Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Loan Workout Officer interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Loan Workout Officer so you can tailor your answers to impress potential employers.

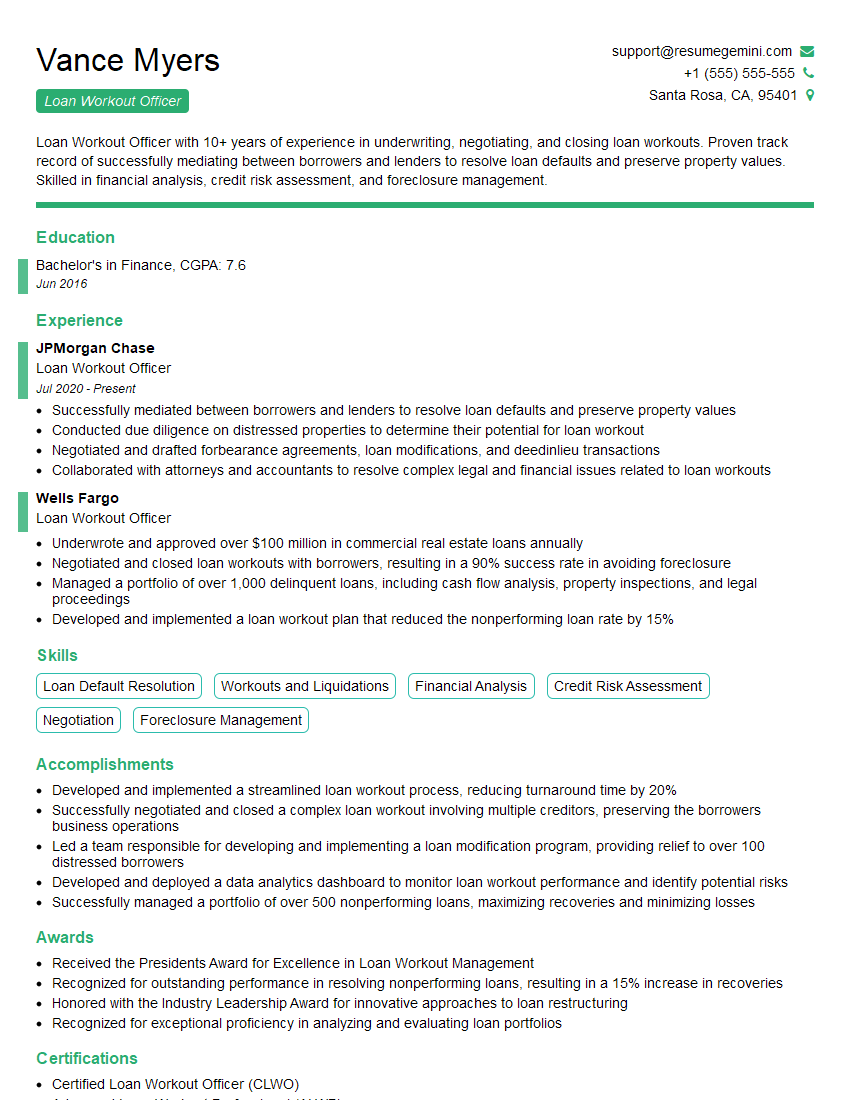

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Workout Officer

1. What are the key steps involved in the loan workout process?

The key steps involved in the loan workout process are:

- Identify and assess the problem loan.

- Develop and implement a workout plan.

- Monitor the workout plan and make adjustments as needed.

- Resolve the loan workout.

2. What are the different types of loan workouts?

Types of Loan Workout

- Forbearance: Temporarily reducing or suspending loan payments.

- Extension: Extending the loan term.

- Modification: Changing the loan terms, such as interest rate or payment amount.

- Refinancing: Replacing the existing loan with a new loan.

- Liquidation: Selling the collateral to repay the loan.

Factors Affecting Workout Type

- Financial condition of the borrower

- Collateral value

- Loan terms and conditions

3. What are the factors that you consider when evaluating a loan workout proposal?

The factors that I consider when evaluating a loan workout proposal include:

- The financial condition of the borrower.

- The collateral value.

- The loan terms and conditions.

- The potential impact of the workout on the lender and other stakeholders.

