Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Loan Teller interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Loan Teller so you can tailor your answers to impress potential employers.

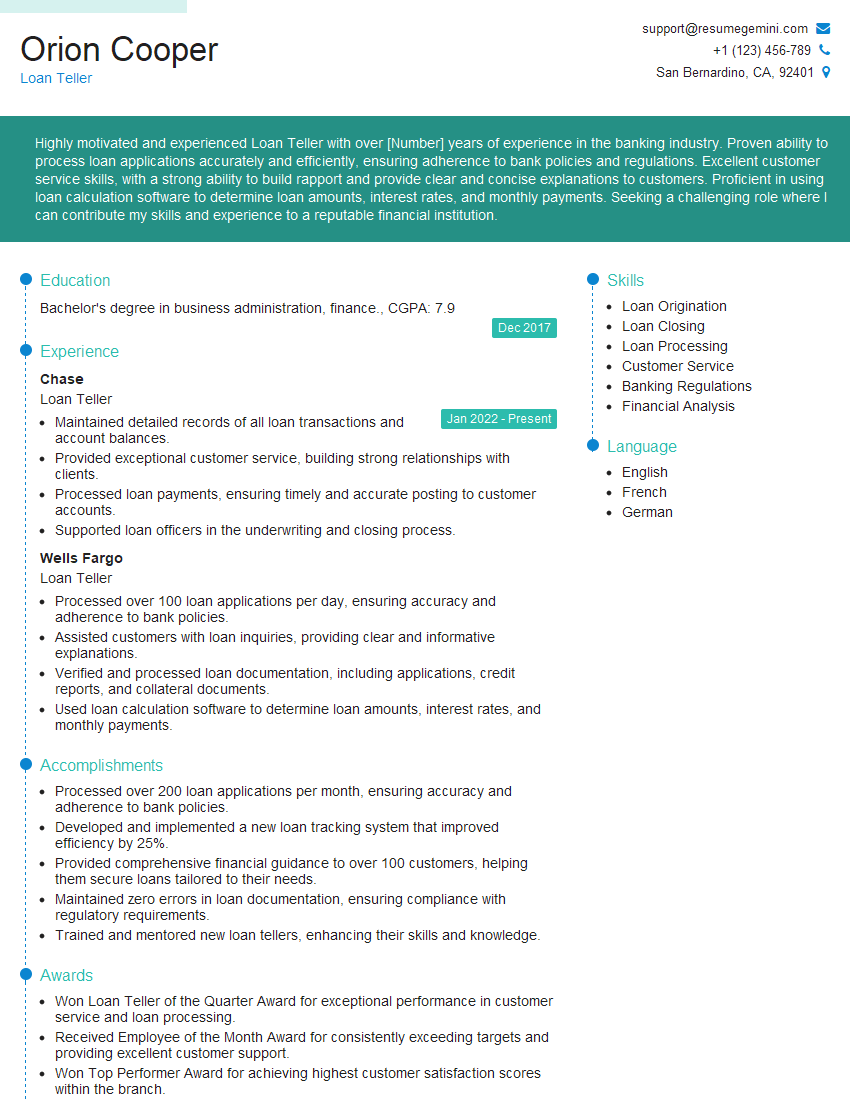

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Teller

1. What are the different types of loans that you are familiar with?

- Mortgage loans: These are loans that are secured by real estate, such as a house or a condo.

- Auto loans: These are loans that are secured by a car.

- Personal loans: These are loans that are not secured by any collateral.

- Business loans: These are loans that are used to finance a business.

- Student loans: These are loans that are used to finance education.

2. What are the key factors that you consider when evaluating a loan application?

Credit history

- This is one of the most important factors that we consider when evaluating a loan application.

- We look at your credit score, which is a number that represents your creditworthiness.

- We also look at your credit report, which shows your history of borrowing and repaying debt.

Income and employment

- We need to make sure that you have a stable income and that you are employed by a reputable company.

- We will ask for proof of income, such as pay stubs or tax returns.

- We will also verify your employment with your employer.

Debt-to-income ratio

- This is the percentage of your monthly income that goes towards paying off debt.

- We want to make sure that your debt-to-income ratio is not too high, as this could indicate that you are overextended.

3. What are some of the challenges that you face in your role as a loan teller?

- Dealing with difficult customers. Some customers can be difficult to deal with, especially if they are not approved for a loan.

- Maintaining a high level of accuracy. We need to be very careful when processing loan applications, as even a small mistake can have serious consequences.

