culture like?

- What is the training and development process for new employees?

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Loan Counselor interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.