Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Loan Manager position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

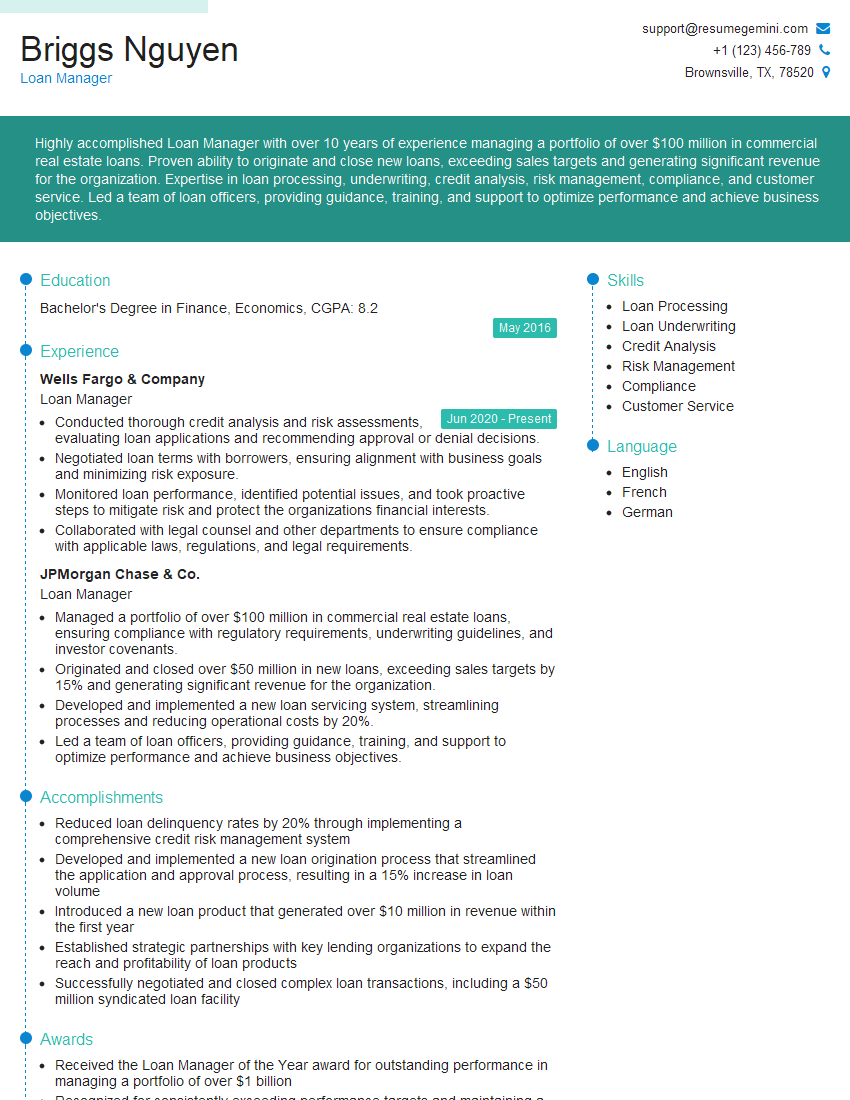

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Manager

1. Explain the key aspects of credit underwriting for a loan application?

Credit underwriting is the process of assessing the creditworthiness of a loan applicant. The key aspects of credit underwriting include:

- Income and employment: The lender will assess the applicant’s income and employment history to determine their ability to repay the loan.

- Debt-to-income ratio: The lender will calculate the applicant’s debt-to-income ratio to determine how much of their income is already being used to repay debt.

- Credit history: The lender will review the applicant’s credit history to assess their track record of repaying debt.

- Collateral: The lender may require the applicant to provide collateral, such as a house or a car, to secure the loan.

2. Describe the different types of loan products you have experience with?

I have experience with a wide range of loan products, including:

- Mortgages: I have experience with both residential and commercial mortgages.

- Consumer loans: I have experience with auto loans, personal loans, and credit card loans.

- Business loans: I have experience with small business loans, commercial real estate loans, and equipment loans.

3. How do you stay up to date with the latest lending regulations and industry best practices?

I stay up to date with the latest lending regulations and industry best practices by:

- Reading industry publications: I read industry publications such as Mortgage Banking and American Banker to stay informed about the latest trends and developments.

- Attending industry conferences: I attend industry conferences to learn about new products and services and to network with other professionals.

- Completing continuing education courses: I complete continuing education courses to keep my knowledge up to date on the latest regulations and best practices.

4. What are some of the challenges you have faced in your previous role as a Loan Manager and how did you overcome them?

One of the challenges I faced in my previous role as a Loan Manager was the economic downturn of 2008. During this time, there was a significant increase in loan defaults and foreclosures. To overcome this challenge, I worked closely with my team to develop new underwriting guidelines and to implement new risk management strategies. I also worked with our borrowers to help them stay in their homes and avoid foreclosure.

5. What are some of the key performance indicators (KPIs) that you track as a Loan Manager?

The key performance indicators (KPIs) that I track as a Loan Manager include:

- Loan origination volume: The total amount of loans that I originate in a given period of time.

- Loan default rate: The percentage of loans that I originate that default.

- Customer satisfaction: The level of satisfaction that my customers have with my services.

- Operational efficiency: The efficiency of my loan origination process.

6. How do you manage risk in your loan portfolio?

I manage risk in my loan portfolio by:

- Diversifying my portfolio: I diversify my portfolio across a range of loan products and borrowers.

- Setting prudent underwriting guidelines: I establish prudent underwriting guidelines to ensure that I only originate loans to borrowers who are likely to repay their debts.

- Monitoring my portfolio: I closely monitor my portfolio for any signs of trouble.

- Taking appropriate action: I take appropriate action, such as modifying the loan terms or foreclosing on the property, to mitigate any losses.

7. What are your thoughts on the future of the lending industry?

I believe that the future of the lending industry is bright. There is a growing demand for loans from both consumers and businesses. I also believe that technology will continue to play a major role in the lending process, making it easier and more efficient for borrowers to get the financing they need.

8. What are your strengths and weaknesses as a Loan Manager?

My strengths as a Loan Manager include:

- Strong understanding of lending regulations and industry best practices: I have a strong understanding of the lending regulations and industry best practices, which allows me to originate loans that are compliant and safe.

- Excellent communication and interpersonal skills: I have excellent communication and interpersonal skills, which allow me to build strong relationships with my customers and colleagues.

- Proven track record of success: I have a proven track record of success in the lending industry. I have originated a significant volume of loans and have consistently exceeded my performance goals.

My weaknesses as a Loan Manager include:

- Lack of experience in some areas of lending: I do not have experience in all areas of lending, such as commercial real estate lending.

- Can be too detail-oriented at times: I can be too detail-oriented at times, which can sometimes slow down the loan origination process.

9. Why are you interested in this position?

I am interested in this position because I am confident that I have the skills and experience that you are looking for in a Loan Manager. I am also excited about the opportunity to work for your company. I have heard great things about your company’s culture and commitment to customer service. I believe that my skills and experience would be a valuable asset to your team.

10. What are your salary expectations?

My salary expectations are in line with the market rate for similar positions. I am open to discussing a salary that is commensurate with my experience and qualifications.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Loan Managers play a crucial role in the financial services industry by overseeing the entire loan application lifecycle, from initial underwriting to loan servicing and collections. Their responsibilities encompass the following key areas:

1. Loan Underwriting

Assess and evaluate loan applications to determine the applicant’s creditworthiness, risk profile, and ability to repay the loan. Utilize financial analysis tools and industry knowledge to make informed lending decisions.

- Analyze financial statements, credit reports, and other relevant documentation.

- Determine the loan amount, interest rate, and repayment terms that align with the applicant’s financial situation and risk profile.

2. Loan Servicing

Monitor loan accounts to ensure timely and accurate payments, provide customer service, and resolve any issues or disputes that arise during the loan term.

- Process monthly payments, apply interest, and maintain accurate loan records.

- Communicate with borrowers to provide updates, answer questions, and collect past-due payments.

- Negotiate payment plans or loan modifications in cases of financial hardship.

3. Loan Collections

Manage delinquent loan accounts, implement collection strategies, and work with external collection agencies to maximize loan recovery.

- Identify and categorize delinquent accounts based on payment status and risk level.

- Develop and implement collection strategies that adhere to ethical guidelines and regulatory compliance.

- Coordinate with legal counsel to pursue legal action if necessary.

4. Risk Management

Analyze loan portfolios to identify potential risks, develop strategies to mitigate losses, and ensure compliance with industry regulations.

- Monitor loan performance, identify trends, and forecast potential risks.

- Implement policies and procedures to minimize loan defaults and protect the institution’s financial stability.

- Stay up-to-date on industry best practices and regulatory changes.

Interview Tips

To help candidates ace their Loan Manager interview, here are some essential tips and preparation strategies:

1. Research the Industry and the Company

Thoroughly research the financial services industry, loan products, and the specific company you’re interviewing with. This will demonstrate your interest and knowledge of the field.

- Read industry publications, attend conferences, and follow industry experts to stay informed about current trends.

- Visit the company’s website, social media pages, and LinkedIn profile to learn about their culture, values, and loan portfolio.

2. Practice Your Presentation Skills

Loan Managers often need to present their findings and recommendations to senior management or loan committees. Practice your presentation skills to ensure you can clearly and concisely convey your analysis and insights.

- Prepare a brief presentation on a loan case that you’ve recently worked on, highlighting your analytical skills and decision-making process.

- Practice delivering the presentation with confidence and clarity, using visuals to support your points.

3. Demonstrate Your Analytical Abilities

Loan Managers need to be able to analyze financial data, assess risk, and make informed lending decisions. Brush up on your financial analysis skills and be prepared to discuss your approach to credit evaluation.

- Review the fundamentals of financial statement analysis, including key ratios and metrics.

- Prepare examples of loan applications you’ve evaluated, explaining how you determined the applicant’s creditworthiness and repayment capacity.

4. Show Your Passion for Customer Service

Loan Managers often interact directly with borrowers, so it’s crucial to demonstrate your passion for customer service. Share examples of how you’ve resolved customer issues and built strong relationships.

- Describe a situation where you went above and beyond to help a borrower in financial distress.

- Discuss how you prioritize customer satisfaction and ensure that borrowers have a positive experience throughout the loan lifecycle.

5. Prepare for Common Interview Questions

Be prepared for common interview questions related to your loan management experience, analytical skills, and approach to customer service. Practice answering these questions with confidence and clarity.

- Tell me about your experience in loan underwriting and risk management.

- How do you approach the evaluation of a loan application?

- Describe your strategy for managing delinquent accounts and maximizing loan recovery.

- What are your strengths and weaknesses as a Loan Manager?

- Why are you interested in this position and our company?

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Loan Manager interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!