- Keeping up with the latest regulations. The banking industry is constantly changing, so we need to stay up-to-date on the latest regulations.

4. What are some of the most important qualities that a successful loan teller should have?

- Excellent customer service skills. We need to be able to communicate effectively with customers and build relationships with them.

- Attention to detail. We need to be able to pay close attention to detail and make sure that we are processing loan applications accurately.

- Strong work ethic. We need to be able to work hard and meet deadlines.

- Teamwork skills. We need to be able to work well with others and as part of a team.

5. What are your career goals?

- I would like to continue developing my skills and knowledge in the banking industry.

- I am interested in eventually becoming a loan officer.

- I am also interested in learning more about other areas of banking, such as investment and wealth management.

6. Why are you interested in working for our bank?

- I am impressed by your bank’s commitment to customer service.

- I believe that my skills and experience would be a valuable asset to your team.

- I am eager to learn more about the banking industry and grow my career with your company.

7. What is your understanding of the role of a loan teller?

- The role of a loan teller is to provide excellent customer service to customers who are applying for loans.

- Loan tellers process loan applications, answer customer questions, and provide information about loan products.

- Loan tellers also need to be able to identify and mitigate risks associated with lending.

8. What is your experience with lending?

- I have worked as a loan teller for the past three years.

- In this role, I have processed loan applications, answered customer questions, and provided information about loan products.

- I have also received training on how to identify and mitigate risks associated with lending.

9. What is your understanding of the different types of loans that are available?

- There are many different types of loans available, including:

- Mortgages

- Auto loans

- Personal loans

- Business loans

- Student loans

- Each type of loan has its own unique features and benefits.

- It is important to understand the different types of loans available in order to help customers choose the best loan for their needs.

10. What is your experience with customer service?

- I have a strong track record of providing excellent customer service.

- I am always polite and respectful, even when dealing with difficult customers.

- I am able to build rapport with customers and make them feel comfortable.

- I am also able to resolve customer complaints quickly and effectively.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Teller.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Teller‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Loan Tellers play a crucial role in financial institutions by providing exceptional customer service and handling loan-related transactions. Their primary responsibilities include:

1. Customer Service and Loan Processing

Loan Tellers provide personalized service to customers seeking loan products.

- Greet customers, establish rapport, and address their loan inquiries.

- Process loan applications, collect required documentation, and verify customer information.

2. Loan Account Management

Tellers manage customer loan accounts efficiently and accurately.

- Receive and process loan payments, issue receipts, and maintain accurate account records.

- Handle loan modifications, extensions, or payoffs as per bank policies and procedures.

3. Cashier Functions

Loan Tellers perform cashier duties related to loan transactions.

- Disburse loan funds, issue cashier’s checks, and cash customer checks.

- Reconcile cash drawers, balance transactions, and adhere to security protocols.

4. Sales and Marketing

Loan Tellers may contribute to the bank’s sales and marketing efforts.

- Promote loan products and services to potential customers.

- Maintain a positive and professional image of the bank.

Interview Tips

Preparing for a Loan Teller interview requires thorough research and practice. Here are some essential tips to help candidates ace the interview:

1. Research the Company and Position

Familiarize yourself with the financial institution and the specific loan teller position.

- Visit the bank’s website, read about their loan products, and understand their customer service philosophy.

- Research industry trends and best practices related to loan processing and customer service.

2. Practice Common Interview Questions

Anticipate common interview questions and prepare thoughtful responses that highlight your skills and experience.

- Prepare an introduction that showcases your enthusiasm for the role and how your qualifications match the job requirements.

- Practice answering behavioral questions using the STAR method (Situation, Task, Action, Result).

3. Emphasize Customer Service Skills

Interviewers will want to assess your ability to provide exceptional customer service.

- Highlight your interpersonal skills, empathy, and problem-solving abilities.

- Share examples of how you have successfully handled challenging customer interactions in the past.

4. Demonstrate Attention to Detail

Loan Tellers must be highly accurate and detail-oriented in their work.

- Emphasize your ability to handle complex loan transactions accurately and efficiently.

- Explain how you ensure data accuracy and maintain confidentiality during loan processing.

5. Be Professional and Enthusiastic

A professional demeanor and a positive attitude are essential for success in this role.

- Dress professionally, arrive on time, and maintain a confident but respectful demeanor throughout the interview.

- Express your eagerness to learn, contribute, and grow within the organization.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Loan Teller role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.