4. What are the challenges of being a Loan Workout Officer?

The challenges of being a Loan Workout Officer include:

- Dealing with distressed borrowers.

- Negotiating complex workouts.

- Managing risk and exposure.

- Staying up-to-date on industry regulations and best practices.

5. What is your approach to working with distressed borrowers?

My approach to working with distressed borrowers is to be both empathetic and assertive.

- Empathy: I understand that borrowers may be going through a difficult time, and I am willing to work with them to find a solution that meets their needs.

- Assertiveness: I am also assertive in protecting the interests of the lender. I will not hesitate to take legal action if necessary to protect the lender’s collateral.

6. How do you negotiate complex workouts?

I negotiate complex workouts by:

- Understanding the interests of all parties involved.

- Developing creative solutions that meet the needs of all parties.

- Being patient and persistent.

7. How do you manage risk and exposure in loan workouts?

I manage risk and exposure in loan workouts by:

- Performing thorough due diligence on borrowers.

- Structuring workouts that minimize the lender’s risk.

- Monitoring workouts closely and taking corrective action when necessary.

8. How do you stay up-to-date on industry regulations and best practices?

I stay up-to-date on industry regulations and best practices by:

- Attending industry conferences and seminars.

- Reading industry publications.

- Networking with other professionals in the industry.

9. What is your experience with using data analytics in loan workouts?

I have experience using data analytics in loan workouts to:

- Identify distressed borrowers.

- Assess the financial condition of borrowers.

- Develop workout plans.

- Monitor workouts and make adjustments as needed.

10. What are your thoughts on the future of loan workouts?

I believe that the future of loan workouts is bright. There is a growing demand for loan workouts as the economy becomes more complex and borrowers face more challenges.

- I expect to see increased use of data analytics in loan workouts.

- I also expect to see more complex workouts as borrowers become more sophisticated.

- Finally, I believe that loan workouts will become more important as a tool for banks to manage risk.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Workout Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Workout Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Loan Workout Officers are responsible for managing and resolving defaulted or delinquent loans. They work with borrowers to develop workout plans, negotiate loan modifications, and ultimately protect the lender’s financial interests.

1. Manage and Resolve Delinquent Loans

This involves reviewing loan documentation, identifying potential problems, and developing strategies to address them. Loan Workout Officers may also contact borrowers to gather information, negotiate payment plans, or discuss other options for resolving the delinquency.

2. Develop Workout Plans

Workout plans outline the specific actions that borrowers must take to bring their loans current. These plans may include reduced interest rates, extended payment deadlines, or other concessions. Loan Workout Officers must carefully consider the borrower’s financial situation and ability to repay the loan when developing workout plans.

3. Negotiate Loan Modifications

Loan modifications involve changing the terms of a loan agreement. This may include reducing the principal balance, lowering the interest rate, or extending the loan term. Loan Workout Officers must negotiate with borrowers to reach an agreement that is fair to both parties.

4. Protect Lender’s Financial Interests

Loan Workout Officers must always act in the best interests of the lender. This means protecting the lender’s financial position by ensuring that delinquent loans are repaid or resolved in a timely manner. Loan Workout Officers may also be responsible for taking legal action against borrowers who default on their loans.

Interview Tips

To ace an interview for a Loan Workout Officer position, candidates should prepare by:

1. Researching the Lender and Industry

This will demonstrate your interest in the position and the company. Be prepared to discuss the lender’s products and services, as well as the current state of the lending industry.

2. Practicing Your Communication Skills

Loan Workout Officers must be able to communicate effectively with borrowers, lawyers, and other professionals. Practice your negotiation skills and be prepared to discuss your experience in managing and resolving delinquent loans.

3. Demonstrating Your Analytical Abilities

Loan Workout Officers must be able to analyze financial data and make sound decisions. Be prepared to provide examples of your analytical skills and your ability to develop creative solutions to problems.

4. Highlighting Your Customer Service Skills

Loan Workout Officers must be able to work with borrowers who are experiencing financial distress. Be prepared to discuss your customer service skills and your ability to build rapport with clients.

Additionally, candidates should dress professionally, arrive on time for their interview, and be prepared to provide references.Next Step:

Now that you’re armed with the knowledge of Loan Workout Officer interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Loan Workout Officer positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini